Executive Summary:

Income Tax

- 1. Notification for relaxations of due date in time barring matters

- 2. Circular for extension of due dates falling on 31st March /30th April 2021, up to 31st May 2021

- 3. Circular extending compliance due dates for the FY 2020-21, relating to filing of returns and audit reports

- 4. Covid-19 relaxation in Section 269ST- Cash Receipt more than INR 2 Lakh.

- 5. Time line to update UDIN of Past Audit Reports and certificates has been further extended up to 30th June 2021

- 6. Government to launch new income tax e- filing website on 7th June 2021

International Tax

- 1. New Rule 11UD inserted in ITA to define the threshold limits for Significant Economic Presence

- 2. Section 139A exemption to Eligible Foreign Investors.

Goods and Services Tax

- 1. Relaxations in waiver of late fee and reduction in interest rates for compliance periods of March and April 2021

- 2. Amnesty and relaxations recommended by GST council in its 43rd Meeting dated 28th May 2021, capping late fee in filing GST returns

- 3. Recommendations by GST council for full exemption from GST to covid-19 related goods, imported from outside India on payment basis, for donating to government or any relief agency

- 4. Recommendations of the GST council to make present system of filing GSTR-1 / 3B, as default return filing mechanism under GST

- 5. Refund filing timeline to exclude period in notifying by the officer, deficiencies in refund application filed

Corporate & Other Laws

- 1. MCA has provided relaxation on additional fee on various forms as per the circular no. 06/2021 and 07/2021

- 2. MCA has provided clarification on offsetting the excess CSR spent for Financial Year 2019-20

- 3. MCA has provided the relaxation under the Section 173 by increasing the gap between two Board Meeting by 180 days

Income Tax

Notification for extension of Time barring matters

- The CBDT vide Notification No. 38/2021 Dated 27th April,2021 has decided to extend the various time barring dates, which were earlier extended to 30-04-2021, by various notifications. It has been decided to extend due dates from 30-04-2021 to 30-06-2021 in the following cases:

- a) Time limit for passing of any order for assessment or reassessment, the time limit for which is provided under section 153 or section 153B.

- b) Time limit for passing an order consequent to the direction of DRP under section 144C(13).

- c) Time limit for issuance of notice under section 148 for reopening assessment where income has escaped assessment.

- d) Time Limit for sending intimation of processing of Equalisation Levy.

- The CBDT vide Notification No. 39/2021 Dated 27th April,2021 has decided to extend the due date for making payment without additional charge under Vivad se Vishwas Act., which were earlier extended to 30-04-2021 has extended further from 30-04-2021 to 30-06-2021.

Time line to update UDIN of Past Audit Report and certificates has been further extended

CBDT notifies dated 30th April 2021 that the timeline to update UDIN of past uploads of audit report and certificates has been further extended

up to 30th June, 2021 to avoid invalidation.

Notifications for Statement of Financial Transactions (SFT) for Depository Transactions

CBDT vide Notification No. 3 & 4 of 2021 dated 30.04.2021, issued format, procedure and guidelines for submission of Statement of Financial Transactions (SFT) for Depository Transactions & Mutual Fund Transactions by Registrar and Share transfer Agent.Extension of dates by up to 31st May 2021 for compliances ending 31st March / 30th April

(Circular No. 08/2021, Dated 30th April, 2021)

| Particulars | Original Due Date | Revised / Extended Due dates |

| Belated/Revised ITR for AY 2020-21 (FY 2019-20) | 31st March, 2021 | 31st May, 2021 |

| Payment & Filing of Challan- cum- Statement for TDS u/s 194IA,194IB & 194M | 30th April, 2021 | 31st May, 2021 |

| -Appeal to CIT -Objections to DRP |

If last date to file was 1st April or Afterwards | 31st May or the actual last date, whichever is later |

| Income tax Return in response to notice u/s 148 | If last date to file was 1st April or Afterwards | 31st May or time allowed in notice, whichever is later |

| Form 61 | 30th April, 2021 | 31st May, 2021 |

| Statement of Income paid or credited by an investment fund to its unit’s holder in Form 64D for FY 2021 | 15th June, 2021 | 30th June, 2021 |

| Statement of Income paid or credited by an investment fund to its unit’s holder in Form 64C for FY 2021 | 30th June, 2021 | 15th July 2021 |

Though the due date for filing of Income-tax Return for the Assessment Year 2021-22 has been extended, but no relief shall be provided from the interest chargeable under section 234A if the tax liability exceeds Rs. 1 lakh. Thus, if self-assessment tax liability of a taxpayer exceeds Rs. 1 lakh, assessee would be liable to pay interest under section 234A from the expiry of original due dates, i.e., 31-07-2021 or 31-10-2021 or 30-11-2021. The interest under section 234A shall not be levied if the self- assessment tax liability of taxpayer does not exceed Rs. 1 lakh and ITR if filed within the extended due date.

