Income Tax

-

-

-

-

-

-

-

- CBDT vide Circular No.21/2020[ F.No.IT(A)/1/2020-TPL] dated 04.12.2020 , has issued more clarification(34 FAQs) in Vivad se Vishwas scheme. Earlier 22nd April 2020, 55 FAQs are issued in support of the scheme.

-

- CBDT vide Circular No.20/2020[ F.No.275/192/2020-TPL] 03.12.2020 has issued annual circular in regards to TDS on salary. Annual circular contains slab rates etc. as complete set of guidance for deduction of TDS on salary.

Goods & Services Tax (GST)

-

- CBIC vide Notification No 89 /2020 – Central Tax Dated 29th-Nov -2020 has waived the penalty payable by a registered person u/s 125 of CGST Act, 2017(i.e. general penalty under GST), in respect of non-compliance for the generation of e-invoice in case of B2C transactions. The Penalty has been waived off for the period from 1st December 2020 to 31st March 2021 subject to the condition that the said registered person complies with the QR code provisions with effect from 1st April 2021.

-

- CBIC vide Notification No 90 /2020 – Central Tax Dated 1st-Dec-2020 has mandated mentioning of 8-digit HSN code on invoices by taxpayers supplying 49 specified chemical items

-

- CBIC videNotification No. 91/2020 – Central Tax dated 10th November 2020 CBIC vide Notification No. 91/2020 dated 14th December 2020 has extended the due date for completion or compliance of any action, by any authority u/s 171, i.e. Anti-profiteering measures, which falls during the period 20th March 2020 to 30th March 2021, till 31st March 2020. The Notification has been issued to amend the earlier Notification no. 35/2020-Central Tax dated 3rd April 2020.

-

-

- CBIC videNotification No. 92/2020 – Central Tax dated 22nd December 2020 has appointed 1st day of January, 2021 as the date on which the provisions of sections 119,120,121, 122,123,124,126,127 and 131 of the CGST Act shall come in force.

-

- CBIC vide Notification No. 94/2020– Central Tax, dated 22nd December 2020 has amended certain rules to give effect to amendments made to the CGST Act vide Finance Act,2020.

-

-

- 1. The Limit under Rule 36(4) for Input not reflecting in GSTR-2B has been reduced to 5% from 10% of the ITC available.

-

- 2. Rule 59(5) has been inserted to provide that a registered person shall not be allowed to file GSTR-1, if he has not furnished GSTR-3B for preceding 2 months. Similarly, for quarterly return filers, the taxpayer failing to file Form GSTR 3B for the preceding quarter shall not be permitted to file Form GSTR 1 for the subsequent quarter.

-

- 3. The time limit for granting GST registration has been increased from 3 days to 7 days. And in case applicant has not opted for Aadhar authentication or where department feels fit to carry out physical verification the time limit shall be 30 days instead of 7 days.

-

- 4. New clause in Rule 21 has been inserted providing power to cancel GST registration of a person in the following cases:

-

- a. Availment of ITC in violation of section 16 of CGST Act, 2017

-

- b. Where outward supplies declared in GSTR-1 for one or more term are in excess of supplies declared in GSTR-3B

-

- c. The taxpayer violets the conditions inserted by rule 86B of CGST Act, 2017

-

- 5. Where the tax officer has significant reasons to believe or in case there are deviations in the supplies reported in GSTR-1 and GSTR-3B or ITC claimed in GSTR-3B and Form GSTR-2B, he can suspend the registration without giving a reasonable opportunity to the registered person.

-

- 6. When GST registration is suspended, no refund under section 54 of CGST Act can be availed by the taxpayer.

-

- 7. Validity of E-way bill has been reduced. Earlier, validity of E-way bill was 1 day for every 100 KM which now has been increased to 200 KM for 1 day. E.g. If the distance to be covered is 600 KM, validity of E-way bill shall be 3 days comparing to 6 days before amendment.

-

- 8. New Rule 86B has been inserted and shall come into effect from 1st January 2021 onwards. The said rule has been inserted to restrict the claim of credits to 99% of the credits available in the electronic credit ledger. The restriction shall be imposed where the value of taxable supplies other than exempt supply and zero-rated supply in a month exceeds Rs. 50 lakhs. Certain exceptions have been provided to this rule which are as below:

-

- a. Where the taxpayer has paid Income tax > Rs. 1 lakh in 2 preceding FY.

-

- b. Where taxpayer has received refund exceeding Rs. 1 lakh in the preceding FY on unutilized ITC either on account of zero-rated supplies made without payment of tax or under inverted tax structure.

-

- c. Where taxpayer has used electronic cash ledger to pay off liability on outward supplies which cumulatively makes 1% of the total liability up to the said month.

-

- d. Where a person is a Government Department, Public Sector Undertaking (PSU), local authority or a statutory body.

Companies Act, 2013

-

- The Ministry of Corporate Affairs has issued Notification for Companies (Share Capital and Debentures) Second Amendment Rules, 2020

-

-

- Which shall come into force on the date of their publication in the official Gazette i.e 24-12-2020. The said rules amend the Companies (Share Capital and Debentures) Rules 2014 by substituting the Form SH-7. The Form SH-7 is used for filing a notice to the Registrar of any changes in Share Capital pursuant to section 64(1) of the Companies Act, 2013 and Rule 15. A new option has been inserted in Point 3 of the form to cater the need for Cancellation of unissued shares of one class and increase in shares of another class of shares.

-

-

- The Ministry of Corporate Affairs has issued Notification for Companies (Share Capital and Debentures) Second Amendment Rules, 2020

-

- Which shall come into force on the date of their publication in the official Gazette i.e 24-12-2020. The said rules amend the Companies (Share Capital and Debentures) Rules 2014 by substituting the Form SH-7. The Form SH-7 is used for filing a notice to the Registrar of any changes in Share Capital pursuant to section 64(1) of the Companies Act, 2013 and Rule 15. A new option has been inserted in Point 3 of the form to cater the need for Cancellation of unissued shares of one class and increase in shares of another class of shares.

- The Ministry of Corporate Affairs has issued the Companies (Auditor’s Report) Second Amendment Order, 2020

-

-

- To further amend the Companies (Auditor’s Report) Order, 2020. The amendments have been made in Paragraph 2, which specifies the auditor’s report to contain matters specifies, has been substituted, to provide that every report made by the auditor under section 143 of the Companies Act on the accounts of every company audited by him, to which this Order applies, for the financial years commencing on or after April 01, 2021, shall in addition, contain the matters specified in paragraphs 3 and 4, as may be applicable.

-

- MCA has notified the dates as 21-12-2020 as the date from which certain provisions shall come into force.

-

-

- The Companies (Amendment) Act, 2020 has introduced several measures to improve the ease of doing business and decriminalize certain offences. The Companies (Amendment) Act, 2020, which amends the Companies Act, 2013, has been published in the Official Gazette on September 28, 2020. The Amendment Act’ does away with imprisonment as a consequence of a violation of certain provisions of the Companies Act, 2013. It also reduces or modifies the fines/penalties for certain offences under the Companies Act, 2013. The Amendment Act has now reduced the one-time penalty payable by companies in case of contravention of failure to file an annual return to INR 10,000 from INR 50,000, and in case of continuing offences, a fine of INR 100 for every day subject to a reduced limit of INR 200,000 from INR 500,000. Further, Imprisonment has been removed as a punishment for contravention of the provisions in relation to (i) buy-back of securities; (ii) financial statements and board’s report; (iii) knowingly functioning as a director despite the seat being vacated due to disqualification; (iv) constitution of the audit committee, nomination and remuneration committee and stakeholders relationship committee; and (v) disclosure of interest by director and participation in relation to matters in which he is interested. In addition, the Amendment Act extends provisions of the Companies Act relating to reduced fines for certain offences presently applicable to one-person companies or small companies to producer companies and start-up companies as well.

