Snapshot

Exports in India are promoted through various promotional schemes. Goods and services are to be exported and not taxes. Hence, the taxes on exports are either exempted or adjusted or refunded on both outputs and Inputs, through schemes of Duty Exemption, Duty Refund (Drawbacks and Rebates). Duty credit scrips Schemes are designed to promote exports of some specified goods to specified markets and to promote export of specified services. exports and imports can utilize a lot of benefits that are available under various provisions of the FTP. The policy not only prescribes the guidelines as to which goods and services can be imported/exported and the relevant procedures thereto but also provides a lot of benefits if properly planned.

Schemes like Duty Exemption Schemes, EPCG Schemes, Deemed Exports, etc., benefit exporters, importers and even defined domestic businesses thereby assisting all businesses to reduce costs at every stage in the value chain. In addition, exporters can avail other benefits under promotional schemes.

Reward schemes are the schemes which entitle the exporters to duty credit scrips subject to various conditions. These scrips can be used for payment of customs duties on import of inputs/goods including notified capital goods.

These scrips are transferable, i.e. they can be sold in market, if the holder of duty credit scrip does not intend to import goods against the scrips. Goods imported under the scrip are also freely transferable.

Following are two schemes for exports of merchandise and services:

- Merchandise Exports from India Scheme (MEIS)

- Service Exports from India Scheme (SEIS)

A. MERCHANDISE EXPORTS FROM INDIA SCHEME (MEIS)

The objective of MEIS scheme is to promote the manufacture and export of notified goods/ products.

Rewards under the Scheme:

Under MEIS, exports of notified goods/products to notified markets shall be eligible for reward at the specified rate(s) (2-5%). Unless otherwise specified, the basis of calculation of reward would be:

- On realized FOB value of exports in free foreign exchange, or

- On FOB value of exports as given in the Shipping Bills in free foreign exchange,

Whichever is less.

Ineligible categories under MEIS:

Some exports categories/sectors ineligible for Duty Credit Scrip entitlement under MEIS are listed below:

- Supplies made from DTA units to SEZ units

- Exports through trans-shipment, i.e., exports that are originating in third country but trans-shipped through India

- Deemed Exports

- SEZ/EOU/EHTP/BPT/FTWZ products exported through DTA units

- Export products that are subject to Minimum export price or export duty

B. SERVICE EXPORTS FROM INDIA SCHEME (SEIS)

The objective of the SEIS scheme is to encourage the export of notified Services from India.

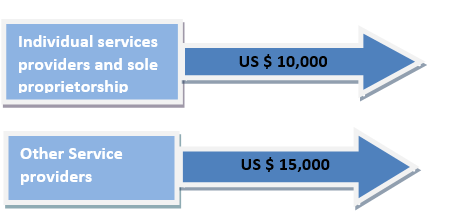

Eligible service providers A service provider (with active IEC at the time of rendering services) located in India, providing notified services rendered in a specified manner* shall be eligible for a reward at the notified rate(s) on net foreign exchange earned provided the minimum net free foreign exchange earnings of such service provider in year of rendering service is:

*Specified manner is the supply of a ‘service’ from India to any other country; (Mode 1- Cross border trade) and supply of a ‘service’ from India to services consumer(s) of any other country in India; (Mode 2- Consumption abroad).

Ineligible categories under SEIS:

- Foreign exchange remittances other than those earned for rendering of notified services would not be counted for entitlement. Thus, other sources of foreign exchange earnings such as equity or debt participation, donations, receipts of repayment of loans, etc. and any other inflow of foreign exchange, unrelated to rendering of service, would be ineligible

- The following shall not be taken into account for the calculation of entitlement under the scheme:

-

Foreign Exchange remittances

related to the Financial Services Sector:

- Raising of all types of foreign currency Loans

- Exports proceeds realization of clients

- Issuance of Foreign Equity through ADRs/GDRs

- Issuance of foreign currency Bonds

- Sale of securities and other financial instruments

- Payments for Services received from EEFC Account

- Foreign exchange turnover by Healthcare Institutions like equity participation, donations etc.

- Foreign exchange turnover by Educational Institutions like equity participation, donations etc.

- Export turnover relating to services of units operating under EOU/ EHTP/ STPI/ BTP Schemes or supplies of services made to such units

- Clubbing of turnover of services rendered by EOU/ EHTP/ STPI/ BTP units with turnover of DTA Service Providers

- Foreign Exchange earnings for services provided by Airlines, Shipping lines service providers plying from any foreign country X to any foreign country Y routes not touching India at all

- Service providers in Telecom Sector

-

Common Provisions for Exports from India Schemes (MEIS and SEIS)

-

Drawback:

Basic Custom duty paid in cash or through debit under Duty Credit scrip shall be adjusted for Duty Drawback as per DOR rules or notifications.

Duty credit scrip shall be permitted to be utilized for payment of customs duty in case of import of capital goods under lease financing.

- Transfer of export performance: Transfer of export performance from one IEC holder to another IEC holder shall not be permitted.

- Duty Credit Scrips are provided for exports to diversify markets and offset the disadvantage faced by exporters with regard to freight costs, transport hurdles and other disabilities. They are like debit notes which can be used to pay import duties.

- Such duty credit scrips can be used for payment of custom duties for import of inputs or goods, payment of excise duty on domestic procurement, payment of service tax and payment of custom duties in case of EO default.

- The Scrips i.e. under MEIS and SEIS referred to above could also be used to lease capital goods. Duty Credit Scrip can be utilised / debited for payment of Custom Duties in case of EO defaults for Authorizations issued under Chapter 4 and 5 of the Policy i.e. for instance, advance authorization and EPCG schemes with the exception of interest and penalty which would have to be paid separately.

- Where goods procured from abroad under the scrips, these can be re-exported with fresh scrip being available to the extent of 98% of the duty debited, with the same port of registration.

- Duty Credit Scrips shall be granted as rewards under MEIS and SEIS. The Duty Credit Scrips and goods imported / domestically procured against them shall be freely transferable.