Income Tax

-

-

-

-

-

-

- CBDT vide Notification No. S.O. 3865(E) [No. 87/2020 / F. No. 370142/21/2020-TPL], Dated 28-10-2020 , has amend the Equalisation Levy Rules 2016 and now rules may be called the Equalisation levy (Amendment) Rules, 2020. Changes are done in Rules 2, 3, 6, 7, 8, 9 and Form No. 2 and substitute Rules 4, 5, Form No. 1, Form No. 3 and Form No. 4.

-

- CBDT vide Press Release, Dated 29-10-2020, , has announced encashment of LTC scheme to non-central employees too, the Govt. has allowed the payment of cash allowance, subject to below:

1. Maximum of Rs 36,000 per person as Deemed LTC fare per person (Round Trip).

2. Applicable LTC for Block year 2018-21.

3. The employee needs to spend amount on goods / services which carry a GST 12% or more through digital mode during the period from the 12th of October, 2020 to 31st of March, 2021 and produce the GST Invoice.

4. An employee needs to spend three times of the deemed LTC fare on specified expenditure.

Please note that the above benefit is not available if employee has opts for new tax regime u/s 115BAC.

- CBDT vide Press Release, Dated 29-10-2020, , has announced encashment of LTC scheme to non-central employees too, the Govt. has allowed the payment of cash allowance, subject to below:

-

- CBDT videNotification S.O. 3906(E) [No. 88/2020/ F. No. 370142/35/2020-TPL], Dated 29-10-2020,has extend the due date of filing of various audit reports & Income tax return to 31st December & 31st January respectively, however in other cases(non-audit) due date of filing of ITR will be 31st December only.

-

- CBDT vide Press Release, Dated 13-11-2020, , has increase the safe harbour from 10% to 20% under section 43CA of the Act for the period from 12th November, 2020 to 30th June, 2021 in respect of only primary sale of residential units of value up to Rs. 2 crore. Consequential relief by increasing the safe harbour from 10% to 20% shall also be allowed to buyers of these residential units under section 56(2)(x) of the Act for the said period. In order to provide relief to real estate developers and buyers, the Finance Act, 2018, provided a safe harbour of 5%. In order to provide further relief in this matter, Finance Act, 2020 increased this safe harbour from 5% to 10%.

-

Goods & Services Tax (GST)

-

-

- CBIC vide Notification No 80 /2020 – Central Tax Dated 28th-Oct-2020 has extended the due date of filing of form GSTR-9/9C for the financial year 2018-19.

-

- CBIC vide Notification No. 83/2020 – Central Tax dated 10th November 2020 has given certain relaxation in filing of form GSTR-1 as follows:

-

-

- The time limit for furnishing the details of outward supplies in FORM GSTR-1 of the CGST Rules, 2017, for each of the tax periods extended till the 11th day of the month succeeding such tax period.

-

-

- The time limit for furnishing the details of outward supplies in FORM GSTR-1 of the CGST Rules, 2017 for the class of registered persons required to furnish quarterly return under proviso to section 39(1) of the CGST Act, 2017 extended till 13th of the month succeeding such tax period.

-

- Notification No. 88/2020 – Central Tax dated 10th November 2020 ― E-Invoicing in terms of rule 48(4) of the CGST Rules, 2017 in respect of supply of goods or services or both to a registered person (B2B) made mandatory for registered persons with aggregate turnover exceeding Rs. 100 crore w.e.f 1st January 2020.

-

- Quarterly Return Monthly Payment (QRMP) Scheme (Notifications No. 81, 82, 84 & 85/2020 – Central Tax, all dated 10.11.2020; Circular No. 143/13/2020)

- Registered person having aggregate turnover up to five (5) crore rupees allowed to furnish return on quarterly basis along with monthly payment of tax, with effect from 01.01.2021.

- The aggregate annual turnover for the preceding financial year shall be calculated in the common portal taking into account the details furnished in the returns by the taxpayer for the tax periods in the preceding financial year.

- In case the aggregate turnover exceeds 5 crore rupees during any quarter in the current financial year, the registered person shall not be eligible for the Scheme from the next quarter.

- Rule 61A of the CGST Rules, 2017 -A registered person can opt in for any quarter from first day of second month of preceding quarter to the last day of the first month of the quarter. The registered person must have furnished the last return, as due on the date of exercising such option.

- The option to avail the QRMP Scheme is GSTIN wise and therefore, distinct persons as defined in Section 25 of the CGST Act (different GSTINs on same PAN) have the option to avail the QRMP Scheme for one or more GSTINs. In other words, some GSTINs for that PAN can opt for the QRMP Scheme and remaining GSTINs may not opt for the Scheme.

- For the first quarter of the Scheme i.e. January, 2021 to March, 2021, all registered persons, whose aggregate turnover for the FY 2019-20 is up to 5 crore rupees and who have furnished the return in FORM GSTR-3B for the month of October, 2020 by 30th November, 2020, shall be migrated on the common portal.

- GSTN has introduced auto-populated Form GSTR-3B in PDF format, for benefit of the taxpayers. The auto-populated PDF of Form GSTR-3B will consist of 1) Liabilities in Table 3.1(a, b, c and e) and Table 3.2 from Form GSTR-1. 2) Liability in Table 3.1(d) and Input Tax Credit (ITC) in Table 4 from auto-drafted ITC Statement from Form GSTR-2b.

Companies Act, 2013

- The MCA extends due date of defaulting LLP to file belated documents under LLP Settlement Scheme, 2020.

-

-

- TThe MCA has notified the extension for defaulting LLP to file belated documents under LLP Settlement Scheme, 2020 till Nov. 30, 2020. The Government issued this notification due to the prevailed COVID-19 pandemic, in continuation of the Ministry’s General Circular No. 13/2020 dated March 30, 2020, and in General Circular No. 31/2020 dated September 28, 2020, the scheme was extended till 31st December 2020. It has been decided to extend the date on applicability to defaulting LLP and therefore, in serial number 3, para 8A, sub-para (iii) of the said circular dated 30.03.2020, belated documents due for filing till 30th November 2020 shall be substituted instead of August, 2020. All other requirements provided in the said circulars shall remain unchanged. It is further clarified that, if a statement of account and solvency for the financial year 2019-2020 has been signed beyond the period of six months from the end of the financial year but not later than 30th November 2020, the same shall not be deemed as non-compliance.

-

-

- MCA has issued a Sensitizing General Public Notice about Nidhi Companies.

-

-

- In order to make regulatory regime for Nidhi Companies more effective and also to accomplish the objectives of transparency & investor friendliness in the corporate environment of the country, the Central Government has amended the provisions related to NIDHI under the Companies Act and the Rules (effective from 15.08.2019). The amended provisions of the Companies Act (Section 406) and Nidhi rules (as amended w.e.f. 15.08.2019) require that the companies have to apply to the Central government for updation/ declaration of their status as Nidhi Company in e-Form NDH-4. These companies are required to ensure strict adherence to provision of Companies Act, 1956/ 2013 and Nidhi Rules, 2014 as amended. Further, applications are being received by the Ministry of Corporate Affairs from such companies in e- form NDH-4 for either updation OR declaration as Nidhi Company. It has been noticed that many of these companies are not following the extant rules. Stakeholders are advised to verify/ ensure that the Nidhi Company in which they are planning to become member, has been declared as such under the amended provisions of Companies Act and is following the rules prescribed in this regard.

Other Laws

- IBBI

- The Insolvency and Bankruptcy Board of India has issued the Insolvency Professionals to act as Interim Resolution Professionals, Liquidators, Resolution Professionals and Bankruptcy Trustees (Recommendation) (Second) Guidelines, 2020.

-

- The Board will prepare a common Panel of IPs for appointment as IRP, Liquidator, RP and BT and share the same with the AA (Hon’ble NCLT and Hon’ble DRT) in accordance with these Guidelines. An IP will be eligible to be in the Panel of IPs, if there is no disciplinary proceeding, whether initiated by the Board or the IPA of which he is a member, pending against him; He has not been convicted at any time in the last three years by a court of competent jurisdiction; He expresses his interest to be included in the Panel for the relevant period; He undertakes to discharge the responsibility as IRP, Liquidator, RP or BT, as he may be appointed by the AA; He holds an Authorization for Assignment (AFA), which is valid till the validity of Panel. For example, the IP included in the Panel for appointments during January – June 30, 2021 should have AFA valid up to June 30, 2021.