-

- MCA has published the Companies (Compromises, Arrangements and Amalgamations) Second Amendment Rules, 2020

-

-

- To further amend the Companies (Compromises, Arrangements, and Amalgamations) Rules, 2016. Through this amendment a new definition for the term corporate action has been inserted which means “any action taken by the company relating to the transfer of shares and all the benefits accruing on such shares namely, bonus shares, split, consolidation, fraction shares, and right issue to the acquirer”. Further a new Rule 26A has been inserted which deals with the Purchase of minority shareholding held in Demat form in which the company shall within 2 weeks from the date of receipt of the amount equal to the price of shares to be acquired by the acquirer, verify the details of the minority shareholders holding shares in dematerialised form. After following the prescribed procedure and upon successful payment to the minority shareholders, the company shall inform the depository to transfer the shares of such shareholders, kept in the designated DEMAT account of the company, to the DEMAT account of the acquirer.

-

- MCA has notified the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2020

-

-

- Which shall come into force on the date of their publication in the Official Gazette i.e 18-12-2020. The amendment provides that an individual shall now pass an online proficiency self-assessment test within a period of two years instead of one year with only 50% as pass percentage. Further. An individual shall not be required to pass the online proficiency self-assessment test when he has served for a total period of not less than three years as of the date of inclusion of his name in the data bank as a Director or KMP, as on the date of inclusion of his name in the databank, in a listed public company, an unlisted public company having a paid-up share capital of rupees ten crores or more, body corporate listed on any recognized stock exchange, statutory corporations set up under an Act of Parliament or any State Legislature carrying on commercial activities. MCA has further extended exemptions to person above the Director in certain Ministries and having experience in handling the matters relating to corporate laws or securities laws or economic laws.

-

- MCA has designated Special Courts in the States of Maharashtra, West Bengal (WB) and Tamil Nadu (TN) for the purposes of trial of offences under Companies Act, 2013, in respect of cases filed by the Securities and Exchange Board of India.

-

-

- In exercise of the powers conferred by Section 435(1) of the Companies Act, 2013, the Central Government hereby designates the Court Number 22, City Civil and Sessions Court, Mumbai; Court Number 39, City Civil and Sessions Court, Greater Mumbai; 5th Special Court, Calcutta; Principal Judge, City Civil Court, Chennai as Special Courts in the States of Maharashtra, West Bengal and Tamil Nadu for the purposes of trial of offences under this Act.

-

- MCA has released a circular to provide Relaxation of additional fees and extension of last date of filing of CRA-4 (form for filing of cost audit report) for FY 2019-20 under the Companies Act, 2013.

-

-

- The Form CRA-4 Form is used for filing the cost audit report. Various Stakeholders have sent representations seeking the extension of the last date of filing of CTR-4 due to the impact of the COVID-19 outbreak. MCA decided that if the cost auditor submits the cost audit report for the financial year 2019-20 in front of the Board of Directors of the companies by 31st December 2020 then it will not be considered as a violation of rule 6(5) of Companies (cost records and audit) Rules, 2014.

-

Other Laws

- IBBI

- MCA has extended the suspension of the Insolvency and Bankruptcy Code (IBC) till March 31, 2021

-

- To help businesses cope with the lingering difficulties posed by the COVID-19 pandemic. All defaults arising on or after March 25, when the national lockdown was imposed to curb the pandemic, will effectively remain out of the insolvency net for a full year. The government has already obtained Parliamentary approval, through the Insolvency and Bankruptcy Code (Second Amendment) Bill, 2020, for an up to one-year suspension of the initiation of insolvency proceedings for fresh defaults from March 25. Initially, the suspension was kept valid for six months, which was then extended by three months. The government had suspended the invocation of three Sections – 7, 9 and 10 of the IBC for COVID related defaults. These sections deal with the initiation of the insolvency proceedings by financial and operational creditors and corporate debtors.

