Executive Summary

Income Tax

- CBDT proposes New common ITR except ITR 1 & 4

- Explanatory Notes to Finance Act 2022 issued.

Goods & Services Tax (GST) & Customs

- CBIC Issues guidelines for verification of transition Input Tax Credit.

- CBIC Notifies amendment in form GSTR-9 for FY 2021-22.

- CBIC Clarifies issues regarding refunds.

Companies Act 2013/ Other Laws

- MCA has notified Companies (Registered Valuers and Valuation) Amendment Rules, 2022

- RBI has launched the Daksh, an advanced monitoring system to make the supervisory processes more robust Notified vide press release dated 6th October 2022.

- SEBI reduces the timeline for listing Non-convertible Securities, Securitised Debt Instruments, etc. to T+3 days.

- SEBI introduces the mechanism of Net Settlement of the cash segment and F&O segment upon the expiry of stock derivatives

- IBBI revises fee structure applicable to Insolvency professionals (IPs) and Insolvency Professional Entities (IPEs)

Income Tax

- Circular No. 20/2022 [F.NO. 225/49/2021/ITA-II], Dated 26-10-2022: The date of furnishing Income-tax returns falling due on 31st October 2022 has been extended to 7th November 2022 for assesses referred in clause (a) of Explanation 2 to sub-section (1) of section 139 of the Income-tax Act, 1961.

- Circular No. 21/2022 [F.NO. 225/49/2021/ITA-II], Dated 27-10-2022: CBDT has extended the due date of filing Form 26Q from 31st October to 30th November for Q2 of FY 2022-23.

- CBDT has proposed a common ITR for the general public in lieu of filing different ITR forms. However, ITR 1 & 4 will continue in force.

- CBDT issued explanatory notes on 3rd Nov. to Finance Act 2022.

- CBDT has announced amendments for different saving schemes like the National Saving Scheme, Kisan Vikas Patra & Senior Citizen’s Saving scheme with updated interest rates & terms.

GOODS AND SERVICES TAX

- Central Board of Indirect Taxes & Customs (CBIC) notifies amendment in Form GSTR-9 (annual return for regular taxpayers) for FY 2021-22. If a taxpayer fails to report or reports incorrectly the value of supplies or input tax credits for a specific Financial Year (FY), the taxpayer is allowed to report or correct it in the monthly or quarterly Form GSTR-1 (statement of outward supply) and/or Form GSTR-3B (summary return) in the following FY. This can be done latest by 20 October of the subsequent FY. According to Notification No. 18/2022-Central Tax dated September 28, 2022, this deadline has been extended from October 20 to November 30. Form GSTR-9 for FY 2021–2022 has now been updated to reflect the aforementioned modification.

- Circular No. 182/14/2022-GST dated 10-Nov2022 CBIC specified the procedures for verifying this transitional Input Tax credit. The jurisdictional tax officer, who will issue the proper order, will verify the transitional credit. The central or applicable state tax authority shall verify the form transition ITC declaration forms filed or changed under the administrative supervision of the central or state tax authority. The officer has access to the back-office systems where taxpayers filed their forms. The taxpayers must additionally file a downloadable copy of the paperwork that they have self-certified. The officer will determine whether the taxpayer previously filed a declaration based on the information provided and the taxpayer’s declaration. If there is no change, the jurisdictional tax officer may reject the transitional credit. If there is a change, the jurisdictional tax officer will proceed with the verification of applying for transitional credit using the recommended procedures.

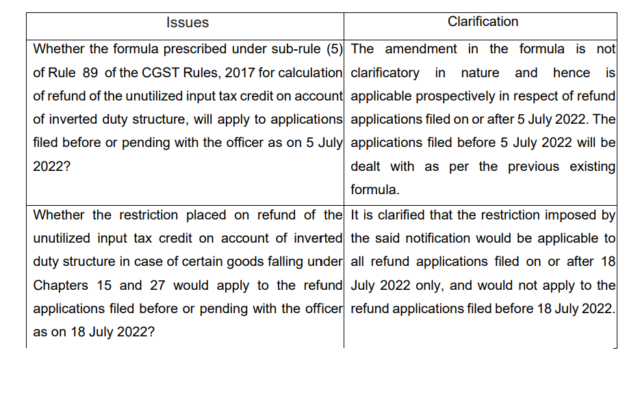

- Circular No.181/13/2022-GST dated 10-Nov-2022 – CBIC clarifies issues regarding refund, as per subsection (3) of section 54 of the CGST Act, 2017, which allows for the return of unused input tax credits in situations where credits are accumulated because the tax rate on inputs is higher than the tax rate on output supply, or because of an inverted duty structure. The formula specified in sub-rule (5) of rule 89 of the CGST Rules, 2017, has been modified by notification

number 14/2022-Central Tax dated 5 July 2022. Additionally, the restriction on the reimbursement of unused input tax credits has been put in place by Notification No. 09/2022- Central Tax (Rate) of July 13, 2022, which became effective on July 18, 2022.

Companies Act, 2013

- MCA has issued Companies (Registered Valuers and Valuation) Amendment Rules, 2022 – The Central Government notified the Companies (Registered Valuers and Valuation) Amendment Rules, 2022 on November 21, 2022, to amend the extant Companies (Registered Valuers and Valuation) Rules, 2017. The amendment provides further clarity to the functions of registered valuers and registered valuers organizations, especially in connection with partners and partnership entities, directors and companies already registered or looking to be registered as registered valuers.

RBI

RBI has launched the Daksh, an advanced monitoring system to make the supervisory processes more robust Notified vide press release dated 6th October 2022.

The Reserve Bank of India has been taking various initiatives in strengthening supervision, which among other initiatives includes the adoption of the latest data and analytical tools as well as leveraging technology for implementing more efficient and automated work processes. In continuation of this effort, Shri Shaktikanta Das, Governor, today launched a new SupTech initiative named “दक्ष (DAKSH) – Reserve Bank’s Advanced Supervisory Monitoring System”, which is expected to make the Supervisory processes more robust. ‘दक्ष (DAKSH)’ means ‘efficient’ & ‘competent’, reflecting the underlying capabilities of the application. ‘दक्ष (DAKSH)’ is a web-based end-to-end workflow application through which RBI shall monitor compliance requirements in a more focused manner with the objective of further improving the compliance culture in Supervised Entities (SEs) like Banks, NBFCs, etc. The application will also enable seamless communication, inspection planning, and execution, cyber incident reporting, and analysis, provision of various MIS reports, etc., through a Platform that enables anytime-anywhere secure access.

SEBI

- SEBI reduces the timeline for listing of Non-convertible Securities, Securitised Debt Instruments, etc. to T+3 days – Sebi has listed out the steps involved in pre-listing and post-listing along with relevant timelines, both through Electronic Book Provider (EBP) platform and otherwise. This is to provide more clarity and standardization in the process of issuance and listing of such securities on the private placement basis. The time taken for listing of such securities after the closure of the issue has been reduced to three working days (T+3) as against the present requirement of 4 working days (T+4).

- SEBI introduces the mechanism of Net Settlement of cash segment and F&O segment upon expiry of stock derivatives

– Securities and Exchange Board of India (SEBI) introduced the mechanism of net settlement of cash and Futures and Options (F&O) segment upon expiry of stock derivatives. The move is aimed at providing better alignment of cash and derivatives segment, mitigation of price risk in certain cases and netting efficiencies for market participants, the Capital markets regulator SEBI said in a circular.

Insolvency And Bankruptcy Code

IBBI revises fee structure applicable to Insolvency professionals (IPs) and Insolvency Professional Entities (IPEs) IBBI has hiked the fees for Insolvency professionals (IPs) and Insolvency Professional Entities (IPEs). Application fees for IPs (individuals) have been increased to Rs 20,000 from Rs 10,000. Also, Annual fees have been increased from 0.25% of professional fees earned during the last financial year to 1.00%

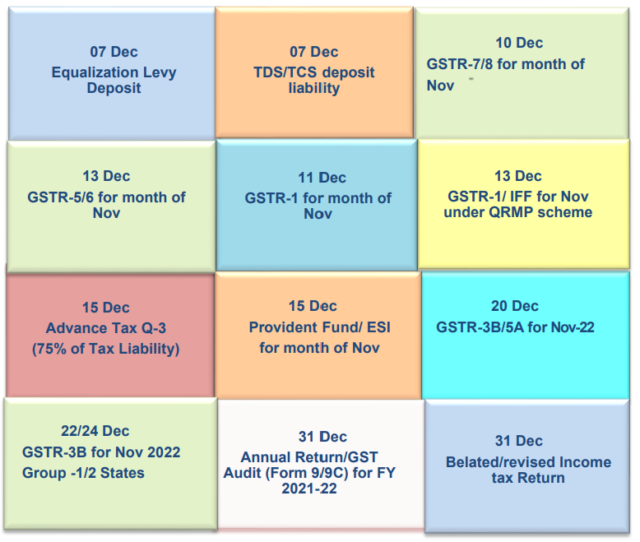

Monthly Compliance Calendar

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility forloss arising from any action taken or not taken by anyone using this publication. Updates are for the period from 25th oct till 25th Nov. 2022.