Income Tax

-

-

-

-

-

-

- Hon’ble FM Ms. Nirmala Sitharaman presented the union Budget 2021. Detailed budget analysis by us can be reached by link below:

https://www.knmindia.com/updates_dh/union-budget_ 2021/union-budget_2021/

Now the budget has been passed from the Lok Sabha & Rajya Sabha and also got Hon’ble President Assent too on 28th March 2021.

- Hon’ble FM Ms. Nirmala Sitharaman presented the union Budget 2021. Detailed budget analysis by us can be reached by link below:

-

- CBDT vide order F.No. 187/4/2021-ITA-1 dated 26.02.2021 , clarify that penalty proceedings pending with investigation wings/ Commissioner/ Commissioner(appeal) and above are outside the purview of Faceless Penalty scheme. Further it is also clarified that this penalty scheme covers the penalty provisions mentioned under Income Tax Act, 1961.

-

- CBDT vide Notification No. S.O. 966(E) [NO. 10/2021/F. NO. 370142/35/2020-TPL], DATED 27-2-2021 , issued timeline upto which penalty proceedings and assessment proceedings can be extended considering current situation. As per said notification, Penalty order can be passed upto 30th June, 2021 & Assessment order 30th April, 2021. Assessment proceedings which are not covered by 30th April, 2021 will be completed by 30th September, 2021.Order covered by Prohibition of Benami Property Transaction Act, 1988, will be passed upto 30th June, 2021 but further extension can be done till 30th September, 2021.

-

- CBDT vide Instruction F. NO. 225/40/2021/ITA-II, Dated 4-3-2021 , issued list of cases to be covered under escaped assessment to be taken up by Jurisdictional Assessing officer. However, this instruction will not covered search cases as well as International taxes cases.

-

- Interest on EPF will continue to 8.5% as recommended by EPFO board on 04th March, 2021.

-

- CBDT vide Notification No. 11/2021, Dated 05-03-2021, made amendment and inserted Rule 3B and formula has been provided to calculate annual accretion under section 17(2)(viia) as given in Finance Act, 2020. Section 17(2)(viia) has been inserted to provide that any annual accretion by way of interest, dividend or any other amount of similar nature during the previous year to the balance at the credit of the fund or scheme may be treated as perquisite to the extent it relates to the such excess employer’s contribution. Further as Section 17(2)(vii), any excess contribution to specified fund can’t be excess to INR 7,50,000 in a previous year otherwise it will become perquisites in the hands of Employee.

-

- CBDT vide Notification No. NO. 15/2021, Dated 11-03-2021, has also amendment in form 16, Form 12BA & Form 24Q to incorporate the changes done by Finance act 2020 & notification no.11/2021.

-

- CBDT vide Notification no. 16/2021, Dated 12th March 2021 , amended Rule 114E of the Income Tax Rules to cover the transactions of Dividend, Interest, Capital gain in the category of SFT for reporting purposes by the specified person. Here it is pertinent to note that these new reportable transactions is without any limit for the purpose of reporting. For more details, kindly refer the link:

https://www.knmindia.com/updates_dh/specified-financial-transaction/specified-financial-transaction/

- CBDT vide Notification no. 16/2021, Dated 12th March 2021 , amended Rule 114E of the Income Tax Rules to cover the transactions of Dividend, Interest, Capital gain in the category of SFT for reporting purposes by the specified person. Here it is pertinent to note that these new reportable transactions is without any limit for the purpose of reporting. For more details, kindly refer the link:

-

- CBDT vide Press release, Dated 17th March 2021, has clarified that taxation in case of FPI @ 5% u/s 115AD will still apply on interest income earned u/s 194LD.

-

- CBDT vide Circular no. 5/2021, Dated 25th March 2021, has again deferred the reporting requirement of Clause 30C & 44 i.e. GAAR reporting & Breakup of GST expenditure respectively. These clauses are deferred 4th time by the tax authority considering the Global Pandemic due to Covid-19.

International Taxation

-

- CBDT vide Notification no. 18/2021, Dated 16th March 2021, inserted new Rule 29BA read with Section 195(2)/(7) for determination of amount to be chargeable to tax in case of Non-Resident Recipient. Now application in this case will be filed through Form 15E.

-

- CBDT vide Circular No. 2/2021& Press release dated 03-03-2021, has issued clarification with regard to residential status of person for the Financial Year 2020-21. Vide the said Circular, it has been provided that if any individual is facing double taxation even after taking into account the relief provided by the relevant Double Taxation Avoidance Agreement (DTAA), he/she may furnish the specified information by 31st March, 2021 in Form -NR annexed to the said Circular.

Goods & Services Tax (GST)

-

-

- CBIC vide Notification No. 05/2021-Central Tax dated 08th March 2021, has mandated E-Invoicing to taxpayers having turnover more than Rs. 50 crores, w.e.f. 01st April 2021, for all B2B supplies made including exports. E-invoicing applicable where turnover of a taxpayer crossed the aforesaid limits during any F.Y. from 2017-18.

-

- Currently, the recipients of the deemed export supplies are finding difficulty in claiming refund of tax paid in respect of such supplies, because the system is not allowing them to the file refund claim under the aforesaid category unless the claimed amount is debited in the electronic credit ledger. This is due to the reason that Para 41 of circular no:125/44/2019 –GST dt. 18/11/2019 has placed a condition that the recipient of deemed export supplies shall submit an undertaking that he has not availed ITC on invoices for obtaining the refund of tax paid on such supplies. Accordingly, the recipient of deemed export supplies cannot avail ITC on such supplies, but when they proceed to file refund on the portal, the system requires them to debit the amount so claimed from their electronic credit ledger.

-

-

- CBIC vide Vide Order No.147/02/2021-GST dated 12-03-2021 has now remove the restriction of non-availment of ITC by the recipient of deemed export supplies on the invoices, for which refund has been claimed by such recipient.

-

-

- CBIC vide Circular No. 146/02/2021-GST dated 23-02-2021 has issued the following clarifications in respect of the applicability of Dynamic QR code on invoices issued for B2C supplies:- QR code shall not be required to be generated in case of export transaction even though such supplies are made by a registered person to unregistered persons;- Following details to be captured in the QR code: GSTN of the supplier, UPI ID and bank A/C number and IFSC of the supplier, invoice number, invoice date, total invoice value and GST amount along with breakup i.e., CGST, SGST, IGST and Cess.- Where the payment is made without using the dynamic QR code, the invoice shall be deemed to have complied with the requirement of Dynamic QR Code, if the cross reference of the payment is made on the invoice.- Where payment is made after generation /issuance of invoice, the supplier shall provide Dynamic QR Code on the invoice. This is applicable to suppliers making supplies through E-commerce portal or an online application.

Companies Act, 2013

-

- MCA amends Schedule III of Companies Act 2013. The Read disclosures to be made in Balance Sheet with effect from 1st day of April, 2021.

-

-

- The Schedule III of the Companies Act 2013 contains the general instructions for preparation of Balance Sheet and Statement of Profit and Loss of a Company. Broadly, changes have been made to align the Schedule III with recent changes and to make it more meaningful and speaking. Now companies have to round off the figures appearing in the financial statements, hitherto it was optional. Further, the criteria for rounding off shall be based on “total income” in place of “turnover”. All Companies now have to disclose Shareholding of Promoters, Current maturities of long term borrowings, Trade Payables & Trade Receivables ageing schedule to be given, details of all the immovable whose title deeds are not held in the name of the Company, Disclosures to be made where Loans or Advances in the nature of loans are granted to promoters, directors, KMPs and related parties, Capital – work – in progress & Intangible assets under development ageing schedule shall also be given, Disclosure of any proceedings initiated or pending against the company for holding any Benami property under the Benami Transactions (Prohibition)Act, 1988. Further, where a company is a declared willful defaulter by any bank or financial Institution or other lenders, Disclosure of any transactions with companies struck-off, and Where any charges or satisfaction yet to be registered with Registrar of Companies beyond the statutory period, details and reasons thereof shall be disclosed & detail to be provided in the Balance sheet.

- MCA has notified the Companies (Accounts) Amendment Rules, 2021 which shall come into force with effect from the 1st day of April, 2021.

-

- Accordingly, MCA has mandated that for the financial year commencing on or after the 1st day of April, 2021, every company which uses accounting software for maintaining its books of account shall use only such accounting software which has a feature of recording audit trail of each and every transaction, creating an edit log of each change made in books of account along with the date when such changes were made and ensuring that the audit trail cannot be disabled. Further, the notification also specified that Board Report should contain the following additional information’s relating to the details of an application made or any proceeding pending under the Insolvency and Bankruptcy Code, 2016 during the year along with their status as at the end of the financial year and the details of the difference between the amount of the valuation is done at the time of one-time settlement and the valuation done while taking a loan from the Banks or Financial Institutions along with the reasons thereof.

- MCA has notified Companies (Audit and Auditors) Amendment Rules, 2021 which shall come into force with effect from the 1st day of April, 2021.

-

- MCA has deleted the clause relating to dealings in Specified Bank Notes during the prescribed time period from the Auditors Report and instructed to insert the clause relating to the funds advanced/received or loaned or invested by the company to or in any other person(s) or entity(ies), including foreign entities with the understanding that the Intermediary shall lend or invest in other persons or entities identified in any manner whatsoever by or on behalf of the Company. Further, the Auditors is required to comment on the status the dividend declared or paid during the year by the company is in compliance with section 123 of the Companies Act, 2013. The Auditors are also required to comment on accounting software used by the Company for maintaining its books of account which has a feature of recording audit trail (edit log) facility and the same has been operated throughout the year for all transactions recorded in the software

- MCA has created a way to compensate non-executive or Independent Directors of companies, which are loss-making or have inadequate profits.

-

- The MCA has issued a notification to make amendments in the Schedule V of the Companies Act, 2013, which limits the remuneration that a non-executive director can be given depending upon the effective capital of the Company. Earlier, only the executive director was entitled to remuneration in the event of a loss. The new provision allows the Board of Directors to pass a special resolution if they want to further increase the remuneration beyond the upper limit. This provision is applicable to both non-executive and executive directors. The Rule 4 of the company’s appointment and remuneration of managerial personnel 2014, the sitting fees to an independent director or a director would not exceed a sum of Rs 100,000 per meeting. At the lowest slab of Rs 12 lakh, a year independent director could still draw thrice the amount that would have been payable for four board meetings in a year.

- MCA notified the 18th March, 2021 as the effective date for implementation of changes in provisions of Independent Director and Remuneration to Directors inserted Companies (Amendment) Act, 2020.

-

- The Central Government hereby appoints the 18th March, 2021 as the date on which the provisions of section 32 and section 40 of the said Act shall come into force. Section 32 of the Companies (Amendment) Act, 2020 seeks to amend Section 149 of the Companies Act, 2013 wherein a proviso was added to provide that an independent director may receive remuneration, if a company has no profits or inadequate profits in accordance with Schedule V of the Act. Further, Section 40 of the Companies (Amendment) Act, 2020 seeks to amend Section 197(3) of the Companies Act, 2013 to provide that, if a company fails to make profits or makes inadequate profits in a financial year, any non-executive director of such company, including an independent director shall be paid remuneration in accordance with Schedule V of the Act.

- MCA establishes CSC for carrying out Scrutiny of STP E-Forms filed by Companies.

-

- The Ministry of Corporate Affairs established a Central Scrutiny Centre (CSC) for carrying out scrutiny of Straight Through Processes (STP) e-forms filed by the companies under the Act and the rules. The notification said that the CSC shall function under the administrative control of the e-governance Cell of the Ministry of Corporate Affairs. The CSC shall carry out scrutiny of the aforesaid forms and forward findings thereon, wherever required, to the concerned jurisdictional Registrar of Companies for further necessary action under the provisions of the Act and the rules made thereunder. The CSC shall be located at the Indian Institute of Corporate Affairs (IICA), Plot No. 6, 7, 8, Sector 5, IMT Manesar, District Gurgaon (Haryana), Pin Code- 122050. Notification is attached.

- The Ministry of Corporate Affairs has further amended the Companies (Management and Administration) Rules, 2014 and have released the Companies (Management and Administration) Amendment Rules, 2021.

-

- Which shall come into force on the date of their publication in the Official Gazette i.e 05-03-2021. The amendment provides that One Person Company and Small Company shall file their Annual Return under the provisions of the Section 92 of the Companies Act, 2013, in Form No. MGT-7A from the financial year 2020-21 onwards and every other Company shall continue to file their Annual Return in Form No. MGT-7. A copy of the annual return shall also be filed before the registrar of companies with prescribed fees. Further, details regarding indebtedness of the company and details of Foreign Institutional Investors (FII) like their name, address, countries of incorporation, registration and shareholding pattern are omitted in the revised Form MGT – 7.

- The Ministry of Corporate Affairs, has issued the Companies (Incorporation) Third Amendment Rules, 2021 to further amend the Companies (Incorporation) Rules,2013,

-

- Which shall come into force on the date of their publication in the Official Gazette i.e 05-03-2021. The amendment provides companies the option to undergo Aadhar authentication for GSTIN registration along with companies’ registration. The amendment has revised Form INC-35 AGILE PRO to include the option to perform Aadhar authentication for GSTIN registration. The applicants who opt for it must submit an Aadhar Card along with the application for registration under GST. After this, they need to verify the same on the GST portal. An OTP will be sent on the mobile number and email ID linked to the Aadhaar card. Only upon entering this OTP, the Aadhar will get e-validated. As per GST provisions, only authorized signatory will be required to go for Aadhar authentication, not all the directors, managing director, whole-time director or other directors who are not authorized signatories, need not go for Aadhar authentication.

Other Laws

- SEBI

- The Securities & Exchanges Board of India in its recent Board Meeting has approved several resolutions which would go a long way.

-

- The SEBI Board approved several amendments to the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 which inter-alia covers the requirement for formulation of dividend distribution policy to the top 1,000 listed companies on the basis of market capitalization; in case of the board meeting held for more than one day, financial results must be disclosed by the listed entities within 30 minutes of end of the board meeting for the day on which the financial results are considered; the timelines for submission of periodic reports. The SEBI Board has approved several amendments to the SEBI (Delisting of Equity Shares) Regulations, 2009 to make the delisting process more transparent and efficient which inter-alia covers that promoter/acquirer will be required to disclose their intention to delist the company by making an initial public announcement; the committee of independent directors will be required to provide their reasoned recommendations on the proposal for delisting. New requirements for sustainability reporting by listed entities has been introduced by SEBI. The new reporting called the Business Responsibility and Sustainability Report (BRSR) will replace the existing Business Responsibility Report (BRR). The BRSR will be applicable to the top 1000 listed entities (by market capitalization), for reporting on a voluntary basis for FY 2021 – 22 and on a mandatory basis from FY 2022 – 23. Further, the SEBI Board approved the proposal to rationalize the existing framework pertaining to the reclassification of promoter/ promoter group entities. It has also been decided to reduce the time gap between the date of the board meeting and shareholders meeting for consideration of reclassification request, to a minimum of one month and a maximum of three months from the existing requirement of a minimum period of three months and maximum six months.

- SEBI has issued a circular on Prior Approval for Change in control w.r.t Transfer of shareholdings among immediate relatives and transmission of shareholdings and their effect on change in control.

-

- SEBI has provided clarity on change in control criteria for market intermediaries and requirements for seeking its prior approval. With regard to unlisted body corporate intermediary, transfer of shareholding among immediate relatives would not be construed as a change in control. Further, transfer of shareholding by way of transmission to an immediate relative or not, shall not result in a change in control. Immediate relatives include any spouse of that person, or any parent, brother, sister, or child of the person or of the spouse. In case of an intermediary being a proprietary concern, the transferor bequeathing of the business/capital by way of transmission to another person is a change in the legal formation or ownership and is hence a change in control. The legal heir or transferee in such cases is required to obtain prior approval and thereafter fresh registration needs to be obtained in the name legal heir/ transferee. For transfer of ownership interest in case of partnership firm with more than two partners, inter-se transfer amongst the partners would not be construed to be changed in control. Where the partnership firm consists of two partners only, the same would stand as dissolved upon the death of one of the partners, it added. However, if a new partner is inducted in the firm, it would be considered as a change in control, requiring fresh registration and prior approval of SEBI.

- SEBI issues a new framework for delivery default in the derivatives segment.

-

- SEBI has received representations from market participants in the commodity derivatives segment for standardization of delivery default norms, among others. Consequently, Securities and Exchange Board of India in consultation with clearing corporations came out with delivery default norms, which will be effective from the first trading day of May 2021. The clearing corporation, having commodity derivatives segment, should have an appropriate deterrent mechanism in place against intentional or willful delivery default and ensure adequate compensation to the non-defaulting counterparty. In agricultural and non-agricultural commodities, the penalty for delivery default by the seller will now be 4 percent and 3 percent of the settlement price plus replacement cost, respectively. Further, the provisions for levy of penalty on delivery default by the buyer will be put in place by the clearing corporations. The Clearing Corporations and exchanges will have the flexibility to increase or decrease the penalty for specific commodities depending on the situation in consultation with SEBI.

- SEBI has advised all registered entities including MIIs (which use bulk SMS for providing their services to the investors) to ensure strict compliance with the Telecom Regulatory Authority of India’s (TRAI) Telecom Commercial Communications Customer Preference Regulations, 2018 (TCCCP Regulations).

-

- These new regulations have a provision for Principal Entities to register with the telecom service providers and are also required to register the template of the message. It may be noted that effective implementation of these new regulations will help to protect investors and the general public from unsolicited and often misleading messages. The regulator said non-compliance with the provisions of Telecom Commercial Communications Customer Preference Regulations, 2018 (TCCCP Regulations) may result in disruption of delivery of their messages to the investors.

- The Finance Ministry has notified the new format of the Annual Report for Securities & Exchange Board of India (SEBI).

-

- The SEBI has issued the Securities and Exchange Board of India (Annual Report) Rules, 2021. Accordingly, the Board shall submit a report to the Central Government giving a true and full account of its activities, policies, and programs during the previous financial year in the Annexure appended to these rules. The report shall be submitted within ninety days after the end of each financial year. Market Activity and Trends Observed (including details of applications for public issuance received and approved during the financial year, fund-raising under different categories, the median time is taken for regulatory approval on an aggregate basis). Complete details of Merchant Bankers, Bankers to an Issue, Underwriters, Debenture Trustees, Registrar to an Issue and Share Transfer Agents, etc. (including details such as new registrations, the median time is taken for approval of registrations on an aggregate basis, number of applications rejected, suspension/cancellation of registration, and regulation of activities of the intermediaries associated with the securities market). Risk Management Measures (including the categorized list of investors; concentration of investments; NPAs; instances of diversion of funds; quantum of unclaimed units, etc.). Investor grievances received and redressed (including their type, increase in number and geographic location and segment-wise categorization, major nature, or types of complaints). A detailed report on the inflow of money into IPF / beneficial owner protection funds of MIIs and SEBI shall also be attached.

- SEBI extends Central KYC Registry to legal entities.

-

- SEBI has asked regulated entities to upload ‘Know Your Customer’ data pertaining to accounts of legal entities opened on or after April 1, onto the Central KYC Registry. Regulated entities (REs) have already been uploading the KYC data pertaining to all individual accounts opened on or after August 1, 2016, onto CKYCR. Regulated entities (REs) have already been uploading the KYC data pertaining to all individual accounts opened on or after August 1, 2016, onto CKYCR. Accordingly, RIs (registered intermediaries) shall upload the KYC records of LE accounts opened on or after April 1, 2021, on to CKYCR in terms of the Prevention of Money Laundering (Maintenance of Records) Rules, 2005. The regulator has also come out with a template for legal entities in this regard. Also, registered entities would have to ensure that during such receipt of updated information, the clients’ KYC details are migrated to current client due diligence standards. Further, once a KYC identifier is generated by CKYCR, the RIs would ensure that the same is communicated to the legal entity. The provisions of this circular are not applicable to Foreign Portfolio Investors (FPIs).

- SEBI has issued a circular which specifies the Unique Client Code (UCC) and mandatory requirement of Permanent Account Number (PAN).

-

- The amendments are carried out in Clause 3 which specifies that it is mandatory for all the members of exchanges having commodity derivatives segments to use UCC. It shall now be mandatory for the members of the exchanges having commodity derivatives segment to use Unique Client Code (UCC) for all clients transacting on the commodity derivative segment. The exchanges with commodity derivatives segment shall not allow execution of trades without uploading of the UCC details by the members of the exchange. Further, Clause 5 has been modified, to provide the exchanges having commodity derivatives segment shall ensure that the members of their exchanges shall collect copies of PAN cards issued to their existing as well as new clients after verifying with the original and cross-check the aforesaid details collected from their clients with the details on the website of the Income Tax (IT) Department. However, in case of e-PAN, verify the authenticity of e-PAN with the details on the website of IT Department and maintain the soft copy of PAN in their records and upload details of PAN or e-PAN so collected to the Exchanges as part of Unique Client code.

- SEBI has come out with guidelines on votes cast by mutual funds to further improve transparency and encourage such fund houses to diligently exercise their voting rights in best interest of the unit holders.

-

- Mutual funds, including their passive investment schemes like index funds, exchange-traded funds (ETFs), will be required to cast votes compulsorily in respect of related party transactions of the investee companies and corporate governance matters. In addition, mutual funds will have to cast votes on corporate governance matters, including changes in the state of incorporation, merger and other corporate restructuring, and anti-takeover provisions as well as capital structure, including increases and decreases of capital and preferred stock issuances. Also, casting of votes would be necessary for stock option plans and other management compensation issues, social and corporate responsibility issues, appointment and removal of directors and any other issue that may affect the interest of the unit holders. Further, in case of the mutual funds having no economic interest on the day of voting, it may be exempted from compulsory casting of votes. The vote would be cast at the mutual fund level. However, in case a fund manager of any scheme has a strong view against the views of fund manager of the other schemes, the voting at scheme level would be allowed, subject to recording of detailed rationale for the same. Fund managers need to submit a declaration on a quarterly basis to the trustees that the votes cast by them have not been influenced by any factor other than the best interest of the unit holders.

- SEBI has come out with operational guidelines to credit physical shares in Demat Account of investors following re-lodged transfer request.

-

- SThe shares in demat form would help in maintaining a transparent record of shareholding of companies amid rising concerns over beneficial ownership of entities. Subsequent to processing of re-lodged transfer request, the RTA (registrar to an issue and share transfer agent) would retain physical shares and intimate the investor (transferee) about the execution of transfer through a letter of confirmation. Further, this letter will be sent through speed post or e-mail, with the digitally signed letter containing details of endorsement, shares, folio of investor as available on physical shares. The investor would have to submit the demat request, within 90 days of issue of letter of confirmation, to depository participant along with the letter of confirmation. In case of shares that are required to be locked-in, the RTA, while confirming the demat request, will also intimate the depository about the lock-in and its period. Such shares would be in lock-in demat mode for six months from the date of registration of transfer. Transfer of securities held in physical mode has been discontinued with effect from April 1, 2019, but investors have not been barred from holding shares in physical form. In March 2019, SEBI had clarified that transfer deeds lodged before the deadline of April 1, 2019, and rejected or returned due to deficiency in documents may be re-lodged with requisite documents.

- SEBI has issued the Consultation Paper on Review of Regulatory Provisions related to Independent Directors for public comments

-

- With an intent to further strengthen the independence of IDs and enhance their effectiveness in the protection of interests of minority shareholders and performing other functions. It is proposed that KMPs or employees of promoter group companies, cannot be appointed as Independent Directors in the company, unless there has been a cooling-off period of 3 years. The said restriction shall also extend to relatives of such KMPs for the same period. The prescribed cooling-off period for eligibility condition shall be harmonized to 3 years. The Consultation Paper seeks views of the public on proposals including broadening the eligibility criteria for IDs, process of appointment / re-appointment and removal of IDs, enhancing transparency in the nomination and resignation of IDs, strengthening the composition of Board Committees, etc. Additionally, views are also sought on the need for review of remuneration of IDs. The Consultation Paper is open for public comments till April 01, 2021.

- RBI

- The Reserve Bank of India (RBI) has decided to extend the cheque truncation system (CTS) across all bank branches by September 2021 in a bid for faster and smoother cheque clearances in the Country.

-

- To leverage the availability of CTS and provide uniform customer experience irrespective of location of her/his bank branch, it has been decided to extend CTS across all bank branches in the country. All Banks will have to ensure that all their branches participate in image-based CTS under respective grids by September 30, 2021. Further, they are free to adopt a model of their choice, like deploying suitable infrastructure in every branch or following a hub & spoke model and concerned banks should coordinate with the respective Regional Offices of RBI to operationalize this system.

- DGFT

- The DGFT has issued a Trade Notice for issuance of Import Authorization for ‘Restricted’ items from DGFT HQs w.e.f. March 22, 2021

-

- As part of IT Revamp of its exporter/importer related services, DGFT has now introduced a new online module for filing of electronic, paperless applications for import authorizations with effect from 22.03.2021. All applicants seeking import authorization for restricted items may apply online by navigating to the DGFT website and import authorizations for restricted items would be issued from DGFT HQ, Udyog Bhawan, New Delhi with effect from 22.03.2021. It may further be noted that all pending applications have been migrated to this new system and will be processed suitably at DGFT(HQ). For re-validation or amendment of such authorizations issued on or after this date, applications would be required to be submitted electronically to DGFT(HQ). Original Copies of the authorization would be required to be presented to DGFT(HQ) for re-validation/amendment endorsements.

- IBBI

- IBBI has notified the has notified Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) (Amendment) Regulations, 2021.

-

- which shall come into force on the date of their publication in the Official Gazette i.e. 15-03-2021. The Board inserted Rule 12A in respect of the Updation of claim which said, “a creditor shall update its claim as to and when the claim is satisfied, partly or fully, from any source in any manner, after the insolvency commencement date. The Board notified that where any activity requiring the filing of Form CIRP 7, if not completed by the specified date the interim resolution professional or resolution professional, as the case may be, shall file Form CIRP 7 within three days of the said date, and continue to file Form CIRP 7, every 30 days, until the said activity remains incomplete. However, subsequent filing of Form CIRP 7 shall not be made until thirty days have lapsed from the filing of an earlier Form CIRP 7. IBBI has also clarified that only one Form CIRP 7 shall be filed at any time whether one or more activity is not complete by the specified date. Further, in the Schedule to the principal regulations, Form C in respect of Submission of Claim by Financial Creditors shall be substituted.

