Government ReliefsNews & UpdatesCBDT extends the Time Limit for Processing Validly filed Income Tax Returns with refund claims up to Assessment Year 2017-18 until January 31, 2024

Executive Summary

Income Tax

CBDT extends the Time Limit for processing validly filed income tax returns with refund claims up to assessment year 2017-18 until January 31, 2024.

➢ Guidelines Prescribed by CBDT for withholding Tax u/s 194-O.

➢ CBDT has notified ITR-1 and ITR-4 for Assessment Year 2024-25

➢ Central Government notifies Godavari River Management Board of Hyderabad for exemption in exercise of the powers conferred by clause (46) of section 10 of the Income-tax Act, 1961.

➢ Sovereign Gold Bond Scheme 2023-24 (Series III) will be opened for subscription during the period December 18-22, 2023.

➢ PowerGrid Infrastructure Investment Trust to be recognized as a mode for continuity of tax exemption for Charitable Trust and Institution

➢ The CBDT vide Notification No. 106/2023 dated December 27, 2023, notified an exemption to Ravenna Investments Holding B.V for pension funds under section 10(23FE) of the Income Tax Act, 1961.

➢ The government has revised the rate of Interest for the Small Savings Scheme with the approval of the competent authority.

➢ CBDT has notified the Income-tax (Twenty-Ninth Amendment) Rules, 2023, to amend Rules 10TA and 10TD for revising the definition of intra-group loans and circumstances in which they are treated as Safe Harbour.

Goods And Service Tax (GST)

➢ Extension of due date of GSTR 3B for the month of November 2023.

➢ Government issued time limit for issuing order under sec 73.

➢ GSTN issues advisory for pilot project of biometric-based Aadhaar authentication and document verification

➢ Advisory related to amnesty for taxpayer who missed to file appeal for the order passed on or before 31st march 2023.

➢ GSTN has given advisory on Two factor authentication (2FA).

Companies Act 2013/ Other Laws

➢ Mandatory Pre-Requisite For E-filing Matters in NCLT

➢ Foreign Exchange Management (Manner of Receipt and Payment) Regulations, 2023

➢ RBI modifies MSME lending norms

➢ RBI issues revised instructions for inoperative accounts/unclaimed deposits in Banks

➢ Employees’ State Insurance (Central) Amendment Rules, 2023

➢ Filing of Announcements Related to Loss of Share Certificate, Issue of Duplicate Share, Certificate Closure of Trading Window and CIRP- NSE

➢ SEBI (Listing Obligations and Disclosure Requirements) (Seventh Amendment) Regulations, 2023

➢ SEBI (Issue of Capital and Disclosure Requirements) (Third Amendment) Regulations, 2023

INCOME TAX

➢ CBDT extends the Time Limit for Processing Validly Filed Income Tax Returns with Refund Claims up to Assessment Year 2017-18 until January 31, 2024

Central Board of Direct Taxes (Board) vide its order under section 119 of the Income-tax Act,1961 dated July 05, 2021 and September 30, 2021 on the captioned subject relaxed the timeframe prescribed in second proviso to subsection (1) of Section 143 of the Act. It was directed that all validly filed returns up to Assessment Year 2017-18 with refund claims, which could not be processed under section 143(1) of the Act and which had become time barred, should be processed by November 30, 2021, subject to the conditions exceptions specified therein.

The matter has been re-considered by Board in view of pending taxpayer grievances related to issue of refund. To mitigate the genuine hardship being faced by the taxpayers on this issue, Board, by virtue of its power under section 119 of the Act and in partial modification of its earlier order under section 119 of the Act dated July 05, 2021 and September 30, 2021, supra, hereby further extends the time frame mentioned in the para no. 2 of the order dated September 30, 2021 till January 31, 2024 in respect of returns of income validly filed electronically. All other contents of the said order u/s 119 of the Act dated July 05, 2021 will remain unchanged.

Above relaxation shall not be applicable to the following returns:

(i) returns selected in scrutiny

(ii) returns remain unprocessed, where either demand is shown as payable in the return or is likely to arise after processing it

(iii) returns remain unprocessed for any reason attributable to the assessee.

➢ Guidelines Prescribed by CBDT for withholding Tax u/s 194-O.

The guidelines contemplate following situations and explains in detail how section 194- O would operate in such cases, including illustrations.

• In case of a platform or network ( e.g., the open network for digital commerce) wherein multiple ECOs are participating in a single transaction of sale of goods / services through the platform / network. For example, there could be a buyer side ECO involved in buyer side functions and a seller side ECO involved in seller side functions.

Example 1 – Where the seller-side ECO is not the actual seller of goods / services. In this situation, withholding of tax u/s 194-O is required to be done by the seller side ECO who finally makes the payment to the seller. The seller-side ECO would file the requisite withholding tax return in Form 26Q and issue certificate to the seller in Form 16A.

Example 2 – Where the seller-side ECO is the actual seller of goods / services. In this situation, withholding of tax u/s 194-O is required to be done by the ECO which finally makes the payment to the seller for goods / services sold, which in the case mentioned below is ECO-2. The ECO 2 would file the requisite withholding tax return in Form 26Q and issue certificate to the seller in Form 16.

• ECOs may be levying convenience fees or charging commission for each transaction and seller might levy logistics and delivery fees for the transaction. Payments may also be made to the platform or network provider for facilitating the transaction. Whether these would form part of ‘gross amount’ for the purpose of withholding tax u/s 194-O of the Act?

• How will GST, various state levies and taxes other than GST (such as Value Added Tax / Sales tax / Excise duty / Central Sales Tax) be treated when calculating ‘gross amount’ of sale for the purpose of section 194-O?

• How will adjustment for purchase -returns take place?

• How will discounts given by seller as an E -Commerce Participant or by any of the multiple ECOs be treated while calculating ‘gross amount’ for the purpose of section 194-O?

➢ CBDT has notified ITR-1 and ITR-4 for Assessment Year 2024-25

CBDT has notified ITR1 SAHAJ and ITR4 SUGAM for Assessment Year 2024-25 for filing return for Financial Year 2023-24.

➢ Central Government notifies Godavari River Management Board of Hyderabad for exemption in exercise of the powers conferred by clause (46) of section 10 of the Income-tax Act, 1961.

Central Government in pursuance of section 85 of the Andhra Pradesh Re-Organization Act, 2014, in respect of the following specified income arising to the said Authority, as follows:

(a) Grants/Subsidies received from CG and from the SG of Andhra Pradesh and Telangana and

(b) Interest from bank deposits, including savings account.

Above notification shall be effective subject to the conditions that Godavari River Management Board, Hyderabad-

(a) shall not engage in any commercial activity;

(b) activities and the nature of the specified income shall remain unchanged throughout the financial years; and

(c) shall file return of income in accordance with the provision of clause (g) of sub- section (4C) of section 139 of the Income-tax Act, 1961.

This notification shall be deemed to have been applied for assessment years 2020-21 to 2023-2024.

➢ Sovereign Gold Bond Scheme 2023-24 (Series III) will be opened for subscription during the period December 18-22, 2023.

The Gold Bonds issued under this Scheme may be held by a Trust, HUFs, Charitable Institution, University or by a person resident in India, being an individual, in his capacity as such individual, or on behalf of minor child, or jointly with any other individual.

The issue price of the Bond during the subscription period shall be ₹6,199 per gram . The Government of India in consultation with the Reserve Bank of India has decided to allow discount of ₹50 per gram from the issue price to those investors who apply online and the payment is made through digital mode. For such investors the issue price of Gold Bond will be ₹6,149 per gram of gold.

Interest on the Gold Bonds shall commence from the date of issue and shall be paid at a

fixed rate of 2.50 percent per annum on the nominal value of the bond and the interest shall be payable in half-yearly rests and the last interest shall be payable along with the principal on maturity and these Gold Bonds shall be repayable on the expiration of eight years from the date of the issue of the Bonds.

➢ PowerGrid Infrastructure Investment Trust to be recognized as a mode for continuity of tax exemption for Charitable Trust and Institution

Charitable Trusts / Institutions enjoying Income-tax exemption u/s 11(5) of the Income- tax Act are required to invest their surplus funds in prescribed modes, such as savings certificates, post office savings, deposit in an account with a scheduled bank or co- operative society, units of Unit Trust of India, deposit in any public sector company of India, etc. the CBDT has added investment in units of PowerGrid Infrastructure Investment Trust as one of the recognised modes for continuity of tax exemption for such trusts / institutions.

➢ The CBDT vide Notification No. 106/2023 dated December 27, 2023, notified an exemption to Ravenna Investments Holding B.V for pension funds under section 10(23FE) of the Income Tax Act, 1961.

The notified funds are eligible to claim an exemption for eligible investments made in India on or before March 31, 2024, subject to following conditions.

i. The assessee shall file a return of income, for all the relevant previous years falling within the period beginning from the date in which the said investment has been made and ending on the date on which such investment is liquidated.

ii. the assessee shall furnish along with such return a certificate in Form No. 10BBC in respect of compliance with the provisions of clause (23FE) of section 10 of the Act.

iii. the assessee shall intimate the details in respect of each investment made by it in India during the quarter within a period of one month from the end of the quarter in Form No. 10BBB.

iv. the assessee shall maintain a segmented account of income and expenditure in respect of such investment which qualifies for exemption under clause (23FE) of section 10 of the Act;

v. the assessee shall continue to be regulated under the laws of the Government of the Netherlands;

vi. the assessee shall not have any loans or borrowings directly or indirectly, for the purposes of making investment in India and

vii. the assessee shall not participate in the day-to-day operations of investee but the monitoring mechanism to protect the investment with the investee shall not be considered as participation in the day-to-day operations of the investee and

viii. any other conditions as may be prescribed.

Violation of any of the conditions as stipulated in clause (23FE) of section 10 of the Act and this notification shall render the assessee ineligible for the tax exemption.

➢ Government has revised the rate of Interest for Small Savings Scheme with the approval of competent authority.

The rates of interest on various Small Savings Schemes for the fourth quarter of financial year 2023-24 starting from 1 st January, 2024 and ending on 31 st March, 2024 have been revised as detailed below:

➢ CBDT has notified the Income-tax (Twenty-Ninth Amendment) Rules, 2023, to amend Rules 10TA and 10TD for revising the definition of intra-group loans and circumstances in which they are treated as Safe Harbour.

Intra-group loan definition has been revised to include loans extended to “Associate Enterprise” rather than wholly owned subsidiaries and the condition for the loans to be advanced must be sourced in Indian Rupees has been omitted. The updated definition of intra-group loan is now stated as follows:

Intra-group loan means a loan advanced to an associated enterprise being a non-resident, where the loan

(i) is not advanced by an enterprise, being a financial company including a bank or a financial institution or an enterprise engaged in lending or borrowing in the normal course of business, and

(ii) does not include a credit line or any other loan facility which has no fixed term for repayment;

Rule 10TD has been amended to replace the conditions for safe harbor in the event of the advancement of intra-group loans denominated in a foreign currency. The reference to “CRISIL” credit rating has been omitted from Rule 10TD. Thus, the credit rating of any other entities can be used while determining Safe Harbour.

➢ As per Notification No. 56/2023 Dated 28 th December, 2023 – The Government, on the recommendations of the Council, hereby, extends the time limit specified under sub- section (10) of section 73 for issuance of order under sub-section (9) of section 73 of the said Act, for recovery of tax not paid or short paid or of input tax credit wrongly availed or utilized, relating to the period as specified below, namely: –

• For the financial year 2018-19, up to the 30th day of April, 2024;

• For the financial year 2019-20, up to the 31st day of August, 2024

➢ As per Notification NO. 55/2023 Dated 20 th December, 2023

The Commissioner, on the recommendations of the Council, hereby extends the due date for furnishing the return in FORM GSTR-3B for the month of November, 2023 till the twenty-seventh day of December, 2023, for the registered persons whose principal place of business is in the districts of Chennai, Tiruvallur, Chengalpattu and Kancheepuram in the state of Tamil Nadu

.

➢ The GSTN on has issued an advisory 1 st December 2023 for applicants of GST registration in the state of Andhra Pradesh, for pilot project of biometric-based Aadhaar authentication and document verification.

The functionality now also provides for the document verification and appointment booking process Once the applicant has applied to Form GST REG- 01, it will receive an email either of the following:

• A link for OTP based Aadhaar authentication, or

• A link for booking an appointment with GST Suvidha Kendra (GSK) for authentication/verification

If the applicant receives the link for OTP-based Aadhaar authentication as per above,

He/she can proceed with the application as per the existing process. however, If the applicant receives the link for booking appointment with GSK, he / she will be required to book the appointment to visit the designated GSK, using the link provided in the e-mail. Once the applicant gets the confirmation of appointment through e-mail, he / she will be able to visit the designated GSK as per the chosen schedule.

At the time of the visit of GSK, the applicant is required to carry the following details.

• Copy of confirmation e -mail (for booking of appointment)

• Details of jurisdiction as mentioned in the e -mail

• Aadhaar number

• Original documents that were uploaded with the application. The biometric authentication and document verification will be done at the GSK, for the individuals as per the GST application Form REG-01.

➢ The GSTN has issued the following advisory on 28 November 2023 the GST Council, in its 52nd meeting held in October 2023, recommended granting amnesty to taxpayers who could not file an appeal (u/s 107 of the CGST Act, 2017), against the demand order (u/s 73 or 74 of the CGST Act, 2017) passed on or before March 31, 2023, or whose appeal against the said order was rejected due to not being filed within the specified time limit.

• In compliance with this recommendation the government has issued notification No. 53/2023 on November 2, 2023.

• Considering the pre-requisite to deposit the admitted amount of tax, interest and penalty, it is the responsibility of the taxpayer to select the appropriate ledgers and make the payment correctly (the GST portal allows taxpayers to choose the correct mode of payment – electronic credit / cash ledger). An appeal filed without proper payment of tax, interest or penalty, may be rejected or dealt with as per the legal provisions

• In case taxpayer has already filed an appeal and wants it to be covered by the benefit of amnesty scheme, it would be required to make the differential payment to comply with Notification no. 53/2023. The payment should be made against the demand order using the ‘Payment towards demand’ facility available on the GST portal. The navigation step for making this payment is: Login >> Services >> Ledgers >> Payment towards Demand.

• Taxpayers who have previously filed an appeal, but it was rejected as time barred in APL-02 by the appellate authority, are entitled to refile the appeal. In case taxpayer faces any issue in re-filing of appeal, a ticket shall be raised on the grievance redressal portal (https://selfservice.gstsystem.in). The taxpayer shall select the category ‘Amnesty Scheme’ and the sub-category ‘Amnesty scheme- Issue in appeal filing’ while raising a ticket.

• If the appellate authority has issued a rejection order in APL-04 due to the application for appeal being time-barred, the taxpayer has to approach the respective appellate authority office well in advance to comply with the dates in the said notification. The appellate authority after checking the eligibility of the taxpayer for the amnesty scheme will forward the case to GSTN through the state nodal officer.

• For the APL 04 issued cases, no direct representations will be entertained by GSTN or through the grievance redressal portal. APL 04-issued cases have to be compulsorily forwarded through the state nodal officer.

• Post receiving the case from the state nodal officer, GSTN will enable the taxpayer to file an appeal against the concerned order.

➢ GSTN has issued an advisory on 1 December 2023 for implementation of 2FA on the GST portal nationwide starting 1 December 2023 onwards.

The 2FA helps in strengthening the login security in the GST portal. The initial rollout of 2FA has been successfully conducted in Haryana. In the 1st phase, 2FA will be implemented in Punjab, Chandigarh, Uttarakhand, Rajasthan and Delhi. The 2nd phase will include the remaining states across India. Taxpayers would need to provide a one-time password (OTP) post entering user ID and password. The OTP will be delivered to the primary authorized signatory’s mobile phone number and email address. Accordingly, taxpayers have been advised to keep their email addresses and mobile numbers of authorized signatories updated on the GST portal for receiving the OTP communication.

Companies Act, 2013/LLP Act, 2008

➢ Mandatory Pre-Requisite For E-filing Matters in NCLT

The National Company Law Tribunal has informed that all Litigants/Advocates/parties have to follow the pre-requisite outline on formatting, proper book marking Petition/Applications/Pleadings/Documents, electronic signature using e-sign, retention of originals, etc. at the time of e-filing in NCLT portal with effect from January 01, 2024.

RBI

➢ Foreign Exchange Management (Manner of Receipt and Payment) Regulations, 2023

The Reserve Bank of India has introduced Foreign Exchange Management (Manner of Receipt and Payment) Regulations, 2023 in supersession of Notification No. FEMA 14(R)/2016-RB dated May 02, 2016.

The core of the regulations addresses how residents in India can make or receive payments from individuals outside the country. It emphasizes the role of Authorised Banks and Authorised Persons. The provision allows residents to seek the Reserve Bank’s permission for specific transactions under the Act.

➢ RBI modifies MSME lending norms

The RBI has notified amendment in Paragraph 2.2 of the Master Direction- Lending to Micro, Small & Medium Enterprises (MSME) Sector. Now, it has been directed that for Priority Sector Lending (PSL) purposes, banks shall be guided by the classification recorded in the Udyam Registration Certificate (URC). All the MSMEs are required to register online on the Udyam Registration portal and obtain a ‘Udyam Registration Certificate’.

➢ RBI issues revised instructions for inoperative accounts/unclaimed deposits in Banks

The RBI issued revised guidelines w.r.t. inoperative accounts /unclaimed deposits in banks. The central banks called for steps to trace the customers of inoperative accounts or unclaimed deposits including their nominees or legal heirs for re-activation of accounts, settlement of claims, or closure. RBI also stressed a periodic review and measures to prevent fraud in such accounts. No charges must be levied for the activation of inoperative accounts.

LABOUR LAW

➢ Employees’ State Insurance (Central) Amendment Rules, 2023

The Ministry of Labour of Employment has issued a notification to further amend Employees’ State Insurance (Central) Rules, 1950 wherein, in Rule 29(2) Proviso, for the words “rupees five crores”, the words “rupees twenty–five crores” shall be substituted.

SEBI

➢ Filing of Announcements Related to Loss of Share Certificate, Issue of Duplicate Share, Certificate Closure of Trading Window, and CIRP- NSE

The National Stock Exchange of India has advised the listed entity to file the disclosures intimating the following announcements under SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (‘SEBI LODR’) will be made available in XBRL format. with from December 09, 2023:

1. Loss of Share Certificate/Issue of Duplicate Share Certificate

2. Closure of Trading Window

3. Corporate Insolvency Resolution Process.

➢ SEBI (Listing Obligations and Disclosure Requirements) (Seventh Amendment) Regulations, 2023

The Securities and Exchange Board of India has amended the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015.

➢ SEBI (Issue of Capital and Disclosure Requirements) (Third Amendment) Regulations, 2023

The Securities and Exchange Board of India has amended the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018.

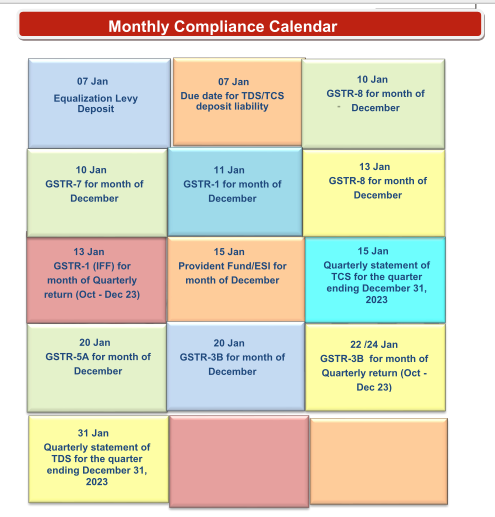

Monthly Compliance Calendar