Further In case of senior citizen having no PGBP Income, all taxes paid upto 31st July will be deemed as Advance Tax.

Relaxation in Section 269ST: Cash Receipt more than INR 2 Lakh

On account of Curbing cash transaction, Government had introduced the section 269ST, in which no person is allowed to take an amount of INR Two lakh or more from a person on a single day for one event/transaction.

However considering the surge of Covid-19, Govt. vide Notification No.56/2021 dated 07th May 2021, has allowed to below mentioned entities to take Cash after obtaining PAN or AADHAAR of the patient and the payee and the relationship between the patient and the payee:

– Hospitals, -Dispensaries, -Nursing Homes, -Covid Care Centres or similar other medical facilities. during period begin from 01.04.2021 to 31.05.2021.

On 10th May, 2021 Govt. has issued a corrigendum that instead of payee, Payer should be read.

Government to launch new income tax e-Filing website

Government has announced that it is launching a new website on 7th June, 2021 for income tax e-filing. ITA also said that the existing website will not be accessible between 1st June 2021 to 6th June 2021.

CBDT has issued first instruction for Faceless Assessment Scheme

CBDT has issued instruction that notices u/s 143(2) will be issued electronically by NeAC and cases covered under Central charge i.e. search & seizure, & International Taxation will still continue with Prescribed authority.

Extension of time limits of year end compliances for FY 2020-21

(Circular No. 09/2021, Dated 20th May, 2021)

| Particulars | Original Due Date | Revised / Extended Due dates |

| Income Tax Returns-Original ITR [ FY 2020-21] | ||

| Non-Tax Audit / Non-Transfer Pricing(‘TP’) Case | 31st July 2021 | 30th September 2021 |

| Tax Audit / Non TP-Case | 31st October 2021 | 30th November 2021 |

| Belated/Revised ITR | 31st December, 2021 | 31st January 2022 |

| Audit Reports by CA -Tax Audit -TP Certification/Audit u/s 92E of ITA |

30th September 2021 31st October 2021 |

31st October 2021 30th November 2021 |

| TDS Return -Quarter 4 (FY 2020-21) |

31st May, 2021 | 30th June 2021 |

| Issuance of TDS Certificate -Form 16 | 15th June 2021 | 15th July 2021 |

| Form 61-Statement of Financial Statement (SFT) | 31ST May, 2021 | 30th June, 2021 |

| Statement of Reportable Account under Rule 114G | 31ST May, 2021 | 30th June, 2021 |

| TDS/TCS Book adjustment statement in Form 24G for the month of May 2021 | 15th June 2021 | 30th June, 2021 |

| Statement of Deduction of Tax in the case of superannuation fund for FY 2021 |

31st May, 2021 | 30th June, 2021 |

Computation of FMV in case of Slump Sale

CBDT has notified a new rule 11UAE for computation of fair market value of capital assets in slump sale. As per the amendment, the new Rule 11UAE under section 50B has given two formulae for calculation and has stated that the fair market value will be the higher among the two values. It is to be noted that earlier, the actual consideration of the slump sale transaction was considered as full value of consideration for computing capital gains meaning thereby that there was no need to arrive at Fair Market Value.

Formula 1: The FMV1 shall be the fair market value of the capital assets transferred by way of slump sale

Formula 2: FMV2 shall be the fair market value of the consideration received or accruing as a result of transfer by way of slump sale

Accordingly, now a uniform formula to compute FMV in case of slump sale has been provided, which shall provide a certainty in tax litigation and clarity to taxpayers.

Clarification on limitation for filing of CIT(A)

CBDT via Circular No 10 of 2021 dt 25.05.2021, issues clarification w.r.t. limitation for filing of appeals before CIT(Appeals) under Income- tax Act,1961 in consonance with directions issued by Hon’ble Supreme Court in Suo Motu WP(Civil) No 3 of 2020 vide order dt 27th Apr, 2021. It was clarified that if different relaxations are available to the taxpayers for a particular compliance, the taxpayer is entitled to the relaxation which is more beneficial to him. Thus, for the purpose of counting the period(s) of limitation for filing of appeals before the CIT(Appeals) under the Act, the said limitation stands extended till further orders as ordered by the Hon’ble Supreme Court in aforesaid Suo-motu Writ Petition.

International Tax

- New Rule 11UD inserted in ITA to define the threshold limits for Significant Economic Presence

CBDT vide Notification No. 41/2021 Dated 3rd May,2021 has inserted a new rule 11UD to define the threshold limits for Significant Economic Presence u/s 9(1)(i) that specify transaction based threshold is Rs.2 Crores whereas user based threshold is Rs. 3 lacs users in India. - Notifications for exemption of provision of section 139A not apply on Eligible Foreign investor

CBDT vide Notification No. 42 of 2021 dated 04.05.2021, further amend rule 114aab to give exemption w.r.t. to provision of section 139A, to those Non-resident or foreign companies who are investing in capital asset like GDRs & etc. which are listed on IFCs & consideration are paid in Foreign currency only. Person must ensure that they are having income from these capital asset only in India.

GST

Section-A: Relaxations on account of Covid-19 – Period Covered: March and April 2021

| Filing of: GSTR- 3B and waiver of Late fee (Notification nos.08/2021 and 09 / 2021 dated 01st May 2021) | Return Period Covered: March and April 2021

Category-A: Taxpayers with turnover* > Rs. 5 Crores Relaxation allowed: 15 days from original due date Category-B: Taxpayers with turnover < Rs. 5 Crores Relaxation allowed: 30 days from original due date Category-C: For Quarterly taxpayers (QRMP Scheme) Relaxation allowed: 30 days from original due date |

March 2021- 5th April 2021 April 2021- 4th June 2021March 2021-20th May 2021 April 2021- 19th June 2021Cat-1 states – 22nd May 2021 Cat-2 states- 24th May 2021 |

| Filing of GSTR-1, IFF, GSTR-4, ITC-04 | For Regular Taxpayers: GSTR-1 | March 2021: N.A. April 2021: 26th May 2021 |

| (Notification no.10/2021, 11 /2021, 12/2021 and 13/2021 dated 01st May 2021) | For Regular Taxpayers: IFF

For Composition Dealers (Quarterly) : GSTR-4 For Job-Worker : ITC-4 |

March 2021: N.A. April 2021: 28th May 2021March 2021: 31st May 2021 April 2021: N.A. |

| Issuance of Notice filing of appeal, furnishing of returns, completion of proceedings (Notification no.14/2021 dated 01st May 2021) |

– For Completion of any proceeding or passing of any order or issuance of any notice, intimation, notification, sanction or approval, by any authority, commission or tribunal – Filing of any appeal, reply or application or furnishing of any report, document, return, statement etc. Original Due Date: 15th April 2021 to 30th May 2021** |

Revised Due Date: 31st May 2021** |

** Pursuant to recommendations of GST council in its 43rd Meeting dated 28th May 2021, the said period has been extended from 15th April 2021 to 29th June 2021 and the revised due date being 30th June 2021.

| Relaxation Particulars | Relaxation provided |

| Interest payment (Notification no.08/2021 dated 01st May 2021) |

Category-A: – No relaxation from Interest – Interest @ 9% p.a. if filed within relaxed period – Interest @ 18% p.a. if filed after relaxed period Categories B and C: – Relaxation from Interest for first 15 days from original due date – Interest @ 9% p.a. from 16th day till 30 days – Interest @ 18% p.a. after 30th day |

| ITC as per Rule 36(4) of CGST Rules, 2017 (Notification no.13/2021 dated 01st May 2021) |

– ITC Availment on the basis of GSTR-2A to be checked cumulatively for the tax period April and May 2021; – Any adjustment for the said periods shall be made in Return in Form GSTR 3B to be furnished for the month of May 2021 |

Section-B : Key outcomes of 43rd GST Council Meeting dated 28th May 2021

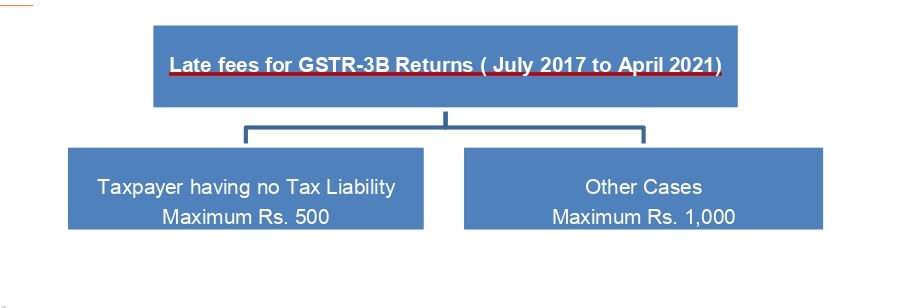

1. Amnesty scheme for waiver of Late Fee

Condition: The reduced rate of late fee would apply if GSTR-3B returns for these tax periods are furnished between 01st June 2021 to 31st August 2021.

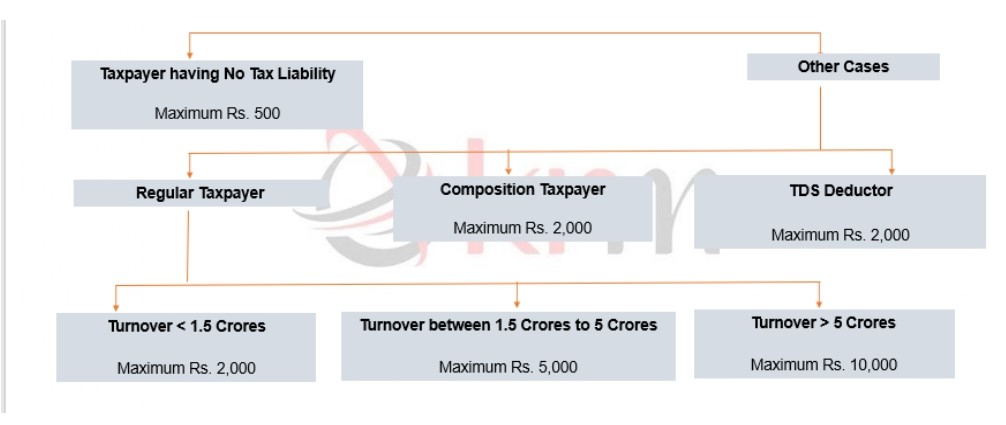

2. Rationalization of Late fees for Future periods

3. Simplification of Annual Return for Financial Year 2020-21

– In order to ease compliance in filing of Annual return- GSTR-9 for the FY 2020-21, amendments were made in Finance Act, 2021 omitting

the requirement for obtaining certified Reconciliation Statement in GSTR-9C, from a chartered accountant.

– Accordingly, compliance for the FY 2020-21 regarding annual return is as under:

| Annual Aggregate Turnover for FY 2020-21 | Compliance Requirement |

| Exceeding Rs. 5 Crores

Up to Rs. 2 Crores |

Mandatory to file self-certified GSTR-9C, along with Annual return in GSTR-9

Optional to file Annual Return in GSTR-9/9A. |

4. Other key recommendations of the Council

| Relaxations | Particulars | Recommendations |

| COVID-19 Relief | GST on specified COVID-19 related goods and Supplies.

IGST exemption has been extended for Black fungus medicine Amphotericin B. |

Full exemption from IGST valid upto 31.08.2021 |

| Filing of Returns by Companies by other means | Allowing filing of GST returns by companies using EVC (Electronic Verification Code), instead of Digital Signature Certificate (DSC) |

This relaxation available upto 31st August 2021. |

| Payment of interest on net cash basis | Reference regarding section 50 of the CGST Act providing for payment of interest on net cash basis. | Formal notification yet to be released |

| Filing of GSTR-1, IFF, GSTR-04, ITC-04 for the m/o May 2021 | – For Regular Taxpayers: GSTR-1 – For Regular Taxpayers: IFF – For Composition Dealers (Quarterly) : GSTR-4 – For Job-Worker : ITC-4 |

May 2021: 26th June 2021 May 2021: 28th June 2021 March 2021: 31st July 2021March 2021: 30th June 2021 |

| Decisions relating to GST rates | – To support the Lympahtic Filarisis (an endemic) elimination, GST rate on Diethylcarbamazine (DEC) tablets. – GST on MRO services in respect of ships/vessels – Services supplied to a Government Entity by way of construction of a rope-way attract |

Reduced to 5%.

