Executive Summary

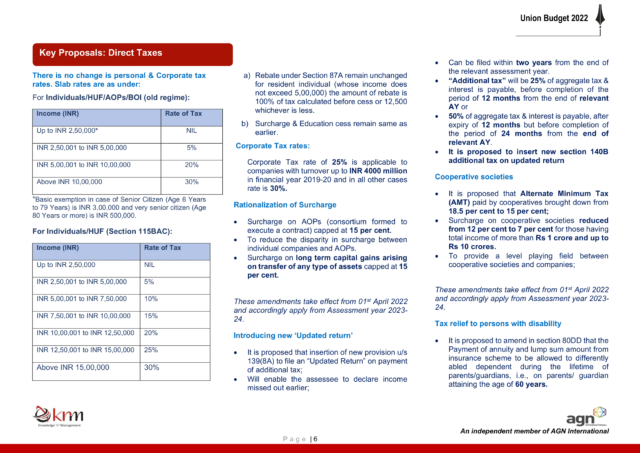

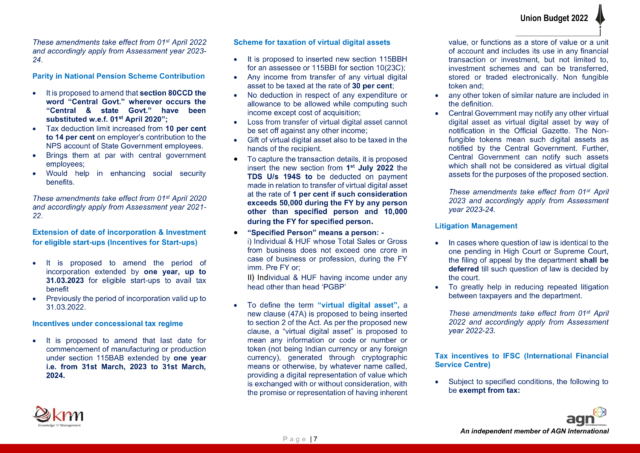

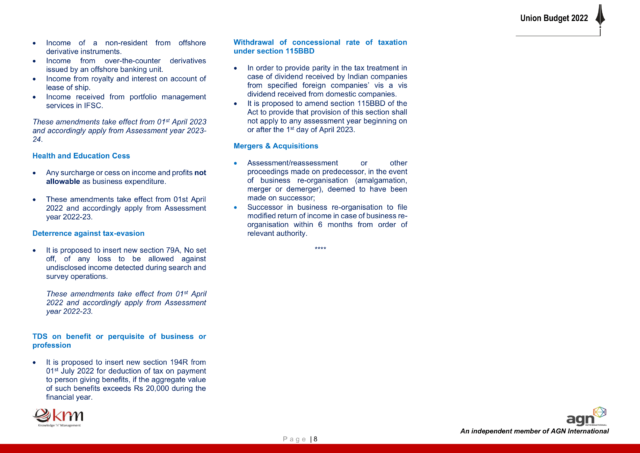

Income Tax

- Procedure of PAN application & allotment through Simplified Proforma for incorporating Limited Liability Partnerships (LLPs) electronically (Form: FiLLiP) of MCA.

- Specific documentation needs to be provided to avail the Covid-19 tax exemption

- Form 67 can be filed upto the end of the relevant Assessment year. In case of updated return it can be filed upto the date of filing

- ITR need to be verified within 30 days instead of 120 days

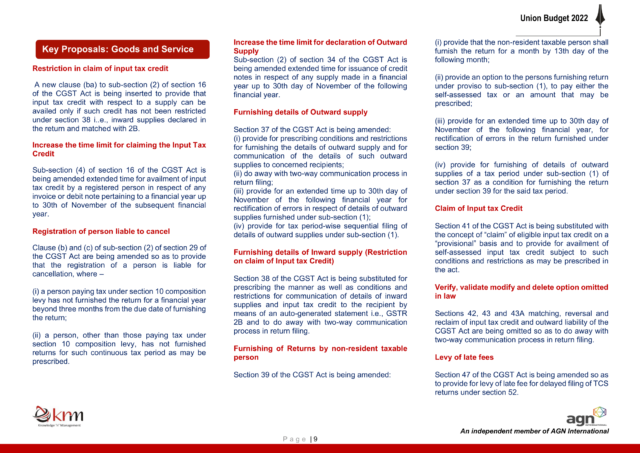

Goods & Services Tax (GST) & Customs

- Turnover limit for generating E-invoice for B2B supply of goods and services or both or for exports is decreased to exceeding 10 crores from 20 crores

- GSTN has enabled Form GSTR-9 (Annual Return) and GSTR-9C (Self- Certified Reconciliation Statement for FY 2021-22 on GST portal

- Single click Nil filing of GSTR-1 has been introduced on the GSTN portal to improve the user experience and performance of GSTR-1/IFF filing

Companies Act 2013/ Other Laws

- MCA has upgraded the present version of the portal from Version 2 to Version 3.

- MCA has issued the new rules for registration of company office.

- MCA has notified the manner in which the books of accounts are kept in electronic mode.

- SEBI has notified the definition for Related Party.

- RBI has published the rules which simplifying the existing framework for overseas investment and has aligned with the current business and economic dynamic

Income Tax

- CBDT vide Notification No. 4/2022, dated 26/07/2022, specified that to ease to the newly incorporating LLPs can apply PAN through FilliP form instead of filing a separate PAN form.

- CBDT vide Notification No. 5/2022, dated 29/07/2022, notified the new rules of ITR verification. As per the new rules ITR needs tobe verified within 30days of ITR filing. As this notification is effective from 01.08.2022, therefore ITR filed before this date old rule of 120 days will be applicable.

- CBDT vide Notification No. 90/2022, dated 05/08/2022, notified that employees needs to submit covid-19 related documents to themself & of their family to avail the benefits of tax exemption. This notification is applicable for AY 2020-21 & 2021-22.

- CBDT vide Notification No. 94/2022, dated 10/08/2022, inserted the Rule 17AA in which specified books of accounts/documents needs to maintained by the every entity registered u/s 10(23C) & 12A(1)(b).

- CBDT vide Notification No. 98/2022, dated 17/08/2022, inserted the Rule 40G to implemented the provision as inserted by the Finance Act 2022 in section 239A. As per section 239A if tax is bear by the tax payer and claims that tax is not payable within 30day of such payment then refund of such tax can be claimed by filing Form 29D alongwith relevant documents.

- CBDT vide Notification No. 99/2022, dated 17/08/2022, clarify that provision of section 206(1G) is not applicable on Non-resident doesn’t have PE in India.

- CBDT vide Notification No. 100/2022, dated 18/08/2022, amended the rule 128(9) that now Form 67 can be submitted on or before the end of the relevant assessment year in which related income is offered to tax & ITR is filed. Further if Updated Return filed (U/s 139(8A)) then such Form 67 need to be filed before furnishing of such ITR.

Goods & Services Tax

- CBIC vide Notification no. 17/2022-Central Tax dated August 01, 2022, the turnover limit for generating E-invoice for B2B supply of goods and services or both or for exports is decreased from 20 crores from 10 crores from October 01, 2022 onwards.

- CBIC vide Circular no. 179/11/2022-GST dated August 03, 2022 notifies clarification regarding GST rates and classification goods based on the recommendation of GST council as below:

- Electric vehicles whether or not fitted with a battery pack classified under HSN 8703 and attracts GST rate of 5%.

- Concessional rate of 5% on stones covered in S.No. 123 minor polished stone. Napa Stone is a variety of dimensional limestone, which is a brittle stone and cannot be subject to extensive mirror polishing and do not qualify as mirror polished stone.

- All forms of fresh, dried and sliced mangoes including mango pulp attracts GST at 12% rate.

- Supply of treated sewage water, falling under heading 2201, is exempt under GST.

- The Nicotine Polacrilex gum which is commonly applied orally and is intended to assist tobacco use cessation is appropriately classifiable with applicable GST rate of 18%.

- The condition of 90 per cent. or more fly ash content applied only to Fly Ash Aggregates and not to fly ash bricks and fly ash blocks.

- By-products of milling of Dal/ Pulses such as Chilka, Khanda and Churi attracts GST at 5% rate.