- SEBI

- SEBI has issued a Master Circular on Scheme of Arrangement by Listed Entities and Relaxation under Sub-Rule (7) of Rule 19of the Securities Contracts (Regulation) Rules, 1957.

-

- In order to enable the users to have access to the applicable circulars at one place, a Master Circular in respect of Schemes of Arrangement has been prepared. This Master Circular is a compilation of relevant and updated circulars issued by SEBI which deal with Schemes of Arrangement and which are operational as of the date of this circular. Further, it is also clarified that in case of any inconsistency between the Master Circular and the applicable circulars, the content of the relevant circular shall prevail.

- SEBI issues Consultation Paper on Review of framework of Innovators Growth platform (IGP) under SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018.

-

- The paper proposes recommendations on the Eligibility Criteria, Lock –In, Discretionary Allotment to Anchor Investors, Continuing Rights & Takeover requirements. The period of holding of 25% of pre-issue capital to be held by eligible investors for 2 years, may be reduced to 1 year. The issuer company may be allowed to allocate upto 60% of the issue size on a discretionary basis, prior to issue opening. The SAST stipulation for triggering open offers may therefore be relaxed to a higher threshold from existing 25% to 49%. The threshold for disclosure of the aggregate shareholding can be increased from the present 5% to 10% and whenever there is subsequent change of ± 5% (instead of present ± 2%) in the shareholding.

- SEBI clears shareholding norms for stressed companies, relaxes FPO norms in its board meet.

-

- The market regulator SEBI cleared some crucial regulations for companies that wish to re-list themselves after undergoing the Corporate Insolvency Resolution Process or CIRP. SEBI said that the companies wanting to re-list after coming out of CIRP will have to mandatorily achieve Minimum Public Shareholding (MPS) of 5 percent at the time of re-listing on the exchanges. Such companies will get a period of 12 months to achieve MPS of 10 percent and 3 years to achieve MPS of 25 percent. The move will ensure sufficient float in a listed entity and hence reduce any volatility which could happen otherwise due to the low float in the market. An adequate amount of float may also restrict any sort of price manipulation. SEBI has also made some crucial amendments to its ICDR Regulations for Follow-on Public Offer (FPO). SEBI’s board also approved the proposal to do away with the applicability of Minimum Promoters’ Contribution or MPC and the subsequent lock-in requirements for the issuers making a Follow-on Public Offer (FPO). The relaxations will be subject to the company’s equity shares being frequently traded on the exchanges for the last three years, also the company has to be in compliance with listing and disclosure rules for three years and has redressed 95 percent of investor complaints. Currently, promoters are mandated to contribute 20 percent towards an FPO.

- The Securities and Exchange Board of India (SEBI) has issued a Consultation Paper on Compliance Standards for Index Providers for public comments.

-

- SEBI with an intent to prescribe a set of compliance standards for index providers in order to ensure quality and integrity of the indices administered, maintained or calculated by the index providers. The attributes of Benchmark Indices in India vis-a-vis all listed stocks and notes that both (Nifty 50 and Sensex 30) indices represent the largest & most liquid companies and represents the majority of average free-float market capitalization, average total market capitalization and average daily turnover of all stocks traded. In respect of Indices based on which any product including derivatives, Exchange Traded Funds (ETFs), Market Linked Debentures (MLDs) are available/ traded on Indian stock exchanges. In respect of Indices which are constructed based on data provided by Indian stock exchange(s). In respect of Indices provided by the index providers that are used by Mutual Funds for benchmarking of funds performances or issuance of Index Funds. The suggested framework casts responsibility on Indian Stock Exchanges and Asset Management Companies, as applicable, to ensure that the Index provider is in compliance with IOSCO Principles on a continuous basis. In addition to ensuring compliance by the Index provider with the IOSCO principles, the stock exchange is also required to assess the impact of any product based on such indices on trading in the Indian market. SEBI releases a framework to monitor foreign holding in depository receipts.