-Reduced to 5%. -GST at the rate of 18%. |

| ITC as per Rule 36(4) of CGST Rules, 2017

Exemption of services under GST |

– ITC Availment on the basis of GSTR-2A to be checked cumulatively for the tax period April, May and June 2021; – Any adjustment for the said periods shall be made in Form GSTR 3B to be furnished for the month of June 2021 – services supplied to an educational institution including anganwadi, by way of serving of food including mid- day meals |

Exempt from levy of GST irrespective of funding of supplies from government grants or corporate decisions. |

The aforesaid relaxations are recommendations of the GST council in its recent 43rd meeting dated 28th May 2021. Formal notification in respect of various relaxations shall be separately released, wherever applicable.

Section-C : Other Notifications

Changes made according to various CGST rules Notification No. 15/2021 – Central Tax dated 18th May 2021

CBIC vide notification No. 15/2021 dated 18th May 2021, On the recommendations of the council Government made amendment in procedures of various rules including additions or removal of proviso in rules of revocation of cancellation of registration, acknowledgement of refund applications, order sanctioning refund and E- way bill rules to provide ease of compliances and procedures to support respective sections.

CBIC has issued circular on Standard Operating Procedure (SOP) for implementation of the provision of extension of time limit to apply for revocation of cancellation of registration

CBIC vide circular No. 148/04/2021-GST dated 18th May,2021, issue procedure on SOP for implementation of the provision of extension of time limit to apply for revocation of cancellation of registration u/s 30 of CGST Act amended to ensure uniformity in the implementation of the provisions, till the time an independent functionality for extension of time limit for applying in FORM GST REG-21 is developed on the GSTN portal.

Measures to facilitate trade during lockdown period facility of acceptance of an undertaking in lieu of Bond

CBIC vide Circular No. 09/2021 – Customs dated 08th May 2021 has decided to restore the facility of acceptance of an undertaking in lieu of bond by custom formations from the date of issue of circular till 30th June 2021, terms and conditions remain the same as underlined in circular no. 17/2020, dated 30th April 2020 as amended by circular no. 21/2020 dated 21st April 2020. Importers/ Exporters availing the facility shall ensure that the undertaking furnished in lieu of bond is duly replaced with a proper bond by 15th July 2021.

Clarification regarding carrying out Job work under the ambit of the Customs (Import of goods at concessional rate of duty IGCR) Amendment rules, 2021

CBIC vide Circular no.10/2021-customs , dated 17.05.2021, extended scope of job work for a manufacturer importer who is without complete manufacturing facility. Also, 100% out sourcing for manufacture of goods on job-work basis has been permitted for importers who do not have any manufacturing facility at all. However, sensitive sectors such as gold, articles of jewellery and other precious metals or stones have been excluded from the facility of job work. Detailed procedure had been prescribed for an importer which provide prior Intimation to Jurisdictional officer along with one time continuity bond. Periodical prescribed details has to be made available to the concerned officers as prescribed.

Exempt IGST on imports of specified covid-19 relief material donated from abroad

Ad hoc exemption has been provided through Exemption order no. 4/2021- Customs Dated 03rd May 2021 for IGST on imports of specified COVID-19 relief material donated from abroad, up to 30th June, 2021.

IGST has been reduced on oxygen concentrators when imported for personal use

CBIC vide Notification No. 30/2021-customs dated 01st May, 2021 notifies to reduce IGST to 12% on Oxygen Concentrators when imported for personal use. This notification shall remain in force upto and inclusive of the 30th June, 2021.

