Section 194R: Tax on benefit or perquisite or Reformed Fringe Benefits Tax Applicability: 01st July 2022

Contents:

- Background of Section 194-R

- Snapshot to the guidelines of section 194R dated 16.06.2022

- Clarification relating to provisions of section 194R

Background- 194R

Section 194R: Deduction of TDS if benefits/Perquisites provided by any person to a Resident arising from business/profession.

Applicability :

• Value of benefit or perquisite provided > Rs. 20,000 (Cash or Kind or both).

• Rate @ 10%

• If cash is not sufficient then Advance tax must be paid by the recipient on such benefits/Perquisites.

Exception:

• Individual or a HUF is not liable to deduct if immediately preceding financial year:

o business turnover < one crore rupees or,

o profession gross receipts < fifty lakh rupees

Clarification 1: Is it necessary that the person providing benefit or prerequisite needs to check if the amount is taxable under clause (iv) of section 28 of the Act, before deducting tax under section 194R of the Act?

• No.

• The deductor is not required to check or verify the taxability of the amount or the rate of taxability in the hands of the recipient, whether as a resident or non-resident.

Clarification 2: Is it necessary that the benefit or prerequisite must be in kind for section 194R of the Act to operate?

• No.

• Benefits can be in cash or kind or partly in cash and in-kind

• Deductor required to deduct TDS, whether the benefit or perquisite is either in cash or in-kind or partly in cash or partly in kind.

Clarification 3: Is there any requirement to deduct tax under section 194R of the Act, when the benefit or perquisite is in the form of a capital asset?

• Yes

• Tax deducted in all cases where benefit or prerequisite (of whatever nature) is provided.

• Courts have held many benefits or perquisites to be taxable even though they are in the nature of capital assets.

• Deductor is not required to check if the benefits or perquisites are taxable in the hands of the recipient.

Clarification 4: Whether sales discounts, cash discounts, or rebates beneficial or perquisite?

• No tax is not required to be deducted u/s 194R on sales discount, cash discount, and rebates allowed to customers.

• Even in case, a seller is offering a free item on a certain purchase, still it will not be taxable. For Example, Sellers offer 2 items free with the purchase of 10 items. But this is not a case of free sample, in case of the free sample having worth more than INR 20000 will become under the preview of TDS u/s 194R

• Examples of benefits/perquisites on which tax is required to be deducted – free Samples, car, TV, computers, gold coin, mobile phone, sponsors a trip upon achieving certain targets, free ticket for an event, medicine samples free to medical practitioners.

• The provision of section 194R of the Act shall not apply if the benefit or perquisite is being provided to a Government entity, like a Government hospital, not carrying on business or profession. • Benefits/Perquisites received by the Owner/director/employee/their relative of the recipient entity will be taxable in the hands of the recipient entity.

For Example, if the benefit or perquisite is provided to a doctor who is working as a consultant in the hospital. In this case, the benefit or perquisite the provider may deduct tax under section 94R of the Act with the hospital as the recipient, and then the hospital may again deduct tax under section 194R of the Act for providing the same benefit or prerequisite to the consultant. To remove the difficulty, as an alternative, the original benefit or perquisite the provider may directly deduct tax under section 194R of the Act in the case of the consultant as a recipient.

Clarification 5: How is the valuation of benefit/prerequisite required to be carried out?

⦁ The valuation would be based on the fair market value(FMV) of the benefit or perquisite except in the following cases:-

⦁ benefit/perquisite provider has purchased the benefit/prerequisite before providing it to the recipient i.e. purchase price shall be the value for such benefit/perquisite.

⦁ benefit/perquisite provider manufactures such items given as benefit/prerequisite, then the price that it charges to its customers for such items shall be the value for such benefit/perquisite.

⦁ GST will not be included for the purpose of valuation.

