Income Tax

-

- CBDT vide Press release dated 26/09/2020 has informed that now there is no requirement of scrip wise reporting for day trading and short-term sale or purchase of listed shares.

-

- CBDT vide Circular No. 17 OF 2020 [F. No.370133/22/2020-TPL], Dated 29-9-2020, has issued guidelines for section 194-O & 206C(1-I) of the income tax act. Impact of guidelines was already circulated in our last mail dated September 30, 2020.

-

- CBDT vide Circular No. F. NO. 225/150/2020-ITA-II, Dated 30-9-2020, has further extend the date for furnishing of belated and revised returns for the Assessment Year 2019-20 from 30th September 2020 to 30th November, 2020.

-

- CBDT vide Notification G.S.R. 610(E) [NO. 82/2020/F.NO.370142/30/2020-TPL], DATED 1-10-2020, has amend the rule 5, FORM NO. 3CD, FORM NO. 3CEB AND FORM ITR-6; INSERTION OF RULES 21AG, 21AH, FORM NO. 10-IE AND FORM NO. 10-IF to incorporate the provision of section 115BAA, 115BAB, 115BAC, 115BAD.

-

- CBDT vide Notification G.S.R. 664(E) [NO. 84/2020/F. NO. 370149/76/2019-TPL], DATED 22-10-2020, has reduced the minimum rating from AA to A for certain funds mentioned in Rule 67(2) of the Income-tax Rules, 1962. Rule 67 prescribes an investment pattern for provident funds which is to be followed mandatorily to avail tax benefits. The said amendment shall be effective from Assessment Year 2021-22 and subsequent years.

-

- CBDT Press release DATED 24-10-2020, has extended the date for furnishing of Various audits report & Income tax returns for the Assessment Year 2020-21 from 31st October & 30th November to 31st December & 31st January respectively.

Goods & Services Tax (GST)

-

- CBIC vide Notification No 74 & 75 /2020 – Central Tax Dated 15-Oct-2020 has extended the due date of filing of GSTR-1 (Quarterly) for the Quarter October 2020 to December 2020 to 13th January 2020.

-

- CBIC Notification No 76 /2020 – Central Tax Dated 15-Oct-2020 has extended the due date of filing of GSTR-3B for the taxpayer having turnover below 5 Cr. to 22nd of subsequent month for category A states and 24th of subsequent month for category B states for the tax period October 2020 to March 2021. For taxpayer having turnover more than 5 cr. Will file GSTR-3B on 20th of the subsequent month.

- CBIC vide Notification No. 77 & 79/2020 – Central Tax dated 15th October 2020 has given certain relaxation in Annual return and GST Audit as follows:

-

- Relaxation for registered taxpayers who have aggregate turnover below Rs 2 Crores to not to file GSTR 9 – Annual Return for the FY 2017-18 and FY 2018-19 extended to include registered taxpayers for the FY 2019-20 as well.

-

- Relaxation for the registered taxpayers who have aggregate turnover below Rs 5 Crores to not to file GSTR 9C – Reconciliation Statement for the FY 2017-18 and FY 2018-19, extended to include registered taxpayers for the FY 2019-20 as well.

-

- CBIC vide Notification No. 78/2020 – Central Tax dated 15th October 2020 ― has given new HSN disclosure rules with effect from 01st April 2021 as follows:

Aggregate Turnover in the preceding FY Number of Digits of HSN

Below Rs 5 Crores 4 (Not required for B2C invoices)

Above Rs 5 Crores 6

-

- CBIC vide Notification No. 79/2020 – Central Tax dated 15th October 2020 amended The Rule 138E ( Blocking of E-way bill generation facility if returns are not filed for two consecutive tax periods) has been amended so as to provide relaxation in cases where E-way bills are generated during the period from 20th March 2020 till 15th October 2020, for all such class of person who have not furnished return in FORM GSTR-3B or FORM GSTR-1 or the statement in FORM GST CMP-08 for the tax period from February 2020 to August 2020.

-

- Notification No. 05/2020 – Central Tax (Rate) dated 16th October 2020 -Satellite launch services supplied by Indian Space Research Organisation, Antrix Corporation Limited or New Space India Limited ( S. No. 19C of Notification No.12/2017- Central Tax (Rate) dated 28th June 2017) exempted from GST.

Companies Act, 2013

The Lok Sabha has passed the Companies (Amendment) Bill, 2020 through voice vote

- MCA has extended the Relaxation in minimum residency requirements of 182 days in India by at least one director in every Company.

