Content:

1 |

Covid-19 Pandemic and its Impact |

2 |

Compliance dates during lockdown period and extended new date |

3 |

Checklist during and after Lockdown |

A. Covid-19 Pandemic and its Impact

COVID-19

The 2019–20 coronavirus pandemic is an ongoing pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus (SARS-CoV-2). The disease was first identified in December 2019 in Wuhan, the capital of China’s Hubei province, and has since spread globally, resulting in the ongoing coronavirus pandemic. The World Health Organization (WHO) declared the 2019–20 coronavirus outbreak a Public Health Emergency of International Concern on January 30, 2020 and a pandemic on March 11, 2020.

| Countries impacted Countries | 185 |

| Total Cases as on April 22, 2020 | More than 2.6 Million |

| Total deaths as on April 22, 2020 | 184,235 |

| Total cases recovered as on April 22, 2020 | 721,734 |

https://www.worldometers.info/coronavirus/

Updated on April 23, 2020 till 4.03 GST

India Response to COVID-19

–On March 24: Lockdown was declared for 21 days till April 14, 2020

–On April 14: Lockdown was Extended till May 03, 2020 (with some relaxation applicable form April 20, 2020)

What is not open during relaxation

–Passenger traffic movement by rail, road and air—except

–School, College and education institutions

–Industrial, commercial activity and hospitality services including hotels (unless they are specially exempted)

–Shopping mall & Cinema Hall

–No Social gathering place including religious places

–E-commerce – other than essential goods & services

What is open during relaxation

–Agriculture activities

–All Heath services

–IT and IT enabled Services, with up to 50% strength

–Industries operating in rural areas

–Supply of essential goods

–Print and electronic media including broadcasting, DTH and c ..

–Services provided by self-employed people such as electrician, plumber etc.

Detailed guide line are available at https://www.mha.gov.in/media/whats-new

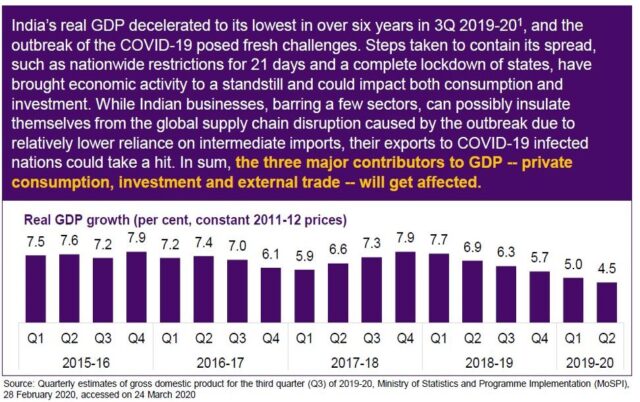

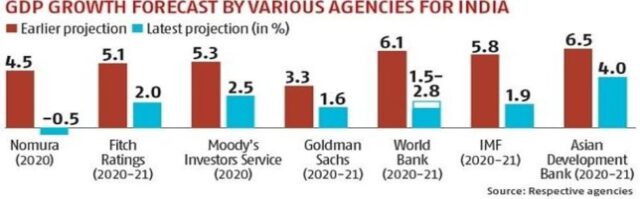

ØIndia to grow at 1.9% in FY20-21, recover to 7.4% path in 2021-22: IMF

ØS&P cuts India growth forecast for FY21 to 1.8% and expects growth to recover to 7.5% in FY22

ØMoody’s slashes India GDP growth in 2020 to 2.5%

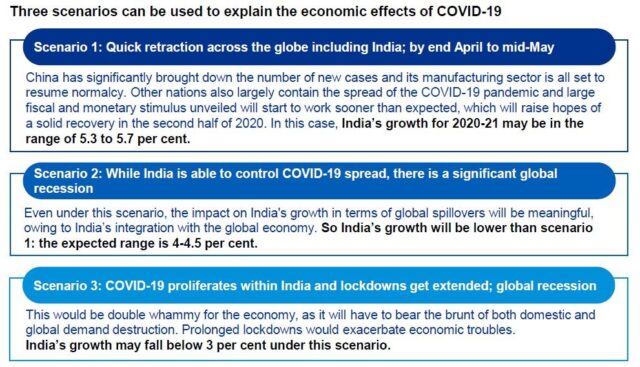

The pandemic is likely to impact the country’s economy through the following four vectors:

A- Supply Disruptions

- Dependence on China for imports of raw and immediate material

- Higher Input prices and reduced reliability, leading to decline in capacity building

- Supply-side disruptions may be temporary as China revives production units

B- Global and Domestic demand

- Consumer spending to take a hit due to movement restrictions and fear of falling sick

- Reduced wealth effect due to falling share prices

- Hospitality and aviation sectors are impacted the most at a short span of time.

- Low profitability and production disruption impact business sentiments and investments

- Loss of employment, especially in the informal sector and for contractual workers, reduce consumer spending.

- Demand in top few export destinations, (China, the US, and Europe) accounting for 40% of India’s Exports is severely hit.

C- Stress on Banking and Financial sectors and parameters

Banks:

- Exposure to stressed industries and MSMEs

- Rising consumer loan default because of high unemployment and household leverage.

- Stress on bank impact credit growth

Capital market and Financial parameters:

- The stock market has fallen 30% since pandemic started spreading in the west

- A sharp depreciation of rupee against the dollar worsens trade deficit as export contribution to GDP is low

- Rising bond yields make borrowing more expensive, thereby reducing bank margins.

D- Falling oil Prices

- Oil prices have fallen sharply. Brent crude oil fell from US$ 68.5 per barrel on 3rd January to US$ 28.2 per barrel on 20th March.

- Lower oil prices could be a boon for India’s twin deficit (the fiscal and current account)

- Gives policymakers some headroom to act.

- The rupee depreciation may partially offset the gains. Rupee has depreciated from INR 71.7 per US$ on 3rd January to INR 75 per US$ on 20th March.

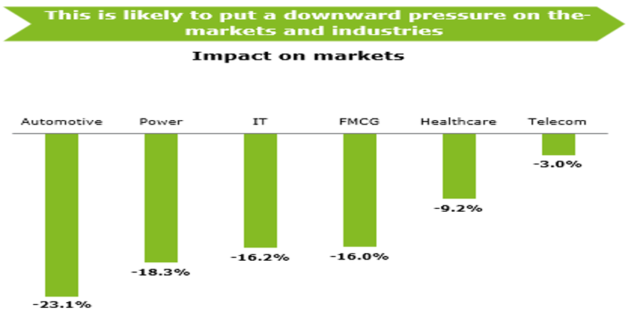

IMPACT OF COVID-19: ON CONSUMER BUSINESS IN INDIA

The pandemic has set foot in India and is expected to lead the country towards a major slowdown.

SEGMENTAL IMPACT: AUTOMATIVE

The sector has inventories sufficient for short-term support, but lack of single, critical components can hurt OEMs

Local Indian auto-component manufacturers are unlikely to immediately capitalise on the void created by China, as it takes time for OEMs to recalibrate their supply chain.

In a scenario of disruption in the supply of key components, the industry could look at sourcing them either locally or from other countries such as Germany, South Korea, Japan, and Thailand (currently accounting for around one-third of the total imports)

However, the change in procurement channels could be costlier and the supply could be insufficient to meet the demand

According to a report released by Fitch Solutions recently, vehicle production in India is likely to contract by 8.3% in 2020 following an estimated 13.2% decline in 2019. Covid-19 will also make the transition to Bharat Stage Six (BS-VI) emission norms difficult which is scheduled from April 2020

Government Actions

On March 21st, 2020, the Union Cabinet approved incentives worth ₹40,995 crore (US$5.7 billion) for electronic manufacturing.

FM Sitaraman has announced on March 26th, 2020, a Package of Rs.1.7Cr Lakh (Rs.1700 Billion) for the benefits of various section of society.

On March 28th, 2020, the Hon’ble Prime Minister launched a new fund called PM CARES fund for combating such situations and Donations to PM CARES Fund would qualify for 80G benefits for 100% exemption under the Income Tax Act, 1961.

On April 3rd, 2020 the Central Government (CG) released ₹17,287 crore (US$2.4 billion) to different states to help combat coronavirus. The Ministry of Home Affairs approved ₹11,092 crore (US$1.6 billion) for states as relief under the State Disaster Risk Management Fund.

On April 21st 2020, it was announced that a team from “The Technology Information, Forecasting and Assessment Council” (TIFAC)” under the Department of Science and Technology are preparing a white paper on the revival of the India economy.

Apart from above on March 26th ,2020, India participated in the virtual ‘Extraordinary G20 Leaders’ Summit‘. The G20 nations decided to inject over $5 trillion into the global economy to counteract the pandemic’s impacts. They agreed to work together, to strengthen the World Health Organisation, develop a vaccine and make it available and further on April 2nd ,2020, the World Bank approved $1 bn emergency financing for India to tackle coronavirus labelled ‘India COVID-19 Emergency Response and Health Systems Preparedness Project.

RBI Actions

RBI Governor on March 27, 2020,

–reduce Repo by 75bps to 4.4

-reduce reverse repo cut by 90bps at 4%

–CRR is reduced by 100bps to 3% for period of 1 year & minimum daily CRR maintenance reduced to 80% from 90% ( for period till June)

-It was also allowed to have moratorium of 3 months w.r.t. to term loans.

RBI Governor on April 17, 2020

– Reduce Reverse repo cut by 25bps at 3.75%

– announced Rs 1 lakh crore (Rs.1000 Billion) liquidity lifeline

–No dividend by banks till further notice

-NBFCs can grant relaxed NPA classification to borrowers

–Overdraft facility for state Govt. under “ways and Means Advance” doubled to 60% of borrowing limit

-Banks to maintain higher provision of 10% on moratorium loans over two quarter.

Change in foreign direct investment (FDI) rules

On 18 April 2020, India changed its (FDI) policy to curb “‘opportunistic takeovers/acquisitions’ of Indian companies due to the current pandemic”, according to the DPIIT. And as per Financial Express: China’s protest of India’s revised FDI Policy https://www.financialexpress.com/economy/chinas-protest-of-indias-revised-fdi-policy-a-process-of-de-globalisation-begins-opine-experts/1936163/

Latest by Industry on Lockdown and Expectations

Rajiv Bajaj- (MD Bajaj Auto)

– Significant job losses

-Extended lockdown worsen the situation

-Capital expenditure are frozen except R&D

-All investment on hold at least for one year

-Reducing salary of employees during lockdown period, voluntary accepted by employees

-Start the front end like dealer and exports, otherwise no benefit on starting the plant

-Scarp the rule for sealing the factory or dealers in case of any infected Covid-19 employee

Source : CNBC-TV18

Pawan Goenka

(Mahindra & Mahindra)

-Can not start production till dealer start working

-Already have inventory

-Starting of financing by Banks and NBFC

-It will take 2-3 months to get normalise

Society of Indian Automobile Manufacturers (SIAM)

-Temporary reduction of GST on Auto Sector

–Reduce in interest rate for availability of working capital

Industry Voice on Salary reduction or deferment announced

-Odisha, Andhra, Rajasthan defer salaries of top govt employees

-Future Group may defer salaries to staff : https://tech.economictimes.indiatimes.com/news/corporate/future-group-may-defer-salaries-of-staff/75301420

–

-Oyo announces pay cuts, leave with limited benefits options for India staff

-GoAir announces company-wide pay cut

Wage stimulus package for private sector likely, says labour secretary

B. Compliance Due Date and Extended New date

Extension of Due Dates & Facilitation Measures announced by Govt of India due to COVID19

| S. No | Type | Period | Actual Due Date | Extended Due Date |

| A-Income Tax Act | ||||

| 1 | TDS Returns in

Form 24Q/26Q |

4th quarter ending Mar 2020 | 31st May 2020 | 30th Jun 2020 |

| 2 | TDS Returns in Form 26QB/QC/QD | Feb Month return | 30th Mar 2020 | 30th Jun 2020 |

| Mar Month return | 30th Apr 2020 | 30th Jun 2020 | ||

| Apr Month return | 30th May 2020 | 30th Jun 2020 | ||

| 3 | Income Tax Return for FY 18-19 | FY 18-19 i.e. AY 19-20 | 31st Mar 2020 | 30th Jun 2020 |

| 4 | Issue of Form 16/16A | 4th quarter ending Mar 2020 | 15th Jun 2020 | 30th Jun 2020 |

| 5 | Issue of Form 16B/16C/16D | Mar Month return | 15th May 2020 | 30th Jun 2020 |

| Apr Month return | 14th Jun 2020 | 30th Jun 2020 | ||

| 6 | Chapter VIA – 80C, 80G, 80D,

Donations, PPF, Life & Health Insurance, etc. |

FY 19-20 | 31st Mar 2020 | 30th Jun 2020

*Insurance payments, Investments etc. can be made till 30th June 2020 for claiming exemptions in FY 19-20 IT returns |

| 7 | TDS Payment | Monthly TDS payment | 7th of next month

* For March 20, it is April 30 |

No change , except rate of interest has been reduced to 9% per annum in case of delay |

| S.No | Type | Period | Actual Due Date | Extended Due Date | Remarks |

| B-Goods & Service Tax Act | |||||

| 1 | GSTR3B (Turnover more than 5 crores) | Feb, Mar, Apr Month returns | 20th of subsequent