- The Insolvency and Bankruptcy Board of India has notified amendments in the regulations pertaining to the Insolvency Resolution Process for Corporate Persons Regulations.

-

- The Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) (Fifth Amendment) Regulations, 2016 which shall come into force on the date of their publication in the Official Gazette i.e 13-11-2020. As per section 7 of the I&B Code, a Financial Creditor in order to substantiate the pre occurred default, has to furnish ‘evidence of the default’ recorded with the information utility along with the application made under Section 7. The Board in pursuance of this power has amended the Regulations to specify/add two ‘other record’ or ‘evidence of default’ such as Certified copy of entries in the relevant account in the bankers’ book, and Order of a Court or Tribunal that has adjudicated upon the non-payment of a debt. Further, to improve the level of transparency, the IBBI amended the Regulations to require the RP to intimate each claimant the principle or formulae for payment of debts under a resolution plan, within 15 days of the order of the AA approving such resolution plan. The IRP/RP are now required to submit the list of creditors on an electronic platform for dissemination on its website.

- The Insolvency and bankruptcy board of India has notified the IBBI (Information Utilities) (Amendment) Regulations, 2020.

-

- To further amend the Insolvency and Bankruptcy Board of India (Information Utilities) Regulations, 2017, which shall come into force on the date of their publication in the Official Gazette i.e 13-11-2020. The amendment brings in new regulation 21A which deals with dissemination of public announcement in which an information utility shall disseminate every public announcement it receives or has access to, on the date of its receipt or access, to its registered users, who are creditors of the corporate debtor undergoing insolvency proceeding under the Code.

- IBBI has issued a Facilitation Letter on Common Mistakes committed by Insolvency Professionals in conduct of Corporate Insolvency Resolution Process (CIRP).

-

- The IBBI and Insolvency Professional Agencies (IPAs) have come across some mistakes being committed by a some of the IPs in conduct of CIRPs. These mistakes are costs to the CD and the economy, and often amount to contravention of provisions of the law. Most of these are probably unintentional and can be avoided with a little more care and diligence. This communication lists out a few such mistakes with a hope that these will not be committed by any IP, pre-empting the IBBI/IPA to initiate any disciplinary action. The IBBI has provided guidance on the matters relating to acceptance of Assignment without having Authorisation; Fee payable to IP; Application for cooperation; Public announcement; Updating of list of claims; Authority of CoC; Appointment of professionals; Appointment of registered valuers; Payment for professional services; Disclosure of fee and relationship; Fee for authorised representatives; Representation in judicial proceedings; Related party transactions; Payment to creditors during CIRP; Avoidance transactions; Supply of information; Confidentiality undertaking; Disclosure of information; Window for views; Circulation of minutes; Inclusion of costs in IRPC; Compliance with applicable laws; Timeline; Compliance with orders; Maintenance of records and Co-operation with the Inspecting Authority. It is further clarified that, the observations made herein are only indicative. An IP must refer to the Code, the Rules/Regulations/Circulars under the Code and relevant case laws and / or may seek professional advice if he intends to take any action or decision, in any matter dealt with in this communication.

- SEBI

- The Securities and Exchange Board of India (SEBI) has issued a Circular introducing Unified Payments Interface (UPI) mechanism and Application through Online interface and Streamlining the process of Public issues of securities

-

- Under SEBI (Issue and Listing of Debt Securities) Regulations, 2008 (ILDS Regulations), SEBI (Issue and Listing of Non-Convertible Redeemable Preference Shares) Regulations, 2013 (NCRPS Regulations), SEBI (Issue and Listing of Securitised Debt Instruments and Security Receipts) Regulations, 2008 (SDI Regulations) and SEBI (Issue and Listing of Municipal Debt Securities) Regulations, 2015 (ILDM Regulations). The Process flow for applying though UPI mechanism data required and roles of the stakeholders includes the modes of application in public issue of securities as mentioned in this circular: Through Self-Certified Syndicate Bank (SCSB) or intermediaries or Through Stock Exchanges (App/ Web interface). Further, there are three processes for investor application submitted with UPI as mode of payment; Bidding and validation process, The Block process and Post issue closure. The data fields required in Application and Bidding Form relating to UPI include; Payment details–UPI ID with maximum length of 45 characters, acknowledgement Slip for SCSB / Broker / RTA / DP, and acknowledgement Slip for bidder. The Role of the Stock Exchange is to provide a platform for making applications. The Stock Exchange shall be responsible for addressing investor grievances arising from applications submitted online through the App based/ web interface platform of stock exchange or through their Trading Members.

- SEBI proposes proposed to change the minimum threshold required for reclassification of promoters as public shareholders.

-

- Promoters seeking re-classification should not hold 15 per cent or more of the total voting rights in a Company. At present, the minimum threshold requirement is 10 per cent. The review comes in the wake of feedback from market participants that promoters who are no longer in day-to-day control and have less than 15 per cent stake in the company may opt out from being classified as promoters without having to reduce their shareholding. The regulator also proposed exemption from the procedure for reclassification following an open offer provided the intent of the existing promoter to reclassify has been disclosed in the letter of offer. It also proposed exemption from the procedure for re-classification following an open offer, where a listed entity intends to reclassify former promoter entities but they are not traceable or are not co-operative. Further, all entities falling under promoter and promoter group should be disclosed separately even in case of ‘nil’ shareholding. Besides, companies should obtain a declaration on a quarterly basis from their promoters on the entities and persons forming part of the promoter group.

- The Securities and Exchange Board of India has issued a circular on Non-compliance with provisions related to continuous disclosures which shall come into force for compliance period ending on or after December 31, 2020.

-

- SEBI has prescribed continuous disclosure norms for issuers of listed Non-Convertible Debt Securities, Non-Convertible Redeemable Preference Shares (NCRPS) and Commercial Papers. Further, to ensure effective enforcement of continuous disclosure obligations by issuers of listed Non-Convertible Debt Securities or NCRPS or Commercial Papers, it has been decided to lay down a similar uniform structure for imposing fines for non-compliance with continuous disclosure requirements after discussion with market participants. Therefore, in the interest of the investors and the securities market, the Stock Exchanges shall levy fines and take actions in case of non-compliance. In case a non-compliant entity is listed on more than one recognized stock exchange, the concerned recognized stock exchanges shall take uniform action under this circular in consultation with each other.

- SEBI has released the Consultation Paper on the Applicability and role of the Risk Management Committee.

-

- With an objective to solicit public comments / views on the proposed amendments to the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (hereinafter referred as “LODR Regulations “or “LODR”) regarding the applicability and role of the risk management committee. Considering the multitude of risks faced by listed entities, risk management has emerged as a very important function of the board. In light of the increasing importance of the risk management function, a need is thus felt to extend the requirement of formation of a Risk Management Committee to a larger number of listed entities and define the role and responsibilities of the Risk Management Committee in the LODR Regulations and increase the frequency and define a quorum for the meetings of the Risk Management Committee.

- The SEBI has issued a circular with an intent to strengthen the Investor Grievance Redressal Mechanism.

- The SEBI has issued a Circular wherein it has enhanced the investment limits per mutual funds.(Prohibition of Insider Trading) Regulations, 2015.

-

- A mutual fund launching a New Fund Offer (NFO) and intending to invest overseas will be required to specify the amount it will invest outside India and use the limit specified within six months. SEBI has doubled the foreign investment limit per mutual fund house to $600 million, from the existing $300 million. $50 million would be reserved for each mutual fund individually, within the overall industry limit of US $ 7 billion. Mutual Funds can invest in overseas Exchange Traded Fund (ETFs) subject to a maximum of US $ 200 million per mutual fund, within the overall industry limit of US $ 1 billion. For existing schemes, SEBI specified a headroom of 20% of the assets under management (AUM) in the previous three months in overseas securities, for investment in foreign securities subject to the overall limit of $600 million. Further, AMCs would have to report the utilization of the foreign limit to Sebi on a monthly basis, within 10 days from the end of each month. The changes come into force with immediate effect.

- SEBI has come out with a framework for creation of security for listed debt securities and ‘due diligence’ that needs to be carried out by Debenture Trustees.