- SEBI has issued a circular with a mechanism to make the e-voting process more secure, convenient and simple for shareholders.

-

- With an intent to increase the efficiency of the voting process, SEBI has decided to enable e-voting for all Demat account holders by way of a single login credential through their Demat accounts and websites of depositories. Demat account holders would be able to cast their votes without having to register again with the e-voting service providers (ESPs), thereby not only facilitating seamless authentication but also enhancing ease and convenience of participating in the e-voting process. This will be implemented in a phased manner, under phase 1, Shareholders can directly register with depositories wherein they would be able to access the e-voting page of various ESPs through the websites of the depositories without further authentication by ESPs. The depository may advise the Demat account holders to update their mobile number and e-mail ID in order to access the e-voting facility. Further, the listed company would have to ensure that the ESPs engaged by them also provide a dedicated helpline in this regard. In order to enable better deliberations and decision making by shareholders while casting their votes, ESP portals would have to provide specific weblinks to the disclosures by the company on the websites of the exchanges and report on the websites of the proxy advisors.

- SEBI has introduced additional payment mechanism, including ASBA, for making subscription and payment of balance money for calls in respect of partly paid securities issued by listed entities.

-

- The decision has been taken as payment through Application Supported by Blocked Amount (ASBA) mechanism is investor friendly and enables faster completion of the process. The additional payment methods provided by SEBI are online as well as physical ASBA and the facility of linked online trading, demat and bank account (three-in-one type) account offered by some brokers. Investors can apply through an online portal of the self-certified syndicate banks (SCSBs) or physically submit application at the branch of a SCSB. The SCSBs would then send the application to RTA and block funds in shareholders accounts. Further, the intermediaries including the issuer company and its RTA would provide necessary guidance to the specified security holders in use of ASBA mechanism while making payment of calls.

- SEBI has come out with operational guidelines to credit physical shares in Demat Account of investors following re-lodged transfer request.

-

- SThe shares in demat form would help in maintaining a transparent record of shareholding of companies amid rising concerns over beneficial ownership of entities. Subsequent to processing of re-lodged transfer request, the RTA (registrar to an issue and share transfer agent) would retain physical shares and intimate the investor (transferee) about the execution of transfer through a letter of confirmation. Further, this letter will be sent through speed post or e-mail, with the digitally signed letter containing details of endorsement, shares, folio of investor as available on physical shares. The investor would have to submit the demat request, within 90 days of issue of letter of confirmation, to depository participant along with the letter of confirmation. In case of shares that are required to be locked-in, the RTA, while confirming the demat request, will also intimate the depository about the lock-in and its period. Such shares would be in lock-in demat mode for six months from the date of registration of transfer. Transfer of securities held in physical mode has been discontinued with effect from April 1, 2019, but investors have not been barred from holding shares in physical form. In March 2019, SEBI had clarified that transfer deeds lodged before the deadline of April 1, 2019, and rejected or returned due to deficiency in documents may be re-lodged with requisite documents.

- SEBI has issued a circular for the relaxation in timelines for compliance with regulatory requirements, due to the prevailing COVID conditions.

-

- The timelines have been extended for compliance with the regulatory requirements by the trading members/ clearing members and Depository Participants (DPs). Accordingly, the trading members/ clearing members is allowed to submit Internal Audit, System Audit and Half yearly net worth certificate for half year ended on September 30, 2020 till December 31, 2020 and Cyber Security and Cyber Resilience Audit for half year ended on September 30, 2020 has been extended till January 31, 2021. Further, the Depository Participants is allowed to submit half yearly Internal Audit Report by DPs, for the half year ended on September 30, 2020 has been extended till December 31, 2020. DP can submit KYC application form and supporting documents of the clients to be uploaded on system of KRA within 10 working days has been extended for the Period of exclusion shall be from March 23, 2020 till December 31, 2020. A 15-day period after December 31, 2020 can Depository / DPs, to clear the back log. Further, Systems audit on annual basis for the financial year ended March 31, 2020 is extended till December 31, 2020 for DP’s.

- RBI

- RBI has allowed banks to open specific accounts which are stipulated under various statutes and instructions of other regulators/regulatory departments, without any restrictions.

-

- An indicative list of such accounts is also released by the RBI which includes Accounts for real estate projects mandated under Section 4 (2) l (D) of the Real Estate (Regulation and Development) Act, 2016 for the purpose of maintaining 70% of advance payments collected from the home buyers; Nodal or escrow accounts of payment aggregators/prepaid payment instrument issuers for specific activities as permitted by Department of Payments and Settlement Systems (DPSS), Reserve Bank of India under Payment and Settlement Systems Act, 2007; Accounts for settlement of dues related to debit card/ATM card/credit card issuers/acquirers; Accounts permitted under FEMA, 1999; Accounts for the purpose of IPO / NFO /FPO/ share buyback /dividend payment / issuance of commercial papers/allotment of debentures/gratuity, etc. which are mandated by respective statutes or regulators and are meant for specific/limited transactions only; Accounts for payment of taxes, duties, statutory dues, etc. opened with banks authorized to collect the same, for borrowers of such banks which are not authorized to collect such taxes, duties, statutory dues, etc; Accounts of White Label ATM Operators and their agents for sourcing of currency. The above permission is subject to the condition that the banks shall ensure that these accounts are used for permitted/specified transactions only. Further, banks shall flag these accounts in the CBS for easy monitoring. Lenders to such borrowers may also enter into agreements/arrangements with the borrowers for monitoring of cash flows/periodic transfer of funds (if permissible) in these current accounts.

- RBI has issued a Press Release to announce the date for the launching of the Real-Time Gross Settlement System (RTGS) 24×7.

-

- The RTGS will be available round the clock on all days of the year and RTGS 24x7x365 will be launched with effect from 00:30 hours on December 14, 2020. Round the clock availability of RTGS will provide extended flexibility to businesses for effecting payments and will enable the introduction of additional settlement cycles in ancillary payment systems. This can also be leveraged to enhance operations of Indian financial markets and cross-border payments.

- The Reserve Bank of India has released Draft Circular on Declaration of Dividend by NBFCs

-

- In order to infuse greater transparency and uniformity in practice. NBFCs may declare a dividend, subject to compliance with the guidelines laid down in the circular including Deposit taking Non-Banking Financial Company (NBFC-D) and Systemically Important Non-Deposit taking Non-Banking Financial Company (NBFC-ND-SI) should have CRAR of at least 15% for the last 3 years, including the accounting year for which it proposes to declare dividend. Further, Non-Systemically Important Non-Deposit taking Non-Banking Financial Company (NBFC-ND) should have a leverage ratio of less than 7 for the last 3 years, including the accounting year for which it proposes to declare dividend. The Core Investment Company (CIC) should have Adjusted Net Worth (ANW) of at least 30% of its aggregate risk-weighted assets on the balance sheet and risk-adjusted value of off-balance sheet items for the last 3 years, including the accounting year for which it proposes to declare a dividend.

- The Reserve Bank of India RBI has issued a Notification to notify the Foreign Exchange Management (Export and Import of Currency) (Second Amendment) Regulations, 2020.

-

- Which shall come into force from the date of their publication in the Official Gazette i.e 03-12-2020. Amendments to the Foreign Exchange Management (Export and Import of Currency) Regulations, 2015, are carried out to insert new Regulation 10 which allows Reserve Bank’s power to restrict export or import of currency. Accordingly, the Reserve Bank, may, in public interest and in consultation with the Central Government, restrict the amount of Indian currency notes of Government of India and/or of Reserve Bank, and/or foreign currency, on case-to-case basis, that a person may bring into or take outside India and prescribe such conditions as it may deem necessary.

- NCLT

- The National Company Law Tribunal to Start Second Phase of E-Courts Mandatorily From 1st Jan 2020.

-

- The National Company Law Tribunal, has decided to start the second phase of e-court which is Automatic Case Number Generation for all the benches wherein e-filing procedure has been implemented. The order was issued after the approval of the Hon’ble Acting President Shri BSV Prakash Kumar. In the order it was informed that the Competent Authority has decided that Automatic Case Number Generation should be mandatorily started from 1st January 2021 in all the branches across the country. It was further informed that an automatic number has to be generated from E- Filing portal i.e., efiling.nclt.gov.in. This Order came in to complete the E- court stages which include e-filing, Automatic Case Number Generation, e-scrutiny, Case allocation & e-cause list generation. The NCLT conceptualized e-courts in 2017 and now e-filing has been mandatorily started in all the benches of NCLT across the Country.

- DGFT

- The Directorate General of Foreign Trade has issued a notification for the amendment in Para 2.14 of Chapter 2 of the Handbook of Procedures, 2015-2020.

-

- The amendments have been made in Para 2.14 (d), which specifies that the IEC can be obtained against the new PAN. It is now specifically provided that in case of change in constitution of the PAN based IEC by way of merger, acquisition, liquidation, inheritance etc. such that the PAN of the new entity so formed is different from the earlier one, an IEC can be availed against the new PAN, if not existing already. Previous IEC’s can also be linked operationally to the PAN/IEC of the new entity. Further, in Para 2.14 (e), which specifies the application procedure can be done online and an application for linking the obligations under the old/previous IEC may be submitted online to the jurisdictional RA of the new entity along with supporting documents. Concerned RA may sanction the given linkage after due scrutiny of the evidence provided by the applicant including submission of the affidavits etc. After RA’s approval, the previous IEC shall be treated as surrendered.

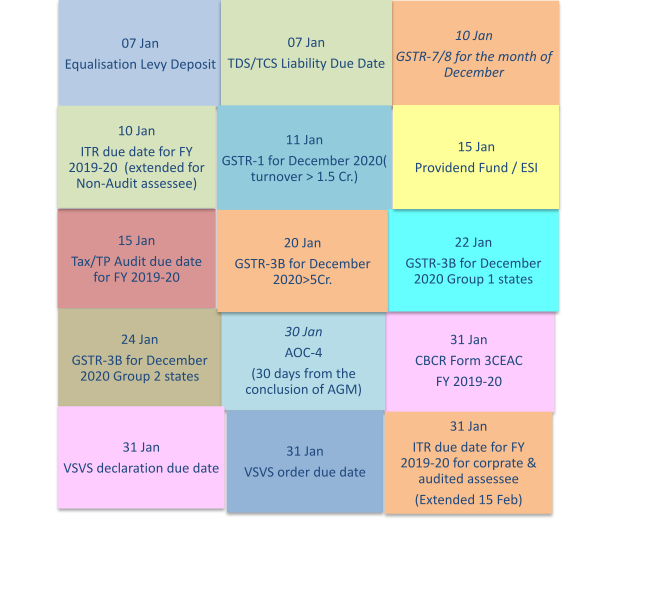

KNM India can assist you with a range of complete financial services that range from Corporate advisory to Transaction advisory, Pre-incorporation to Post-incorporation, Insolvency and bankruptcy code to Secretarial services, Assurance to Internal audit services, along with Market entry strategy to Foreign company registration in India. To discuss about any of these please book your slot, or call us on +91-99105-04170 – or email us at services@knmindia.com to get a quick response.Monthly Compliance Calendar

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period 26.11.2020 till 25.12.2020.Prepared by

KNM MANAGEMENT ADVISORY SERVICES PVT. LTD.E-mail: services@knmindia.com

Web site: www.knmindia.com -

-

-