Month |

24th Jun 2020 | Late fee waived only if filed before this date and Interest payable will be @NIL for first 15 days from original due date and @9% thereafter (this rate will be applicable only if filed before this date). In case returns are filed after this date, then interest is payable @18% for the full period from the original due date and late fees is also payable. |

| 2 | GSTR3B (Turnover more than 1.5 crores but less than 5 crores) | Feb, Mar Month returns | 20th of subsequent

month |

29th Jun 2020 | Both Interest and Late fee waived only if filed before this date |

| Apr Month return | 30th Jun 2020 | ||||

| 3 | GSTR3B (Turnover less than 1.50 crores) | Feb Month return | 20th of subsequent Month | 30th Jun 2020 | Both Interest and Late fee waived only if filed before this date |

| Mar Month return | 3rd Jul 2020 | ||||

| Apr Month return | 6th Jul 2020 | ||||

| S.No | Type | Period | Actual Due Date | Extended Due Date | Remarks |

| 4 | GSTR3B (Turnover > 5 Cr) | May Month | 20th Jun 2020 | 27th Jun 2020 | |

| 5 | GSTR3B (Turnover <5 Cr) | 22th/24thJun 2020 | 12th/14thJul2020 | ||

| 6 | GSTR1 – Monthly Filings | Mar, Apr, May Month returns | 10th of subsequent month | 30th Jun 2020 | Late fee waived only if filed before this date |

| 7 | GSTR1 – Quarterly

filings |

Mar quarter returns | 30th Apr 2020 | 30th Jun 2020 | Late fee waived only if filed before

this date |

| 8 | Input GST credit – restriction rule of 10% with reference to GSTR2A | Feb, Mar, Apr, May, Jun, Jul, Aug month returns | the said condition shall not apply to input tax credit availed by the registered persons in the returns in FORM GSTR-3B for the months of February, March, April, May, June, July and August, 2020, but that the said condition shall apply cumulatively for the said period and that the return in FORM GSTR-3B for the tax period of September, 2020 shall be furnished with cumulative adjustment of input tax credit for the said months in accordance with the 10% condition |

| S. No | Type | Period | Actual Due Date | Extended Due Date | Remarks |

| C-Other Misc. Act | |||||

| 1 | ESI Contribution | Feb Month | 15th Mar 2020 | 15th Apr 2020 | |

| March Month | 15th Apr 2020 | 15th May 2020 | |||

| 2 | PF Contribution | Mar, Apr, May month | Employer Contribution 12% + Employee 12% to be paid fully by government if the establishment employs less than 100 persons and 90% of such employees are drawing wages less than Rs.15000 | ||

| 3 | Motor Third Party Insurance | Renewal due between 25th Mar to 14th Apr | As per policy | 21st Apr 2020 | |

| 4 | Health Insurance Policy | Renewal due

between 25th Mar to 14th Apr |

As per policy | 21st Apr 2020 | |

| S. No | Type | Period Ended/Particulars | Actual Due Date | Extended Due Date | Remarks | |

| D-Companies & LLP Act | ||||||

| 1 | Companies Fresh Start Scheme 2020 | Documents due for filing till 31st March 2020 under Companies Act, if not filed earlier can now

be filed. |

— | Scheme open till 30.9.2020 | Late Fees completely waived , Full immunity from Prosecution | |

| 2 | LLP Settlement Scheme 2020 | Documents due for filing till 31st Mar 2020 under Limited Liability Partnership Act, if not filed earlier can now be filed. | — | Scheme open till 30.9.2020 | Late Fees completely waived , Full immunity from Prosecution | |

| 3 | MSME | Every specified company file E-Form for Oct to Mar | 30th Apr, 2020 | 30th Sep 2020 | ||

| 4 | DPT-3 | Every company file E-Form within 90 days from March 31st 2020 | 30th Jun, 2020 | 30th Sep 2020 | ||

| 5 | DIR-3 KYC | Every Individual have DIN as on March 31st 2020 | 30th Apr, 2020 | 30th Sep 2020 | ||

| 6 | BEN-2 | E-Form filed by company within 30 days of receipt of declaration, | 31st Mar, 2020 | 30th Sep 2020 | ||

| 7 | Form-11 LLP | FY 2019-20 (Annual Return of LLP within 60 days from end of Financial Year) | 30th May, 2020 | 30th Sep 2020 | ||

CHANGES INTRODUCED BY MINISTRY OF CORPORATE AFFAIRS

CAR (Companies Affirmation of Readiness towards COVID-19)

Ministry of Corporate Affairs vide a notification conveyed and strongly advised to all the Companies and LLPs to put in place an immediate plan to implement ‘Work from Home’ Policy in their headquarters and field offices. It was a web based form and filing of this form was voluntary.