Clarification 6: Many times, a social media influencer is given a product of a manufacturing company so that he can use that product and make audio/video to speak about that product on social media. Is this product given to such influencer a benefit or perquisite?

• If the product is returned to the manufacturing company after using-: No TDS u/s 194R.

• If the product is retained -: then it will be in the nature of benefit/perquisite and taxes are required to be deducted under section 194R of the Act.

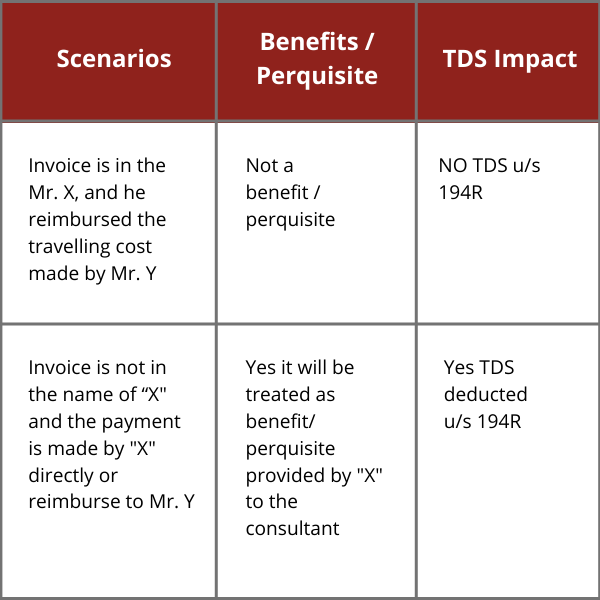

Clarification 7: Whether reimbursement of the out-of-pocket expense incurred by the service provider in the course of rendering service is benefit/perquisite?

• Yes, however, it depends on the facts of the case. Let’s take an example If Mr. X gets services from the services provider says Y. If Mr. Y takes the services of the traveling agent, Mr. Z, then:

Clarification 8: If there is a dealer conference to educate the dealers about the products of the company – Is it benefit/perquisite?

• No if dealer/business conference is held with the prime object to educate dealers/customers.

• However, such a conference must not be in the nature of incentives/benefits to select dealers/customers who have achieved particular targets.

Further, in the following cases, the expenditure would be considered as a benefit or prerequisite for the purposes of section 194R of the Act:

(i) Expense attributable to leisure trip or leisure component, even if it is incidental to the dealer/business conference.

(ii) Expenditure incurred for family members accompanying the person attending dealer/business conference

(iii) Expenditure on participants of dealer/business conference for days which are on account of prior stay or overstay beyond the dates of such conference.

Clarification 9: Section 194R provides that if the benefit/prerequisite is in kind or partly in kind (and cash is not sufficient to meet TDS) then the person responsible for providing such benefit or perquisite is required to ensure that tax required to be deducted has been paid in respect of the benefit or perquisite, before releasing the benefit or perquisite. How can

such person be satisfied that the tax has been deposited?

• Benefits provider provides benefit in kind to a recipient and tax is required to be deducted under section 194R of the Act, the Benefit the provider is required to ensure that the tax required to be deducted has been paid by the recipient. Such recipients would pay tax in the form of advance tax.

• In Form 26Q he will need to show it as tax deducted on the benefit provided.

Clarification 10: Section 194R would come into effect from the I” July 2022. The second proviso to subsection (I) of section 194R of the Act provides that the provision of this section does not apply where the value or aggregate of the value of the benefit or perquisite provided or likely to be provided to a resident during the financial year does not exceed twenty

thousand rupees. It is not clear how this limit of twenty thousand is to be computed for the Financial Year 2022-23?

• Since, the threshold of Rs 20,000 is with respect to the financial year

• Calculation of value or aggregate of the value of the benefit or perquisite shall be counted from 1″ April 2022.

• However, The benefit or perquisite which has been provided on or before 30″ June 2022, would not be subjected to tax deduction under section 194R of the Act.

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication.