The company that comes beneath the provisions of sub-section (1) to section 135 will file a report on the CSR in Form CSR-2 to the Registrar for the preceding financial year (2020-2021) or onwards.

A. BACKGROUND-

Corporate Social Responsibility was, for the first time, introduced as a statutory obligation for all the companies by enacting the Companies Act 2013 (Section 135 is related to CSR).

The Companies Amendment Acts of 2019 and 2020 have consequently resulted in some tectonic changes in the CSR provision as per Section 135 of the Companies Act.

B. OVERVIEW:

Basically, “Corporate Social Responsibility” means and includes but is not limited to:

- Projects or program relating to activities specified in Schedule VII to The Act.

- Projects or program relating to those activities which are undertaken by the Board of directors of a company in ensuring the recommendation of the CSR Committee of the Board as per declared CSR Policy of the Company along with the conditions that such policy will cover subjects specified in Schedule VII of the Act.

C. SCOPE OF CSR EXPENDITURE:

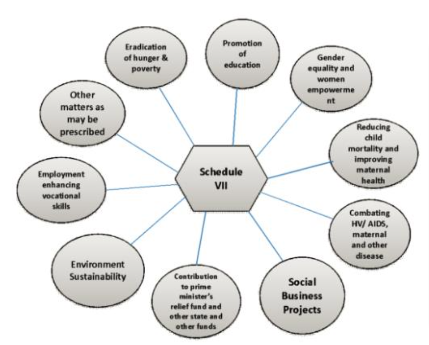

“The Board shall ensure that the activities included by a company in its CSR Policy fall within the purview of the activities included is schedule VII. Some activities are specified in Schedule VII as the activities which may be included by companies in their Corporate Social Responsibility Policies”. These activities are related to:

D. UNIQUE CSR REGISTRATION NO:

Every entity who is covered under CSR Rules, who intends to undertake any CSR activity, shall register itself with the CG by filing the e-form CSR-1 with the ROC w.e.f. 01 April 2021. On filing of CSR -1, one ‘Unique CSR Registration Number’ shall be generated by the system automatically.

It is mandatory for every implementing agency to register itself with the ROC by filing the e-form CSR-1, from 1st April 2021. If any implementing agency fails to file CSR-1, they shall not be eligible to continue as the Implementing agency.

E. AMENDMENT-

The MCA vide its notification dated 11th February, 2022 has notified Companies (Accounts) Amendment Rules, 2022 which shall come into force from 11th February 2022.

https://www.mca.gov.in/bin/dms/getdocument?mds=%252FAD3Plv%252FhT6P7xcgxfw4tQ%253D%253D&type=open

In the Companies (Accounts) Rules, 2014, after Rule 12 (1A) the following shall be inserted:

“(1B) Every company covered under the provisions of sub-section (1) to section 135 shall furnish a report on Corporate Social Responsibility in Form CSR-2 to the Registrar for the preceding year (2020-2021) and onwards as an addendum to form AOC-4 or AOC-4 XBRL or AOC-4 NBFC (Ind AS), as the case may be:

Provided that for the preceding year (2020-2021), Form CSR-2 shall be filed separately on or before 31st March, 2022, after filing form AOC-4 or AOC-4 XBRL or AOC-4 NBFC (Ind AS), as the case may be.”

F. DUE DATE OF CSR-2:

- 2020-21: separately on or before 31st March, 2022

- 2021-22 onwards: as an addendum to form AOC-4 (due date of AOC-4)

Recent Amendment : Further MCA vide its notification dated 31st March, 2022 has extended the due date of filing WEB Based Form CSR-2 till 31st May, 2022.

https://www.mca.gov.in/bin/dms/getdocument?mds=IzW7fqstVJYuFz6gHMSkKw%253D%253D&type=open

G. CONCLUDING REMARKS

Directors are “officers in default” and in cases of non-compliance and fraud committed by the company, the Government has to impose penalty or imprisonment or both on each such officer. In order to fulfil this very purpose, the latest personal details of these defaulting officers are required to be maintained by the Ministry of Corporate Affairs in their registry so that timely communication can be sent to them as and when required.

The MCA has from time to time brought about various changes to the Compliance on CSR process in order to make it more effective and ensure better compliance check on corporates.

The above although seems a straight forward process but it goes a long way in not only achieving better corporate governance but also enables the regulator the monitoring of corporates as well as securing the interest of investors.

This article has been contributed by:

CS Shubham Prashar

Executive- Secretarial

Further, we shall be happy to assist in case of any clarifications. For a deeper discussion, feel free to revert us at services@knmindia.com

KNM India can assist you with a range of complete financial services that range from Corporate advisory to Transaction advisory, Pre-incorporation to Post-incorporation, Insolvency and bankruptcy code to Secretarial services, Assurance to Internal audit services, along with Market entry strategy to Foreign company registration in India. To discuss any of these please book your slot, or call us on +91-99105-04170 – or email us at services@knmindia.com to get a quick response.

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication.