Executive Summary

Income Tax

- Annual Finance Bill 2023 has been approved in Lok Sabha with few amendments.

- Govt. has released Mobile APP for quick verification/update for AIS information Income tax exemption has been granted to IBBI.

Good & Services Tax (GST) & Customs

- GSTN Issues advisory on e-invoice registration with private IRPs.

- GSTN Issues advisory for taxpayer wishing to register as OPC.

- GSTN Issues advisory for GTAs on opting for payment of tax under the forward charges mechanism.

- HSN Code reporting in e-invoice on IRPs portal.

Companies Act 2013/ Other Laws

- Govt. establishes C-PACE, to fasten the voluntarily winding up process

- RBI signs MoU with Central Bank of UAE to promote innovation in financial products and services

- Govt. fixes April 10, 2023 as the date for closure of residual transactions of banks for March 2023

- Use of e-wallets for investing in Mutual Funds are to be fully compliant with KYC norms prescribed by RBI

- SEBI issues simplified norms/procedural requirements for processing investor’s service requests by RTAs

Income Tax

CBDT vide Press Release dated Dated 22.03.2023: has issued AIS Mobile app to make user easier to give feedback for transaction reflected in AIS/TIS. Govt has issued clarification also that if taxpayer is disagree with the AIS/TIS information, he needs to submit the feedback and accordingly action will be taken by the Income tax dept. If any mismatch is there with the information and filed ITR then dept will issue notice and taxpayer need to comply the same.

- CBDT vide Notification No.09/2023 dated 01.03.2023 grant tax exemption to Insolvency & Bankcruptcy Board of India(IBBI) on the following income:

- Grants-in-aid received from Central Government

- Fees received under Insolvency and Bankruptcy Code, 2016

- Fines collected under Insolvency and Bankruptcy Code, 2016,

- Major Changes as introduced & approved in Lok Sabha w.r.t. Finance Bill 2023:

- Marginal relief to a resident individual opting new tax scheme: The Finance Bill (Lok Sabha) has substituted said proviso to Section 87A to allow a marginal rebate if the total income marginally exceeds Rs. 7,00,000. The marginal rebate under Section 87A shall be computed in the following steps:

- Step 1: Calculate tax payable on total income before rebate under Section 87A

- Step 2: Calculate the difference between total income and Rs. 7,00,000.

- Step 3: Calculate the difference between Step 1 and Step 2.

- Step 4: If the figure in Step 3 is positive, the difference will be the rebate allowed under Section 87A. However, if the figure is negative, then no rebate shall be allowed under Section 87A.

- Expansion in Section 50AA: Section 50AA as introduced in Finance Bill that will cover the STCG on transfer of Market linked Debenture irrespective of the period of holding will now also cover the specified mutual funds as well. The “specified mutual fund” means a mutual fund where not more than 35% of its total proceeds is invested in the equity shares of domestic companies.

- Changes in the tax rate of Royalty, FTS & Dividend u/s 115A: Royalty & Fees for Technical services which was currently taxable @ 10%, now been proposed to taxable @20% u/s 115A.

- No higher TDS on winning from online games if the deductee is a non-filer of return or didn’t furnish PAN

- Exemption from capital gains on transferring the interest in a JV by a Public sector company in exchange for shares in a foreign company [Section 47(xx) and Section 49(2AI)]

- Marginal relief to a resident individual opting new tax scheme: The Finance Bill (Lok Sabha) has substituted said proviso to Section 87A to allow a marginal rebate if the total income marginally exceeds Rs. 7,00,000. The marginal rebate under Section 87A shall be computed in the following steps:

- Exemption to be available to a “Sikkimese woman marrying a non-sikkimese” and an “Individual domiciled in Sikkim” [Section 10(26AAA)]: As per the Finance Bill(Lok Sabha), now proviso that restrict to claim the exemption is substituted and changes made in Section 10(26AAA) as below:

- The proviso to Section 10(26AAA) has been omitted; and

- The definition of ‘Sikkimese’ has been amended to include the followings:

- Any other individual whose name does not appear in the Register of Sikkim Subjects but it is established that such individual was domiciled in Sikkim on or before 26-04-1975;

- Any other individual who was not domiciled in Sikkim on or before 26-04-1975, but it is established beyond doubt that such individual’s father or husband or paternal grand-father or brother from the same father was domiciled in Sikkim on or before 01-04-1975.

- Changes Proposed for IFSC: With respect to IFSC, Finance bill(Lok Sabha) proposes the following amendments:

- No surcharge and cess on income earned by GIFT Category III from securities under section 115A(1)(a)

- Provision for tax neutral reallocation of any investment vehicle in which ADIA is sole direct or indirect shareholder/ unitholder to GIFT City introduced; power to notify any other funds for tax neutral reallocation to GIFT City added (section 47(viiad);

- Dividend distributions from IFSC unit to be taxable at 10% (as against 20%)

- Interest income on borrowing by foreign company from long-term bond or rupee denominated bond listed on IFSC stock exchange taxable @ 9%.

- Changes proposed in TCS: Following changes has been proposed in Finance bill(Lok Sabha) with regards to Tax Collected at Source(TCS):

- Earlier TCS will be applicable when funds are remit out of India. The Finance Bill (Lok Sabha) has amended Section 206C(1G)(a) to omit the words “out of India” to expand the scope of the provision to the remittance made under LRS, even within India. Thus, where the remittance is made under LRS to the GIFT city, the new rates of TCS shall

- The Finance Bill (Lok Sabha) has inserted a proviso to Section 206CC(1) and Section 206CCA(1) to provide that the rate of TCS under Section 206C shall not exceed 20% even if the collectee does not furnish his PAN or is a non-filer. These provisos have been inserted with effect from 01-07-2023

- The Finance Bill (Lok Sabha) has inserted a new proviso after clause (b) to Section 80LA(1) to increase the amount of deduction available to the eligible assessees under Section 80LA(1) for the subsequent 5 years from 50% to 100%. It should be noted that there is no change in the period for which deduction is available or the quantum of deduction, and the total deduction can be claimed for a maximum period of 10 years.

Goods & Services Tax

- GSTN Issues advisory dated 4 mar 2023 for launches e-invoice registration services with private IRPs. Clear Tax, Cygnet, E&Y and IRIS Business Ltd were empaneled by GSTN for providing these e-invoice registration services to all GST taxpayers of the country The taxpayers can now register their e-invoices using more than one IRP. This significantly increases the capacity and redundancy of the previous single e-invoice registration portal.

- GSTN issues advisory dated 21 mar 2023 for the taxpayer who wants to be register as “One Person Company”. If Taxpayer wants to be register as one person, then he needs to select an option Other in ‘Part B’ of GST Registration Form ‘REG-01’and also mentioned “one person company” in the text field.

- It is mandatory to report minimum six digits HSN code for the outward supply having AATO more than 5 crores in Previous FY. Now in the process of implementing the same at IRPs portal in collaboration with our IRP partners including NIC.

- GSTN issues advisory dated 25 Feb 2023 for GTA’s on opting for payment of tax under forward charge mechanism. For such option it requires to submit Annexure V Form on the portal every year before commencement of financial year. GTA’s can opt this option for the financial year 2023-24 till 15 march 2023.

- Ministry of finance issued clarification dated 14 march 2023, CGST Act 2017 does not restrict GST registration of management consultants, architects and other professionals operating from residential premises, due to Covid19 pandemic or otherwise.

- Major Changes as introduced & approved in Lok Sabha w.r.t. Finance Bill 2023:

- Levy of IGST and GST Compensation Cess on removal of imported goods to warehouse for further manufacturing/processing: The Finance Bill (Lok Sabha) has proposed to insert a new Section 65A under the Customs Act, 1961 which imposes IGST and GST Compensation Cess on the goods, which are moved to the warehouse for the purpose of carrying on any manufacturing process or other operations in the warehouse, at the time of removal of goods to such warehouse, instead of imposing it at the time of clearance of home consumption from the warehouse. Notably, no amendment is proposed in the existing provisions for the levy of customs duty, which will continue to be paid by the importer when the goods are cleared for home consumption from the bonded warehouse.

- Amendment relating to GST Appellate Tribunal: The GST Appellate Tribunal (‘GSTAT’) is the forum of second appeals in GST law for filing the appeals against the orders passed by the First Appellate Authority or Revisional Authority.

- After the proposed amendment, the jurisdiction, authority and power of GSTAT shall be exercised by the Principal Bench located at New Delhi will be constituted by the Government via notification and it will consist of the President, a Judicial member and one Technical members from both Centre and State.

- The appeals, where the amount of tax/input tax credit/fine/fees/penalty does not exceed Rs. 50 Lakhs and does not involve any question of law, can be heard by a single member with the approval of President and subject to such conditions.

- In all the other cases, the appeal shall be heard by one Judicial member and one Technical member. The existing provisions under the GST law, though not effective yet, provides the monetary limit of Rs. 5 lakhs for the above purpose.

- As per the GST law, an appeal before GSTAT can be filed within 3 months from the date on which the order sought to be appealed is communicated. However, since GSTAT has not been constituted, the appeal in many cases could not be filed within 3 months. In this regard, the Government by way of issuing the Removal of Difficulties Order, 2019 prescribed the time limit for filing the appeal before GSTAT once the same is constituted.

- Removing the requirement of compulsory registration where exemption is granted by the Government through notification: In the Finance Bill 2023, amendment is made in Section 23 by inserting a non – obstante clause. As per the new amendment, if the person or class of persons falls under the category as specified under Section 23 (2), the person shall not be liable to get registered even if Turnover increases the threshold limit or falls under Section 24.

- Extension of time limit to apply for revocation of cancellation of registration from 30 days to 60 days: The Finance Bill (Lok Sabha) has proposed to increase the time limit for filing of return from 30 days to 60 days for enabling deemed withdrawal of best judgment assessment orders. It has also been proposed that where the return is not filed by the taxpayer within 60 days, the same can be done in another 60 days by paying additional late fees of Rs. 200 per day (e.Rs. 100 CGST + Rs. 100 IGST) for delay after 60 days of the said assessment order. If the person furnishes a ‘valid return’ within extended days, the assessment order will be deemed to have been withdrawn, but the person will still be liable to pay interest under section 50(1) or a late fee under section 47.

- Place of supply in case of services of transportation of goods where location of supplier/recipient is outside India: The Finance Bill (Lok Sabha) has been proposed to omit the provision regarding place of supply of transportation of goods where the location of the supplier or the recipient is outside India. The location of the service recipient would be considered as the place of supply of services of transportation of goods where either the location of the supplier or the recipient is located outside India.

- The proposal relating to changes in the GST compensation cess is as below:

S No. Description of supply Maximum rate at which GST compensation cess may be collected Existing Proposed 1. Pan Masala 135% ad valorem 51% of retail sale price per unit 2. Tobacco and manufactured tobacco substitutes, including tobacco product Rs. 4170 per 1000 sticks or 290% ad valorem or a combination thereof, but not exceeding Rs. 4170 per 1000 sticks plus 290% ad valorem Rs. 4170 per 1000 sticks or 290% ad valorem or a combination thereof, but not exceeding Rs. 4170 per 1000 sticks plus 290% ad valorem or 100% of retail sale price per unit - Changes in Customs Duty Rates relating to few items: The Finance Bill (Lok Sabha) provides some changes in the Customs duty rates, which are summarized below:

| HSN Code | Description of Goods | Old Import Duty | New Import Duty |

| 90221410 | X-ray generators and apparatus | 10 % | 15 % |

| 90221420 | Portable X-ray machine | 10 % | 15 % |

| 90221490 | Others | 10 % | 15 % |

| 29335950 | Bispyribac-sodium (ISO) | 7.5 % | 10 % |

Companies Act, 2013

Govt. establishes C-PACE, to fasten the voluntarily winding up process

The Centre has taken the next big step towards accelerating the process for voluntary winding up of companies. The Corporate Affairs Ministry (MCA) has now established a dedicated unit — Centre for Processing Accelerated Corporate Exit (C-PACE) in IMT Manesar, Gurugram — as part of its overall efforts to speed up the voluntary winding up of companies from the currently required two years to less than 6 months. C-PACE will be located at the Indian Institute of Corporate Affairs (IICA) in Manesar.

