Executive Summary

Income Tax

- CBDT issued the annual circular for TDS on Salary under one Umbrella.

- CBDT gives relaxation to Non-resident taxpayers for filing online Form-10F having No PAN in India.

Good & Services Tax (GST) & Customs

- GST Council Recommend Reduction in Compounding Amount.

GST Council Recommend Raising the Minimum Threshold amount for launching prosecution.

Companies Act 2013/ Other Laws

- MCA to Roll out 56 Company Forms on MCA21 V3 Portal in January 2023

- Clarification of holding of Annual General Meeting through Video Conference Mode

- Sovereign Gold Bond (SGB) Scheme 2022-23

- RBI migrates fraud reporting module to ‘DAKSH’ to streamline reporting, enhance efficiency and automate processes

- SEBI proposes a regulatory framework for index providers; prescribes various compliances and conditions

- IBBI specifies the proforma for reporting the liquidator’s decision if different from the advice of SCC

Income Tax

- Circular No. 24/2022 [F. NO. 275/15/2022-IT(B)], Dated 07-12-2022: CBDT has issued an annual circular for TDS on salary to clarify the various applicable provisions under one umbrella.

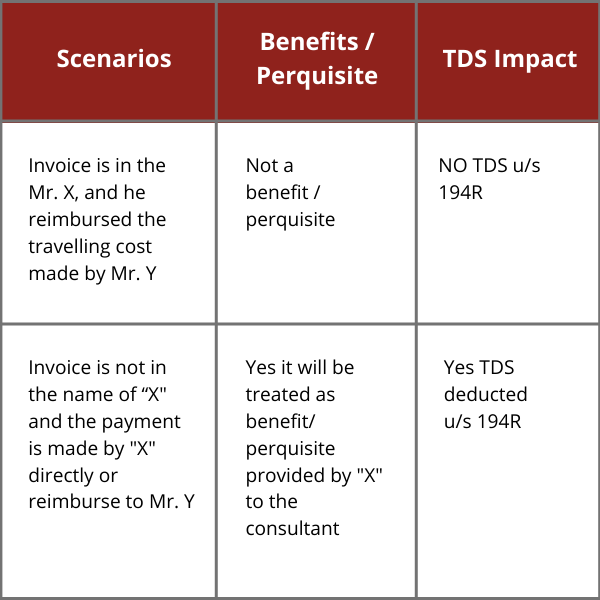

- CBDT vide CIRCULAR F.NO. DGIT(S)-ADG(S)-3/e-FILING NOTIFICATION/FORMS/2022/9227, DATED 12-12-2022 gives partial exemption to those entities not having PAN in India but need to submit Form 10F to the deductor. Earlier CBDT Notification No.3/2022 dated 16.07.2022 mandated to furnish Form 10F electronically. Now by exemption CBDT gives relaxation to Non-resident taxpayers to furnish manual Form 10F but this exemption is up to 31st March 2023 only.

Goods & Services Tax

- As per 48th GST council meeting – The GST council has recommended to raise the minimum threshold of tax amount for launching prosecution under GST from Rs. One Crore to Rs. Two Crores, except for the offence of issuance of invoices without supply of goods or services or both

- As per 48th GST council meeting – The GST council has recommended to reduce the compounding amount from the present range of 50% to 150% of tax amount to the range of 25% to 100%.

- The GST council has recommended to decriminalize certain offences under clause (g), (j) and (k) of sub-section (1) of section 132 of CGST Act 2017, viz.-

- obstruction or preventing any officer in discharge of his duties;

- deliberate tempering of material evidence;

- failure to supply the information

- Facilitate e-commerce for micro enterprises: GST Council in its 47th meeting had granted in-principle approval for allowing unregistered suppliers and composition taxpayers to make intra-state supply of goods through E-Commerce Operators (ECOs), subject to certain conditions. Further, considering the time required for development of the requisite functionality on the portal as well as for providing sufficient time for preparedness by the ECOs, Council has recommended that the scheme may be implemented w.e.f. 01.10.2023.

- Further, Issuance of the following circulars in order to remove ambiguity and legal disputes on various issues, thus benefiting taxpayers at large:

- Procedure for verification of input tax credit in cases involving difference in input tax credit availed in FORM GSTR-3B vis a vis that available as per FORM GSTR-2A during FY 2017-18 and 2018-19.

- Clarifying the manner of re-determination of demand in terms of sub-section (2) of section 75 of CGST Act, 2017.

- Clarification in respect of applicability of e-invoicing with respect to an entity.

Companies Act, 2013

- MCA to Roll out 56 Company Forms on MCA21 V3 Portal in January 2023 – MCA vide announcement dt. 23/12/2022 is going to release the Second Set of Company Forms on the MCA21 V3 portal, in January 2023, comprising of total 56 forms. The first lot will consist of 10 forms to be released on January 9, 2023, and the second lot will consist of 46 forms to be released on January 23, 2023. All stakeholders are advised to ensure that there are no SRNs in “pending payment” or “resubmission” status. The V2 Portal for company filing will continue to be available for all forms except the 56 forms as notified by MCA.

- Clarification of holding of Annual General Meeting through Video Conference Mode – The Ministry of Corporate Affairs vide its General Circular No. 10/2022 dated 28/12/2022 has allowed the companies whose AGMs are due in year 2023, to conduct their AGMs on or before 30/09/2023 through video conference (VC) or other audio visual means (OAVM) in accordance with the requirements laid down in Para 3 and Para 4 of the General Circular No. 20/2020 dated 05/05/2020.

RBI

- Sovereign Gold Bond (SGB) Scheme 2022-23

Government of India, vide its Notification No F.No4.(6)-B (W&M)/2022 dated December 15, 2022, has announced Series III and IV of Sovereign Gold Bond Scheme 2022-23. Under the Scheme, there will be a distinct series (Series III and IV) for every tranche. The terms and conditions of the issuance of the Bonds shall be as per the above notification. - RBI migrates fraud reporting module to ‘DAKSH’ to streamline reporting, enhance efficiency and automate processes

To streamline reporting, enhance efficiency and automate the payments fraud management process, the fraud reporting module is being migrated to DAKSH – Reserve Bank’s Advanced Supervisory Monitoring System. The migration will be effective from January 01, 2023, i.e., entities shall commence reporting of payment frauds in DAKSH from this date. In addition to the existing bulk upload facility to report payment frauds, DAKSH provides additional functionalities, viz. maker-checker facility, online screen-based reporting, option for requesting additional information, facility to issue alerts / advisories, generation of dashboards and reports, etc.

SEBI

SEBI proposes regulatory framework for index providers; prescribes various compliances and conditions

With the objective of furthering transparency and accountability in financial benchmarks / indices in the Indian securities market, the SEBI has proposed a regulatory framework for index providers. The Index providers offering indices for use in India shall be required to register with SEBI for the introduction of indices in India. Further, it shall be a legal entity incorporated under the Companies Act. Also, many conditions have been prescribed.

Insolvency And Bankruptcy Code

IBBI specifies the proforma for reporting the liquidator’s decision if different from the advice of SCC

The IBBI has made available an electronic platform at www.ibbi.gov.in, for reporting the liquidator’s decisions different from the advice given by the SCC. The insolvency professionals are directed to make use of the aforesaid proforma for reporting to the Board and Adjudicating Authority, under proviso to sub-regulation (10) of regulation 31A. This Circular is issued in exercise of the powers under section 196 of the Insolvency and Bankruptcy Code, 2016

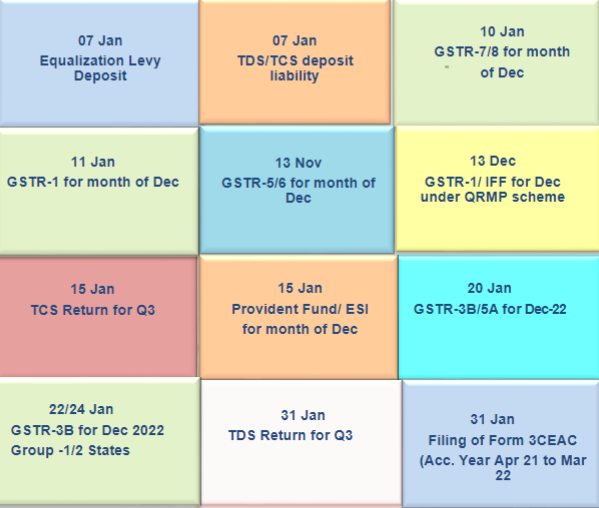

MONTHLY COMPLIANCE CALENDAR

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period from 25th Nov till 25th Dec 2022.