Executive Summary

Income Tax

- The due dates for ITR return and TDS returns have been extended.

- Form No. 10–IK and 10BBD are available for filing on the portal.

Goods & Services Tax (GST) & Customs

- Amendments made in sections 37 & 39 of the CGST Act 2017

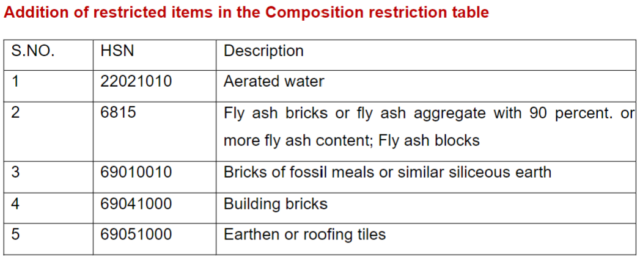

- Addition of restricted items in the composition restriction table

- Conditions regarding ITC Availment and reversal in case of non–payment of consideration

Companies Act 2013/ Other Laws

- MCA has made amendments in the format of the Annual Report on Corporate Social Responsibility (“CSR”)

- MCA has made amendments in the definition of a Small Company.

- RBI revises the ARC norms. And will soon commence pilot launches of Digital Rupee (e₹) for specific use cases

- RBI issued instructions to disclose details of divergence in asset classification and provisioning where such divergence assessed by the Reserve Bank of India (RBI) exceeds certain specified thresholds

- Provisions pertaining to specifications related to International Securities Identification Number (ISIN) for debt securities issued on private placement basis

- SEBI has reduced denomination for debt securities and non–convertible redeemable preference shares

Income Tax

- Circular No. 20/2022 [F.NO. 225/49/2021/ITA–II], Dated 26–10–2022: The date of furnishing Income–tax returns falling due on 31st October 2022 has been extended to 7th November 2022 for assesses referred in clause (a) of Explanation 2 to sub–section (1) of section 139 of the Income–tax Act, 1961.

- Time for updating UDINs for forms filed in the assessment year 2021–2022 is available till 30th November 2022.

- Form No. 10–IK is available for filing on the portal.

- Form No. 10BBD is now available for filing vide Notification No. 50/2022 dated 6 May 2022.

- Provisions of section 139A of the Income Tax Act mandate every person earning taxable income in India and other specified persons to obtain PAN. However, the provisions of newly inserted rule 114AAB to the Income Tax Rules 1962 states that the non–resident is not required to obtain PAN if both the below criteria are satisfied–Exemption is available only to Non–Resident (other than a company or a foreign company); and during the previous year, the non–resident has made an investment in the specified funds.

- CBDT vide Circular 21/2022 dated 27–Oct–2022: On Consideration of difficulties in timely filing of TDS statement in Form 26Q on account of revisions of its format and consequent updating required for its Filing, the Central Board of Direct Taxes, in the exercise of its powers under section 119 of Income Tax Act, 1961, hereby extends the due date of filing of Form 26Q for the second quarter of the financial year 2022–23 from 31st October 2022 to 30th November 2022.

Good And Service Tax

- Notification No. 17/2022 – Central Tax: Seeks to implement e–invoicing for the taxpayers having aggregate turnover exceeding Rs. 10 Cr from 1st October 2022.

- Notification No. 78/2020 – Central Tax dated 15th October 2020: It is mandatory for the taxpayers to report a minimum 4–digit or 6–digit of the HSN Code in table–12 of GSTR–I on the basis of their Aggregate Annual Turnover (AATO) in the preceding Financial Year. To facilitate the taxpayers, these changes are being implemented in a phase–wise manner on GST Portal.

- Part I & Part II of Phase 1 have already been implemented from 01st April 2022 & 01st August 2022 respectively and are currently live on the GST Portal. From 01st November 2022, Phase–2 would be implemented on GST Portal and the taxpayers with up to Rs 5 crore turnover would be required to report 4–digit HSN codes in their GSTR–1

- Notification No. 18/2022–Central Tax dated 28th September 2022 with effect from 01 October 2022: The Central Government has amended Section 37 & Section 39 of the Central Goods & Service Tax Act (CGST),2017 by which taxpayers shall not be allowed to file GSTR–1 if the previous GSTR–1 is not filed and as per sec 39(10) a taxpayer shall not be allowed to file GSTR–3B if GSTR–1 for the same tax period is not filed. These changes are being implemented prospectively and will be operational on GST Portal from 01st November 2022. Accordingly, from the October 2022 tax period onwards, the filing of the previous period GSTR–1 will be mandatory before filing the current period GSTR–1.