- MCA has clarified that relaxation of the residency norms of minimum stay of 182 days in India, by at least one director of every Company, for the financial year 2020-2021 and that non-compliance of residency norms of minimum stay of 182 days in India, by at least one director of every Company, shall not be treated as a violation of Section 149 of the Companies Act, 2013 for the financial year 2020-2021. Earlier, MCA had relaxed the aforesaid residency norms for the financial year 2019-2020 vide General Circular No. 11/2020 dated March 24, 2020.

-

- The Ministry of Corporate Affairs has notified the Companies (Meetings of Board and its Powers) Third Amendment Rules, 2020 to further amend the Companies (Meetings of Board and its Powers) Rules, 2014 which shall come into force on the date of their publication in the Official Gazette i.e 28-09-2020.

- The amendment is brought under Rule 4(2) which specifies certain matters to be not dealt in a meeting through video conferencing or other audio-visual means, however, it has now allowed matters like approval of the annual financial statements, the approval of the Board’s report, and the approval of the prospectus etc which shall be held through video conferencing or other audio-visual until 31st December 2020. The MCA has relaxed this provision up to 30/09/2020 initially and now extended the same up to 31/12/2020.

- MCA has issued a circular for Extension of the period for the creation of deposit repayment reserve, investment of debentures under the provisions of Section 72(2)(c) of the Companies Act, 2013.

-

- In continuation of earlier issued by the MCA and keeping in view the requests received from various stakeholders seeking an extension of time for compliance of the subject requirements on account of Covid-19, it has been decided to further extend the time in respect of matters referred to in Paras V, VI of the original circular, up to 31st December, 2020. All other requirements shall remain unchanged. Accordingly, the time is extended for the creation of a deposit repayment reserve of 20% u/s. 73 (2) (C) of the Companies Act 2013 and to invest or deposit 15% of the amount of debentures u/r.18 of Companies (Share Capital and Debentures) Rules 2014 up to 31/12/2020.

- MCA has decided to extend the timeline for Companies Fresh Start Scheme, 2020 & LLP Settlement Scheme, 2020.

-

- for filing of all pending statutory documents till December 31 this year. These decisions came on the back of continued disruption faced by the companies on account of the COVID-19 pandemic. MCA has extended the timeline for Companies Fresh Start Scheme, 2020, which was originally valid from April 1, 2020 to September 30, 2020. The scheme, rolled out in March this year, granted immunity to companies from legal action and penalties over delay in filing statutory documents like annual returns and financial statements. Companies Fresh Start Scheme also allowed inactive companies to get themselves declared as ‘dormant company’ under provisions of the Companies Act. A similar facility for LLPs, the LLP Settlement Scheme, 2020, has also been extended till December 31. Originally valid from April 1 June 13, the scheme was extended till September 30 to allow LLPs to make good on their defaults.

-

-

- MCA has announced ‘Scheme for relaxation of time for filing forms related to creation or modification of charges under the Companies Act, 2013’ has been extended till December 31.

- Companies that raised funds via loans or debentures have to create a charge on their assets or undertakings within or outside India to acquire these instruments. The scheme, introduced on June 17, pardoned delay in regulatory filings of charges on property, assets, or any undertaking created on March 1, 2020. Further. the MCA has allowed companies to hold their extraordinary general meetings (EGMs) through video conference or other audio-visual means till the same date.

- MCA has announced ‘Scheme for relaxation of time for filing forms related to creation or modification of charges under the Companies Act, 2013’ has been extended till December 31.

- Special Measures under the Companies Act, 2013 and Limited Liability Partnership Act, 2008 in view of COVID-19 outbreak- Extension- reg. Relaxation in minimum residency requirements of 182 days in India by at least one director in every company

-

-

-

-

- On receipt of various representation from the stakeholders, Ministry of Corporate Affairs (‘MCA’) had vide General Circular No. 36/2020 dated 20th October, 2020, relaxed the residency norms of minimum stay of 182 days in India, by at least one director of every Company, for the financial year 2020-2021 and has clarified that non-compliance of residency norms of minimum stay of 182 days in India, by at least one director of every Company, shall not be treated as violation of Section 149 of the Companies Act, 2013 for the financial year 2020-2021.

-

- In continuation of General Circular No. 11/2020 dated 24th March 2020, keeping in view the requests received from various stakeholders seeking relaxation from the residency requirement of 182 days in a year and after due examination, it is hereby clarified that non-compliance of minimum residency in India for a period of at least 182 days in a year, by at least one director in every company, under section 149 of the Companies Act, 2013 shall not be treated as non-compliance for the financial year 2020-21 also.

-

-

-

-

-

-

- The Complete text of the Circular No. 36/2020 dated 20th day of October, 2020 can be viewed at below link:

http://www.mca.gov.in/Ministry/pdf/GeneralCircularNo.36_20102020.pdf

-

-

-

Other Laws

IBBI

- IBBI has issued a circular to standardises meetings norms of the Disciplinary Committee and Appellate Panel of RVOs.

-

- With a view to bring uniformity in conducting meetings, the IBBI has come up with directions to be followed by the Disciplinary Committee (DC) and Appellate Panel (AP) of the Registered Valuers Organisations (RVOs) RVOs. The guidelines prescribe that meeting of the DC and AP should be held only if there is an agenda for the meeting. Meetings to be held preferably, through Video Conferencing (VC) facility, keeping in view the current pandemic. The quorum of the conferences must be as offered within the Bye Legal guidelines of the RVO however must be a minimum of two members together with the Chairperson. Additionally, if a member of the committee is expounded to the particular person in opposition to whom the motion is proposed by the DC or AP, or there’s every other subject of the battle of curiosity, the member must recuse himself/herself from the proceedings. The IBBI has now stated that will probably be the governing Board of the RVO that might be the only real authority for fixing the quantity of sitting charge to be paid to the members of the DC and the AP. Nonetheless, this can’t be lower than the quantity payable to the impartial director as sitting charges. Additionally, the tenure of the IBBI’s nominee shall, usually, be for 2 years from the date of appointment, until determined in any other case by IBBI.

- IBBI has issued Guidelines on Use of Caveats, Limitations, and Disclaimers by the Registered Valuers in Valuation Reports.

-

- These Guidelines may be called the Insolvency and Bankruptcy Board of India (Use of Caveats, Limitations and Disclaimers in Valuation Reports) Guidelines, 2020 and shall come into force in respect of valuation reports in respect of valuations completed by Registered Valuers (RVs) on or after 1st October, 2020. These Guidelines are divided into three sections, viz. the first section elaborates on the need for Caveats, Limitations, and Disclaimers in a valuation report; the second section provides a guidance note on the use of Caveats, Limitations, and Disclaimers, while the third section provides an illustrative list of Caveats, Limitations, and Disclaimers for each asset class provided in the Rules. These Guidelines provide guidance to the RVs in the use of Caveats, Limitations, and Disclaimers in the interest of credibility of the valuation reports. These also provide an illustrative list of the Caveats, Limitations, and Disclaimers which shall not be used in a valuation report. All Registered Valuers shall prepare valuations reports under rule 8 of the Rules in adherence to these Guidelines.

- SEBI

- SEBI has issued a circular to all issuers of listed or proposed to be listed debt securities would have to deposit 0.01% of the issue size or maximum of Rs 25 lakh towards creation of recovery expense fund.

-

- In order to enable the debenture trustees to take prompt action for enforcement of security in case of default in listed debt securities, a ‘Recovery Expense Fund’ (REF) shall be created which shall be used in the manner as decided in the meeting of the holders of debt securities. In order to enable the debenture trustees to take prompt action for enforcement of security in case of default in listed debt securities, a ‘Recovery Expense Fund’ (REF) shall be created which shall be used in the manner as decided in the meeting of the holders of debt securities. The balance in the recovery expense fund should be refunded to the issuer on repayment to holders of debt securities on their maturity or at the time of the exercise of call or put option, for which a No Objection Certificate (NOC) should be issued by the debenture trustee to the stock exchange.

- The SEBI has issued the clarification on the procedure for handling certain types of complaints by the Stock Exchanges as well as the standard operating procedure for actions to be taken against listed companies in case of failure to redress investor grievances.

-

- The SEBI has encouraged the Investors to initially take up their grievances directly with the listed company and the investors can use the SCORES platform to submit their complaints. If the complaints are not addressed by the listed company within a period of 30 days from the date of receipt of the complaint, the complaints are to be forwarded to the Designated Stock Exchange through the SCORES platform. Now the SEBI has clarified that in respect of Paras 16, 27, 32 and Point 2C, the words “promoter and promoter group” and promoter/ promoter group” shall be read as “promoter(s)” and restricting the provisions only to the promoters.

