Employee ownership can be accomplished in a variety of ways. Employees can buy stock directly, be given it as a bonus, can receive stock options, or obtain stock through a profit-sharing plan.

Employee stock ownership plans are simply choices that could be bought at a predetermined price before the exercise date. There are characterized rules and guidelines spread out in the Companies Rules which businesses need to keep for giving of Employee stock ownership plans to their representatives.

Terms Used:

- ESOP – or Employee Stock Option Plan allows an employee to own equity shares of the employer company over a certain period of time. The terms are agreed upon between the employer and employee.

- Grant Date –The date of the agreement between the employer and employee to give an option to own shares (at a later date).

- Vesting Date – The date the employee is entitled to buy shares after conditions agreed upon earlier are fulfilled. This date is also the agreed-on grant date.

- Vesting Period – The time period between the grant date and vesting date.

- Exercise Period – Once stocks have ‘vested’, the employee now has a right to buy (but not an obligation) the shares for a period of time. This period is called the exercise period.

- Exercise Date – The date on which employee exercises the option.

- Exercise Price – The price at which an employee exercises the option. This price is usually lower than the prevailing FMV (fair market value) of the stock. An employer and employee agree on ESOP terms on the grant date. Once the employee has fulfilled the conditions or the relevant time period has elapsed, these employee stock options are vested. At this time the employee can exercise them or put simply – buy them. The employee is allowed some time period during which this option to buy can be exercised. Once the employee decides to buy, these stock options are allotted to him at an exercise price that is usually lower than the FMV of the stock. Of course, the employee can choose not to exercise his option. In that case, no tax is payable

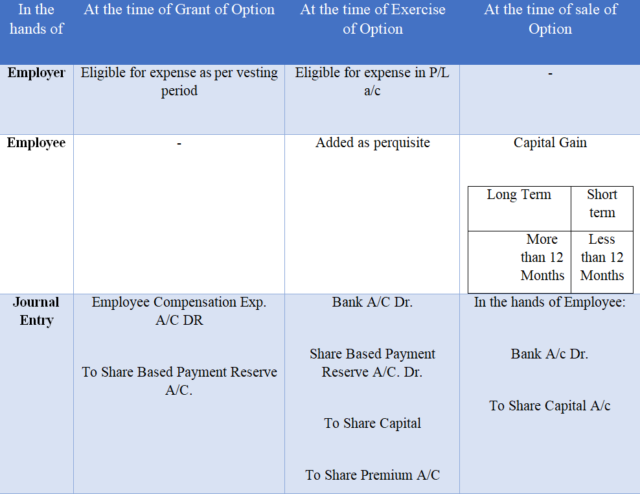

Accounting & Taxation:

It should be added as a prerequisite in the hands of the employee (Salary head) i.e., the difference between Fair Market Value (FMV) as on date of exercise and the exercise price is taxed as a prerequisite. This amount is shown in the employee’s Form 16 and included as part of total income from salary in the tax return.

In the case of sale of these shares, it would be liable as capital gains depending upon the period of holding i.e., long term (holding period>12 months) and short term (holding period<12 months).

Taxability Amendment for Startups:

Budget 2020 amendment – From FY 2020-21, an employee receiving ESOPs from an eligible start-up need not pay tax in the year of exercising the option. The TDS on the ‘perquisite’ stands deferred to earlier of the following events:

- Expiry of five years from the year of allotment of ESOPs

- Date of sale of the ESOPs by the employee

- Date of termination of employment

Earlier, ESOPs are taxed as perquisites under section 17(2) of the income-tax Act read with Rule 3(8)(iii) of the Rules.

The change has been proposed on the payment of taxes at the time of exercise of ESOPs. This is currently treated as a prerequisite under the head income from salary at the time of exercise. This is done to ease the cash flow problem of the employees as no cash benefit arises by buying shares and leads to additional tax payout over and above the exercise price.

Cross Border Implications:

There are many conflicts regarding the taxation of ESOPs, different countries have different conventions.

There is no doubt that a stock-option provided as part of an employment package falls within the words “salaries, wages, and other similar remuneration”, even when it is granted by a company that is not the employer of the recipient (e.g., when the ESOP covers employees of subsidiaries).

While it is clear that the granting of an employee stock-option constitutes part of the remuneration of the employee for purposes of Article 15, some commentators have considered that the holding and subsequent exercise of the option constitute investment decisions and that the gain represented by the difference between the value of the option at the time it is exercised and the value of the option at the time it was granted constitutes a capital gain falling under Article 13, which does not allow source taxation of the gain, rather than under Article 15, which would. Others have suggested that this analysis should only apply to the part of the gain that accrues after the option has vested since the employee cannot make an investment decision to keep or exercise the option before that time.

The benefit to Employer:

Investment opportunities are given by an association as an inspiration to its representatives. As the representatives would help when the organization’s offer costs take off, it would be a motivating force for the worker to put in his 100%. In spite of the fact that inspiration, worker maintenance, and granting difficult work are the key advantages that ESOP brings to the businesses, there are a few other critical benefits as well.

With the assistance of ESOP alternatives, associations could stay away from the money remunerations as an award, hence setting aside quick money outpouring. For associations that are beginning their business procedure on a greater scale or growing their business, granting their representatives with ESOPs would work out to be the most achievable alternative than the monetary compensations.

KNM India can assist you with a range of complete financial services that range from Corporate advisory to Transaction advisory, Pre-incorporation to Post-incorporation, Insolvency and bankruptcy code to Secretarial services, Assurance to Internal audit services, along with Market entry strategy to Foreign company registration in India. To discuss any of these please book your slot, or call us on +91-99105-04170 – or email us at services@knmindia.com to get a quick response.