Key features of Invoice Reference Number:

- It is a unique 64 characters shuffle based on 4 parameters which are supplier GSTIN+ Fin. Year+ Doc Type+ Doc number, Invoice Reference Number (IRN) is different from invoice number,

- An invoice Reference Number (IRN) is required to be generated before the issuance of the invoice or before the movement of the goods,

- The Invoice Reference Number generated remains on the Invoice Reference Portal (IRP) portal for 1 or 2 days.

- The Invoice Reference Number generated by the Invoice Reference Portal (IRP) portal is stored in the GST Invoice Registry under GST systems

➢Conditions for availing ITC

• Supplier has defaulted in tax payment, or

• Supplier’s output tax liability declared in Form GSTR–1 exceeds the tax paid in Form GSTR–3B, or

• Supplier has availed ITC in excess of ITC eligible to him based on Form GSTR–2B (statement containing details of ITC), or

• Purchase from any class of suppliers other than above, as may be prescribed by the Government

➢ Change in timelines for compliances

For certain compliances relating to availment of unclaimed ITC, declaration of details of credit notes, and rectification of details filed in Form GSTR–1, Form GSTR–3B and Form GSTR–8 (TCS return under GST) have been made by CBIC • Earlier, the timeline for said compliances was the due date of filing of return for the month September of the following FY. Now the said timeline has been extended to 30 November of the following FY.

➢ Reversal of ITC in case of non–payment of consideration Vide Notification no. 19/2022–Central Tax dated 28 September 2022, in case of non–payment or short–payment of consideration to a supplier within 180 days of the date of invoice, CBIC has amended the rule to say that the entire amount of ITC availed by the taxpayer in such case needs to be paid by him/her (i.e. INR 1000 in this case) in Form GSTR–3B of the tax period following the period of 180 days from the date of invoice.

Companies Act, 2013

- MCA has issued notification regarding the format for the annual report on CSR activities to be included in the board’s report for the financial year commencing on or after the 1st day of April 2020 The format of the Annual Report on CSR is revised. The earlier format was quite elaborate. The same has been now rationalized by omitting the requirement of mentioning the details of each project (ongoing and others). The revised format is available on the MCA website.

- The ministry–wide notification number G.S.R. 700(E) dated 15.9.2022 has amended the Companies (specification of

definition details) rules,2014 to substitute clause (t) of sub–rule (1) of rule 2 with regards to small companies. According to the latest revision, the definition of ‘Small Companies’ has further been revised by increasing the thresholds for paid–up Capital from “not exceeding Rs 2 crore” to “not exceeding Rs 4 crore”. Furthermore, the turnover has increased from “not exceeding Rs 20 crore” to “not exceeding Rs 40 crore.”

RBI

- RBI vide Press Release dated October 7, 2022, announced that the Reserve Bank will soon commence pilot launches of Digital Rupee (e₹) for specific use cases. Accordingly, the first pilot in the Digital Rupee – Wholesale segment (e₹–W)

shall commence on November 1, 2022.

The use case for this pilot is the settlement of secondary market transactions in government securities. use of e₹–W is expected to make the interbank market more efficient. Settlement in central bank money would reduce transaction costs by preempting the need for settlement guarantee infrastructure or for collateral to mitigate settlement risk. Going forward, other wholesale transactions and cross–border payments will be the focus of future pilots, based on the learnings from this pilot. Nine banks have been identified for participation in the pilot. The first pilot in Digital Rupee – Retail segment (e₹–R) is planned for launch in select locations in closed user groups comprising customers and merchants. - RBI Revised asset reconstruction company norms:

The new regulatory guidelines for asset reconstruction companies (ARCs) will lead to consolidation in the sector apart from structurally fortifying them with improved governance, better disclosures, lower funding needs for asset acquisitions, and robust balance sheets says a report. According to Crisil Ratings’ analysis, the new norms announced by the Reserve Bank last Tuesday for ARCs, however, will require them to increase net–owned funds by fourfold to Rs 300 crore from Rs 100 crore in a phased manner by March 2026, which could be challenging for smaller ones. - RBI vide its circular dated October 11, 2022 issued instructions to disclose details of divergence in asset classification and provisioning where such divergence assessed by the Reserve Bank of India (RBI) exceeds certain specified thresholds.

In order to strengthen compliance with income recognition, asset classification and provisioning norms, it has now been decided to introduce similar disclosure requirements for Primary (Urban) Co–operative Banks (UCBs) and revise the specified thresholds for commercial banks.

Accordingly, for the financial statements for the year ending March 31, 2023, banks shall make suitable disclosures in the manner specified in paragraph C.4(e) of Annex III to the afore–mentioned Directions, if either or both of the following conditions are satisfied:

a) the additional provisioning for non–performing assets (NPAs) assessed by the RBI exceeds 10 percent of the reported profit before provisions and contingencies for the reference period; and

b) the additional Gross NPAs identified by the RBI exceed 10 percent of the reported incremental Gross NPAs for the reference period. Provided further that in the case of UCBs the threshold for reported incremental Gross NPAs specified in paragraph 2(b) above shall be 15 percent, which shall be reduced progressively in a phased manner, after review.