Corporate Laws

Relaxation of time of filing forms related to creation or modification of charges under the Companies Act, 2013

a) In case, a form CHG-1 and Form CHG-9 where the date of creation and modification of charge is before 01.04.2021, but time line for filing such form had not expired under section 77 of the act as on 01.04.2021 , the period beginning from 01.04.2021 and ending on 31.05.2021 shall not be reckoned for the purpose of counting the number of days under section 77 or section 78 of the Act. In case, the form is not filed within such period, the first day after 31.03.2021 shall be reckoned as 01.06.2021 for the purpose of counting the number of days within which the form is required to be filed under section 77 or section 78 of the Act.

b) In case a modification and creation of charge fall on any date between 01.04.2021 to 31.05.2021, the period beginning from the date of

creation/modification of charge to 31.05.2021 shall not be reckoned for the purpose of counting of days under section 77 or section 78 of the Act.

Gap between two Board Meeting under section 173 of the Companies Act, 2013:

It has now said that the gap between two consecutive board meetings can extend to 180 days during the quarter – April to June 2021 and July to September 2021 – instead of 120 days as stipulated in the company law. Resurgence of Covid-19 cases during the ongoing second wave has prompted the corporate affairs ministry (MCA) to relax the norm around the time gap between two consecutive board meetings of companies in a financial year. It has now said that the gap between two consecutive board meetings can extend to 180 days during the quarter – April to June 2021 and July to September 2021 – instead of 120 days as stipulated in the company law. Put simply, another sixty days window is being extended as gap between two consecutive Board meetings.

Clarification on offsetting the excess CSR spent for Financial Year 2019-20:

The certain companies claimed to have contributed CSR funds to the ‘PM CARES Fund’ over and above their prescribed CSR amount for FY 2019-20. Several representations have been received in the Ministry for setting off the excess CSR amount spent by the companies in FY 2019-20 by way of contribution to ‘PM CARES Fund’ against the mandatory CSR obligation for FY 2020-21. The issues raised in the said representations have been examined in the Ministry and accordingly, it is hereby clarified that where a company has contributed any amount to ‘PM CARES Fund’ on 31.03.2020, which is over and above the minimum amount as prescribed under section 135(5) of the Companies Act, 2013 (“Act”) for FY 2019-20, and such excess amount or part thereof is offset against the requirement to spend under section 135(5) for FY 2020-21 in terms of the aforementioned appeal, then the same shall not be viewed as a violation subject to the conditions that:

i. the amount offset as such shall have factored the unspent CSR amount for previous financial years, if any;

ii. the Chief Financial Officer shall certify that the contribution to “PMCARES Fund” was indeed made on 31st March 2020 in pursuance of the appeal and the same shall also be so certified by the statutory auditor of the company; and

iii. the details of such contribution shall be disclosed separately in the Annual Report on CSR as well as in the Board’s Report for FY 2020-21 in terms of section 134(3) (o) of the Act.

Waiver of additional fees on filing of various forms as per Circular no. 06/2021 and 07/2021, dated 3rd May 2021

Relaxation was provided to Companies and LLPs in filing of various forms, related to companies and LLP without payment of any additional fees where it has been due for filing for a specified period of time, the Ministry has issued a clarification listing out the forms covered under such relaxation. Further, it is to be noted that the relaxation w.r.t waiver off additional fees has been provided for the forms which are due for filing during a specific period of time only; therefore the clarification (list of forms) has to be referred along with its respective circular issued on 3rd May 2021.

Other Laws

SEBI notifies substantial amendments in Listing Regulation(Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) (Second Amendment) Regulations, 2021)

SEBI, the capital market regulator of India, vide a gazette notification dated 06th May, 2021 notified Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) (Second Amendment) Regulations, 2021 [“the Amendment Regulations”] that were approved in SEBI’s Board Meeting held on March 25, 2021. Most of the amendments were already rolled out earlier as consultation papers in 2020. The amendments become effective from May 06, 2021.

RBI

Sponsor Contribution to an AIF set up in Overseas Jurisdiction, including IFSCs:

The Ministry of Finance, Government of India, Reserve Bank of India vide Circular No. 04/RBI/2021-22 dated 12.05.2021 has provided that in attention of AD Category – I banks is invited to paragraph A.3.(e) and B.6 of Master Direction No.15 dated January 1, 2016, on “Direct Investment by Residents in Joint Venture (JV) / Wholly Owned Subsidiary (WOS) Abroad”, as amended from time to time and Regulation 7 of the Notification FEMA 120/2004-RB, pertaining to provisions for an Indian Party (IP) making investment/ financial commitment in an entity engaged in the financial services sector.

The Circular states that Investment by Indian Party (“a company incorporated in India or a body created under an Act of Parliament or a partnership firm registered under the Indian Partnership Act, 1932 making investment in a Joint Venture or Wholly Owned Subsidiary abroad”), as a sponsor into AIF set-up in an overseas jurisdiction and IFSCs in India will be considered as an outbound investment under the automatic route provided Indian Party complies with the conditions investing in an entity engaged in the financial service sector outside India.

This is a welcome move by the regulator as Indian Party is no longer required to take prior RBI approval. This move should boost the IFSC regime.

Relaxation on in timeline for compliance with various payment system requirements

A reference is invited to Reserve Bank of India instructions – (a) DPSS.CO.PD.No.1164/02.14.006/2017-18 dated October 11, 2017(as updated from time to time) on Master Direction on Issuance and Operation of Prepaid Payment Instruments (PPI-MD);

(b) DPSS.CO.PD.No.629/02.01.014/2019-20 dated September 20, 2019 on Harmonization of Turn Around Time (TAT) and Customer Compensation for Failed Transactions using Authorised Payment Systems; (c) DPSS.CO.OD.No.1325/06.11.001/2019-20 dated January 10, 2020 on Scope and Coverage of System Audit of Payment Systems; (d)DPSS.CO.PD.No.1810/02.14.008/2019-20 dated March 17, 2020 on Guidelines on Regulation of Payment Aggregators (PAs) and Payment Gateways (PGs); and (e) DPSS.CO.PD.No.1897/02.14.003/2019-20 dated June 4, 2020 on Extension of Timeline for Compliance with Various Payment System Requirements.

Keeping in view the resurgence of the COVID-19 pandemic and the representations received from various bank and non-bank entities, it has

been decided to extend the timeline prescribed for compliance in respect of a few areas.

DGFT

Amendment in Import Policy of integrated circuits and incorporation of policy condition.

The Ministry of Finance, Government of India, Central Board of Indirect Taxes and Customs vide Notification No. 05/2015-2020 dated 10.05.2021 has amended Import policy of item of Electronic Integrated Circuits shall be subject to Chip Imports Monitoring System (CHIMS) with effect from 01.08.2021.

Issuance of Export Authorisation for Restricted Items (Non-SCOMET) from new online Restricted Exports IT Module w.e.f. 17.05.2021.

The Ministry of Finance, Government of India, Central Board of Indirect Taxes and Customs vide Trade Notice No. 03/2021-22 dated 10.05.2021 has introduced a new online module for filing of electronic, paperless applications for export authorizations with effect from 17.05.2021. All applicants seeking export authorization for restricted items may apply online by navigating to the DGFT website (https://www.dgft.gov.in) → Services → Export Management Systems → License for Restricted Exports. Accordingly, applications for issuance as well as for amendment/re-validation of export authorization will need to be submitted online as per the above link and export authorizations for restricted items(Non-SCOMET) will continue to be issued from DGFT HQ, Udyog Bhawan, New Delhi through new module with effect from 17.05.2021. It may further be noted that all pending applications will be migrated to this new system and will be processed at DGFT(HQ).

On account of COVID 19, Indian Government is trying to provide relieves / measures to address the confusion / unrest in the industry. In continuation of relaxation and other parameters addressed by government, RBI; SEBI; DGFT and MCA has provided some of the important announcement / clarifications as mentioned in this presentation.

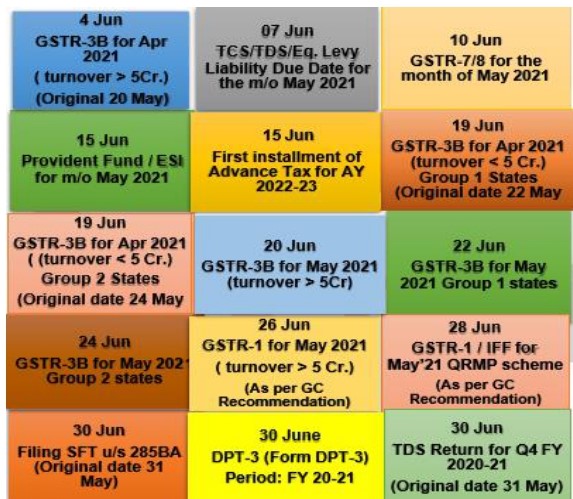

Due Dates: June 2021

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication.