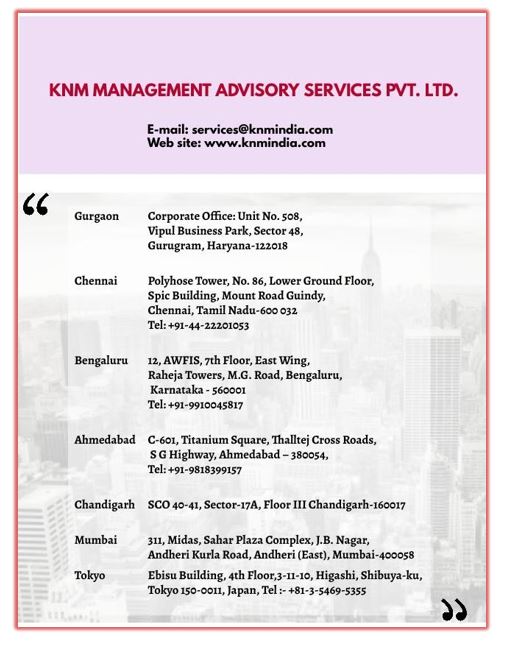

Executive Summary

Income Tax

- Section 10(46) Of the Income-Tax Act, 1961-Exemptions–Statutory body/Authority/Board /Commission – Notified Body or Authority.

- Amendment in Form No. 27Q.

- Special provision for collection of Tax at Source for Non-Filer of Income Tax Returns u/s 206CCA

- Special provision for Deduction of Tax at Source for Non-Filer of Income Tax Return u/s 206AB

Goods And Service Tax (GST)

- Filing of information by manufacturers of Pan Masala and Tobacco taxpayers

Companies Act 2013/ Other Laws

- Clarification Regarding Notification Pertaining to Restricting Import of Specific Items

- Insolvency Professionals to act as Interim Resolution Professionals, Liquidators, Resolution Professionals and Bankruptcy Trustees Recommendation Guidelines 2024

- SEBI amends Insider Trading norms, mandates Compliance Officer to approve/reject trading plan within 2 days of receipt

- SEBI modifies duration for call auction in pre-open session for IPOs and relisted scrips

![]()

Section 10(46) of the Income Tax Act, 1961- Exemption- Statutory body/ Authority/ Board/ Commission – Notified Body or Authority.

- The Central Government hereby notifies the Mathura Vrindavan Development Authority, an authority constituted under the Uttar Pradesh Urban Planning Development Act, 1973 (President’s Act 11 of 1973), for the purposes of the (46) clause of Section 10.

- This notification shall be effective from the assessment year 2024-25, subject to the condition that the assessee continues to be an authority constituted under the Uttar Pradesh Urban Planning Development Act, 1973 with one or more of the purposes specified in sub-clause (a) of clause (46A) of section 10 of the Income-tax Act

AND

- The Central Government hereby notifies for the purposes of the said clause, ‘Real Estate Appellate Tribunal, Punjab’ (PAN AAALR2230D), a body constituted by the Government of Punjab, in respect of the following specified income arising to that body, namely: —

- Levy of fees/charges/fines collected under The Real Estate (Regulation and Development) Act, 2016 (Central Act No. 16 of 2016) and Punjab State Real Estate (Regulation and Development) Rules, 2017.

- Government Grants

- Interest on Bank Deposits

- This notification shall be effective subject to the conditions that Real Estate Appellate Tribunal, Punjab –

- shall not engage in any commercial activity

- its activities and the nature of the specified income shall remain unchanged throughout the financial years

- shall file return of income in accordance with the provision of clause (g) of sub-section (4C) of section 139 of the Income-tax Act, 1961.

- This notification shall be deemed to be applicable for Assessment Year 2023-2024 to Assessment Year 2027-2028.

- Amendment in Form 27Q

In exercise of the powers conferred by section 295, read with sub-section (3) of section 200 of the Income-tax Act, 1961, The Central Government hereby makes the following rules further to amend the Income-tax Rules, 1962, namely: –

- These rules may be called the Income-tax (Sixth Amendment) Rules, 2024.

- They shall come into force on the 1st day of July 2024.

In the Income-tax Rules, 1962, the following note shall be inserted in Form No. 27Q in the Annexure, under the heading “Verification” in the Notes, after Note No. 7 ––

- ‘7A. Write “P” if lower deduction or no deduction is in view of notification issued under sub-section (1F) of section 197A.’.

- Special provision for Collection of Tax at Source for Non-Filer of Income Tax Returns u/s 206CCA

- Through Notification No. 46/2024/F.NO. 370142/8/2024-TPL dated 27.05.2024, Central Government notifies Reserve Bank of India to be a specified person to whom higher collection of Tax at Source will not be applicable as per Clause (ii) of the proviso to sub section (3) of Section 206CCA of Income Tax Act.

- This notification shall come into force from the date of its publication in the Official Gazette.

- Special provision for Deduction of Tax at Source for Non-Filer of Income Tax Returns u/s 206AB

- Through Notification No. 46/2024/F.NO. 370142/8/2024-TPL dated 27.05.2024, Central Government notifies Reserve Bank of India to be a specified person to whom higher collection of Tax at Source will not be applicable as per Clause (ii) of the proviso to sub section (3) of Section 206AB of Income Tax Act.

- This notification shall come into force from the date of its publication in the Official Gazette.

![]()

Filing of information by manufacturers of Pan Masala and Tobacco taxpayers

Filing of information by manufacturers of Pan Masala and Tobacco taxpayers

Referring to the Notification No. 04/2024 – Central Tax dated 05-01-2024 to seek information from taxpayers dealing in the goods mentioned therein. Two forms have been notified vide this notification namely GST SRM-I and GST SRM-II. The former pertains to the registration and disposal of machines while the latter asks for information on inputs and outputs for a month.

Form GST SRM-I meant for registration of machines, has already been made available on the portal w.e.f. 15-05-2024. Concerned taxpayers are using the same for the registration of machines and other information asked therein.

Now, the second form namely, Form GST SRM-II is also available on the portal. Taxpayers dealing in the manufacture of Pan Masala and Tobacco products can now report the details of inputs and outputs procured and consumed for the relevant month.

![]()

- Clarification Regarding Notification Pertaining to Restricting Import of Specific Items

Directorate General of Foreign Trade has issued a policy circular for clarification regarding Notification No. 17/2024-25 dated June 11, 2024 pertaining to restricting import of specific items under ITC (HS) Codes 71131912, 71131913, 71131914, 71131915 and 71131960, Representations have been received from SEZ wherein it is clarified that import made by SEZ units (Other than FTWZ units) under the ITC (HS) Codes 71131912, 71131913, 71131914, 71131915 and 71131960 are outside the purview of this notification.

Insolvency and Bankruptcy Code

- Insolvency Professionals to act as Interim Resolution Professionals, Liquidators, Resolution Professionals and Bankruptcy Trustees Recommendation Guidelines 2024

Insolvency and Bankruptcy Board of India has issued guidelines to provide the procedure for preparing panel of Insolvency Professionals to act as Interim Resolution Professionals, Liquidators, Resolution Professionals and Bankruptcy Trustees:

- These guidelines may be called the Insolvency Professionals to act as Interim Resolution Professionals, Liquidators, Resolution Professionals and Bankruptcy Trustees (Recommendation) Guidelines, 2024

- The panel of IPs prepared as per these guidelines will be effective from 1st July 2024 to 31st December 2024.

![]()

- SEBI amends Insider Trading norms, mandates Compliance Officer to approve/reject trading plan within 2 days of receipt

SEBI has notified the SEBI (Prohibition of Insider Trading) (Second Amendment) Regulations, 2024. As per the amended norms, the compliance officer must approve or reject the trading plan within 2 trading days of receiving it. Further, the compliance officer must notify the approved plan to the stock exchanges on which the securities are listed, on the day of approval. These regulations are effective from the 90th day of publication in the Official Gazette.

- SEBI modifies duration for call auction in pre-open session for IPOs and relisted scrips

According to new modifications, the pre-open session for IPOs will be for a duration of 60 minutes i.e, from 9-10 am, out of which 45 minutes will be allowed for order entry, order modification and order cancellation and 10 minutes for order matching and trade confirmation.

![]()

Disclaimer: Information in this note is intended to provide only a general update on the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period 01.06.2024 to 30.06.2024