SEBI

- Provisions pertaining to specifications related to International Securities Identification Number (ISIN)for debt securities issued on a private placement basis With an aim to boost liquidity in the corporate bond market, the Securities and Exchange Board of India (SEBI) suggested further capping the number of ISINs for such bonds issued on a private placement basis.

An International Securities Identification Number (ISIN) is a 12–digit alphanumeric code that uniquely identifies specific security like stocks and bonds. The organization that allocates ISINs in any particular country is the country’s respective National Numbering Agency (NNA). An ISIN is not the same as the ticker symbol, which identifies the stock at the exchange level. The ISIN is a unique number assigned to a security that is universally recognizable. ISINs are used for numerous reasons including clearing and settlement. The numbers ensure a consistent format so that holdings of institutional investors can be tracked consistently across markets worldwide - Operational Circular for issue and listing of Non–Convertible Securities (NCS), Securitized Debt Instruments (SDI), Security Receipts (SR), Municipal Debt Securities, and Commercial Paper (CP) dated August 10, 2021

- Chapter VIII of the above–referred Operational Circular deals with specifications related to ISIN for debt securities.

In continuation to the measures taken to deepen and boost the liquidity in the corporate bond market and based on the trends observed in the market pursuant to the issuance of circulars dated June 30, 2017, and March 28, 2018, the capping of ISINs has reduced fragmentation in the primary market and enhanced liquidity in the secondary market. Thus, it has been decided to further cap the number of ISINs maturing in a financial year for debt securities issued on a private placement basis by modifying the said Chapter of the Operational Circular. - Paragraphs (1), (2), and (3) of Chapter VIII of the Operational circular shall be replaced with the following: “With respect to a private placement of debt securities, the following shall be complied with regard to ISINs:

- A maximum number of fourteen ISINs maturing in any financial year shall be allowed for an issuer of debt securities. In addition, a further six ISINs shall also be available for the issuance of the capital gains tax debt securities by the authorized issuers under section 54EC of the Income Tax Act, 1961 on a private placement basis.

- Out of the fourteen ISINs maturing in a financial year, the bifurcation of ISINs shall be as under:

- A maximum of nine ISINs maturing per financial year shall be allowed for plain vanilla debt securities. Within this limit of nine ISINs, the issuer can issue both secured and unsecured debt securities.

- Provided that the total outstanding amount across the nine ISINs, maturing in a given financial year, reaches Rs. 15,000 crores, then three additional ISINs would be permitted to mature in the same financial year. The same should be intimated by the issuer to the stock exchanges and depositories.

- A maximum of five ISINs maturing per financial year shall be allowed for structured debt securities and market–linked debt securities

- Where an issuer issues only structured/market–linked debt securities, the maximum number of ISINs allowed to mature in a financial year shall be nine.

- SEBI has reduced denomination for debt securities and non–convertible redeemable preference shares. SEBI vide Circular dated 28th October, 2022 has reduced denomination for debt securities and non–convertible redeemable preference shares which provides that the face value of each debt security or non–convertible redeemable preference share issued on private placement basis shall be Rs. 1 lakh and the trading lot shall be equal to the face value. Previously, it was Rs. 10 lakh.

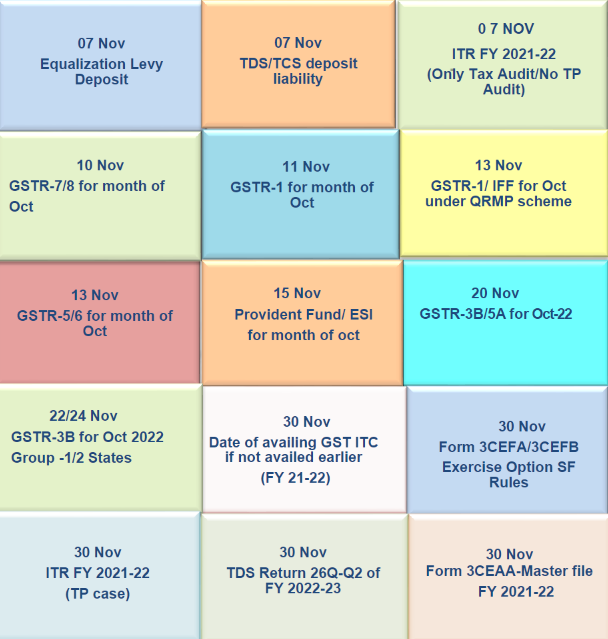

MONTHLY COMPLIANCE CALENDAR