-

- The new framework will become effective from January 1, 2021. In respect of creation of charge of security by issuer, before making the application for listing of debt securities, the issuer will have to create charge as specified in the offer document in favour of the Debenture Trustee (DT) and also execute Debenture Trust Deed (DTD) with the DT. Stock exchanges have been directed to list the debt securities only upon receipt of a due diligence certificate from DT confirming creation of charge and execution of the DTD. The charge created by issuer will be registered with sub-registrar, registrar of companies, depository, among others, as applicable, within 30 days of creation of such charge. In case the charge is not registered anywhere or is not independently verifiable, then the same will be considered a breach of terms of the issue by issuer. Under the norms, DTs will have to exercise independent due diligence and it places obligations on the DTs to ensure that the assets of the issuers are sufficient to discharge the interest and principal amount with respect to debt securities of issuers at all times. DTs will have to maintain records and documents pertaining to due diligence exercised for a minimum period of five years from redemption of debt securities. With regard to disclosures in the offer document, all terms and conditions of DT agreement including fees charged by DTs, details of security to be created and process of due diligence carried out by the DT should be disclosed.

- SEBI has issued Circular to provide Relaxation under Sub -rule (7) of Rule 19 of the Securities Contracts (Regulation) Rules, 1957 for Schemes of Arrangement by Listed Entities.

-

- SEBI has laid down the framework for Schemes of Arrangement by listed entities and relaxation under Rule 19(7) of the Securities Contracts (Regulation) Rules, 1957. This Circular shall be applicable for all the schemes filed with the stock exchanges after November 17, 2020. The amendment indicated at Para 7 of the Annexure shall be applicable for all listed entities seeking listing and/or trading approval from the stock exchanges after November 3, 2020. SEBI has inserted a new condition that a Report from the Committee of Independent Directors recommending the draft Scheme, taking into consideration, interrail, that the scheme is not detrimental to the shareholders of the listed entity. Further, it is now mandated that all listed entities are required to submit a valuation report from a Registered Valuer as specified in Section 247 of the Companies Act, 2013. It also clarified that the expression “substantially the whole of the undertaking” in any financial year shall mean twenty percent or more of value of the company in terms of consolidated net worth or consolidated total income during previous financial year as specified in Section 180(1)(a)(ii) of the Companies Act, 2013.

- SEBI has issued a Public notice in respect of Extension of the SEBI Settlement Scheme 2020.

-

- SEBI has earlier introduced the Settlement Scheme (“the Scheme”) which proposes to provide a onetime settlement opportunity to those entities that have executed trade reversals in the stock options segment of BSE during the period from April 01, 2014 to September 30, 2015 and against whom enforcement proceedings have been approved by SEBI. The period of the Scheme commenced on August 01, 2020 and was to end on October 31, 2020. In view of the large scale disruption caused by the Covid-19 Pandemic, many representations were received by SEBI, seeking extension of the period of the Scheme. Upon consideration of the same, the competent authority has approved the extension of the period of the Scheme till December 31, 2020.

- RBI

- The Reserve Bank of India has issued a Notification to exempted Housing Finance Companies from certain provisions of the RBI Act, 1934.

-

- RBI in supersession of its earlier notification dated November 19, 2019 has amended the provisions and notifies that that the provisions of Sections 45-IA on Requirement of registration and net owned fund, Section 45-IB on Maintenance of percentage of assets, and Section 45-IC on Reserve fund, of the RBI Act, 1934 shall not apply to a Non-Banking Financial Company which is a Housing Finance Institution as defined in clause (d) of section 2 of the National Housing Bank Act, 1987.

- RBI has issued a circular on Delegation of Powers for Compounding of Contraventions under FEMA.

-

- In terms of the Master Direction on “Compounding of Contraventions under FEMA, 1999” the powers to compound certain contraventions have been delegated to the Regional Offices/Sub-Offices of the Reserve Bank. The Foreign Exchange Management (Non-Debt Instruments) Rules, 2019 and Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019 i.e. Notification No. FEMA.395/2019-RB, both notified on October 17, 2019, by Government of India and Reserve Bank of India respectively have since been superseded and the compounding powers stand delegated to the Regional Offices/ Sub Offices of the Reserve Bank to compound the contraventions under FEM (Non –Debt Instruments) Rules, 2019 and FEM (Mode of Payment and Reporting of Non-Debt Instruments) Regulations. Further, with respect to the classification of a contravention under FEMA by the Reserve Bank as ‘technical’ or ‘material’ or ‘sensitive/serious in nature’. On a review it has been decided to discontinue the classification of a contravention as ‘technical’ that was dealt with by way of an administrative/ cautionary advice and regularize such contraventions by imposing minimal compounding amount as per the compounding matrix as contained in the ‘Master Direction – Compounding of Contraventions under FEMA, 1999’ dated January 01, 2016. On partial modification of earlier circular, it has been also decided that in respect of the Compounding Orders passed on or after March 01, 2020 a summary information, instead of the Compounding Orders, shall be disclosed publicly by publishing on the Bank’s website

- The Reserve Bank of India has notified the discontinuation of Returns/Reports under the Foreign Exchange Management Act, 1999.

-

- In order to improve the ease of doing business and reduce the cost of compliance, the existing forms and reports prescribed under FEMA, 1999, were reviewed by the Reserve Bank. Accordingly, it has been decided to discontinue the 17 returns/reports namely Category-wise transaction where the amount exceeds USD 5000 per transaction; Category-wise, transaction-wise statement where the amount exceeds USD 25,000 per transaction; Statement of Purchase transactions of USD 10,000 and above (including transactions of their franchisees); Extension of Liaison Offices (LOs); Extension of Project Offices (POs); Daily inflow/outflow of foreign fund on account of investment by FPIs; Data relating to actual inflow/outflow of remittances on account of investments by Foreign Institutional Investors (FIIs) in the Indian Capital market; Reporting of Inflow/Outflow details in respect of Mutual Fund by Asset Management Companies; Market value of FII Investment in India on fortnightly basis; Market value of FII Investment in India on Monthly basis; FII holdings as percentage of floating stock; Form DRR for Issue / transfer of sponsored / unsponsored Depository Receipts; ADR/GDR Movement Report- two way fungibility; Repatriation of Sales proceeds of underlying shares represented by FCCBs/GDRs/ADRs; GDR/ADR underlying shares issued, re deposited and released monthly reporting and Monitoring of disinvestments by Overseas Corporate Bodies

- RBI Reviews regulatory framework for Housing Finance Companies (HFCs).

-

- The Reserve Bank of India has issued a revised set of guidelines for housing finance companies after it took over regulation of these lenders last year. The draft regulatory framework for HFCs was issued for seeking comments from stakeholders based on the examination of the inputs received, RBI has decided to issue the revised regulatory framework for HFCs with the changes in the Principal business and housing finance i.e. the definition of “Housing finance company” and “Housing Finance”; Net Owned Fund (NOF) Requirement; Applicability of directions issued by Reserve Bank and Exposure of HFCs to group companies engaged in real estate business. HFCs are exempted from section 45-IB (prescribing maintenance of percentage of assets) and section 45-IC (prescribing Reserve fund) of the Reserve Bank of India Act. Necessary Notification in this regard will be issued in due course. Further harmonization between the regulations of HFCs and NBFCs will be taken up in a phased manner in the next two years by RBI.

- NCLT

- The benches of the National Company Law Tribunal (NCLT) have been reconstituted with effect from 1 December 2020.

-

- The benches shall hear matters of respective jurisdiction as were hearing before location (before 23 March 2020). All matters including pending before lockdown and filed during the lockdown shall be heard regularly on all working days. The benches shall sit as per Rule 9 of NCLT Rules, 2016. The Tribunal has 28 benches, six at New Delhi (one being the principal bench) and Three at Ahmedabad (One being the Indore Bench), One at Allahabad, one at Bengaluru, one at Chandigarh, two at Chennai, one at Guwahati, three at Hyderabad of which one is at Amaravathi, One at Cuttack, one at Jaipur, one at Kochi, Two at Kolkata and five at Mumbai. Except the Bench at Allahabad, Amaravathi & Kochi all other benches have been notified as division benches.

- Labour Laws

- The Ministry of Labour and Employment has released draft rules for the Code on Social Security, 2020 for comments from stakeholders.

-

- The draft rules are linked to provisions relating to Employees’ Provident Fund Organisation (EPFO), Employees’ State Insurance Corporation (ESIC), National Social Security Board for un-organised workers, gig workers and platform workers outlined in the Code on Social Security. The draft rules provide for Aadhaar-based registration including self-registration by un-organised workers, gig workers and platform workers on the portal of the Central government. For availing any benefit under any of the social security schemes framed under the Code, an un-organised worker or a gig worker or platform worker shall be required to be registered on the portal with details as may be specified in the scheme. Provision has also been made in the rules regarding gratuity to an employee who is on fixed-term employment. The rules also provide for single electronic registration of an establishment, including cancellation of the registration in case of closure of business activities. Further, under the draft rules, the assessing officer can visit the construction site only with prior approval of the secretary of the Building and Other Construction Workers Board. The rules also provide for the manner of payment of contribution by the aggregators through self-assessment.

- The Ministry of Labour and Employment has notified the draft rules under the Occupational Safety, Health and Working Conditions Code, 2020,

-

- Inviting objections and suggestions, if any, from the stakeholders within 45 days i.e upto January 3, 2021. The draft rules provide for operationalisation of provisions in the Code related to safety, health and working conditions of the dock workers, building or other construction workers, and mines workers, among others. The draft rules provide for appointment letter in prescribed format including designation, category of skill, wages, avenue for achieving higher wages or higher position to every employee of an establishment within three months of coming into force of the rules. According to the draft rules, no employee shall be employed in any establishment unless he has been issued a letter of appointment. It also made provision for annual health examination to be conducted by the employer free of cost for every worker of factory, dock, mine and building or other construction work, who has completed 45 years of age. Provision has also been made in the rules for journey allowance once a year. It also provides for single electronic registration, licence and annual integrated return for an establishment. An all-India single licence for contractor supplying or engaging contract labour in more than one state for five years has been provided as against work order-based licensing at present. Further, Under the rules, safety committees have been made mandatory for every establishment employing 500 or more workers to provide an opportunity for the workers to represent their concern on occupational safety and health matters. Rules have been provided for composition and functions of safety committees. The rules has been made regarding conditions related to safety of women employment in all establishment for all type of work before 6 am and beyond 7 pm with their consent.

- FSSAI

- FSSAI extends timeline for modification of licence by existing FSSAI licenced manufacturer without modification fee.

-

- The Food Safety and Standards Authority of India has extended period for modification of licence by existing FSSAI licenced manufacturer without modification fee. The period for modification of licence by existing FSSAI licensed manufacturers without any modification fee extended till June 30, 2021.

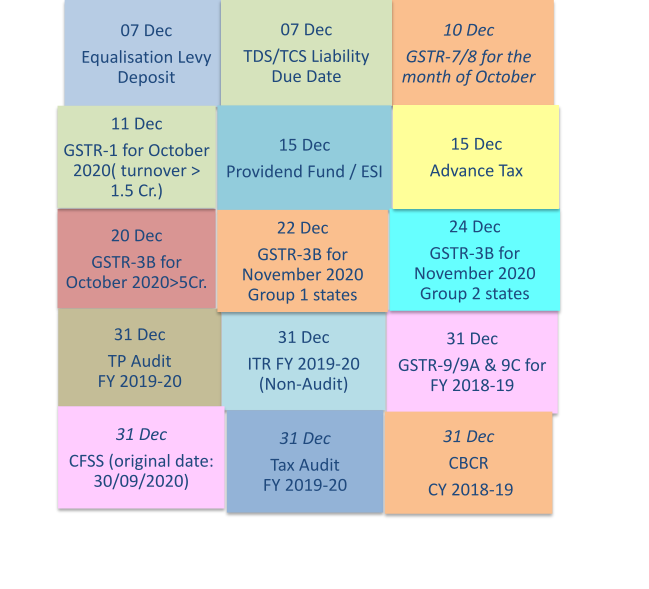

KNM India can assist you with a range of complete financial services that range from Corporate advisory to Transaction advisory, Pre-incorporation to Post-incorporation, Insolvency and bankruptcy code to Secretarial services, Assurance to Internal audit services, along with Market entry strategy to Foreign company registration in India. To discuss about any of these please book your slot, or call us on +91-99105-04170 – or email us at services@knmindia.com to get a quick response.Monthly Compliance Calendar

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period 26.10.2020 till 25.11.2020.Prepared by

KNM MANAGEMENT ADVISORY SERVICES PVT. LTD.E-mail: services@knmindia.com

Web site: www.knmindia.com -

-

-

-