Executive Summary

Income Tax

- Extension of due date of linking of Aadhar with PAN till 30th June 2023

- Extension of due date of filing of Form 10F till 30th September 2023

- Employees is liable to inform about tax regime opted otherwise employer is liable to deduct TDS under new tax regime.

- CII for capital gain computation for FY 2023-24 is 348

Goods & Services Tax (GST) & Customs

- GSTN Issues advisory on Time limit for reporting invoices on the IRP portal.

- GSTN Issues advisory on Bank account validation.

- Extension of time limit for application for revocation of cancellation of registration

- Rationalization of late fee for GSTR-9 and Amnesty to GSTR-9 non-filers

- Amnesty to GSTR-4 non-filers

- Amnesty to GSTR-10 non-filers

- Clarification on the GST rate and clarification of ‘Rab’

Companies Act 2013/ Other Laws

- Form STK-2 will be transited to V3 portal with effect from May 01, 2023

- RBI harmonises provisioning norms for standard assets applicable to all categories of Urban Co-operative banks

- EPFO extends timeline for linking of Aadhar with UAN of EPF members up to 31.03.2024

- SEBI prescribes procedure for obtaining prior approval for change in control of ‘Vault Managers’

- SEBI issues Master Circular for ‘Market Infrastructure Institutions’.

![]()

CBDT vide Press Release dated 28.03.2023: has the date for linking PAN and Aadhaar has been extended to 30th June, 2023, whereby persons can intimate their Aadhaar to the prescribed authority for Aadhaar-PAN linking without facing repercussions after that PAN becomes inoperative. Further CBDT vide CIRCULAR NO. 3 OF 2023, DATED 28-3-2023 has also narrate the consequences as a result of his PAN becoming inoperative as follows:

- refund of any amount of tax or part thereof, due under the provisions of the Act shall not be made to him;

- interest shall not be payable to him on such refund for the period, beginning with the date specified under sub-rule (4) of rule 114AAA and ending with the date on which it becomes operative;

- where tax is deductible under Chapter XVU-B in case of such person, such tax shall be deducted at higher rate, in accordance with the provisions of section 206AA;

- where tax is collectible at source under Chapter XVII-BB in case of such person, such tax shall be collected at higher rate, in accordance with the provisions of section 206CC.

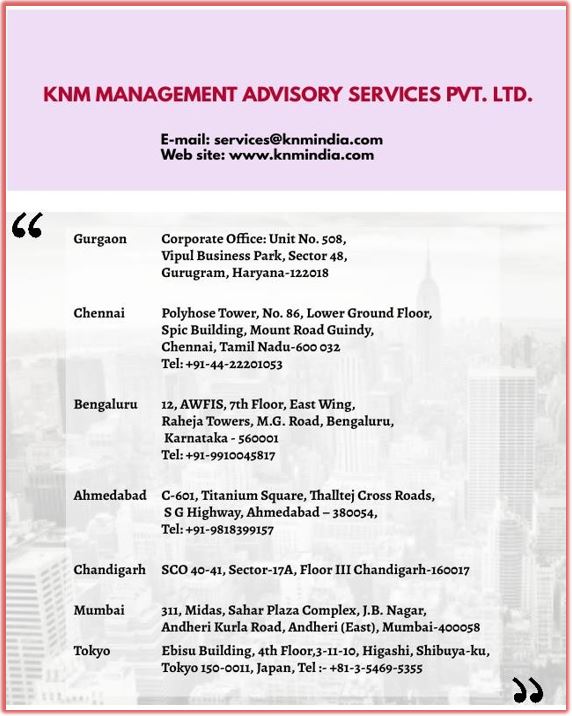

- CBDT vide CIRCULAR F. NO. DGIT(S)-ADG(S)-3/E-FILING NOTIFICATION/FORMS/2023/13420, DATED 28-3-2023 has further extended the due date of filing the electrnoic Form 10F. In view of the continued practical challenges and to mitigate the genuine hardship being faced by those Non-resident taxpayers, it has been decided by the competent authority to extend the above mentioned partial relaxation further till 30th September, 2023.

- CBDT vide NOTIFICATION No. 1/2023, DATED 29-3-2023 has procedure, format and standards for filling an application in Form No. 15C or Form No. 15D for grant of certificate for no-deduction of income-tax U/s 195(3) through traces.

- CBDT vide CIRCULAR NO. 4/2023 DATED 04-3-2023 has directs that a deductor, being an employer, shall seek information from each of its employees having income under section 192 of the Act regarding their intended tax regime and each such employee shall intimate the same to the deductor, being his employer, regarding his intended tax regime for each year and upon intimation, the deductor shall compute his total income, and deduct tax at source thereon according to the option exercised. If intimation is not made by the employee, it shall be presumed that the employee continues to be in the default tax regime and has not exercised the option to opt out of the new tax regime. Accordingly, in such a case, the employer shall deduct tax at source, on income under section 192 of the Act, in accordance with the rates provided under sub-section (1A) of section 115BAC of the Ac

- CBDT vide NOTIFICATION No. 21/2023, DATED 10-04-2023 has notifies the Cost Inflation Index(CII) for FY 2023-24 is “348” for the purpose of computing Capital gain .

![]()

- GSTN Issues advisory dated 13 April 2023 that time limit to report old invoices on the e-invoice portal for the taxpayer whose AATO is more than 100 crores. That they cannot report invoices older than 7 days.this is only applicable to documents on which IRN generated. Also debit note and credit note also have to be reported whitin 7 days from date of issue.GSTN proposes to implement this from May 1,2023 onwards

- GSTN issues advisory dated 24 April 2023 that functionality for the bank account validation is now integrated with the GST system. This feature is introduce to ensure that taxpayer information is corrected or not. Post validation, any bank account number in the database would have one status out of the below mentioned four status types- Success, Failure, Success with Remark, Pending For validation.

Whenever Tax payer is shown Failure icon with further detail such as:

- PAN number is invalid.

- PAN not available in the concerned bank account.

- PAN Registered under GSTIN and PAN maintained in the Bank Account are not same.

- IFSC code entered for the bank account detail is invalid.

In these cases, the Tax Payer is expected to ensure that he has entered correct bank details and the KYC is completed by bank for his bank account.

- As per CBIC Notification NO.02/2023-CENTRALTAX dated 31st march 2023 CG on the recommendation of Council Late fees under sec47 will be waived which in excess of two hundred and fifty rupees and shall fully waived where the total amount of central amount of such return is Nil and register person fail to file GSTR-4 for the quarters from July 2017 to March 2019 or for the FY from 2019-20 to 2021-22 by the due date but furnish the said return between the period from the 1st April 2023 to 30th June 2023.

- As per CBIC Notification NO.03/2023-CENTRAL Tax dated 31st March 2023 Council notifies that registered person whose registration has been cancelled on or before 31st December 2022 and failed to apply for revocation of such cancellation within specified time under the said Act than it requires to follow the specified procedure:

- It required to apply for revocation for cancellation up to 30th June 2023.

- The application shall be filed only after furnishing the return up to the effective date of cancellation of registration and payment of taxes if any,

- No further extension of time for revocation available in these cases.

- It also include a person whose application of revocation cancel on the ground of failure to apply within specified time

- As per CBIC Notification NO.04/2023-CENTRAL Tax dated 31st March 2023 a person opt of authentication of Aadhar number, while submitting the application under sub-rule (4), undergo authentication of Aadhaar number and the date of submission of the application in such cases shall be the date of authentication of the Aadhaar number, or fifteen days from the submission of the application in Part B of FORM GST REG-01 under sub-rule (4), whichever is earlier

- As per CBIC Notification NO.05/2023-CENTRAL Tax dated 31st March 2023 Council recommend amendment in notification of the government of India, the ministry of finance No.27/2022-central tax dated on 26th dec 2022 namely: – In the said notification, for the words, “provisions of”, the words “proviso to” shall be substituted. They shall be deemed to have come into force from the 26th December,2022.

- As per CBIC Notification NO.06/2023-CENTRAL Tax dated 31st March 2023 CG on the recommendation of council, here notifies that the person who failed to file the valid return within a period of thirty days from the service of the assessment order issued on or before 28th Feb 2023.In respect of whom said assessment order shall deemed to have been withdrawn, if the person shall furnish the said return on or before the 30th June 2023 and return shall be accompanied by payment of interest and late fee. irrespective of whether or not an appeal had been filed against such assessment order or whether or not the appeal, if any, filed against the said assessment order has been decided.

- As per CBIC Notification NO.07/2023-CENTRAL Tax dated 31st March 2023 CG on the recommendation of the council hereby waives the amount of late fee in respect of the return to be furnished under sec 44 of the Act for the FY 2022-23 onwards, which is in excess of amount as

- Registered person having turnover up to 5 crore rupees in the relevant FY – Twenty-five rupee Per day subject to maximum .02 per cent of turnover

- Registered person having turnover more than 5 crore rupees in the relevant FY – fifty rupee Per day subject to maximum .02 per cent of turnover

- Provided that who fail to furnish return for FY 2017-18, 2018-19, 2019-20, 2020-21 or 2021-22 but furnish the return within the period of 1st April 2023 to 30th June 2023, the total amount of late fees shall be waived which is excess of ten thousand rupees.

- As per CBIC Notification NO.08/2023-CENTRAL Tax dated 31st March 2023 CG waived the late fees which is excess of rupees five thousand for the person who failed to file GSTR-10 by the due date but furnish return within period of 1st April 2023 to 30th June 2023.

- As per CBIC Notification NO.09/2023-CENTRAL Tax dated 31st March 2023 CG on the recommendation of the council extend the time limit specified under sub-section (10) of the section 73 of the issuance of order under sun-section (9) of sec 73 of the Act, for recovery of tax not paid, short paid or wrongly availed or utilized Input, relating to the period

- For the FY 2017-18 up to 31st Dec,2023.

- For the FY 2018-19 up to 31st Mar,2024.

- For the FY 2019-20 up to 30th Jun 2024.

- As per Circular No. 191/03/2023-GST Dated 27th March 2023 CBIC on the recommendation of the GST Council 5% rate notifies for ‘Rab’ when sold in packed and labelled. And Nil for the other than packaged and labelled. Further as per recommendation of GST council in the above-said meeting, in view of the prevailing divergent interpretations and genuine doubts regarding the applicability of GST rate on ‘Rab’, the issue for past period is hereby regularized on “as is” basis.

![]()

Form STK-2 will be transited to V3 portal with effect from May 01, 2023

Ministry of Corporate Affairs (MCA) is planning to launch Form STK-2 along with C-PACE functionality on May 01, 2023. Form STK-2 on the V2 portal will be disabled from 28th April 11:59 PM to 30th April 11:59 pm. Further, the V3 portal will not be available for filing of all Company/LLP forms due to the STK-2 form roll-out from 30th April (03:00 PM) to 01st May 2023 (12:00 AM). Also, Stakeholders must ensure that there are no SRNs in pending payment and resubmission status.

![]()

- RBI harmonises provisioning norms for standard assets applicable to all categories of Urban Co-operative banks

The RBI vide circular no. dated December 01, 2022 had categorised Urban Co-operative Banks (UCBs) into 4 Tiers namely Tier 1, Tier 2, Tier 3 and Tier 4 for regulatory purposes. Upon review, RBI has now decided to harmonise the provisioning norms for standard assets applicable to all categories of UCBs, irrespective of their Tier in the revised framework. Accordingly, the standard asset provisioning norms have been prescribed. These norms shall be applicable from 24.04.2023.

- EPFO extends timeline for linking of Aadhar with UAN of EPF members up to 31.03.2024

In partial modification of the circular dated 01.04.2022 under reference, the Competent Authority has granted an extension for mandatory seeding of Aadhaar for filing of ECR up to 31.03.2024 in respect of the certain class of establishments i.e. Beedi making, Building and Construction and Plantation Industries (Tea, Coffee, Cardamom, Pepper, Jute, Rubber, Cinchona, Cashewnuts etc.) and for North Eastern Region comprising of States of Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland & Tripura.

![]()

- SEBI prescribes procedure for obtaining prior approval for change in control of ‘Vault Managers’

Regulation 8(b) of SEBI (Vault Managers) Regulations, 2021 was amended vide SEBI (Change in Control in Intermediaries) (Amendment) Regulations, 2023 dated January 17, 2023 which requires Vault Managers to obtain prior approval of the Board in case of change in control in such manner as specified by the Board. As per the procedure, Vault Managers must submit an application to SEBI for obtaining prior approval through the SEBI Intermediary Portal.

- SEBI issues Master Circular for ‘Market Infrastructure Institutions’.

To protect the interest of investors in securities and to promote the development of, and to regulate the securities market SEBI has issued Circular No. SEBI/HO/MRD/POD 3/CIR/P/2023/58 Dated: April 20, 2023.

![]()

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period from 26th Mar till 25th Apr. 2023.