- SEBI has notified the Securities and Exchange Board of India (Alternative Investment Funds) (Amendment) Regulations, 2020 which shall come into force on the date of their publication in the Official Gazette i.e October 19, 2020

-

- The amendment prescribes for the qualifications to the key investment team of the Manager of the Alternative Investment Fund. Accordingly, adequate experience, with at least one key personnel having not less than five years of experience in advising or managing pools of capital or in fund or asset or wealth or portfolio management or in the business of buying, selling, and dealing of securities or other financial assets. Further, at least one key personnel with professional qualification in finance, accountancy, business management, commerce, economics, capital market or banking from a university or an institution recognized by the Central Government or any State Government or a foreign university, or a CFA Charter from the CFA Institute or any other qualification as may be specified by the Board. Furthermore a new sub-Regulation 20(6) on General Obligations for an Alternative Investment Fund of the Principle Rules has been inserted, which provide that the Manager shall be responsible for investment decisions of the Alternative Investment Fund: Provided that the Manager may constitute an Investment Committee (by whatever name it may be called), to approve investment decisions of the Alternative Investment Fund subject to certain conditions.

- The Securities and Exchange Board of India has issued the SEBI (Listing Obligations and Disclosure Requirements) (Third Amendment) Regulations, 2020.

-

- To further amend the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015. In a bid to improve transparency in sharing information, markets regulator SEBI has mandated all listed companies to make disclosures about their forensic audit reports to stock exchanges. The companies will be required to disclose their final forensic audit report, other than the forensic audit initiated by regulatory or enforcement agencies, on receipt by the listed entity, along with comments of the management, if any. All listed entities will now have to maintain 100 percent asset cover or asset cover as per the terms of the offer document, sufficient to discharge the principal amount at all times for the non-convertible debt securities issued. The regulator has removed the framework that said maintenance of 100 percent asset cover will not be applicable in case of “unsecured debt securities issued by regulated financial sector entities eligible for meeting capital requirements as specified by respective regulators. Furthermore, the listed entities will have to promptly forward to debenture trustees a half-yearly certificate regarding maintenance of 100 percent asset cover, or asset cover as per the terms of the offer document, in respect of listed non-convertible debt securities, by the statutory auditor along with the half-yearly financial results. The submission of half-yearly certificates will be exempted only where bonds are secured by a government guarantee.

- The Securities and Exchange Board of India has issued a Circular to extend the facility for conducting extraordinary meetings of unit holders INVIT’s and REIT’s through video conferencing or other audio-visual means under the InvIT Regulations and REIT Regulations.

-

- The InvITs or REITs were permitted to conduct meetings of unitholders through VC or OAVM. SEBI had received representations for extending the facility of VC or OAVM for conducting extraordinary meetings of unitholders for some more time due to the pandemic. Therefore, SEBI has decided to extend the timeline for this purpose till December 31, 2020 due to the COVID-19 pandemic.

- SEBI has issued Revised FAQs on SEBI (Prohibition of Insider Trading) Regulations, 2015.

-

- The SEBI Regulation 2015 for insider trading covers all insiders and their immediate relatives which include spouse, parent, siblings, and child of a person any of whom is either dependent financially on such person or consults such person in taking decisions relating to trading in securities. Through these FAQ’s SEBI has clarified that there is no requirement of pre-clearance is applicable for the exercise of employee stock options. Further, trading in ADRs and GDRs by employees of Indian companies who are foreign nationals is covered under provisions of PIT Regulations on code of conduct, and for such disclosures by such designated persons, a unique identifier analogous to PAN may be used. Furthermore, in case a designated person resigns, all information that is required to be collected from designated persons should be collected till the date of service of such employees with the company. Upon resignation from the service of a designated person, a company/ intermediary/ fiduciary should maintain the updated address and contact details of such designated person. The company/intermediary/ fiduciary should make efforts to maintain the updated address and contact details of such persons for one year after resignation from service. Such data should be preserved by the company/ intermediary/ fiduciary for a period of 5 years.

- SEBI issues guidelines for inter-scheme transfers of securities in mutual funds whereby no such transfer will be allowed in case of negative news in the mainstream media about the security.

-

- If security gets downgraded following Inter-Scheme Transfers (ISTs) within a period of four months, the fund manager of the buying scheme has to provide detailed justification to the trustees for purchasing such security. Presently, ISTs are allowed only if such transfers are done at the prevailing market price for quoted instruments on a spot basis and the securities so transferred are in conformity with the investment objective of the scheme to which such transfers have been made. In order to ensure that transfers of securities from one scheme to another scheme in the same mutual fund are in conformity with the investment objective. Further, Asset Management Companies (AMCs) will have to ensure that compliance officer, chief investment officer, and fund managers of transferor and transferee schemes have satisfied themselves that ISTs has undertaken are in compliance with the regulatory requirements and documentary evidence in this regard will be maintained by them for all ISTs. With regard to meeting liquidity, AMCs need to have an appropriate liquidity risk management model at the scheme level, approved by trustees, to ensure that reasonable liquidity requirements are adequately provided for. The guidelines will be applicable from January 1, 2021.

- The SEBI has come up with a uniform timeline for listing of securities on the basis of a private placement, which shall come into force from 1st December 2020.

-

- SEBI has been receiving requests from various market participants for clarification on the time period within which securities issued on private placement basis under SEBI ILDS, SEBI NCPRS, SEBI SDI, and SEBI ILDM Regulations need to be listed after completion of allotment, therefore after taking feedback from market participants, it has been decided to stipulate the timelines relating to the day of closure of issue is considered the ‘T’ day; the allotment of securities will be completed by ‘T+2’ trading days after receiving funds; the listing permission from the stock exchanges should be received by ‘T+4 and T day refers to the closure of the issue. Further, in case of delay in listing of securities issued on a private placement basis beyond the timeline, the issuer will pay penal interest of 1 percent per annum over the coupon rate for the period of delay to the investor (i.e. from date of allotment to the date of listing).

- SEBI releases a framework to monitor foreign holding in depository receipts.

-

- Under the framework, a listed company will appoint one of the Indian depositories as the designated depository for the purpose of monitoring of limits in respect of depository receipts. The designated depository in co-ordination with domestic custodian, other depositories and foreign depository (if required) will compute, monitor and disseminate the DRs’ information as prescribed in the framework. Further, the information will be disseminated on the websites of both the Indian depositories. For this purpose, the designated depository will act as the lead depository and the other depository shall act as a feed depository. The investor group may appoint one FPI to act as a nodal entity for reporting such grouping information to its DDP in the prescribed format. Similarly, the FPIs who do not belong to the same investor group would report such investment holding details to their custodian on a monthly basis. However, in respect of FPIs which do not belong to the same investor group, responsibility of monitoring the investment limits of FPI will be with the respective DDP or custodian.

- SEBI has issued a Circular reviewing its provisions on valuation of debt and money market instruments due to COVID-19 pandemic. This Circular was issued on 1st October, 2020 and its provisions are effective immediately and will be in force till 31st December, 2020.

-

- It may be noteworthy that on 31st August 2020, SEBI issued a Circular providing relaxation to Credit Rating Agencies in recognition of default for restructuring by the lender/ investors solely due to COVID -19 related stress. SEBI has now decided to extend discretion to valuation agencies to recognise defaults in cases where the proposal of restructuring of debt is only due to COVID-19 related stress. This discretion is granted to valuation agencies engaged by Asset Management Companies (AMCs) or the Association of Mutual Funds of India (AMFI). The valuation agency may not consider the restructuring or non-receipt of dues as default for the purpose of valuation of money market or debt securities held by mutual funds. Furthermore, any restructuring proposal received by debenture trustees must be immediately communicated to the investors. Any proposal received by mutual funds from lenders or issuers or debenture trustees must be immediately reported to the valuation agencies, credit rating agencies and the AMFI. The AMFI shall then disseminate such information to its members immediately. Moreover, valuation agencies must ensure that any changes in the terms of the investments, the financial stress of the issuers and the capabilities of the issuers to repay the dues on the extended dates are reflected in its valuation of the securities. The Circular also clarifies that in case of differences in the valuation of securities by two valuation agencies, the conservative valuation, among the two, will be accepted. Additionally, AMCs will continue to be responsible for the true and fair valuation of the securities.

- SEBI has issued a circular to extend the relaxations till March 31, 2021 pertaining to the validity of regulatory approval for launching IPO and rights issue, in view of the prevailing conditions due to the Covid-19 pandemic.

-

- In addition, the relaxation has been extended in respect of the filing of fresh offer documents in case of an increase or decrease of issue size by 50%. The validity of SEBI’s observations, expiring between Oct. 1, 2020, and March 31, 2021, has been extended up to March 31, 2021. This is subject to an undertaking from the lead manager of the issue confirming compliance with the Issue of Capital and Disclosure Requirements Regulations while submitting the updated offer document to SEBI. Earlier in April, the validity of SEBI’s observation, where the same has expired or will expire between March 1, 2020, and Sept. 30, 2020, was extended by 6 months from the date of expiry of such observation.

- SEBI has amended the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 to rationalize eligibility criteria and disclosure requirements for Rights Issues’ with an objective to make the fundraising through this route, easier, faster, and cost-effective.

-

- The mandatory 90% minimum subscription would not be applicable to those issuers where the object of the issue involves financing other than the financing of capital expenditure for a project, provided that the promoters and promoter group of the issuer undertake to subscribe fully to their portion of rights entitlement. SEBI has also allowed truncated disclosures for rights issues and now companies can file financial statements and periodic reports for last year instead of the last three years as required earlier. That is also applicable to cases where three years have passed after the change in management following the acquisition of control. SEBI has also increased the threshold to Rs 50 crore from Rs 10 crore for prospective issuers to file with SEBI the rights issue draft letter of offer for the regulator’s observations. Further, the issuer shall be eligible to make a fast-track rights issue in case of pending show- cause notices in respect to adjudication, prosecution proceedings, and audit qualification, provided that necessary disclosures along with the potential adverse impact on the issuer are made in the letter of offer.

- Pension Fund Regulatory and Development Authority (PFRDA)

- The Pension Fund Regulatory and Development Authority (PFRDA) has issued a Circular on Launch of D-Remit.

-

- which is proposed as an additional option/mode of contribution wherein existing NPS Subscribers under Government, Non-Government, All Citizens Model would be able to deposit their voluntary contributions by creating a Virtual ID linked to their Permanent Retirement Account Number (PRAN). It is to ease the mode of deposit and to optimize the investment returns. The generation of Virtual ID is a one-time exercise and the virtual ID remains static and can be used to deposit voluntary contributions in the future also. Subscribers will get the same-day NAV if the contribution is made through this mode before 8.30 am, on any bank working day. The creation of a virtual identification number is a one-time activity and can be obtained by visiting the e-NPS link in the websites of the respective Central Record Keeping Agency. The ID will be attached to the PRAN for D-Remit. The subscriber will have to give an online declaration for compliance under the Prevention of Money-Laundering Act, 2002 at the time of generating the virtual ID.

- NCLT

- The NCLT has further notified that the Regular Proceedings at NCLT shall now start from 02-11-2020 instead of 12-10-2020.

-

- The regular proceedings at NCLT Delhi were stopped immediately after the lockdown was announced on 24-03-2020. The NCLT has earlier decided and fixed the dates of hearings for the Principal Bench and for all its New Delhi Benches (Court No. II, III, IV, V & VI) effective from 15-06-2020 which was re-notified from 01-07-2020, 20-07-2020, 05-08-2020, 20-08-2020, 07-09-2020 and 29-09-2020. However, NCLT has now decided that all matters listed for 12-10-2020, 13-10-2020 shall now be held on 02-11-2020, 03-11-2020, 04-11-2020 respectively, and so on. All stakeholders are requested to take note of the same.

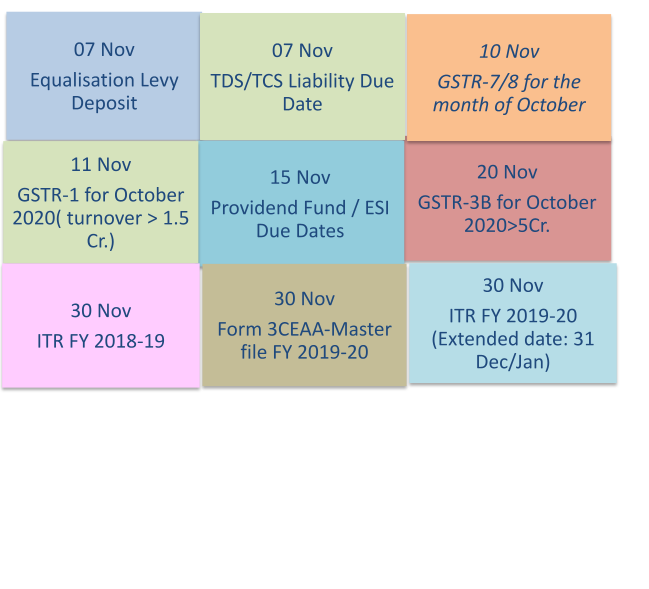

Monthly Compliance Calendar

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period 26.09.2020 till 25.10.2020.

Prepared by

KNM MANAGEMENT ADVISORY SERVICES PVT. LTD.

E-mail: services@knmindia.com

Web site: www.knmindia.com