- CBIC vide Circular no. 177/09/2022-TRU dated August 03, 2022 provides clarification regarding GST rates and exemptions on certain services on the recommendation of GST council as below:

- Applicability of GST rates on supply of ice-cream by ice-cream parlors during the period from 01.07.2017 to 05.10.2021

- Applicability of GST on application fee charged for entrance or the fee charged for issuance of eligibility certificate for admission or for issuance of migration certificate by educational institutions

- Whether storage or warehousing of cotton in baled or ginned form is exempted services by way of storage and warehousing of raw vegetable fibres such as cotton before 18.07.2022

- Whether exemption covers supply of services associated with transit cargo both to and from Nepal and Bhutan

- Applicability of GST on sanitation and conservancy services supplied to Army and other Central and State Government departments;

- Whether the activity of selling of space for advertisement in souvenirs is eligible for concessional rate of 5%

- Taxability and applicable rate of GST on transport of minerals from mining pit head to railway siding, beneficiation plant etc., by vehicles deployed with driver for a specific duration of time

- Whether location charges or preferential location charges (PLC) collected in addition to the lease premium for long term lease of land constitute part of the lease premium or upfront amount charged for long term lease of land and are eligible for the same tax treatment

- Applicability of GST on payment of honorarium to the Guest Anchors

- Whether the additional toll fees collected in the form of higher toll charges from vehicles not having fastag is exempt from GST

- Applicability of GST on services in the form of Assisted Reproductive Technology (ART)/ In vitro fertilization (IVF)

- Whether sale of land after levelling, laying down of drainage lines etc., is taxable under GST

- Situations in which corporate recipients are liable to pay GST on renting of motor vehicles designed to carry passengers

- Whether hiring of vehicles by firms for transportation of their employees to and from work is exempt

- Whether supply of service of construction, supply, installation and commissioning of dairy plant on turn-key basis constitutes a composite supply of works contract service and is eligible for concessional rate of GST prior to 18.07.2022;

- Applicability of GST on tickets of private ferry used for passenger transportation.

- CBIC vide Circular no. 178/10/2022-GST dated August 03, 2022 clarifies issues regarding Compensation and penalty arising out of breach of contract, Cancellation charges or other provisions of law.

- Cheque dishonor fine / penalty is not a consideration for any service, hence not taxable under GST

- Penalty imposed for violation of laws are not consideration for supply received and are not taxable under GST.

- Any amount recovered by the employer under Notice pay recovery are not taxable under GST.

- GST is applicable on the amount collected on account of interest and late payment surcharge or fine/penalty and taxable considering the naturally bundled with the main supply.

- Services such as travel and tour constitute a bundle of services which starts with booking of the ticket for travel and lasts at least till exit of the passenger from the destination terminal. The facilitation service of allowing cancellation against payment of cancellation charges is also a natural part of this bundle. Therefore, such amounts should be considered as consideration for tolerating the act of late payment and hence taxable under GST.

- CBIC vide Notification no. 25/2022-GST dated August 18, 2022 Seeks to impose provisional anti-dumping duty on imports of Ursodeoxycholic Acid (UDCA) originating in or exported from China PR and Korea RP for a period of six months.

- CBIC vide Notification no. 24/2022-GST dated August 18, 2022 seeks to impose anti-dumping duty on Opal Glassware from UAE & China PR for a period of 5 years.

- Introducing Single Click Nil Filing of GSTR-1: Single click Nil filing of GSTR-1 has been introduced on the GSTN portal to improve the user experience and performance of GSTR-1/IFF filing. Taxpayers can now file NIL GSTR-1 return by simply ticking the checkbox File NIL GSTR-1 available at GSTR-1 dashboard.

- GSTN has enabled Form GSTR-9 (Annual Return) and GSTR-9C (Self- Certified Reconciliation Statement for FY 2021-22 on GST portal.

Companies Act, 2013

To further amend the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016, which shall come into force on the date of their publication in the Official Gazette i.e. 24-08-2022. Through this amendment, MCA has revised Form No. STK-1, Form No. STK-5 and Form No. STK-5A to capture the declaration that the company is not carrying on any business or operations, as revealed after the physical verification, as carried out by the Registrar of companies under the provisions of Section 12(9) of the Companies Act, 2013.

These forms will be launched on August 31, 2022 at 12:00 AM. Following forms will be rolled out in this phase: DIR3-KYC Web, DIR3-KYC Eform, DPT-3, DPT-4, CHG-1, CHG-4, CHG-6, CHG-8 & CHG-9. To facilitate implementation of these forms in the V3 MCA21 portal, stakeholders are advised to note that the Company e-Filings on the V2 portal will be disabled from 15th Aug 2022 at 12:00 AM for the above 9 forms. All stakeholders are advised to ensure that there are no SRNs in pending payment and Resubmission status. Further, offline payments for the above 9 forms in V2 using the Pay later option would be stopped from August 07, 2022 at 12:00 AM. You are requested to make payments for these forms in V2 through online mode (Credit/Debit Card and Net Banking).

The Through this amendment, MCA has modified the manner in which the books of accounts are kept in electronic mode. The amendment is brought under Rule, 3 which deals with the manner of books of accounts to be kept in electronic mode in which the books of account and other relevant books and papers maintained in electronic mode shall remain accessible in India, at all times so as to be usable for subsequent reference. Under sub-rule 5, there shall be a proper system for storage, retrieval, display or printout of the electronic records as the Audit Committee, if any, or the Board may deem appropriate and such records shall not be disposed of or rendered unusable unless permitted by law. Provided that the back-up of the books of account and other books and papers of the company is maintained in electronic mode, including at a place outside India, if any, shall be kept in servers physically located in India on a daily basis. Further, the company shall intimate to the Registrar on an annual basis at the time of filing of financial statement, the information about the service provider who maintains the books of accounts and other documents in electric mode.

- MCA has notified the companies (incorporation) third amendment rules, 2022 to amend the companies (incorporation) rules, 2014, which shall come into force from the date of publication in the official gazette i.e 18-08-2022.

In the Companies (Incorporation) Rules, 2014, Rule 25B relating to Physical verification of the Registered Office of the company has been inserted. The Rule provides that If Registrar has a reasonable cause to believe that the Company is not carrying on any business or operations pursuant to section 12(9) of the Companies Act, 2013, the Registrar may carry out Physical verification of the Registered Office. The physical verification of the said registered office should be done in presence of two independent witnesses of the locality in which the said registered office is situated and may also seek the assistance of the local Police for such verification if required. Further, the Registrar shall carry the documents as filed with the MCA while physical verification and shall cross-check with the documents filed by the Company. The Registrar shall take a photograph of the registered office while performing physical verification. The report of such verification shall be prepared and relevant attachments shall be attached. Where the registrar is not getting any reply from the Company on the notices sent by it, the Registrar shall send a notice to the Company and its directors of intention to remove the name of the Company from the register of companies within 30 days from the notice.

MCA21-version 3 is a technology-driven forward-looking project, envisioned to strengthen enforcement, promote Ease of Doing Business and enhance user experience. MCA21 version-3.0 rollout has been planned in phases to ensure minimum disruption in regulatory filings. To start with 9 (Nine) company forms (Form CHG-1, Form CHG-4, Form CHG-6, Form CHG-8, Form CHG-9, Form DIR-3 KYC, Form DIR-3 KYC WEB, Form DPT-3 and Form DPT-4) has been scheduled to go-live from September 01, 2022. The remaining company forms and other modules like e-Adjudication, and Compliance Management System are scheduled to be fully deployed within this Calendar Year. In view of the upcoming launch of 09 Company forms in version-3, LLP filings on the MCA21 V-3 portal will not be available from 27th Aug (00:00 AM) to 28th Aug (23:59hrs). However, the MCA21 V-2 Portal for company filings will remain available.

To further amend the Companies (Appointment and Qualification of Directors) Rules, 2014. The amended Rules shall come into force on the date of their publication in the Official Gazette i.e. 29-08-2022. Keeping in mind the launch of MCA V3 for Companies Act Forms, MCA has released the amended version of the eForms DIR-3-KYC and web-form DIR-3-KYC-WEB and the same have been substituted in place of the old forms. It is clarified that in the case of Indian nationals, the Income-tax Permanent Account Number (Income-tax PAN) is mandatory in all cases even if there is no change in Income-tax PAN. In such cases, director details should be as per Income-tax PAN. In case the details as per Income-tax PAN are incorrect, the director/designated partner is advised to first correct the details in Income-tax PAN. The new forms would be made available from 01-09-2022 on the MCA portal.

Other Laws

SEBI

As per the new guidelines, AIFs/VCFs shall file an application to SEBI for allocation of overseas investment limit in the notified format and they shall invest in an overseas investee company, which is incorporated in a country whose securities market regulator is a signatory to the International Organization of Securities Commission’s Multilateral Memorandum of Understanding or a signatory to the bilateral Memorandum of Understanding with SEBI. AIFs/VCFs shall not invest in an overseas investee company, which is incorporated in a country identified in the public statement of the Financial Action Task Force (FATF) as a jurisdiction having a strategic Anti-Money Laundering or Combating the Financing of Terrorism deficiencies to which counter measures apply; or a jurisdiction that has not made sufficient progress in addressing the deficiencies or has not committed to an action plan developed with FATF to address the deficiencies. Further, if an AIF/VCF liquidates an investment made in an overseas investee company previously, the sale proceeds received from such liquidation to the extent of investment made in the said overseas investee company shall be available to all AIFs/VCFs (including the selling AIF/VCF) for reinvestment. Furthermore, the AIFs/VCFs shall furnish the sale/divestment details of the overseas investments to SEBI in the format given in Annexure B within 3 working days of the divestment, for updating the overall limit available for overseas investment by AIFs/VCFs. All the overseas investments sold/divested by AIFs/VCFs to date shall also be reported to SEBI in the format given in Annexure B within 30 days from the date of this circular.

Through this amendment, the definition for the term “related party “under section 2(1)(PA) has been notified which means a director, partner, or his relative; key managerial personnel or his relative; a firm, in which a director, partner, manager or his relative is a partner; a private company in which a director, partner or manager or his relative is a member or director; a public company in which a director, partner or manager is a director or holds along with his relatives, more than two percent. of its paid-up share capital; anybody corporate whose board of directors, managing director or manager is accustomed to acting in accordance with the advice, directions or instructions of a director, partner or manager; a related party as defined under the applicable accounting standards; such other person as may be specified by the Board. Provided that, any person or entity forming a part of the promoter or promoter group of the listed entity; any person or any entity, holding equity shares: (i) of twenty percent or more; or (ii) of ten percent or more, with effect from April 1, 2023; in the listed entity either directly or on a beneficial interest basis as provided under section 89 of the Companies Act, 2013, at any time, during the immediately preceding financial year; shall be deemed to be a related party. Further, the portfolio manager shall ensure compliance with the prudential limits on investments as may be specified by the Board. The prudential limits shall be applicable at the client level at the time of making investments by the portfolio managers. The portfolio manager shall not be allowed to invest clients’ funds in unrated securities of their related parties or their associates.

For the entities against whom proceedings have been initiated and are pending before any forum or authority, viz. Courts/SAT, Adjudicating Officer, and Recovery Officer (provided an appeal has been filed and the same is pending before the SAT/Court). The terms and conditions along with the FAQ of the Scheme, 2022 are also made available on the respective websites of SEBI and BSE on August 22, 2022. The Scheme shall commence on August 22, 2022 and end on November 21, 2022 (both days inclusive) or such other date as approved by the Competent Authority. The Scheme would be applicable in respect of the entities that have executed reversal trades in the illiquid stock options segment of BSE between April 1, 2014 and September 30, 2015 and against whom proceedings have been initiated and are pending before any forum or authority, viz. Courts/ SAT, Adjudicating Officer and Recovery Officer (provided an appeal has been filed and the same is pending before the SAT/Court); Entities against whom orders have been passed levying penalty that has not been paid and against whom recovery proceedings have been initiated, may be eligible for the scheme only if an appeal is filed and the same is pending before the Courts/ SAT. An entity desirous of availing of settlement under the Scheme would be required to submit a settlement application along with an application registration fee of Rs. 25,000/- + GST @18% in case of body corporates and Rs. 15,000/- + GST @18% in case of individuals in the specified format, available on the respective websites of SEBI and BSE

The enhanced norms shall be applicable to credit ratings of securities that are listed, or proposed to be listed, on a recognized stock exchange, and other credit ratings that are required under various SEBI Regulations or circulars thereunder. In order to standardize the methodology of computation and disclosure of a ‘sharp rating action’, it is clarified that CRAs shall compare two consecutive rating actions. Therefore, a CRA shall disclose a sharp rating action, if the rating change between two consecutive rating actions is more than or equal to 3 notches downward. In other words, if the difference in credit rating between two consecutive press releases is more than or equal to 3 notches downward, the same has to be included in the disclosure on sharp rating actions. In addition to the current disclosures of sharp rating actions excluding noncooperative issuers, CRAs shall also separately disclose sharp rating actions including such actions on non-cooperative issuers. Further, CRAs shall follow a uniform practice of three consecutive months of non-submission of No-default Statement (NDS) (or inability to validate timely debt servicing through other sources) as a ground for considering migrating the ratings to INC and shall tag such ratings as INC within a period of 7 days of three consecutive months of non-submission of NDS. The CRA in its judgment may migrate a rating to the INC category before the expiry of three consecutive months of non-receipt of NDS.

- SEBI has come out with a circular amending its guidelines for the preferential issue and institutional placement of units by listed Real Estate Investment Trusts (REITs)and Infrastructure Investment trusts (INVITS).

Under the new guidelines, the REIT/InvITS shall make an application for listing of the units to the stock exchange(s) and the units shall be listed within two working days from the date of allotment. Provided that where the REIT/InvIT fails to list the units within the specified time, the monies received shall be refunded through verifiable means within four working days from the date of the allotment, and if any such money is not repaid within such time after the issuer becomes liable to repay it, the REIT.InvIT, the manager of the REIT/InvIT and its director or partner who is an officer in default shall, on and from the expiry of the fourth working day, be jointly and severally liable to repay that money with interest at the rate of fifteen percent per annum. Further, the Preferential issue of units shall not be made to any person who has sold or transferred any units of the issuer during the 90 trading days preceding the relevant date. Further, where any person belonging to the sponsor(s) or Sponsor group(s) has sold/transferred their units of the issuer during the 90 days preceding the relevant date, all sponsors and members of sponsor group(s) shall be ineligible for allotment of units on a preferential basis. Provided that this restriction on preferential issue of units shall not apply to a sponsor(s) or member of the sponsor group, in case any asset is being acquired by the REIT/InvIT from that sponsor(s) and/or member of sponsor group(s), and the preferential issue of units is being made to that sponsor and/or member of the sponsor group, as full consideration for the acquisition of the such asset.

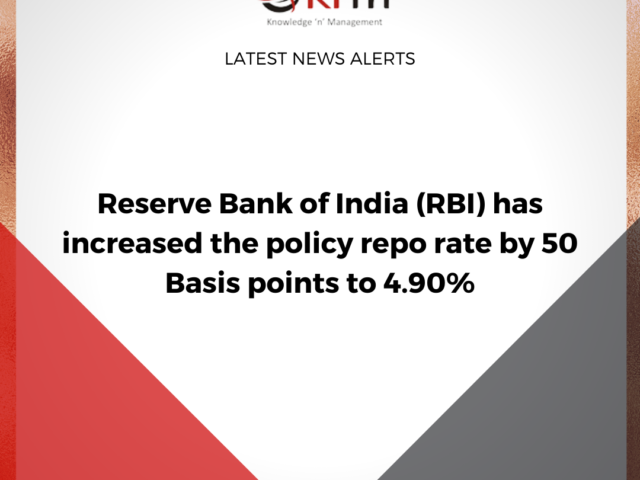

RBI

The recommendations including directions relating to All loan disbursals and repayments are required to be executed only between the bank accounts of the borrower and the RE without any pass-through/ pool account of the LSP or any third party; Any fees, charges, etc., payable to LSPs in the credit intermediation process shall be paid directly by RE and not by the borrower; A standardized Key Fact Statement (KFS) must be provided to the borrower before executing the loan contract; All-inclusive cost of digital loans in the form of Annual Percentage Rate (APR)6 is required to be disclosed to the borrowers. APR shall also form part of KFS; Automatic increase in credit limit without explicit consent of borrower is prohibited.; A cooling-off/ look-up period during which the borrowers can exit digital loans by paying the principal and the proportionate APR without any penalty shall be provided as part of the loan contract; REs shall ensure that they and the LSPs engaged by them shall have a suitable nodal grievance redressal officer to deal with FinTech/ digital lending related complaints. Such grievance redressal officers shall also deal with complaints against their respective DLAs. The details of the Grievance redressal officer shall be prominently indicated on the website of the RE, its LSPs and on DLAs, as applicable. Further, as per extant RBI guidelines, if any complaint lodged by the borrower is not resolved by the RE within the stipulated period (currently 30 days), he/she can lodge a complaint under the Reserve Bank – Integrated Ombudsman Scheme (RB-IOS)7.

- RBI has published the foreign exchange management (Overseas Investment) Regulations, 2022 which shall come into force on the date of their publication in the official gazette i.e. 22-08-2022.

RBI has simplified the existing framework for overseas investment and has aligned with the current business and economic dynamics. Clarity on Overseas Direct Investment and Overseas Portfolio Investment has been brought in and various overseas investment related transactions that were earlier under the approval route are now under the automatic route, significantly enhancing “Ease of Doing Business”. As per the amended Regulation, the Indian entity may lend or invest in any debt instrument issued by a foreign entity or extend the non-fund-based commitment to or on behalf of a foreign entity including overseas step-down subsidiaries of such Indian entity subject to the following conditions within the financial commitment limit as prescribed in the Foreign Exchange Management (Overseas Investment) Rules, 2022. An Indian entity may lend or invest in any debt instruments issued by a foreign entity subject to the condition that such loans are duly backed by a loan agreement where the rate of interest shall be charged on an arm’s length basis. It is clarified that for the purpose of this regulation, the expression “arm’s length” means a transaction between two related parties that is conducted as if they were unrelated so that there is no conflict of interest. Further, where a person resident in India acquires equity capital by way of subscription to an issue or by way of purchase from a person resident outside India or where a person resident outside India acquires equity capital by way of purchase from a person resident in India, and where such equity capital is reckoned as ODI, the payment of the amount of consideration for the equity capital acquired may be deferred for such definite period from the date of the agreement as provided in such agreement subject to prescribed terms and conditions.

The Foreign Exchange Management (Overseas Investment) Rules shall apply to any investment made outside India by a financial institution in an IFSC or acquisition or transfer of any investment outside India made out of Resident Foreign Currency Account; or out of foreign currency resources held outside India by a person who is employed in India for a specific duration irrespective of length thereof or for a specific job or assignment, duration of which does not exceed three years; or in accordance with sub-section (4) of section 6 of the Act. Any investment or financial commitment outside India made in accordance with the Act or the rules or regulations made thereunder and held as on the date of publication of these rules in the Official Gazette, shall be deemed to have been made under these rules and the Foreign Exchange Management (Overseas Investment) Regulations, 2022. Further, any person resident in India who has an account appearing as a non-performing asset; or is classified as a willful defaulter by any bank; or is under investigation by a financial service regulator or by investigative agencies in India, namely, the Central Bureau of Investigation or Directorate of Enforcement or Serious Frauds Investigation Office, shall, before making any financial commitment or undertaking disinvestment under these rules or the Foreign Exchange Management (Overseas Investment) Regulations, 2022, obtain a No Objection Certificate from the lender bank or regulatory body or investigative agency by making an application in writing to such bank or regulatory body or investigative agency concerned. The No Objection Certificate issued shall be addressed by the lender bank or regulatory body or investigative agency concerned to the designated AD bank with an endorsement to the applicant. An Indian entity may make ODI by way of investment in equity capital for the purpose of undertaking bonafide business activity in the manner and subject to the limits and conditions as notified under these rules.

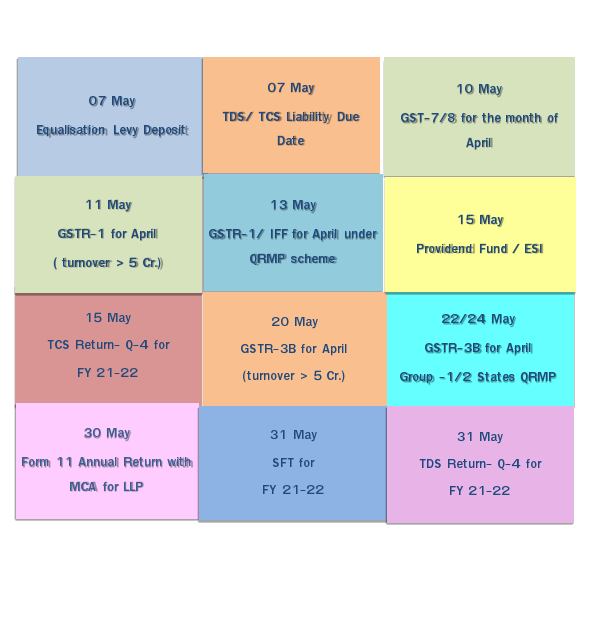

View Monthly Compliance Calendar

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period 25.07.2022 till 25.08.2022