RBI

- RBI signs MoU with Central Bank of UAE to promote innovation in financial products and services – Reserve Bank of India (RBI) and the Central Bank of the United Arab Emirates (CBUAE) have signed a Memorandum of Understanding (MoU) to enhance cooperation and jointly enable innovation in financial products and services. Under the MoU, which was signed on Wednesday in Abu Dhabi, the two central banks will collaborate on various emerging areas of FinTech, especially Central Bank Digital Currencies (CBDCs) and explore interoperability between the CBDCs of CBUAE and RBI.

- Govt. fixes April 10, 2023 as the date for closure of residual transactions of banks for March 2023 – The Government of India has decided that the date of closure of residual transactions for the month of March 2023 be fixed as April 10, 2023. In view of the ensuing closing of Government accounts for the financial year 2022-23, receiving branches including those not situated locally, should adopt special arrangements such as courier service etc., for passing on challans/scrolls etc., to the Nodal/Focal Point branches so that all payments and collections made on behalf of Government towards the end of March are accounted for in the same financial year.

SEBI

- Use of e-wallets for investing in Mutual Funds are to be fully compliant with KYC norms prescribed by RBI – E-wallets used for investing in mutual funds should be compliant with KYC norms prescribed by the Reserve Bank of India (RBI). In its circular, the regulator said that the provisions will be applicable with effect from May 1, 2023. The move was also part of the efforts to promote digital payments in the mutual fund industry and channelise household savings into the capital market.

- SEBI issues simplified norms/procedural requirements for processing investor’s service requests by RTAs – As an on-going measure to enhance the ease of doing business for investors in the securities market, SEBI, vide Circular Nos. SEBI/HO/MIRSD/MIRSD_RTAMB/P/ CIR/2021/655 dated November 03, 2021 & SEBI/HO/MIRSD/MIRSD_RTAMB/P/ CIR/2021/687 dated December 14, 2021, had prescribed the common and simplified norms for processing investor’s service request by RTAs and norms for furnishing PAN, KYC details and Nomination. It shall be mandatory for all holders of physical securities in listed companies to furnish PAN, Nomination, Contact details, Bank A/c details and Specimen signature for their corresponding folio numbers.

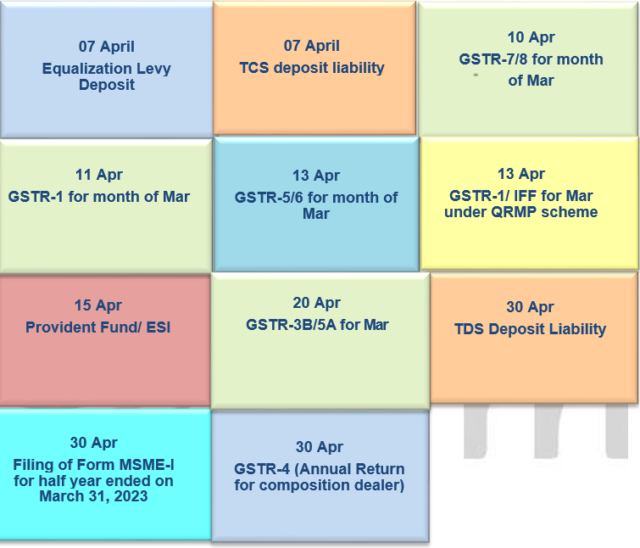

MONTHLY COMPLIANCE CALENDAR

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period from 26th Feb till 25th Mar. 2023.