SNAPSHOT

In common parlance, ‘KYC’ stands for ‘Know your customer’.

It is a process undertaken by Banks and other Financial Institutions, wherein correct identity of the client is established by verifying his personal documents (PAN, Passport, utility bills, etc.), before entering into any kind of transaction.

Why it is being talked about under Company Law or what context does it hold in corporate affairs? Before getting to know the subject matter, let’s understand the need in our field.

The Ministry of Corporate Affairs (“MCA”) also undertakes the KYC process, wherein the particulars and documents of individual DIN holders are verified with the help of an electronic form. Doing this ensures that correct details of the DIN holders are updated on the MCA registry.

This data is very helpful especially when the Government wants to trace a Director or Designated Partner for any acts of non-compliance or fraud committed by him/her.

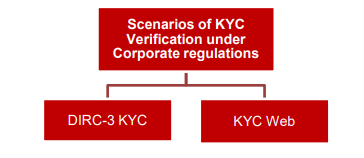

KYC UNDER CORPORATE REGULATIONS

-

DIR 3 KYC

INTRODUCTION

DIR-3 KYC is an electronic form which is required to be filed by every individual, whether Resident or Non-resident or Foreign National, having a Director Identification Number (“DIN”).

For the purpose of updating the Directors’ Database, it has been made compulsory for all Directors to file their respective KYCs with the Government.

As per the provisions of Rule 12A of the Companies (Appointment and Qualification of Directors) Rules, 2014, every individual who is allotted DIN as on 31st March of a financial year must submit his KYC on or before 30th September of the immediately next financial year.

Even if the DIN holder is not a Director in a Company or Designated Partner in a LLP, they are still required to file Form DIR-3 KYC.

INFORMATION TO BE PROVIDED IN KYC FORM

- Name of Director, Father’s Name as per PAN

- PAN/Passport compulsory in case of Indian/Foreign National

- Personal Mobile Number and Email Address – OTP sent on SMS and on E-mail.

Also, if Director is NRI then country code is to be mentioned.

DOCUMENTS REQUIRED TO BE FILED

| NAME OF THE DOCUMENTS | FOR INDIAN RESIDENTS/ FOREIGN RESIDENT |

| Proof of Permanent Address (Mandatory) | Any 1 (one) of the following: –

· Passport, · Aadhar Card, · Voter’s identity Card, · Driving license, · Ration Card, · Bank Statement, · Electricity Bill, · Telephone Bill, · Utility Bills etc. Note: Above documents to be Self attested copy, not older than 2 month, 1 year for foreign national in case of point (f) to (i)) |

| Proof of Present Address (In case ‘No’ is selected in the field “Whether present residential address is same as permanent residential address”) |

Any 1 (one) of the following: –

· Bank Statement · Electricity Bill · Mobile Bill · Telephone Bill Note: Above documents to be Self attested copy, not older than 2 month.

1 year for foreign national |

| Copy of Aadhaar Card (Self Attested) | Mandatory, in case applicant is citizen of India, if it is not assigned, then Voter ID or Passport or Driving Licence. |

| Copy of Passport (Self Attested) | Mandatory,

In case applicant having a valid passport In case of foreign national residing in India, self-attested copy of Visa along with arrival stamp is also required. |

| Self-attested copy of PAN | Mandatory, in case applicant is citizen of India |

SIGNATORIES IN FORM DIR 3 KYC

The DIN holder and a professional (CA/CS/CMA) certifying the form are the two signatories in FORM DIR-3 KYC. Please note that in case of Citizens of India, the PAN mentioned in the DSC is verified with the PAN mentioned in the form. In case of foreign nationals, the name in the DSC affixed should match with the name entered in the form. DSCs affixed on the form should be duly registered on the MCA portal

CONSEQUENCES OF NON-FILING

If the DIN holder does not file his annual KYC within the due date of each financial year, such DIN shall be marked as ‘Deactivated due to non-filing of DIR-3 KYC’ and shall remain in such Deactivated status until KYC is done with a fee of Rs.5000.

CRUX

EFORM DIR-3 KYC applicable in two cases:

Case 1: Where the individual who holds DIN and is filing his KYC details for the first time

Case 2: Where the DIN holder who has already filed his KYC once in E-form DIR-3 KYC, but wants to update his details.

- DIR 3 KYC WEB

INTRODUCTION

If DIN holder has already filed the E-FORM DIR-3 KYC in any previous financial years, and his personal details like name, address, mobile number, email ID, etc. remain unchanged, then he may perform his annual KYC by filing DIR-3 KYC Web form instead.

STEPS TO BE FOLLOWED

The following steps must be followed to do the same:

Step 1: Login with the username/password on the MCA21 portal and click on “DIR-3-KYC-WEB” link under MCA services tab to access the same.

Step 2: The individual DIN holder to enter his DIN and his existing mobile number and email ID will get pre-filled.

Step 3: Now, click on “Send OTP” and put the OTPs sent to the mobile number and email ID.

Step 4: After entering the OTPs, click on “Verify OTP”. On successful verification, click on the “Submit” button to complete the KYC

PENALTY FOR NON-COMPLIANCE

There is no penalty for non-filing of the prescribed Form, but a fee of Rs. 5000/- shall be paid at the time of delayed filing of E-FORM DIR-3 KYC-WEB.

CONCLUDING REMARKS

Directors are “officers in default” and in cases of non-compliance and fraud committed by the company, the Government has to impose penalty or imprisonment or both on each such officer. In order to fulfil this very purpose, the latest personal details of these defaulting officers are required to be maintained by the Ministry of Corporate Affairs in their registry so that timely communication can be sent to them as and when required.

The MCA has from time to time brought about various changes to the KYC process in order to make it more effective and ensure better compliance check on corporates.

In view of the above, MCA vide its Notification dated 5th July, 2018) amended the Companies (Appointment and Qualification of Directors) Rules, 2014 and inserted Rule 12A wherein Form DIR-3 KYC was introduced to ensure that correct particulars of the individual DIN holders were updated in the registry of MCA from time to time.

The above although seems a straight forward process but it goes a long way in not only achieving better corporate governance but also enables the regulator the monitoring of corporates as well as securing the interest of investors.

KNM India can assist you with a range of complete financial services that range from Corporate advisory to Transaction advisory, Pre-incorporation to Post-incorporation, Insolvency and bankruptcy code to Secretarial services, Assurance to Internal audit services, along with Market entry strategy to Foreign company registration in India. To discuss any of these please book your slot, or call us on +91-99105-04170 – or email us at services@knmindia.com to get a quick response.

This article has been contributed by:

Executive- Secretarial

Further, we shall be happy to assist in case of any clarifications. For a deeper discussion, feel free to revert us at services@knmindia.com

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication.