Recently the CBDT has come up with a section 206AB to curb the non-filers of Income tax return having huge tax credits in form of withholding taxes. This section was first introduced vide Finance Act 2021 effective July 01st, 2021.

Before getting into the intricacies, we hereby reproduce provisions of Section 206AB of the Income Tax Act for reference:

Sec.206AB Special provision for deduction of tax at source for non-filers of income-tax return

“(1) Notwithstanding anything contained in any other provisions of this Act, where tax is required to be deducted at source under the provisions of Chapter XVIIB, other than section 192, 192A, 194B, 194BB, 194LBC or 194N on any sum or income or amount paid, or payable or credited, by a person (hereafter referred to as deductee) to a specified person, the tax shall be deducted at the higher of the following rates, namely:—

(i) at twice the rate specified in the relevant provision of the Act; or

(ii) at twice the rate or rates in force; or

(iii) at the rate of five per cent.

(2) If the provisions of section 206AA is applicable to a specified person, in addition to the provision of this section, the tax shall be deducted at higher of the two rates provided in this section and in section 206AA

(3) For the purposes of this section “specified person” means a person:

– who has not filed the returns of income for both of the two assessment years relevant to the two previous years immediately prior to the previous year in which tax is required to be deducted,

-for which the time limit of filing return of income under sub-section (1) of section 139 has expired;

-and the aggregate of tax deducted at source and tax collected at source in his case is rupees fifty thousand or more in each of these two previous years:

Provided that the specified person shall not include a non-resident, who does not have a permanent establishment in India.

Explanation. —For the purposes of this sub-section, the expression “permanent establishment” includes a fixed place of business through which the business of the enterprise is wholly or partly carried on.]”

Key Pointers-Sec.206AB and Compliance Utility

- At first, it is hereby mentioned that Section 206AB starts with non-obstante clause, thereby overriding all the other provisions of Income tax Act. In other words, it will apply even if the assessee has obtained a lower or Nil TDS certificate or he is otherwise not liable to file the return of income, under specific provisions granted under the law;

- Secondly, non-residents not having a Permanent establishment in India do not come under the purview of ‘specified person’.

- Thirdly, using the “compliance check utility” functionality there is no additional criteria to check whether a Foreign company has a PE in India or not.

Status of a Foreign Company claiming relaxation from filing return of Income u/s 115A

- This can be more clarified with the help of an example. Suppose, during the financial year 2021-22, an Indian Co. pays a Technical service fee to a non-resident foreign company and applies withholding tax u/s 115A of the Income Tax Act. The foreign company furnishes PAN to the deductor Indian company but considering the relaxation provided by sub-section (5) of section 115A*, does not file return of income in India.

*Section 115A(5) exempts Foreign companies for filing of Income Tax return if:

- if the income is only in the nature of interest or dividend. However, the exemption in case of Royalty or Fees for Technical services was also introduced vide the Finance Act 2020 w.e.f. April 01st, 2020. So, nature of income can be Interest or Dividend or Royalty or Fees for Technical Services;

- Tax was deducted at a rate mentioned in section 115A

- Thus, it is seen that the foreign company has duly claimed the benefit provided by section 115A(5) thus, is relaxed from filing the return of income once tax gets deducted at the rates u/s 115A.

- However, as the new utility does not have any criteria to check whether a foreign company has a PE or not, it becomes a question of thought whether these foreign companies come under the purview of specified person. This effectively means that the tax authorities could only be informed regarding the existence of PE, only when an information in the form of tax return is submitted with them.

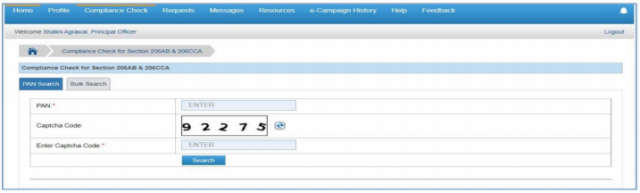

Following is utility screenshot for reference:

At first the non-resident foreign company will bear a higher rate of TDS, in case it does not have a PAN in India. Secondly, does it lead to a conclusion that relaxation given u/s 115A(5) will not be available to the foreign company even if having a no PE in India.

Key Takeaways

With no information available with the tax department regarding the PE of foreign company and limited functionality of the utility, it seems that Foreign Company falls under the criteria of ‘specified persons’ for purposes of section 206AB.

In view of this, it becomes essential for such companies to convince deductors regarding their No PE status based on self-declarations and also submit them copy of Tax residency Certificates along with Form 10F, before deduction of TDS.

However, in view of the aforesaid intention of the law, to avoid being categorized under ‘specified person’ u/s 206AB, foreign companies deriving income from India in nature of specified u/s 115A and not having a PE, need to reconsider their positions while claiming the benefit of relaxation u/s 115A(5) with regard to non-filing of returns.

The article has been contributed by

Sr. Manager-Direct Tax

Further, we shall be happy to assist in case of any clarifications. For a deeper discussion, feel free to revert us at services@knmindia.com

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication.