Introduction

An expatriate means a person based in a foreign country working in India (inbound) or a person based in India (likely Indian citizen) working abroad (outbound).

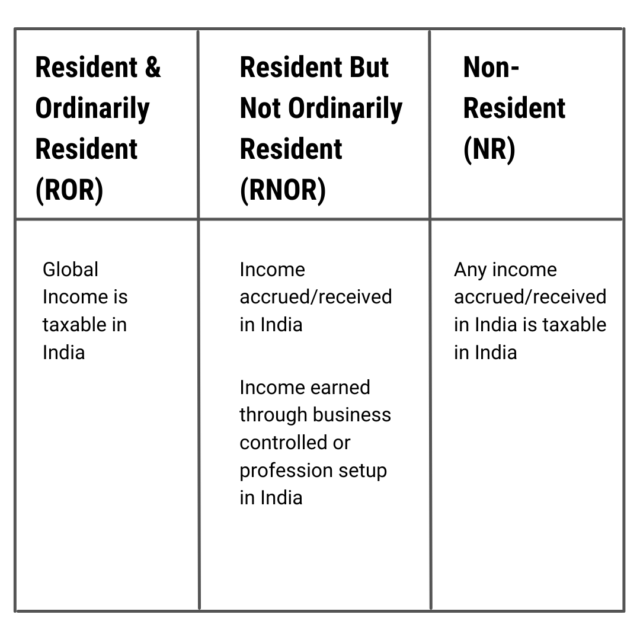

Under the Income Tax Act, 1961 the incidence of tax depends on the following:

- The residential status of the taxpayer

- Whether the accrual/ receipt of such income has a nexus with India.

Determination of Residential Status

182 days or more – General Criteria – Resident

- Alternate -60 days in the year plus 365 days or more in immediately preceding 4 years

- Alternate criteria do not apply to Indian Citizens leaving for employment, etc., and Indian Citizen/person of Indian origin with Indian Sourced Income up to 15 lacs – comes on a visit to India (being out of India).

- Alternate criteria modified to 120 days for Indian Citizen or a person of Indian origin having Indian Sourced Income in excess of Rs. 15 lacs (comes on a visit).

Not Ordinary Resident Category

NR for 9 out of 10 years or stay in India is less than 730 days in immediately preceding 7 years

Scope of Total Income

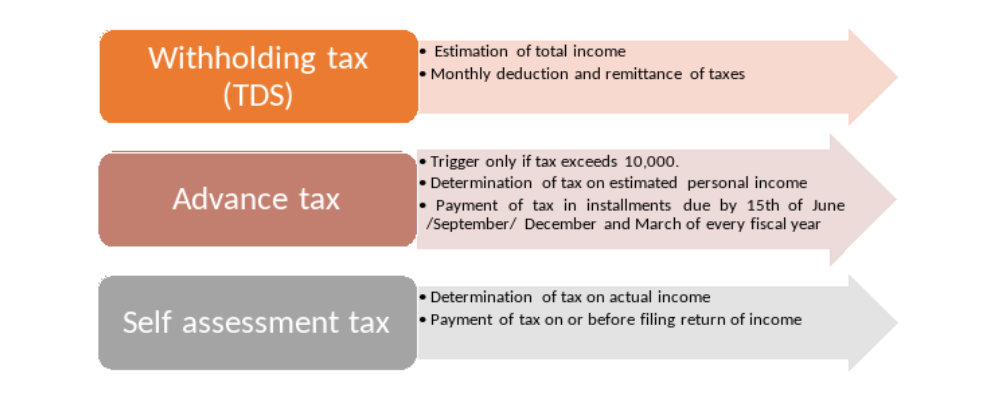

Tax Compliances

3. Income Tax Clearance Certificate (ITCC)

An assignee who is repatriating back to the home country should obtain an ITCC i.e. No Objection Certificate from the Income Tax Authorities issued through Form 30B by filing Form 30A. Form 30A is an undertaking by the employer of the expatriate that any future tax liability arising in the case of the expatriate must be borne by the employer. This certificate is required to be presented to the immigration authorities at the time of departure from India.

Taxability of Salary Income

Remuneration earned by an individual for services rendered in India during the assignment period is taxable in India (irrespective of where the payment has been received). In addition, any sum that is relatable to the India service period and received preceding/ succeeding the assignment period will also form part of salary income. Perquisites/fringe benefits such as accommodation, car, employee stock option, education benefits provided by the employer are also liable to tax. Some of the allowances/benefits like housing and leave travel are eligible for specific deductions/exemptions subject to the amount being actually expended and satisfaction of requisite conditions.

Double Taxation Avoidance Agreements (DTAA)

India has entered into 164 double taxation avoidance agreements and 21 Tax information exchange agreements. An individual who is a resident of a country with which India has entered into DTAA could avail of the treaty benefits to either eliminate taxation in one of the countries or avail credit of taxes paid in the country of residence. Commencing from India fiscal year 2012-13, assignees would require a tax residency certificate (TRC) from the tax authorities of the resident country to avail treaty benefits in the Indian tax return. In addition, prescribed details are to be submitted in Form 10F if not already mentioned in the TRC. Individuals rendering services in India for a shorter span may be eligible to claim short stay exemption under the Indian Income-tax Act, 1961 or the relevant DTAA provided certain conditions are satisfied.

Social Security Obligations in India

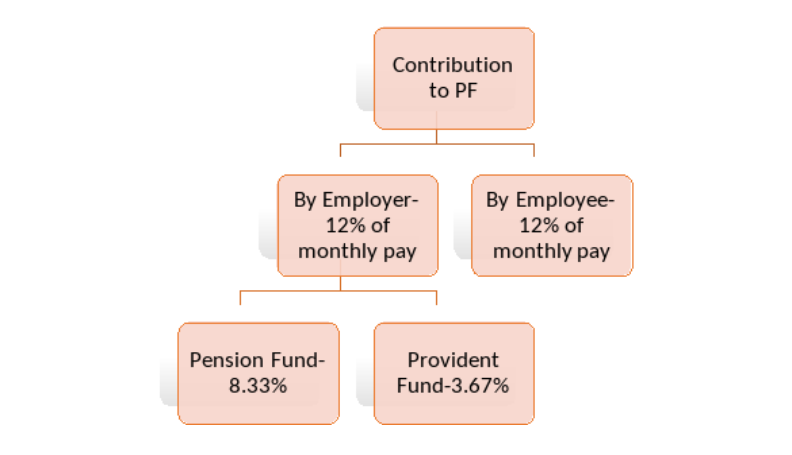

Foreign nationals working in establishments in India to which Employees’ Provident Fund (PF) regulations apply are required to contribute to the PF except those who have been specifically exempted under the regulations.

Social Security Agreements (SSA) Assignees from countries with whom India has signed an SSA, contributing towards the social security of the home country and holding Certificate of Coverage (COC) from the home country will not be required to contribute towards the Indian social security. The COC needs to be filed with the PF authorities.

1. Mandatory PF contribution

2. PF withdrawal

- In case an SSA exists – as per the provisions of the SSA.

- In case no notified SSA exists then –

1. On retirement from services after attainment of 58 years.

2. On retirement on account of permanent and total incapacity for work due to bodily or mental infirmity as certified by a specified medical practitioner.

Expat taxation helps in reducing the tax burden on the individuals as it shifts to the respective employer. The taxability of expatriates is explained here above to make it clearer and more understandable.