Executive Summary

Income Tax

- Section 10(46) of the Income-Tax Act, 1961 – Exemptions – Statutory Body/Authority/Board/Commission – Notified Body or Authority.

- Opening Of Income Tax Offices on Holidays to Facilitate Pending Departmental Work

- Section 35(1)(ii) of the Income Tax Act 1961- Scientific Research expenditure – approved scientific research association/institution.

- Section 194S of the Income Tax Act, 1961- Deduction of Tax at Source- payment on transfer of virtual digital asset.

- Section 10(22B) of the Income tax Act, 1961- Exemptions – News Agency.

- Revision of Interest rates for small savings scheme.

- DTAA between the Republic of India and Kingdom of Spain.

- No deduction of tax under section 80LA

Goods And Service Tax (GST)

- Advisory on GSTR-1/IFF Introduction of New 14A and 15A tables.

- Advisory on Integration of E-Waybill system with New IRP Portal.

- Instances of Delay in registration reported by some Taxpayers despite successful Aadhar Authentication.

Companies Act 2013/ Other Laws.

- SEBI issues safeguards to address investors’ concerns regarding transfer of securities in demat mode.

- Master Direction on NBFC – Housing Finance Company (Reserve Bank) Directions, 2021

![]()

- Section 10(46) of the Income-Tax Act, 1961 – Exemptions – Statutory Body/Authority/Board/Commission – Notified Body or Authority.

- In exercise of the powers conferred by clause (46) of section 10 of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby notifies for the purposes of the said clause, ‘Uttar Pradesh Real Estate Regulatory Authority’ (PAN AAAGU0671E), an Authority constituted by the State Government of Uttar Pradesh, in respect of the following specified income arising to that Authority, namely: —

(a) Amount received as Grant-in-aid or loan/advance from Government

(b) Fee/penalty received from builders/developers, agents or any other stakeholders as per the provisions of the Real Estate (Regulation and Development) Act, 2016

(c) Fee received under Right to Information Act, 2005; and

(d) Interest earned on bank deposits.

- This notification shall be effective subject to the conditions that Uttar Pradesh Real Estate Regulatory Authority, –

(a) shall not engage in any commercial activity.s

(b) activities and the nature of the specified income shall remain unchanged throughout the financial years

(c) shall file return of income in accordance with the provision of clause (g) of sub-section (4C) of section 139 of the Income-tax Act, 1961.

- This notification shall be deemed to have been applied from the Assessment Year 2021-2022.

And

- In exercise of the powers conferred by clause (46) of section 10 of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby notifies for the purposes of the said clause, ‘Karnataka Urban Water Supply and Drainage Board’ (PAN: AAATK5837F), a Board constituted under the Karnataka Urban Water Supply and Drainage Board Act, 1973 (Karnataka Act No. 25 of 1974), in respect of the following specified income arising to that Board, namely:—

(a) Establishment, administrative, supervision, water charges and rent collected as per the Karnataka Urban Water Supply and Drainage Board Act, 1973 (Karnataka Act No. 25 of 1974)

(b) Forfeiture of earnest money deposit as per the Karnataka Urban Water Supply and Drainage Board Act, 1973 (Karnataka Act No. 25 of 1974);

(c) Penalty, Sale of Scrap, Storage charges and Survey charges as per the Karnataka Urban Water Supply and Drainage Board Act, 1973 (Karnataka Act No. 25 of 1974) and

(d) Interest earned on bank deposits.

- This notification shall be effective subject to the conditions that Karnataka Urban Water Supply and Drainage Board-

(a) shall not engage in any commercial activity

(b) activities and the nature of the specified income shall remain unchanged throughout the financial years; and

(c) shall file return of income in accordance with the provision of clause (g) of sub-section (4C) of section 139 of the Income-tax Act, 1961.

- This notification shall be deemed to have been applied from Assessment Year 2021-2022.

And

- In exercise of the powers conferred by clause (46) of section 10 of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby notifies for the purposes of the said clause, ‘National Mission for Clean Ganga’, New Delhi (PAN AABAN3769K), an Authority constituted under the River Ganga (Rejuvenation, Protection and Management) Authority Order, 2016, in respect of the following specified income arising to that Authority, namely:

(a) Grants-in-Aid received from Government of India; and

(b) Interest earned on bank deposits.

- This notification shall be effective subject to the conditions that National Mission for Clean Ganga, New Delhi –

(a) shall not engage in any commercial activity;

(b) activities and the nature of the specified income shall remain unchanged throughout the financial years; and

(c) shall file return of income in accordance with the provision of clause (g) of sub-section (4C) of section 139 of the Income-tax Act, 1961.

- This notification shall be deemed to have been applied from Assessment Year 2021-2022.

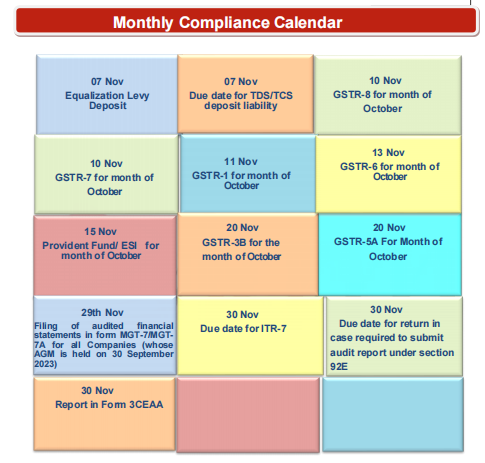

- Opening of Income Tax offices on holidays to facilitate pending departmental work.

The Financial Year 2023-24 closes on 31st March 2024, which is Sunday. Further, 30th March 2024 is a Saturday and 29th March 2024 is a closed holiday. Therefore, to facilitate completion of pending departmental work, all the Income Tax Offices throughout India shall remain open on 29th, 30th and 31st March 2024. This direction is issued for administrative convenience by the Central Board of Direct Taxes in exercise of powers conferred under section 119 of the Income-tax Act, 1961.

- Section 35(1)(ii) of the Income Tax Act 1961- Scientific Research expenditure – approved scientific research association/institution.

- In exercise of the powers conferred by clause (ii) of sub-section (1) of section 35 of the Income-tax Act, 1961 (43 of 1961), read with Rules 5C and 5E of the Income-tax Rules, 1962, the Central Government hereby approves ‘National Forensic Sciences University, Gandhinagar‘ (PAN: AAALN3742Q), ‘Sardar Vallabhbhai National Institute of Technology’, Surat (PAN: AAAJS1184P) and ‘Indian Institute of Technology, Kharagpur’ (PAN: AAAJI0323G) under the category of ‘University, college or other institution’ for ‘Scientific Research’ for the purposes of clause (ii) of sub-section (1) of section 35 of the Income-tax Act, 1961, read with rules 5C and 5E of the Income-tax Rules, 1962.

- This Notification shall be applicable from Assessment Years 2024-25 to 2028-29.

- Section 194S of the Income Tax Act, 1961- Deduction of Tax at Source-payment on transfer of virtual digital asset.

As per section 194S of the Income-tax Act, 1961, any person responsible for paying to any resident person any sum by way of consideration for the transfer of a virtual digital asset is required to deduct an amount equal to 1% of such sum as income tax thereon. Further, as per sub-rule (4D) of rule 31A, a specified person’ is required to report such deductions in a challan-cum-statement electronically in Form No. 26QE within thirty days from the end of the month in which such deduction is made.

It has come to the notice of the Central Board of Direct Taxes (‘the Board’) that specified persons who deducted tax under section 194S of the Act during the period from 1-7-2022 to 31-1- 2023, could not file Form No. 26QE and pay corresponding TDS on or before the due date, due to unavailability of Form No. 26QE. This has resulted in consequential levy of fee under section 234E and interest under clause (ii) of sub-section (1A) of section 201 of the Act. Further, the specified persons who deducted tax under section 194S during the period from 1-2-2023 to 28-2-2023 had insufficient time to file Form No. 26QE and pay corresponding TDS thereon.

To address the grievances of such specified persons, the Board has decided to extend the due date of filing of Form No. 26QE for specified persons who deducted tax under section 194S but failed to file Form No. 26QE. The due date is hereby extended to 30-5-2023 in those cases where the tax was deducted by specified persons under section 194S of the Act during the period from 1-7-2022 to 28-2-2023. Fee levied under section 234E and/or interest charged under section 201(1A) (ii) of the Act in such cases for the period up to 30-5-2023, shall be waived.

- Section 10(22B) of the Income tax Act, 1961- Exemptions – News Agency.

- In exercise of the powers conferred by the clause (22B) of section 10 of the Income-tax Act, 1961 (43 of 1961), the Central Government hereby specifies the “The Press Trust of India Limited, New Delhi” as a news agency set up in India solely for collection and distribution of news, for the purpose of the said clause for two assessment years 2022-23 to 2023-24.

- The notification is subject to the condition that the news agency applies its income or accumulates it for application solely for collection and distribution of news and does not distribute its income in any manner to its members.

- Revision of Interest rates for small savings scheme.

The rates of interest on various Small Savings Schemes for the first quarter of FY 2024-25 starting from 1st April 2024 and ending on 30th June 2024 shall remain unchanged from those notified for the fourth quarter (1st January 2024 to 31st March, 2024) of FY 2023-24.

- Modification made in DTAA between Republic of India and Kingdom of Spain

In the said notification, in the Convention annexed therewith between the Republic of India and Kingdom of Spain, in Article 13 relating to Royalties and Fees for Technical Services, for paragraph 2, the following paragraph shall be substituted, namely: –

“2. However, such royalties and fees for technical services may also be taxed in the Contracting State in which they arise and according to the law of that State, but if the recipient is the beneficial owner of the royalties or fees for technical services, the tax so charged shall not exceed ten per cent of the gross amount of royalties or fees for technical services.”.

Paragraph 2 of Article 13 of the said Convention, as amended by this notification, shall be applicable with effect from the assessment year 2024-25.

- No deduction of tax under section 80LA:

In exercise of the powers conferred by sub-section (1F) of section 197A read with subsection (1A) and sub-section (2) of section 80LA of the Income-tax Act, 1961 (43 of 1961) (hereinafter referred as the Income-tax Act), the Central Government hereby notifies that no deduction of tax shall be made under the provisions of the Income-tax Act in respect of the payments made by any ‘payer’ to a person being a Unit of International Financial Services Centre, (hereinafter referred as ‘payee’), as specified in the notification.

![]()

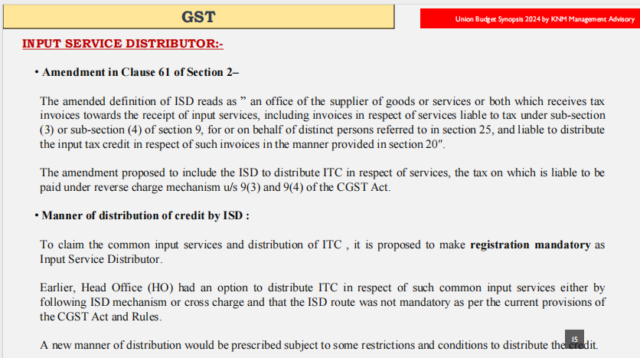

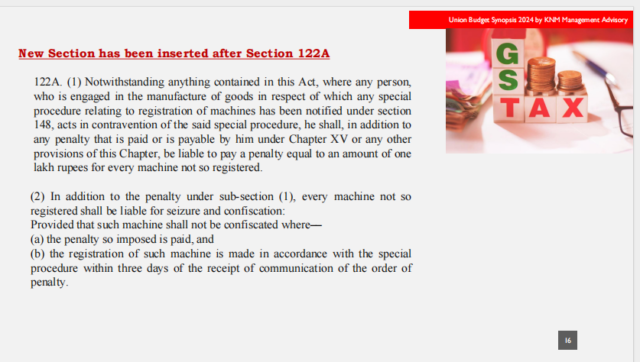

- GSTN Issues advisory on GSTR-1/IFF:

(Introduction of New 14A and 15A tables)

The Central Government, on the recommendations of the Council, as per notification No. 26/2022 introduced two new Table 14A and Table 15A in GSTR-1 to capture the amendment details of the supplies made through e-commerce operators (ECO) on which e-commerce operators are liable to collect tax under section 52 or liable to pay tax u/s 9(5) of the CGST Act, 2017.

Now, these tables have been made live on the GST common portal and will be available in GSTR-1/IFF from February 2024 tax period onwards. These amendment tables are relevant for those taxpayers who have reported the supplies in Table 14 or Table 15 in earlier tax periods.

- GSTN Issues advisory on Integration of E-Waybill system with New IRP Portals –

GSTN announced the successful integration of E-Waybill services with four new IRP portals via NIC, enabling taxpayers to generate E-Waybills alongside E-Invoicing on these four IRPs across all six IRPs.

This new facility complements the existing services available on the NIC-IRP portal, making E-Waybill services, along with E-Invoicing, available across all six IRPs.

- Instances of Delay in registration reported by some Taxpayers despite successful Aadhar Authentication in accordance with Rule 8 and 9 CGST, Rules, 2017

The Central Government In accordance with Rule 9 of the Central Goods and Services Tax (CGST) Rules, 2017, pertaining to the verification and approval of registration applications, following is informed:

Where a person has undergone Aadhaar authentication as per sub-rule (4A) of rule 8 but has been identified in terms of Rule 9(aa) by the common portal for detailed verification based on risk profile, your application for registration would be processed within thirty days of application submission.

Necessary changes would also be made to reflect the same in the online tracking module vis-à-vis processing of registration application.

![]()

- Master Direction on NBFC – Housing Finance Company (Reserve Bank) Directions, 2021

The Reserve Bank of India (the Bank), having considered it necessary in the public interest, and being satisfied that, for the purpose of enabling the Bank to regulate the financial system to the advantage of the country and to prevent the affairs of any Housing Finance Company (HFCs) from being conducted in a manner detrimental to the interest of investors and depositors or in any manner prejudicial to the interest of such HFCs, and in exercise of the powers conferred under sections 45L and 45MA of the Reserve Bank of India Act, 1934

![]()

- SEBI issues safeguards to address investors’ concerns regarding transfer of securities in demat mode.

Market regulator Securities and Exchange Board of India (SEBI) has announced new safeguards on March 20, 2024, to address the concerns of the investors on transfer of securities in dematerialized (demat) mode. As per people privy to the matter, this has been done in order to prevent fraud by means of transferring shares from inactive demat account/accounts.

![]()

The income tax Department has identified certain mismatches between third-party information on interest and dividend income, and the income tax Return (ITR) filed by taxpayers. In many cases, taxpayers have not even filed their ITR.

The income tax Department has identified certain mismatches between third-party information on interest and dividend income, and the income tax Return (ITR) filed by taxpayers. In many cases, taxpayers have not even filed their ITR. MCA operationalizes Central Processing Centre (CPC) for Centralized Processing of Corporate Filings

MCA operationalizes Central Processing Centre (CPC) for Centralized Processing of Corporate Filings