Companies Fresh Start Scheme 2020 and LLP Settlement Scheme, 2020

The Companies Fresh Start Scheme (CFSS) and LLP Settlement Scheme are applicable between the 1st of April, 2020 and the 30th of September, 2020. These schemes were introduced by the Ministry of Corporate Affairs to make good any filing related defaults, irrespective of duration of default, and make a fresh start as a fully compliant entity. The USP of both the schemes is a one-time waiver of additional filing fees for delayed filings by the companies or LLPs with the Registrar of Companies during the currency of the Schemes. Both the Schemes also contain provision for giving immunity from penal proceedings.

Contribution to PM Cares Fund qualifies as CSR Expenditure

MCA clarifies that contributions made by companies to Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund (‘PM CARES Fund’) shall qualify as contribution towards CSR expenditure under item no. (viii) of Schedule VII of Companies Act, 2013.

Conducting Extra Ordinary General Meetings through Video Conferencing

Ministry has on April 08, 2020 issued a circular allowing companies to hold Extraordinary General Meetings (EGMs) through VC or OAVM complemented with e-Voting facility/simplified voting through registered emails, without requiring the shareholders to physically assemble at a common venue. The Companies Act, 2013 allows ordinary and special resolutions to be passed through postal ballot/e-voting route without holding a physical general meeting. However, in present lockdown/social distancing conditions due to COVID 19, postal ballot facility cannot be utilized by the companies.

Special Measures under CA, 2013 & LLP Act, 2008 in view of COVID-19 outbreak

A one time relaxation on the gap between two consecutive Board Meetings may extend to 180 days instead of 120 days.

CARO, 2020 shall be made applicable from the financial year 2020-21 instead of financial year 2019-20.

An additional period of 180 days is allowed for filing declaration of commencement of business after incorporation.

Non compliance of minimum residency in India for a period of at least 182 days shall not be treated as non compliance for the financial year 2019-20.

Board Meeting on restricted matters can be held through video conferencing mode till 30th June, 2020.

Names expiring any day between 15th March 2020 to 3rd May would be extended by 20 days beyond 3rd May 2020.

C. POINTS TO BE TAKEN CARE OF DURING AND AFTER LOCKDOWN

During Lockdown:-

- Keep in touch with client/customers/supplier/service provider regularly as mostly are working form home

- Engage with employees regularly and keep them motivated (group meetings, offline documentations and skill upgrading trainings)

- Review your organization structure, resource needs and recruitments & plan actions to bring back workforce quickly after lockdown

- Access the suppliers capabilities, will they able to cope up with increased demand or requirement after lockdown

- Explore opportunities for employing local workforce

- Talk to your bankers and discuss on ways to ease out financial burden

- Prepare a plan to improve liquidity and cash flow

- Create a priority checklist for payments

- Don’t hesitate to write to your customers on payment dues

- Review your contracts with all relevant parties for discussion for mutual benefit

- Take the stock of current inventories and prepare an action plan

- Review your current processes, templates and checklists for all functions

- Create a business plan and do detailed budgeting for next financial year

- Create a plan of action to protect your business from future crisis

After Lockdown: General Suggestions:

- Ensure that your plan for improving liquidity and cash flow are executed

- Prioritize activities to get back workforce immediately

- Discuss or have meeting with suppliers, subcontractors and customers to understand ground realities

- Be flexible and offer necessary support to all your supply chain partners

- Focus on cash flows for the short term and long term

- Focus on your employees and address them regularly – keep them positive and motivated

After Lockdown: Practical Suggestion:

- Closing of books of account for FY 2019-20 as financial year end

Accurate booking of Provisions for expenses, accruals & Prepaid expenses.

For this you can plan immediately

Make pending payment which are regular in nature like salary, rent, taxes etc. - New Invoice series: Start new invoice series, unique for the FY 2020-21 because start of new financial year as per GST Law.

- LUT: For export of goods and services LUT has to be submitted at the beginning of the FY, the due date for the same has been extended to 30th June 2020

- Opting for Composition scheme: The due date to opt for this the composition scheme for FY 2020-21 is extended till 30th June 2020.

Stay Safe, Stay Healthy, Stay Home………………………