Executive Summary

Income Tax

➢ Guidelines Under Sub-Section (4) of Section 194-O of the Income-Tax Act, 1961.

➢ CBDT has notified the ITR-6 for the Assessment Year 2024-25.

➢ CBDT has notified under Section 10(23FE) of the Income-Tax Act, 1961 – Exemption – Income of Specified Person from an Investment Made in India – Specified Pension Fund.

➢ CBDT has notified under Section 10(4G), read with section 80LA of the Income-tax act, 1961 – Exemption – Activity investment in a financial product by a non-resident under contract with capital market intermediary being a unit in IFSC.

➢ CBDT has notified under section 10(46) of the Income Tax Act, 1961 – Exemptions – Statutory Body/ Authority/ Board/ Commission – Notified Body or Authority.

Goods And Service Tax (GST)

➢ Extension of the due date of furnishing return in GSTR-3B for specified places.

➢ Furnishing of Annual Returns and self-certified reconciliation statements for registered persons of specified areas.

➢ Special Procedures for Certain Processes and Special Procedures to be followed by registered persons engaged in manufacturing notified goods.

Companies Act 2013/ Other Laws.

➢ MCA notifies norms w.r.t listing of equity shares in IFSC by public companies.

➢ RBI issues updated master circular on exposure norms and statutory/other restrictions-UCBs.

➢ Govt. notifies accounting, taxation, & financial crime compliance services as ‘financial services’ under IFSCA Act`

➢ Govt. permits investment by ‘permissible holders’ in the equity of Indian public Cos.listed on international exchanges.

➢ Competition Commission of India (General) Amendment Regulations, 2024

➢ SEBI Streamlines regulatory reporting by Designated Depository Participants (DDPs) and Custodians through SI Portal

➢ SEBI Circular: New Framework for Employee Share Sale via Stock Exchange

INCOME TAX

CBDT has issued the guidelines under sub-section (4) of section 194-O of the Income Tax Act, 1961.

Central Board of Direct Taxes (Board) vide

Circular No. 20 of 2023 [F. NO. 370142/43/2023-TPL], dated 28-12-2023 has issued the guidelines on the above-mentioned subject.

Following are the guidelines:

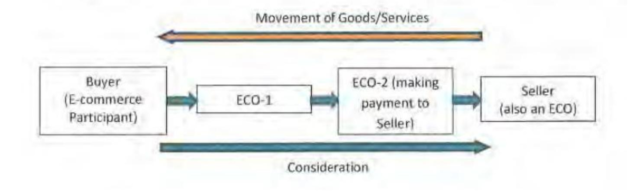

(I) Who should deduct tax at the source where there are multiple e-commerce operators (ECO) involved in a transaction?

For example, a buyer-side ECO could be involved in buyer-side functions, and a seller-side ECO Involved in seller-side functions. In this case, there may be two situations:

a) Where the seller-side ECO is not the actual seller of the goods or services –

In this situation, the compliance is to be done by the seller-side ECO who finally makes the payment to the seller and the tax shall be deducted on the “gross amount” of such sales of goods or provision of services. The tax shall be deducted by the seller-side ECO at the time of credit to the account of a seller or at the time of payment, whichever is earlier.

b) Where the seller-side ECO is the actual seller of the goods or services.

In this situation, compliance is to be done by the ECO which finally makes the payment to the seller for goods or services sold, which in this case is ECO-2* and the tax shall be deducted on the gross amount of such sale of goods or provision of services and shall be deducted by ECO-2* at the time of credit or at the time of the payment, whichever is earlier.

*For Situation (b)

(ii) E-Commerce Operator may levy convenience fees or charge commission for each transaction and the Seller might levy logistics & delivery fees for the transaction.

Payments may also be made to the platform or network provider to facilitate the transaction. Do the logistics charges, delivery fees, etc. form part of the gross amount for TDS Deduction under section 194O? Further, the buyer-side ECO and seller-side ECO may charge a commission to the seller to enable the online transaction, and the seller may choose to recoup all or part of that amount from the buyer.

(iii) Are GST, state levies, and taxes other than GST such as VAT treated when calculating the gross amount of sales of goods or provision of services for section 194O?

(iv) How will adjustment for purchase-returns take place?

(v) How will discounts given by the seller as an E-Commerce Participant or by any of the multiple ECOs be treated while calculating the ‘gross amount’ for section 194-O?`

➢ CBDT has notified the ITR-6 for the Assessment Year 2024-25.

CBDT has notified ITR6 for Assessment Year 2024-25 for filing returns for Financial Year 2023-24.

- How will GST, various state levies, and taxes other than GST (such as Value Added Tax / Sales tax / Excise duty / Central Sales Tax) be treated when calculating the ‘gross amount’ of sale for section 194-O?

- How will adjustment for purchase returns take place?

- How will discounts given by the seller as an E-Commerce Participant or by any of the multiple ECOs be treated while calculating the ‘gross amount’ for section 194-O?

➢ CBDT has notified ITR-1 and ITR-4 for Assessment Year 2024-25

CBDT has notified ITR1 SAHAJ and ITR4 SUGAM for Assessment Year 2024-25 for filing returns for Financial Year 2023-24.

➢ CBDT has notified under Section 10(23FE) of the Income-Tax Act, 1961 –

Exemption – Income of Specified Person from an Investment Made in India –

Specified Pension Fund.

In exercise of the powers conferred by sub-clause (iv) of clause (c) of Explanation 1 to clause (23FE) of section 10 of the Income-tax Act, 1961 (43 of 1961) (hereinafter referred to as the Act), the Central Government hereby specifies the pension fund, namely, Ravenna Investments Holding B.V (PAN: AAMCR8596D), (hereinafter referred to as the assessee) as the specified person for the said clause in respect of the eligible investment made by it in India on or after the date of publication of this notification in the Official Gazette but on or before the 31st day of March 2024 (hereinafter referred to as the said investments) subject to the fulfillment of the following conditions, namely:-

- the assessee shall file a return of income, for all the relevant previous years falling within the period beginning from the date in which the said investment has been made and ending on the date on which such investment is liquidated, on or before the due date specified for furnishing the return of income under sub-section (1) of section 139 of the Act;

- the assessee shall furnish along with such return a certificate in Form No. 10BBC in respect of compliance with the provisions of clause (23FE) of section 10 of the Act, during the financial year, from an accountant as defined in the Explanation below sub-section (2) of section 288 of the Act, as per the provisions of clause (vi) of rule 2DB of the Income-tax Rules, 1962;

- the assessee shall intimate the details in respect of each investment made by it in India during the quarter within a period of one month from the end of the quarter in Form No. 10BBB, as per the provisions of clause (v) of rule 2DB of the Income-tax Rules, 1962;

- the assessee shall maintain a segmented account of income and expenditure in respect of such investment which qualifies for exemption under clause (23FE) of section 10 of the Act;

- the assessee shall continue to be regulated under the laws of the Government of the Netherlands;

- the assessee shall be responsible for administering or investing the assets for meeting the statutory obligations and defined contributions of one or more funds or plans established for providing retirement, social security, employment, disability, death benefits, or any similar compensation to the participants or beneficiaries of such funds or plans, as the case may be;

- he assessee shall be responsible for administering or investing the assets for meeting the statutory obligations and defined contributions of one or more funds or plans established for providing retirement, social security, employment, disability, death benefits, or any similar compensation to the participants or beneficiaries of such funds or plans, as the case may be;

- the assessee shall not have any loans or borrowings [as defined in sub-clause (b) of clause (ii) of Explanation 2 to clause (23FE) of section 10 of the Act], directly or indirectly, to invest in India; and

- the assessee shall not participate in the day-to-day operations of the investee [as defined in clause (i) of Explanation 2 to clause (23FE) of section 10 of the Act] but the monitoring mechanism to protect the investment with the investee including the right to appoint directors or executive directors shall not be considered as participation in the day-to-day operations of the investee

➢ CBDT has notified under Section 10(4G), read with section 80LA of the Income-tax Act, 1961 – Exemption – Activity investment in a financial product by a non-resident under contract with a capital market intermediary being a unit in IFSC.

In exercise of the powers conferred by sub-clause (ii) of clause (4G) of section 10 of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby notifies the activity of investment in a financial product by the non-resident, under a contract with such non-resident entered into by a capital market intermediary, being a Unit of an International Financial Services Centre, where the income from such investment is received in the account of the non-resident maintained with the Offshore Banking Unit of such International Financial Services Centre, as referred to in sub-section (1A) of section 80LA

Explanation. —For this notification —

- “Capital market intermediary” shall have the meaning as assigned to it in clause (ga) of sub-regulation (1) of regulation 2 of the International Financial Services Centres Authority (Capital Market Intermediaries) Regulations, 2021;

- “financial product” shall have the meaning as assigned to it in sub-clause (d) of sub-section (1) of section 3 of International Financial Services Centres Authority Act, 2019 (50 of 2019);

- “International Financial Services Centre” shall have the same meaning as assigned to it in clause (q) of section 2 of the Special Economic Zones Act, 2005 (28 of 2005)

- “Unit” shall have the same meaning as assigned to it in clause (zc) of section 2 of the Special Economic Zones Act, 2005 (28 of 2005)

➢ CBDT has notified under section 10(46) of the Income Tax Act, 1961 – Exemptions – Statutory Body/ Authority/ Board/ Commission – Notified Body or Authority

The Central Government has notified the following Statutory Body/ Authority/Board/ Commission for Section 10(46) subject to specified conditions for the years mentioned in the notification:

a) Karnataka State Rural Livelihood Promotion Society.

b) Polavaram Project Authority.

c) Madhya Professional Examination Board, Bhopal.

d) Punjab State Faculty of Ayurvedic and Unani Systems of Medicine.

e) Karmayogi Bharat.

f) Chennai Metropolitan Water Supply and Sewerage Board.

g) Haryana State Board of Technical Education, Panchkula.

h) District Legal Service Authority Union territory Chandigarh.

i) Bellary Urban Development Authority\

Goods & Services Tax

➢ Extension of Due date of furnishing return GSTR-3B for specified places –

As per Notification No. 1/2024-CENTRAL TAX Dated 05-01-2024, the government has extended the due date of furnishing the return in Form GSTR- 3B for November 2023 till the tenth day of January 2024 for the registered persons whose principal place of business is in the districts of Tirunelveli, Tenkasi, Kanyakumari, Thoothukudi and Virudhunagar in the state of Tamil Nadu. This notification shall come into force w.e.f. 20th day of December 2023

➢ Furnishing of Annual Returns and self-certified reconciliation statements for registered persons of specified areas –

As per Notification No. 2/2024- CENTRAL TAX- Dated 05-01-2024, the Central Government has made the following rules further to amend the Central Goods and ServicesTax Rules, 2017, namely: –

Short title and commencement

1. (1) These rules may be called the Central Goods and Services Tax (Amendment) Rules, 2024.

(2) They shall come into force on the 31st day of December 2023

2. In the Central Goods and Services Tax Rules, 2017, in rule 80, –

(a) after sub-rule (1A), the following sub-rule shall be inserted, namely: – (1B) Notwithstanding anything contained in sub-rule (1), for the financial year 2022-23, the said annual return shall be furnished on or before the tenth day of January 2024 for the registered persons whose principal place of business is in the districts of Chennai, Tiruvallur, Chengalpattu, Kancheepuram, Tirunelveli, Tenkasi, Kanyakumari, Thoothukudi and Virudhunagar in the state of Tamil Nadu.

(b) after sub-rule (3A), the following sub-rule shall be inserted, namely: – (3B) Notwithstanding anything contained in sub-rule (3), for the financial year 2022-23, the said self-certified reconciliation statement shall be furnished along with the said annual return on or before the tenth day of January 2024 for the registered persons whose principal place of business is in the districts of Chennai, Tiruvallur, Chengalpattu, Kancheepuram, Tirunelveli, Tenkasi, Kanyakumari, Thoothukudi and Virudhunagar in the state of Tamil Nadu.”

➢ Special Procedures for Certain Processes and Special Procedures to be followed by a registered person engaged in manufacturing notified good

As per Notification No. 4/2024- CENTRAL TAX- Dated 05-01-2024, Central Government has notified Special Procedures for Certain Processes and Special Procedures to be followed by a registered person engaged in manufacturing notified goods (Schedule includes Description of Goods like Pan Masala, Tobacco, Smoking mixtures for pipes and cigarettes, etc.), namely: –

1. Details of Packing Machines

(1) All the registered persons engaged in manufacturing the goods mentioned shall furnish the details of packing machines being used for filling and packing packages in FORM GST SRM-I, within thirty days of coming into effect of this notification.

(2) Any person intending to manufacture goods as mentioned in the Schedule to this notification, and who has been granted registration after the issuance of this notification, shall furnish the details of packing machines being used for filling and packing of packages in FORM GST SRM-I on the common portal, within fifteen days of grant of such registration.

(3) The details of any additional filling and packing machine being installed at the registered place of business shall be furnished, electronically on the common portal, by the said registered person within twenty-four hours of such installation in PART (B) of Table 6 of FORM GST SRM-I.

(4) If any change is to be made to the declared capacity of the machines, the same shall be furnished, electronically on the common portal, by the said registered person within twenty-four hours of such change in Table 6A of FORM GST SRM-I.

(5) Upon furnishing of such details in FORM GST SRM-I, a unique registration number shall be generated for each machine, the details of which have been furnished by the registered person, on the common portal.

(6) In case, the said registered person has submitted or declared the production capacity of his manufacturing unit or his machines, to any other government department or any other agency or organization, the same shall be furnished by the said registered person in Table 7 of FORM GST SRM-I on the common portal, within fifteen days of filing such declaration or submission:

Provided that where the said registered person has submitted or declared the production the capacity of his manufacturing unit or his machines, to any other government department or any other agency or organization, before the issuance of this notification, the latest such certificate in respect of the manufacturing unit or the machines, as the case may be, shall be furnished by the said registered person in Table 7 of FORM GST SRM-I on the common portal, within thirty days of issuance of this notification.

(7) The details of any existing filling and packing machine disposed of from the registered place of business shall be furnished, electronically on the common portal, by the said registered person within twenty-four hours of such disposal in Table 8 of FORM GST SRM-I

2. Special Monthly Statement

The registered person shall submit a special statement for each month in FORM GST SRM-II, electronically on the common portal, on or before the tenth day of the month succeeding such month.

3. Certificate of Chartered Engineer

(1) The taxpayer shall upload a certificate of Chartered Engineer FORM GST SRM-III in respect of machines declared by him, as per para 1 of this notification, in Table 6 of FORM GST SRM-I.

(2) If details of any machine are amended subsequently, then a fresh certificate in respect of such machine shall be uploaded.

4. This notification shall come into effect from the 1st day of April 2024.

Companies Act, 2013/LLP Act, 2008

➢ MCA notifies norms w.r.t listing of equity shares in IFSC by public companies.

The Companies (Listing of equity shares in permissible jurisdictions) Rules, 2024, introduced by the Ministry of Corporate Affairs (MCA), marks a significant step towards enabling unlisted and listed public companies to issue securities for listing on approved stock exchanges in permissible foreign jurisdictions.

These regulations provide clarity on eligibility criteria, listing requirements, and reporting obligations, fostering transparency and compliance within the international financial landscape.

RBI

➢ RBI issues updated master circular on exposure norms and statutory/other restrictions-UCBs.

RBI issues a master circular consolidating all the instructions/guidelines on exposure norms and statutory/other restrictions related to the (urban) cooperative banks UCBs. Now users can refer to the consolidated master circular, consolidating different circulars in one place.

➢ Govt. notifies accounting, taxation, & financial crime compliance services as ‘financial services’ under the IFSCA Act

The RBI has notified amendment sub-clause (xiv) of clause (e) of sub-section (1) of section 3 of the International Financial Services Centres Authority Act, 2019 (50 of 2019), the Central Government hereby notifies the following as financial services, namely: —

- Book-keeping services

- Accounting services.

- Taxation services; and

- Financial crime compliance services

➢ Govt. permits investment by ‘permissible holders’ in the equity of Indian public Cos. listed on international exchanges

The Ministry of Finance vide. Notification No. S.O. 332(E) dated 24.01.2024 has notified the Foreign Exchange Management (Non-debt Instruments) Amendment Rules, 2024. A new Rule 34 in chapter X has been inserted which permits the Investment by permissible holders in Equity Shares of Public Companies Incorporated in India and Listed on International Exchanges.

COMPETITION LAW

➢ Competition Commission of India (General) Amendment Regulations, 2024

In the Competition Commission of India (General) Regulations, 2009, regulation 49,

after sub-regulation

(1) the following sub-regulation shall be inserted, namely:

(1A) Each Interlocutory Application received under sub-regulation (6) of Regulation 15 shall be accompanied by proof of having paid the fee as under: –

(a) Rupees 500 (five hundred) in case of individual or Hindu Undivided Family (HUF), or

(b) Rupees 1000 (one thousand) in case of a Non-Government Organization (NGO), or Consumer Association, or Co-operative Society, or Trust or

(c) Rupees 1000 (one thousand) in case of firm (including proprietorship, partnership or Limited Liability Partnership) or company (including one person company) having turnover in the preceding year up to rupees two crore, or

(d) Rupees 5000 (five thousand) in all other cases.”

SEBI

➢ SEBI Streamlines regulatory reporting by Designated Depository Participants (DDPs) and Custodians through SI Portal

The Securities and Exchange Board of India (SEBI) has recently issued a circular, SEBI/HO/AFD/AFD-SEC-2/P/CIR/2024/8, dated January 25, 2024. The circular focuses on streamlining regulatory reporting by Designated Depository Participants (DDPs) and Custodians. The objective is to establish uniform compliance standards, enhance ease of reporting, and meet regulatory requirements.

➢ SEBI Circular: New Framework for Employee Share Sale via Stock Exchange

The Securities and Exchange Board of India (SEBI) has issued a circular, SEBI/HO/MRD/MRD-PoD-3/P/CIR/2024/6, dated January 23, 2024. This circular introduces a new framework for the Offer for Sale (OFS) of shares to employees through the stock exchange mechanism. The purpose is to streamline the existing process, enhance efficiency, and reduce costs associated with the current procedure.

Disclaimer: Information in this note is intended to provide only a general update on the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period 25.01.2024.