- IBBI extends the validity of IBBI (Online Delivery of educational Corse and Continuing Professional Education by Insolvency Profession Agencies and Registered Valuers Organization) Guidelines, 2020.

- The Insolvency and Bankruptcy Board of India (IBBI) has issued the Insolvency and Bankruptcy Board of India (Liquidation Process) (Amendment) Regulations, 2021

-

- To further amend the Insolvency and Bankruptcy Board of India (Liquidation Process) Regulations, 2016. The amendments have been made in Regulation 31 (2), which specifies that the liquidator shall file the list of stakeholders with the Adjudicating Authority within forty-five days from the last date for receipt of the claims and the filing of list on stakeholders, has to be filed on the electronic platform of the Board for dissemination on its website. Further, provided that this clause shall apply to every liquidation process ongoing and commencing on or after the date of commencement of the Insolvency and Bankruptcy Board of India (Liquidation Process) (Amendment) Regulations, 2021.”.

- Labour Laws

- The Ministry of Labour and Employment has notified the Code on Wages (Central Advisory Board) Rules, 2021

-

- Which constitutes the Central Advisory Board and nominates a person to the board and rolls out the functions and methods of the meetings. The Board shall consist of persons to be nominated by the Central Government representing employers and employees and the independent persons and representatives of the State Governments. The persons representing employers shall be twelve and the persons representing employees shall also be twelve and the Chairperson may, call a meeting of the Board, at any time he thinks fit, Provided that on requisition in writing from not less than one half of the members, the Chairperson shall call a meeting within thirty days from the date of the receipt of such requisition. All business of the Board shall be considered at a meeting of the Board, and shall be decided by a majority of the votes of members present and voting and in the event of an equality of votes, the Chairperson shall have a casting vote, Provided that the Chairperson may, if he thinks fit, direct that any matter shall be decided by the circulation of necessary papers and by securing written opinion of the members. Provided further that no decision on any matter under the preceding proviso shall be taken, unless supported by not less than two-thirds majority of the members.

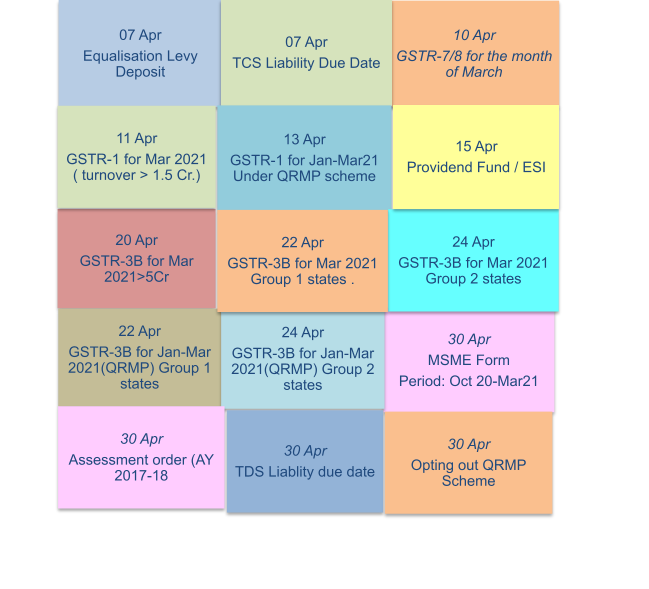

KNM India can assist you with a range of complete financial services that range from Corporate advisory to Transaction advisory, Pre-incorporation to Post-incorporation, Insolvency and bankruptcy code to Secretarial services, Assurance to Internal audit services, along with Market entry strategy to Foreign company registration in India. To discuss about any of these please book your slot, or call us on +91-99105-04170 – or email us at services@knmindia.com to get a quick response.Monthly Compliance Calendar

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period 26.11.2020 till 25.12.2020.Prepared by

KNM MANAGEMENT ADVISORY SERVICES PVT. LTD.E-mail: services@knmindia.com

Web site: www.knmindia.com -

-

-

-