Content:

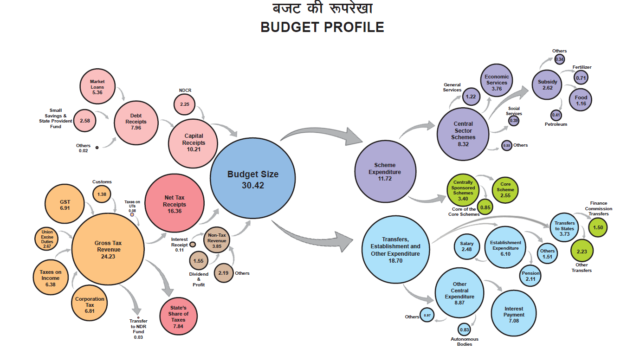

1. Budget Statement 2020-21

2. Economic Survey 2019-20

3. KNM credentials

4. Annexure – I to Budget Statement

1. Budget Statement 2020-21

Finance Minister Nirmala Sitharaman presented her budget which is woven around the theme on Aspirational India, Economic development and caring society. Highlights of budget is as under:

- 16-points action plan to help farmers, Farm markets need to be liberalised with a FY21 agriculture allocation1.38 lakh crore. Expansion of PM KUSUM Scheme under which 20 lakh farmers would be provided fundsto set up standalone solar pumps. Civil Aviation Ministry to launch ‘Krishi Udaan’ for agricultural exports. Railways will set up Kisan Railthrough PPP arrangement.

- Government will promote ‘Study In India’ initiative with a proposal National Police University and National Forensic University. US-like SAT examto be held in African and Asian countries for benchmarking foreign candidates who wish to Study In India.

- Govt to expand Mission Indradhanush, add hospitals to Ayushman Bharat and Allocated Rs 69,000 crore to Healthcare, inclusive of Rs 6,400 crore for Jan Arogya Yojana.

- Five new smart cities to be developed with PPP model (Public Private Partnership). 100 more airportsto be set up by 2024 to support UDAN scheme.

- More Tejas-like trainsfor tourists. 150 new trainto be introduced on PPP basis; Four stations will be also be redevelopment with the help of PPP. Rs 18,600 crore worth Bengaluru suburban transport project launched; 20% equity will be provided be the Centre.

- Tourism:5 archaeology sitesto be developed for world-class museums. Rs 2,500 crore for tourism promotion. An Indian Institute of Heritage and Conservation under Ministry of Culture proposed; with the status of a deemed University. 4 more museums from across the country to be taken up for renovation and re-curation.

- Govt plans to sell part of its holding in Life Insurance Corporation (LIC) by way of Initial Public Offering. Govt to sell govt stake in IDBI Bank to private investors

- Certain specified categories of government securitieswill be open fully for NRIs, apart from being open to domestic investors. FPI limitin corporate bonds raised to 15% from 9%.

- Deposit Insurance Coverage to increase from Rs.1 lakh to Rs.5 Lakh per depositor.

- Personal Income Tax

- No change in income tax slab rates for F.Y. 2020-21 for Individuals/HUF/AOPs/BOI.

| Income (INR) | Rate of Tax |

| Up to INR 250,000* | NIL |

| INR 250,001 to INR 500,000 | 5% |

| INR 500,001 to INR 1,000,000 | 20% |

| Above INR 1,000,000 | 30% |

*Basic exemption in case of Senior Citizen (Age 60 Years to 79 Years) is INR 300,000 and very senior citizen (Age 80 Years or more) is INR 500,000. There is no change in the exemption for 2020-21.

However, an optional tax slab rate is proposed for Individuals /HUF by insertion of section 115BAC in the Act, which provides the slab rate as below:

| Income (INR) | Rate of Tax |

| Up to INR 250,000 | NIL |

| INR 250,001 to INR 500,000 | 5% |

| INR 500,001 to INR 7,50,000 | 10% |

| INR 7,50,001 to INR 1,000,000 | 15% |

| INR 10,00,001 to INR 12,50,000 | 20% |

| INR 12,50,001 to INR 15,00,000 | 25% |

| Above INR 15,00,000 | 30% |

- Rebate under Section 87A remain unchanged for resident individual (whose income does not exceed 5,00,000) the amount of rebate is 100% of tax calculated before cess or 12,500 whichever is less.

- Surcharge: In case of Individuals/ HUF/ AOPs/BOI Surcharge are as under levied on categories of whose annual taxable income is as follows:

| Total income | Rate of Surcharge |

| Upto 5 million | Nil |

| Above INR 5 Million to INR 10 Million | 10% |

| Above INR 10 Million to INR 20 Million | 15% |

| Above INR 20 Million to INR 50 Million | 25% |

| Above 50 Million | 37% |

However, rate of surcharge will be limited to 15% if income Short-term Capital Gain Section 111A and Long-term Capital Gain U/s 112A of the Act .

Surcharge will remain at 12% on persons, other than companies, firms and cooperative societies having income above INR 10 Million.

- Health and Education Cess @ 4% is levied on income tax and surcharge, if any is also same.

Section 115BAC: (w.e.f. AY 2021‐22): To apply the concessional slab rate card, Individual/HUF need to be fulfilled some condition which is as below:

- The option shall be exercised for every previous year where the individual or the HUF has no business income, and in other cases the option once exercised for a previous year shall be valid for that previous year and all subsequent years. The option can be withdrawn only once where it was exercised by the individual or HUF having business income for a previous year other than the year in which it was exercised (i.e. First Year) and thereafter, the individual or HUF shall never be eligible to exercise option under this section.

- The option shall become invalid for a previous year or previous years, as the case may be, if the Individual or HUF fails to satisfy the conditions and other provisions of the Act shall apply;

- Another condition is that the assessee should not set off any brought forward losses and unabsorbed depreciation of past years is the same is attributable to any deduction specified above. Also, the assessee is also not allowed to set off loss from house property with any other head of income.

- Apart from the above conditions, following exemptions/ deductions need to be forego:

- Leave travel concession u/s 10(5)

- House rent allowance u/s 10(13A)

- Allowance u/s 10(14) except:

- Transport Allowance granted to a divyang employee to meet expenditure for the purpose of commuting between place of residence and place of duty

- Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office;

- Any Allowance granted to meet the cost of travel on tour or on transfer;

- Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

- Free food coupons/vouchers

- Allowances to MPs/MLAs u/s 10(17)

- Allowance for income of minor U/s 10(32)

- Exemption for SEZ unit u/s 10AA;

- Standard deduction(Rs.50,000), deduction for entertainment allowance and employment/ professional tax(Rs.2,500) u/s 16;

- Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23.(Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

- Additional deprecation under clause (iia) of sub-section (1) of section 32;

- Deductions under section 32AD, 33AB, 33ABA;

- Various deduction for donation for or expenditure on scientific research contained in sub-clause (ii) or sub-clause or sub-clause (iii) of sub-section (1) or sub-section (2AA) of section 35;

- Deduction under section 35AD or section 35CCC;

- Deduction from family pension under clause (iia) of section 57;

- Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc.). However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be

Section 6: It is proposed to amend Section 6 of Income Tax Act so as to provide that –

(i) the exception provided in clause (b) of Explanation 1 of subsection (1) to section 6 for visiting India in that year be decreased to 120 days from existing 182 days (i.e. a Citizen of India or PIO who came on visit to India now has to spend less than 120 days ).

(ii) an individual or an HUF shall be said to be “not ordinarily resident” in India in a previous year, if the individual or the manager of the HUF has been a non-resident in India in 7 out of 10 previous years preceding that year. (Earlier it was 9 out of 10).

(iii) an Indian citizen who is not liable to tax in any other country or territory shall be deemed to be resident in India. (w.e.f. AY 2021‐22).

Section 10(45): It is proposed to delete the section 10(45) of Income Tax Act and amend Section 8 of Election commission Act, 1991 which provides various perquisites or allowances to UPSC Chairman and members and Chief Election Commissioner and Election Commissioners respectively. (w.e.f. AY 2021‐22).

Section 17(2)(vi)/192/191/156/140A: Currently, ESOPs are taxed as perquisites under section 17(2) of the Act read with Rule 3(8)(iii) of the Rules. The taxation of ESOPs is split into two components:

1 Tax on perquisite as income from salary at the time of exercise.

2 Tax on income from capital gain at the time of sale.

The tax on perquisite under the head Salary is required to be paid at the time of exercising of option which may lead to cash flow problem as this benefit of ESOP is in kind. In order to ease the burden of payment of taxes by the employees of the eligible start-ups or TDS by the start-up employer, it is proposed to amend section 192 of the Act to provide that a person, being an eligible start-up referred to in section 80-IAC, responsible for paying any income in the nature of ESOPs to the assessee being perquisite shall be taxable and tax on such income shall be collected within fourteen days —

(i) after the expiry of 48 months from the end of the relevant assessment year (i.e. 5 years from the end of P.Y.) or

(ii) from the date of the sale of such ESOPs by the assessee; or

(iii) from the date of which the assessee ceases to be the employee of the Start Up;

whichever is the earliest on the basis of rates in force of the financial year in which the said specified security or sweat equity share is allotted or transferred.

Consequential amendments have been carried out in section 191 (for assessee to pay the tax direct in case of no TDS) and in section 156 (for notice of demand) and in section 140A (for calculating self-assessment). (w.e.f. AY 2020‐21).

Section 17(2)(vii): Under the existing provisions of the Act, the contribution by the employer to the account of an employee in a recognized provident fund exceeding 12% of salary is taxable. Further, the amount of any contribution to an approved superannuation fund by the employer exceeding Rs. 1,50,000 is treated as perquisite in the hands of the employee. Similarly, the assessee is allowed a deduction under National Pension Scheme (NPS) for 14% of the salary contributed by the Central Government and 10% of the salary contributed by any other employer.

Now, it is proposed to provide a combined upper limit of Rs. 7,50,000 in respect of employer’s contribution in a year to NPS, superannuation fund and recognised provident fund and any excess contribution is proposed to be taxable. Consequently, it is also proposed that any annual accretion by way of interest, dividend or any other amount of similar nature during the previous year to the balance at the credit of the fund or scheme may be treated as perquisite to the extent it relates to the employer’s contribution which is included in total income.(w.e.f. AY 2021‐22).

Section 80EEA: Under the existing provision a deduction in respect of interest up to one lakh fifty thousand rupees on loan taken for residential house property from any financial institution subject to the following conditions:

(i) loan has been sanctioned by a financial institution during the period beginning on the 1st April, 2019 to 31st March 2020.

(ii) the stamp duty value of house property does not exceed forty‐five lakh rupees;

(iii) assessee does not own any residential house property on the date of sanction of loan.

and where a deduction under this section is allowed for any interest, deduction shall not be allowed in respect of such interest under any other provisions of the Act for the same or any other assessment year.

Now it is proposed that the period of sanctioning of loan by the financial institution is to be extended to 31st March, 2021. (w.e.f. AY 2021‐22).

- Corporate Taxation

Currently Corporate Tax rate of 25% is applicable to companies with turnover up to INR 4000 million in financial year 2018-19 so it will cover 99.3% companies in India. Other companies will charge with tax rate 30% in addition to Education cess & Surcharge if any.

However, by Tax Amendment Act 2019, two different rates i.e 22% & 15% has been introduced by Section 115BAA & 115BAB for domestic companies. As per sections no deduction/exemption are allowed to get the benefit of concessional tax rate apart from some other condition as mentioned in Taxation Law Ordinance. Now it is proposed to allow to get deduction u/s 80JJAA & 80M, in case of domestic companies opting of taxation under these sections. (w.e.f. AY 2020‐21) & further it is also proposed generation of electricity also count as manufacturing to be covered for section 115BAB

Section 10 (48C): After Section 10 (48A) & 10(48B) which is related with the exemption to the foreign companies engaged in business of Crude oil, It is now proposed to introduced a new section 10(48C) to provide exemption to any income accruing or arising to Indian Strategic Petroleum Reserves Limited (ISPRL), being a wholly owned subsidiary of Oil Industry Development Board under the Ministry of Petroleum and Natural Gas, as a result of an arrangement for replenishment of crude oil stored in its storage facility in pursuance to directions of the Central Government in this behalf.

Exemption has condition that the crude oil is replenished in the storage facility within three years from the end of the financial year in which the crude oil was removed from the storage facility for the first time. (w.e.f. AY 2020‐21)

Section 35AD: Under the existing provisions of law, a domestic company which opted for concessional tax rate under section 115BAA or section 115BAB of the Act, which does not claim deduction under section 35AD, may also be denied normal depreciation under section 32 due to operation of section 35AD(4).

It is proposed to amend section 35AD(1) to make the deduction thereunder optional. It is further proposed to amend section 35AD(4) to provide that no deduction will be allowed in respect of expenditure incurred under sub-section (1) in any other section in any previous year or under this section in any other previous year, if the deduction has been claimed by the assessee and allowed to him under this section. Now a company opting for concessional tax rate of 22% is eligible for normal depreciation u/s 32. (w.e.f. AY 2020‐21)

Section 43B: Under the existing provision Section 44 of the Act provides that computation of profits and gains of any business of insurance, including any such business carried on by a mutual insurance company or a co-operative society shall be computed in accordance with the rules contained in the First Schedule to the Act.

Section 43B of the Act provides for allowance of certain deductions, irrespective of the previous year in which the liability to pay such sum was incurred by the assessee according to the method of accounting regularly employed by the assessee, only in the previous year in which such sum is actually paid.

As per Rule 5 of the First Schedule, the deduction of expenditure was subject to the provisions of Sec 43B but there is no provision of allowance of the expenses in subsequent year on actual

payment.

Now, it is proposed to insert a proviso after clause (c) of the said rule 5 to provide that any sum payable by the assessee which is added back under section 43B in accordance with clause (a) of the said rule shall be allowed as deduction in computing the income under the rule in the previous year in which such sum is actually paid. (w.e.f. AY 2020‐21)

Section 44AB: In order to reduce compliance burden on small and medium enterprises Tax Audit thresholds increased from Rs 1 crore to Rs 5 crore with a rider that total receipts and total payments in cash should not exceed 5% of such total receipts and total payments made respectively during the year.

Further, to enable pre-filling of returns in case of persons having income from business or profession, it is required that the tax audit report may be furnished by the said assessees at least one month prior to the due date of filing of return of income. This implies that the due date of filing tax audit will be 30th September for all assesses and 31st October in case the assessee is liable for transfer pricing audit.

Further, the due date for filing return of income under section 139 is proposed to be amended to 31st October/30th November of the assessment year. (w.e.f. AY 2020‐21)

Also, the distinction between a working and a non-working partner of a firm for the purpose of determining the due date of filling returns has been removed. (w.e.f. 01.04.2020)

Section 72AA It is proposed to relax the provision of carryforward of losses or depreciation in amalgamation of public banking sector and General Insurance companies. (w.e.f. AY 2020‐21)

Section 80-IAC Earlier 80-IAC of the Act provide for a deduction of an amount equal to 100% of the profits and gains derived from an eligible business by an eligible start-up for 3 consecutive A.Y. out of 7 years, at the option of the assessee, subject to the condition that the eligible start-up is incorporated on or after 1st April 2016 but before 1st April 2021 and the total turnover of its business does not exceed Rs. 25 crores. Now it is proposed that upper limit of 7 years will replace by 10 years and total turnover limit will be Rs. 100 Crores instead of Rs.25 crores. (w.e.f. AY 2021‐22)

Section 80-IBA In order to boost the housing sector under affordable housing scheme, the period of approval of the project by the competent authority is proposed to be extended to 31st March, 2021 which was earlier 31st March 2020.(w.e.f. AY 2021‐22)

Section 115UA Under the existing provision a taxation regime applicable to business trusts. Under the said regime, the total income of the trust, excluding capital gains income is charged at the maximum marginal rate. Further, the income by way of interest and rent, received by the business trust from a Special Purpose Vehicle (SPV) is accorded pass through treatment i.e. there is no taxation of such interest or rental income in the hands of the trust and no withholding tax at the level of SPV. The business trusts are also required to furnish return of income and adhere to other reporting requirements.

The definition of “business trust” has been provided in clause (13A) of section 2 of the Act, to mean a trust registered as an Infrastructure Investment Trust (InvIT) or a Real Estate Investment Trust (REIT) under the relevant regulations made under the Securities and Exchange Board of India (SEBI) Act, 1992 and the units of which are required to be listed on a recognised stock exchange in accordance with the relevant regulations. Now it is proposed to amend clause (13A) of section 2 of the Act to modify the definition of “business trust” so as to do away with the requirement of the units of business trust to be listed on a recognised stock exchange. (w.e.f. AY 2021‐22)

Section 115-O Dividend Distribution Tax being abolished w.e.f. April 1,2020. Dividend income now to be taxed as normal income in the hands of shareholder. Benefit of section 80M will be available to a company in respect of dividend income received by it during the previous year and distributed by it, one month before the due date of filing return.

No deduction of expenditure against dividend income will be allowed under section 57 except interest which will not exceed 20% of dividend income

Section 194 is also amended to include dividend for tax deduction at the rate of 10% with the threshold limit of Rs. 5,000 instead of Rs. 2,500 for dividend paid other than cash. Consequential changes with regards to taxation of Dividend are proposed in Section 10(34), 115R,10(35),10(23FC), 10(23FD), 10(23D),115BBDA, 194LBA, 195, 196A, 196C & 196.

New Section 194K has been proposed to introduced to provide that any person responsible for paying to a resident any income in respect of units of a Mutual Fund specified under clause (23D) of section 10 or units from the administrator of the specified undertaking or units from the specified company shall at the time of credit of such income to the account of the payee or at the time of payment thereof by any mode, whichever is earlier, deduct income-tax there on at the rate of ten per cent. It may also be provided for threshold limit of Rs 5,000/- so that income below this amount does not suffer tax deduction.

It is also proposed to defined “Administrator”, “specified company”, as already defined in clause (35) of section 10. It is also proposed to define “specified undertaking” as in clause (i) of section 2 of the Unit Trust of India (Transfer of Undertaking and Repeal) Act, 2002. It is also proposed to provide that where any income is credited to any account like suspense account, in the books of account of the person liable to pay such income, the liability for tax deduction under this section would arise at that time.

- International Taxation/ Transfer Pricing

Section 9(i): It is proposed to defer the provision of Significant Economic presence(SEP) as introduced by Finance Act 2018 and will become applicable from AY 2022-23

Further it is proposed to amend the source rule by inserting the Explanation 3A has been inserted to provide that the income attributable to the operations carried out in India, as referred to in Explanation 1 to Section 9, shall include income from––

(i) such advertisement which targets a customer who resides in India or a customer who accesses the advertisement through internet protocol address located in India;

(ii) sale of data collected from a person who resides in India or from a person who uses internet protocol address located in India; and

(iii) sale of goods or services using data collected from a person who resides in India or from a person who uses internet protocol address located in India

As per the discussion going on in international forum, countries generally agree that income from advertisement that targets Indian customers or income from sale of data collected from India or income from sale of goods and services using such data collected from India, needs to be accounted for in Indian revenue . Hence, it is proposed to amend the source rule to clarify this position. (w.e.f. AY 2021‐22). However, for attribution of income related to SEP transaction or activities the amendment will take effect from 1st April, 2022 and will, accordingly, apply in relation to the assessment year 2022-23 and subsequent assessment years.

Section 9(1)(vi) deems certain income by way of royalty to accrue or arise in India. Explanation 2 of said clause defines the term “royalty” to, inter alia, mean the transfer of all or any rights (including the granting of a licence) in respect of any copyright, literary, artistic or scientific work including films or video tapes for use in connection with television or tapes for use in connection with radio broadcasting, but not including consideration for the sale, distribution or exhibition of cinematographic films.

Due to exclusion of consideration for the sale, distribution or exhibition of cinematographic films from the definition of royalty, such royalty is not taxable in India even if the DTAA gives India the right to tax such royalty. Such a situation is discriminatory against Indian residents, since India is foregoing its right to tax royalty in case of a non-resident from another country without that other country offering similar concession to Indian resident. Hence, it is proposed to amend the definition of royalty so as not to exclude consideration for the sale, distribution or exhibition of cinematographic films from its meaning.

Further, CBDT has been empowered u/s 295 to make rules to provide for the manner in which and the procedure by which the income shall be arrived at in the case of:

(i) operations carried out in India by a non-resident; (w.e.f. AY 2021‐22) and

(ii) transaction or activities of a non-resident (w.e.f. AY 2022‐23)

Section 9A: The existing two conditions are relaxed after getting representations with regards to Average corpus balance and contribution fund limit. Proposal for change in condition is as under:

(i) For the purpose of calculation of the aggregate participation or investment in the fund, directly or indirectly, by Indian resident, contribution of the eligible fund manager during first three years up to twenty-five crore rupees shall not be accounted for; and

(ii) If the fund has been established or incorporated in the previous year, the condition of monthly average of the corpus of the fund to be at one hundred crore rupees shall be fulfilled within twelve months from the last day of the month of its establishment or incorporation. (w.e.f. AY 2020‐21)

Section 10: Income of Foreign Sovereign Wealth Fund from their investments in India have been exempted for investments made till 2024 for a period of 3 years. (w.e.f. AY 2021‐22)

Section 90/90A: Aligning purpose of entering into Double Taxation Avoidance Agreements (DTAA) with Multilateral Instrument (MLI):It is proposed to amend section 90(1)(b) of the Act so as to provide that the Central Government may enter into an agreement with the Government of any country outside India or specified territory outside India for, inter alia, the avoidance of double taxation of income under the Act and under the corresponding law in force in that country or specified territory, as the case may be, without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance (including through treaty-shopping arrangements aimed at obtaining reliefs provided in this agreement for the indirect benefit of residents of any other country or territory). Similar amendment has also been proposed in section 90A of the Act. (w.e.f. AY 2021‐22)

Section 94B: Section 94B of the Act provides that deductible interest or similar expenses exceeding Rs. 1 crore of an Indian company, or a permanent establishment (PE) of a foreign company, paid to the associated enterprises (AE) shall be restricted to

– 30 % of EBITDA or

– interest paid or payable to AE, whichever is less.

Further, a loan is deemed to be from an AE if an AE provides implicit or explicit guarantee in respect of that loan. AE for the purposes of this section has the meaning assigned to it in section 92A of the Act.

This section was inserted in the Act through the Finance Act, 2017 in order to implement the measures recommended in BEPS Action Plan 4 of OECD. It is, therefore, proposed to amend section 94B of the Act so as to provide that provisions of interest limitation would not apply to interest paid in respect of a debt issued by a lender which is a PE of a non-resident, being a person engaged in the business of banking, in India. (w.e.f. AY 2021-22)

Section 92CB & 92CC: Amendment has been proposed for providing attribution of profit to PE in Safe Harbour rules & APA. Safe Harbour rules (SHR) u/s 92CB provides tax certainty for relatively smaller cases for future years on general terms, while Advance Pricing Agreement (APA) u/s 92CC provides tax certainty on case to case basis not only for future years but also Rollback years. Both SHR and the APA have been successful in reducing litigation in determination of the ALP.

Now, It is proposed to have Safe Harbour Rules and APA for the attribution of profits to the PE u/s 9(1)(i) in accordance with rule 10 of the Rules which may result in avoidable disputes in a number of cases. (w.e.f. AY 2020-21)

Section 115A: It is proposed to extend the exemption from filing of Income Tax Return by the Non-Resident if TDS has been deducted on Royalty or Fees for Technical Services as mentioned in the Section and assessee has no other income. Non-Resident already have such exemption if income contain Dividend or Interest only and prescribed TDS has been deducted thereon.(w.e.f. AY 2020-21)

- Capital Gain

Section 43CA/50C/56: It is proposed to amend the Circle rate value adjustment for computing capital gain, sale proceeds and income in the hands of buyer allowed up to 10% of amount paid as against 5% at present. (w.e.f. AY 2021-22)

Section 49 & 2(42A): It is proposed to introduced 49(2AG) & 49(2AH) for defining the cost of acquisition of units of Segregated Portfolio. As per a new sub-section (2AG) is proposed to be inserted in section 49 of the Act to provide that the cost of acquisition of a unit or units in the segregated portfolio shall be the amount which bears to the cost of acquisition of a unit or units held by the assessee in the total portfolio, the same proportion as the net asset value of the asset transferred to the segregated portfolio bears to the net asset value of the total portfolio immediately before the segregation of portfolios.

And sub-section (2AH) in the said section to provide that the cost of the acquisition of the original units held by the unit holder in the main portfolio shall be deemed to have been reduced by the amount as so arrived at under the proposed sub-section (2AG). (w.e.f. AY 2020-21)

Section 55: The existing provisions of section 55 of the Act provide that for computation of capital gains, an assessee shall be allowed deduction for cost of acquisition of the asset and also cost of improvement, if any. However, for computing capital gains in respect of an asset acquired before 1st April, 2001, the assessee has been allowed an option of either to take the fair market value of the asset as on 1st April, 2001 or the actual cost of the asset as cost of acquisition.

Now, It is proposed to amend the provision to provide that in case of a capital asset, being land or building or both, the fair market value of such an asset on 1st April, 2001 shall not exceed the stamp duty value of such asset as on 1st April, 2001 where such stamp duty value

is available. (w.e.f. AY 2021-22)

- Permanent Account Number (PAN) /Income Tax Return (ITR)

Section 119A:The Board shall adopt and declare a Taxpayer’s Charter and issue such orders, instructions, directions or guidelines to other income-tax authorities as it may deem fit for the administration of such Charter. (w.e.f. AY 2020‐21).

Section 139A: As per speech of FM, PAN will be issued on the basis of Aadhar particulars, therefore no need for further documentation. (w.e.f. AY 2020‐21)

Section 140A: It is proposed to insert “any other person, as may be prescribed” in this section for the verification of ITR in case of Company or LLP as the case may be.

- Tax deducted at Sources (TDS)

Section 194A:it is proposed to withhold the TDS on interest paid by co-operative society u/s 194A, if-

(a) the total sales, gross receipts or turnover of the co-operative society exceeds Rs. 50 crore during the financial year immediately preceding the financial year in which the interest is credited or paid; and

(b) the amount of interest, or the aggregate of the amount of such interest, credited or paid, or is likely to be credited or paid, during the financial year is more than Rs. 50,000 in case of payee being a senior citizen and Rs. 40,000, in any other case. (w.e.f.01.04.2020)

Section 194C: It is proposed to amend the triggering point to deduct the TDS in this section by Individual or HUF instead of audit u/s 44AB they become liable where total sales, gross receipts or turnover from business or profession carried on by them exceeding one crore rupees in case of business or fifty lakh rupees in case of profession. Similar amendment also done in section 194H, 194A, 194-I, 194J & 206C.

It is also proposed to amend the definition of work in a contract manufacturing, the raw material provided by the assessee or its associate shall fall within the purview of the ‘work’ under section 194C. Associate is proposed to be defined to mean a person who is placed similarly in relation to the customer as is the person placed in relation to the assessee under the provisions contained in clause (b) of sub-section (2) of section 40A of the Act.(w.e.f.01.04.2020)

Section 194LC: it is proposed to amend of section 194LC of the Act to extend the period to 1st July, 2023 from 1st July, 2020 for concessional rate of withholding tax and also to provide for the concessional rate of four per cent on interest payable on any long term bonds or Rupee Denominated Bonds i.e. RDB listed in stock exchanges in IFSC. (w.e.f. 01.04.2020)

Section 194LD: it is proposed to amend of section 194LD of the Act to extend the period to 1st July, 2023 from 1st July, 2020 for concessional rate of withholding tax and also to provide for the concessional rate of 5% on interest payable to FII or QFI in respect of investment made in municipal debt security. (w.e.f. 01.04.2020)

Section 194J: it is proposed ito reduce rate for TDS in case of fees for technical services, or any remuneration or fees or commission by whatever name called (other than those on which tax is deductible under section 192 of the Act, to a director), or royalty or any sum referred to in clause (va) of section 28 i.e other than professional services, to 2% from existing 10%. The TDS rate in other cases under section 194J would remain same at 10%. (w.e.f. 01.04.2020)

Section 194O: It is proposed to introduce a new levy of TDS on e-commerce at the rate of 1% on the gross amount of such sales or service or both. The TDS is to be paid by e-commerce operator for sale of goods or provision of service facilitated by it through its digital or electronic facility or platform.

E-commerce operator is required to deduct tax at the time of credit of the amount of sale or service or both to the account of e-commerce participant or at the time of payment thereof to such participant by any mode, whichever is earlier. No TDS is liable to deducted if total payment to e-commerce participant doesn’t exceeds Rs. 5 Lakh(threshold for deducting TDS).

Consequential amendments are being proposed in section 197 (for lower TDS), in section 204 (to define person responsible for paying any sum) and in section 206AA to provide for tax deduction at 5 % in non-PAN/ Aadhaar cases instead of 20%.

This proposal will be applicable not only to electronic retailers such as Amazon and Flipkart but also to cab and restaurant aggregators like Uber, Ola, Swiggy, Zomato, etc. (w.e.f. 01.04.2020)

Section 206C: it is proposed to levy TCS on overseas remittance for Rs. 7 lakh or more under LRS scheme of RBI (by Authorised dealer) and on sale of overseas tour package @ 5 % from the buyer of foreign currency & tour package purchaser respectively. In non- PAN/Aadhaar cases the rate shall be ten per cent.

Further seller will also collect TCS on sale of goods @ 0.1% and buyer of goods if total value to be received will be Rs. 50 lac or more during the year. Only those sellers are liable to collect TCS who have turnover from the business exceeding Rs. 10 Crore during the preceding financial year. In non- PAN/Aadhaar cases the rate shall be 1 per cent.

The above TCS provision shall not apply if the buyer is,-

- liable to deduct tax at source under any other provision of the Act and he has deducted such amount. Further in case of sale of Goods No such TCS is to be collected, if the seller is liable to collect TCS under other provision of section 206C.

- the Central Government, a State Government , an embassy, a High Commission, legation, commission, consulate, the trade representation of a foreign State, a local authority as defined in Explanation to clause (20) of section 10 or any other person notified by the Central Government in the Official Gazette for this purpose subject to such conditions as specified in that notification. (e.f. 01.04.2020)

- Charitable Trust

Section 12AB: With the advancement in technology, it is now feasible to standardise the process through which one-to-one matching between what is received by the exempt entity and what is claimed as deduction by the assessee.

Furnishing of Statement: This standardization may be similar to the provisions relating to the tax collection/ deduction at source, which already exist in the Act. Therefore, the entities receiving donation/ sum may be made to furnish a statement in respect thereof, and to issue a certificate to the donor/ payer and the claim for deduction to the donor/ payer may be allowed on that basis only. In order to ensure proper filing of the statement, levy of a fee u/s 234G and penalty may also be provided in cases where there is failure to furnish the statement.

Hence, it is proposed to amend relevant provisions of the Act to provide that,-

- similar to exemptions under clauses (1) and (23C), exemption under clause (46) of section 10 shall be allowed to an entity even if it is registered under section 12AA subject to the condition that the registration shall become inoperative. If the entity wishes to make it operative in the future, it will have to file an application and then it would not be entitled for deduction under clause (46) from the date on which the registration becomes operative.

- Simultaneously Registration under 12AA & 10(23C) not possible. The condition about making it operative again would also be similar to what is proposed for clause (46) of section 10.

- What if already registered: an entity approved, registered or notified under clause (23C) of section 10, section 12AA or section 35 or 80G of the Act, as the case may be, shall be required to apply for approval or registration or intimate regarding it being approved, as the case may be, and on doing so, the approval, registration or notification in respect of the entity shall be valid for a period not exceeding five previous years at one time calculated from 1st April, 2020.

- Registration application to Whom: application for approval under section 80G shall be made to Principal Commissioner or Commissioner.

- an entity making fresh application for approval under clause (23C) of section 10, for registration under section 12AA, for approval under section 80G shall be provisionally approved or registered for three years on the basis of application without detailed enquiry even in the cases where activities of the entity are yet to begin and then it has to apply again for approval or registration which, if granted, shall be valid from the date of such provisional registration. The application of registration subsequent to provisional registration should be at least six months prior to expiry of provisional registration or within six months of start of activities, whichever is earlier.

- the application pending for approval, registration, as the case may be, shall be treated as application in accordance with the new provisions, wherever they are being provided for.

- similar to section 80G of the Act, deduction of cash donation under section 80GGA shall be restricted to Rs 2,000/- only.

- It is also proposed that order passed by Principle Commissioner or Commissioner under newly inserted section 12AB has also been Appealable orders for Appellate Tribunal.(w.e.f. 01.06.2020)

- Co-operative Society

Under the current provision, co-operative society is taxable as per slab rate given as below:

| Income (INR) | Rate of Tax |

| Up to INR 10,000 | 10% |

| INR 10,000 to INR 20,000 | 20% |

| Above INR 20,000 | 30% |

Surcharge @ 12% of income tax if net income exceeds Rs.1 Crore is applicable. Additionally, cess of 4% shall be levied.

However, Resident Co-operative society have option for concessional tax rates of 22% is applicable if opted for section 115BAD. Conditions are similar as laid down in Taxation amendment ordinance, 2019 u/s 115BAB & 115BAA. Further if the person has a Unit in the International Financial Services Centre (IFSC), as referred to in sub-section (1A) of section 80LA, the deduction under section 80LA shall be available to such Unit subject to fulfilment of

the conditions contained in that section. Consequential amendment has been done in AMT Provisions.

- Other Major Amendments

Section 133A: Under the existing provisions of section 133A of the Act, an income tax authority as defined therein (JCIT or above) is empowered to conduct survey at the business premises of the assessee under his jurisdiction with the prior approval of JCIT.

It is proposed to substitute the proviso to sub-section (6) of section 133A to provide that,-

(A) in a case where the information has been received from the prescribed authority, no income-tax authority below the rank of Joint Director or Joint Commissioner, shall conduct any survey under the said section without prior approval of the Joint Director or the Joint Commissioner, as the case may be; and

(B) in any other case, no income-tax authority below the rank of Commissioner or Director, shall conduct any survey under the said section without prior approval of the Commissioner or the Director, as the case may be. (w.e.f. 01.04.2020)

Section 143/144: The existing provisions of section 143 contain provisions relating to E-Assessment scheme i.e 143(3A). Now this E-Assessment is also applicable to 144 also. The Central Government may, for the purpose of giving effect to the scheme made under sub-section (3A), by notification in the Official Gazette, direct that any of the provisions of this Act relating to assessment of total income or loss shall not apply or shall apply with such exceptions, modifications and adaptations upto 31st day of March, 2022. (w.e.f. 01.04.2020)

Section 144C: Section 144C of the Act provides that in case of certain eligible assessees, viz., foreign companies and any person in whose case transfer pricing adjustments have been made under sub-section (3) of section 92CA of the Act, the Assessing Officer (AO) is required to forward a draft assessment order to the eligible assessee, if he proposes to make any variation in the income or loss returned which is prejudicial to the interest of such assessee.

It is proposed that the provisions of section 144C of the Act may be suitably amended to:-

(A) include cases, where the AO proposes to make any variation which is prejudicial to the interest of the assessee, within the ambit of section 144C; earlier only returned particulars are covered.

(B) expand the scope of the said section by defining eligible assessee as a non-resident, earlier only foreign companies are covered. (w.e.f. 01.04.2020)

Section 250(6A)/274 :It is proposed to notify E-Appeal/E-Penalty scheme also as till now only e-Assessment scheme is existing in the statute.

It is also proposed to empower the Central Government, for the purpose of giving effect to the scheme made under the proposed sub-section, by notification in the Official Gazette, to direct that any of the provisions of this Act relating to jurisdiction and procedure of disposal of appeal shall not apply or shall apply with such exceptions, modifications and adaptations as may be specified in the notification. Such directions are to be issued on or before 31st March 2022. (w.e.f. 01.04.2020)

Section 254: As per current provision stay can be granted maximum by 365 days as per second proviso of section (180 days as per first proviso). Now it is proposed that if an assessee needs stay of demand then deposit of 20% of disputed demand is the precondition. And maximum stay of 365 days can be granted only if application made by assessee and with a reason that delay in disposing of appeal is not cause by assessee. (w.e.f. 01.04.2020)

Section 271AAD Penalty on Fake Invoices: It is proposed to introduce a new provision to levy penalty on a person, if it is found during any proceeding under the Act that in the books of accounts maintained by him there is a

(i) false entry or

(ii) any entry relevant for computation of total income of such person has been omitted to evade tax liability.

The penalty payable by such person shall be equal to the aggregate amount of false entries or omitted entry.

It is also propose to provide that any other person, who causes in any manner a person to make or cause to make a false entry or omits or causes to omit any entry, shall also pay by way of penalty a sum which is equal to the aggregate amounts of such false entries or omitted entry.

The false entries is proposed to include use or intention to use –

(a) forged or falsified documents such as a false invoice or, in general, a false piece of documentary evidence; or

(b) invoice in respect of supply or receipt of goods or services or both issued by the person or any other person without actual supply or receipt of such goods or services or both; or

(c) invoice in respect of supply or receipt of goods or services or both to or from a person who do not exist. (w.e.f. 01.04.2020)

Section 285BB: it is proposed to introduce a new section 285BB in the Act regarding annual financial statement. This section proposes to mandate the prescribed income-tax authority or the person authorised by such authority to upload in the registered account of the assessee a statement in such form and manner and setting forth such information, which is in the possession of an income-tax authority, and within such time, as may be prescribed. Consequently, section 203AA is proposed to be deleted. (w.e.f. 01.06.2020)

Section 288: It lays down the list of persons eligible to appear as an authorized representative of the Assessee. While the IBC empowers the Insolvency Professional or the Administrator to exercise the powers of the Board of Directors or corporate debtor, it has been reported that lack of explicit reference in section 288 of the Act for an Insolvency Professional to act as an authorised representative of the corporate debtor has been raising certain practical difficulties.

Therefore, it is proposed to amend sub-section (2) of section 288 to enable any other person, as may be prescribed by the Board, to appear as an authorised representative. (w.e.f. 01.04.2020)

———-x———-

INDIRECT TAXES

CHANGES IN THE CUSTOMS ACT, 1962

- Provision in relation to prohibitions on the importation and exportation of goods has been amended to include any other goods (in addition to gold and silver) for prevention of injury to the economy of the Country.

- Explanation inserted to clarify that any notice issued under provision of recovery of duty prior to March 28, 2018 i.e, date of enactment of the Finance Act 2018, would be governed by the law as it existed before the said enactment, notwithstanding order of any Appellate Tribunal, Court or any other law to the contrary.

- New provision regarding administering the preferential tariff treatment regime under Trade Agreements has been inserted to specifically provide for certain obligations on importer and prescribe for time bound verification from exporting country in case of doubt.

- Pending verification preferential tariff treatment shall be suspended and goods shall be cleared only on furnishing security equal to differential duty.

- In certain cases, the preferential tax treatment may be denied without further verification.

- Any goods imported on a claim of preferential rate of duty which contravenes the provision of law would be confiscated.

- New provision has been inserted to provide for creation of an Electronic Duty Credit Ledger in the customs system. This will enable duty credit in lieu of duty remission to be given in respect of exports or other such benefit in electronic form for its usage, transfer etc.

- Provision relating to recovery of duties expanded to include electronic credit of duties.

- Central Government has been empowered for making rules specifying time, form, manner, restrictions and conditions for administering the preferential tariff treatment regime under Trade Agreements.

- Board has been empowered for making regulations specifying the manner of maintaining electronic duty credit ledger, making payment from such ledger, transfer of duty credit from ledger of one person to the ledger of another and the conditions, restrictions and time limit relating thereto.

Health Cess

- Health Cess is being imposed on the import of medical devices/ instruments at the rate of 5% ad valorem on the import value of such goods Ʈ Health Cess would be a duty of Customs. Ʈ Health Cess would not be imposed on medical devices which are exempt from BCD. Ʈ Inputs/parts used in the manufacture of medical devices will also be exempt from Health Cess. Export Promotion scrips shall not be used for payment of said Cess.

CHANGES IN THE CUSTOMS TARIFF

- General rate of BCD remains at 10 percent.

- Provision inserted to strengthen the anticircumvention measures by making them more comprehensive and wider in scope to deal with the case of circumvention

- Provision inserted to enable investigation into case of circumvention of countervailing duty for enabling imposition of such duty.

- Central Government empowered to apply safeguard measures, in case any article is imported into India in such increased quantities and under such conditions so as to cause or threatening to cause serious injury to domestic industry

Exemption from Basic Custom Duty / Security Welfare Surcharge

- Poly Ester Liquid Crystal Polymers falling under tariff item 3907 99 90 for use in manufacture of Connectors, is being exempted from BCD subject to actual user condition.

- Parts of Microphones falling under tariff line 8518 10 00 is being exempted subject to actual user condition.

- Completely Built Units (CBU) of all commercial vehicles (including electric commercial vehicles) falling under headings 8702 and 8704 is being exempted from levy of Social Welfare Surcharge with effect from April 1, 2020

Withdrawal of Exemption

- Japanese Encephalitis (JE) vaccine imported by the Andhra Pradesh Government through UNICEF’ falling under Chapter 30, these goods will attract BCD at 5%

- Fingerprint readers/ scanner for use in manufacture of cellular mobile phones falling under tariff item 8517 70 90

- Common Wealth Games, 2010

- Exemption to import by Power Grid Corporation of India for setting up of Rihand-Sasaram-Bihar sheriff HV DC Link Back to Back Station Project

- Water supply projects for industrial and agricultural use exempted under Project Imports

- Exemption of SWS on specified goods falling under Chapter 84,85,90 some of key items are as follows :-

- Units of automatic data processing machines falling under sub-heading 8517 62 Information Technology software, falling under heading 8523

- Units of automatic data processing machines falling under sub-heading 8517 62

- Printed circuit assemblies of word processing machines and units thereof

- Parts (other than populated PCBs) for digital still image video cameras

- Printed circuit assemblies falling under tariff item 9017 90 00 for drafting machines or drawing machines of heading 9017

|

Central Goods and Service Tax, 2017 |

- Definition of ‘Union Territory’ has been amended to include Ladakh;

- Certain specified suppliers of goods (namely suppliers of goods not leviable to tax, suppliers making inter-state supply or suppliers supplying goods through e-commerce platforms) were not eligible to opt for the composition scheme. The said provision have been extended to include suppliers of ‘services’ as well in the said cases;

- Earlier the time limit for availing ITC in respect of a debit note was dependent on the invoice pertaining to that debit note. Now the provisions have been amended as per which the time limit for availing ITC in respect of a debit note would depend on the period to which the debit note pertains.

- Provision relating to cancellation (or suspension) of registration have been extended to apply to registered persons who voluntarily obtained GST registration.

- Provision relating to the time limit for filing application for revocation of cancellation of registration (time limit of 30 days) has been amended to enable the Additional Commissioner or the Joint Commissioner to extend such time limit by an additional 30 days. The Commissioner has been granted powers to further extend such period by 30 day.

- Provision relating to tax invoice in case of supply of services has been amended to enable the Government to specify the categories of services or supplies in respect of which a tax invoice shall be issued, within such time and in such manner as may be prescribed.

- Provisions relating to furnishing of certificate of tax deduction at source have been amended wherein the Government would prescribe the form and manner in which certificate of tax deduction at source is required to be issued. Further, provision relating to late fee in case there is delay in furnishing of such certificate has been omitted.

- Provisions related to Constitution of Appellate Tribunal and Benches thereof has been amended to empower the Government for specifying a Bench of Appellate Tribunal for the State of Jammu and Kashmir.

- Penalty provisions in case of specified offences have been extended to a person who retains the benefit of such transaction and at whose instance such transaction is conducted. The penalty sought to be imposed in such cases is an amount equivalent to the tax evaded or input tax credit availed of or passed on.

- Provision related to punishment for certain offences has been extended to include whoever causes to commit and retain benefits arising out of such an offence. Further, the provisions related to punishment for wrong availment of ITC have been extended to include cases where ITC is availed without any bill or invoice.

- Retrospective amendments in transitional arrangements for ITC have been introduced to mandate the law for restricting the time limit for availing ITC.

- Earlier in terms of Schedule II (Activities or transactions to be treated as supply of goods or supply of services) certain specified transactions related to Transfer of business assets were treated as supply “whether or not for a consideration”. Vide the amendment, the said restriction has been removed.

- The refund of accumulated credit of compensation cess on tobacco products arising out of inverted duty structure in Compensation Cess was disallowed vide Notification dated September 30, 2019. The said notification has been given retrospective effect from July 01, 2017, thereby implying that no refund would be admissible on tobacco products on account of inverted duty structure.

The existing provisions of section 9 of the PBPT Act, inter-alia, provides that, a member of the Indian Revenue Service who has held the post of Commissioner of Income-tax or equivalent post in that Service; or a member of the Indian Legal Service who has held the post of Joint Secretary or equivalent post in that Service is qualified for appointment as a Member of the Adjudicating Authority.

It is proposed to amend the said section so as to provide that a person who is qualified for appointment as District Judge shall also be eligible for the appointment as a Member of the Adjudicating Authority.

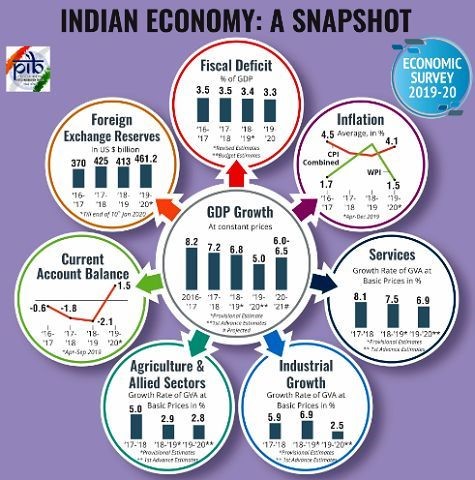

Economic Survey 2019-20

The Department of Economic Affairs, Finance Ministry of India presents the Economic Survey in the parliament every year, just before the Union Budget. This survey has been prepared by the Chief Economic Advisor Sh. Krishnamurthy Subramanian. The Economic Survey, on the other hand, talks about the overall economic progress made in the previous fiscal year and the challenges faced to achieve the targeted GDP Growth. Get here the detailed analysis of the Economic Survey along with the highlights and brief summary.

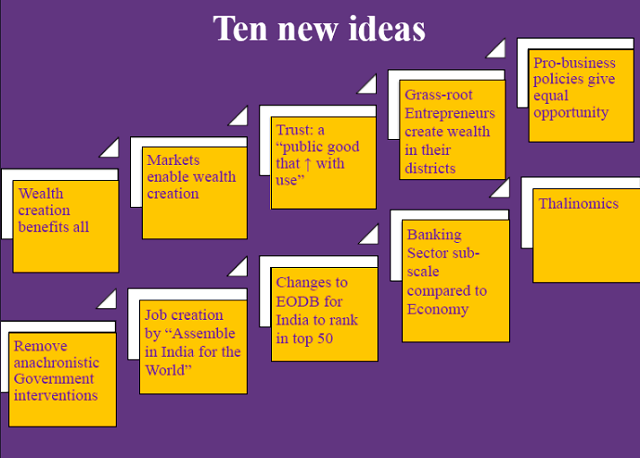

Theme of Economic Survey 2020 – “Enable Markets, Promote ‘Pro-Business’ Policy & Strengthen ‘Trust’ in Economy”

Fiscal Deficit:

- FY 2019-20 ended with fiscal deficit at 3.3 per cent of GDP which is further expected to follow a gradual path of reduction and attain the targeted level of 3 per cent of GDP in 2020-2021 and debt to GDP ratio of 48 percent. The declining path of central govt debt was expected to continue with debt reaching 46.2 percent of GDP and 44.4 percent of GDP in 2020-21 and 2021-22.

- Following the path of fiscal consolidation, the Union Budget 2019-20 sought to contain the fiscal deficit, which is reflective of the total borrowing requirements of Government, at 7,03,760 crore i.e. 3.3 percent of the GDP, as against 3.4 percent of GDP in 2018-19 Provisional Actuals (PA)

GDP Growth:

- GDP growth of India should strongly rebound in 2020-21 and more so on a low statistical base of 5 percent growth in 2019-20. On a net assessment of both the downside/upside risks, India’s GDP growth is expected to grow in the range of 6.0 to 6.5 percent in 2020-21.

Inflation and monetary policy:

- Retail inflation based on consumer price index – Combined (CPI-C) increased to 4.1 per cent(April-December) in 2019-20 from 3.7 per cent in 2018-19(April-December),3.4 per cent in 2017-18, 4.5 per cent in 2016-17, 4.9 per cent 2015-16 and 5.9 per cent in 2014-15.

- Due to the high overall weight attached to the food and clothing & footwear groups in the rural index, the overall inflation observed in rural areas at 3.4 per cent was lower than the overall inflation observed in urban areas which was at 0 per cent in 2019-20 (April-December). The decline in rural inflation in items like clothing and footwear, fuel and light could be due to fall in growth of real rural wages, while rise in rural price index for items like education, health, personal care etc. also raises the question of affordability of these items to the rural segment.

- Wholesale Price Index (WPI) inflation has seen an increase between 2015-16 and 2018-19, it fell from 4.7 per cent in 2018-19 (April to December, 2018) to 5 per cent during 2019-20 (April to December, 2019)

External Sector:

- India’s external sector gained further stability in H1 of 2019-20, with a narrowing of Current Account Deficit (CAD) as percentage of GDP from 2.1 in 2018-19 to 1.5 in H1 of 2019-20.

- On average, India’s merchandise trade balance has improved from 2009-14 to 2014-19, although most of the improvement in the latter period was on account of more than fifty per cent decline in crude prices in 2016-17. Lately the improvement in trade balance has positively contributed to the improvement in BoP position

- The BoP has improved from US$ 412.9 billion of forex reserves in end March, 2019 to US$ 433.7 billion in end September, 2019 and further to US$ 461.2 billion as on 10th January, 2020. Yet the improvement has an undercurrent of

- An increase in merchandise exports to GDP ratio has a net positive impact on BOP position. Over the years the merchandise exports to GDP ratio has been declining, entailing a negative impact on the BoP Merchandise exports as a percent of GDP has declined from 12.1 percent in 2018-19 to 11.3 percent in 2019-20 H1. Growth in Non-POL exports dropped significantly from 11 percent in 2009-14 to 2.6 percent in 2014-19 and 6.6 percent in 2018-19 and further to -0.8 percent in 2019-20.

- An increase in the merchandise imports to GDP ratio has a net negative impact on the BoP position. Over the years the ratio has been declining for India entailing a net positive impact on the BoP position. India’s merchandise imports as a percent of GDP has declined from 24.3 percent in 2009-14 to 17.7 percent in 2019-20 H1. Share of POL import in total imports has declined from 32.1 percent in 2009-14 to 26.3 percent in 2019-20 H1.

Direct and Indirect Tax data and the Indian Economy:

- Budget 2019-20 estimated the Gross Tax Revenue (GTR) to be 24.61 lakh crore which is 7 per cent of GDP. This builds into growth of 9.5 per cent over the revised estimates (RE) of 2018-19 and 18.3 per cent over 2018-19 PA. The direct taxes, comprising mainly of corporate and personal income tax, constitute around 54 per cent of GTR. These were envisaged to grow at 11.3 per cent relative to 2018-19 RE and 18.7 per cent relative to 2018-19 PA. On the other hand, the indirect taxes were expected to grow at 7.3 per cent vis-a-vis 2018-19 RE and 20.6 per cent as against 2018-19 PA.

- The direct taxes were estimated at 6.3 per cent of GDP in 2019-20 BE. Trends in major taxes in relation to GDP show that receipts from corporate and personal income tax have improved over the last few years. Better tax administration, widening of TDS carried over the years, anti-tax evasion measures and increase in effective tax payers base have contributed to direct tax buoyancy. Widening of tax base due to increase in the number of indirect tax filers in the GST regime has also led to improved tax Going forward, sustaining improvement in tax collection would depend on the revenue buoyancy of GST. During the year 2019-20 (up to November), the actual realization of Net Tax Revenue to the Center has been ` 7.51 lakh crore, which is 45.5 per cent of BE.

- The indirect tax receipts have registered a growth of -0.9 per cent in the first eight months of this fiscal year. Gross GST collections, Centre and States taken together, was ` 8.05 lakh crore in April to November 2019, which is an increase of 3.7 per cent over the corresponding period last year. The GST collections for the Centre for the same period registered a growth of 4.1per cent over the corresponding period last year.

- Notably, so far, during 2019-20, despite the rationalisation of GST rates, the gross GST monthly collections has crossed the mark of one lakh crore, for a total of five times, including the consecutive months of November 2019 and December 2019. The increase in GST collections may be a result of concerted efforts taken by the government to improve tax compliance and Tax revenue

- As per PLFS estimates, the share of regular wage/salaried employees has increased by 5 percentage points from 18 per cent in 2011-12 to 23 per cent in 2017-18. As per usual status. In absolute terms, there was a significant jump of around 2.62 crore new jobs in this category with 1.21 crore in rural areas and 1.39 crore in urban

Industry:

- Industrial sector performance in terms of its contribution in GVA improved in 2018-19 over 2017-18. However, as per the estimates of Gross Domestic Product by National Statistical Office (NSO), the real GVA of industrial sector grew by 1.6 percent in first half (H1) (April-September) of 2019-20, as compared to 8.2 per cent in H1 of 2018-19. The low growth in industrial sector is primarily due to manufacturing sector which registered a negative growth of 0.2 per cent in 2019-20 H1.

- The IIP is a measure of industrial performance. It assigns a weight of 77.6 per cent to manufacturing followed by 14.4 per cent to mining and 8.0 per cent to electricity. Overall, IIP growth has moderated to 3.8 per cent in 2018-19 compared to 4.4 percent in 2017-18. During the current year 2019-20 (April-November), it grew at 0.6 percent as compared to 0 per cent in the corresponding period of previous year. The moderation in growth is mainly arising from subdued manufacturing activities due to slower credit flow to medium and small industries, reduced lending by NBFCs owing to liquidity crunch, tapering of domestic demand for key sectors such as automotive sector, pharmaceuticals, and machinery and equipment, volatility in international crude oil prices, prevailing trade related uncertainties, etc.

- As per the use-based classification of IIP, the growth of capital goods and consumer durables declined by 11.6 per cent and 6.5 per cent respectively during the current financial year 2019-20 (April-November). Consumer durables segment was hit mainly due to lack of demand from the household sector especially in Automobile industry. The growth of infrastructure/ construction goods declined by 2.7 per cent in the current financial year 2019-20 (April-November). However, intermediate goods, consumer non-durable and primary goods registered a growth of 12.2 per cent, 3.9 per cent and 0.1 per cent, respectively, during 2019-20 (April-November)

- The Index of Eight Core Industries measures the performance of eight core industries i.e., Coal, Crude Oil, Natural Gas, Refinery Products, Fertilizers, Steel, Cement and Electricity. The industries included in the Index of Eight Core Industries comprise 27 per cent weight in the Index of Industrial Production. Growth of Eight Core Industries stood flat during the current financial year (April-November, 2019). During the corresponding period of the previous year, these industries grew at 5.1 per cent. While fertilizers, steel and electricity have seen expansion in their production, production of coal, crude oil, natural gas and refinery products have contracted during the current financial year (Table 3). Excessive rainfall during monsoon, law and order problem prevailing in mining areas and strike during September 2019 impacted the coal sector. Crude oil industry continued to show contractionary trend with a growth rate of (-) 5.9 per cent in 2019-20 (April-November) owing to operational issues like power shutdowns, electrical faults due to rains/winds/ thunderstorms, etc. Growth rate of 3 Months Moving Average Month-on-Month (M-o-M) of IIP, Eight Core Industries and Manufacturing sector from 2017-18 to 2019-20 shows that the three indicators move in tandem with some occasional deviation.

- Growth in gross bank credit flow to the industrial sector, on a year-on-year (y-o-y) basis, rose to 2.7 per cent in September 2019 as compared to 2.3 per cent in September 2018. Credit flow to industries like wood & wood products, all engineering, cement & cement products, construction and infrastructure increased in September 2019 as compared to September 2018, while credit flow to mining & quarrying, textiles, petroleum, coal products & nuclear fuel, glass & glassware and basic metal & metal products contracted in the same period. Credit flow to industries like food processing, chemicals & chemical products, vehicles, vehicles parts & transport equipment registered lower growth in September 2019 as compared to September 2018.

- As per the First Advance Estimates for Gross Value Added(GVA) from the Ministry of Statistics and Planning Implementation, services sector growth (YoY) continued to moderate during 2019-20, reaching 9 per cent from 7.5 per cent in 2018-19. By sub-sector, growth (YoY) in ‘financial services, real estate & professional services’ decelerated to 6.4 per cent during 2019-20 and that in ‘trade, hotels, transport, communication & broadcasting services’ remained on a downward trend, reaching 5.9 per cent in 2019-20.

- The government liberalized the visa regime in 2016, renaming it to e-Visa scheme with five sub-categories e. ‘e-Tourist Visa’, ‘e-Business Visa’, ‘e-Medical Visa’, ‘e-Conference Visa’ and ‘e-Medical Attendant Visa’. The e-Visa scheme is now available for 169 countries with valid entry through 28 designated airports and 5 designated seaports. With this, foreign tourist arrivals to India on e-visas have increased from 4.45 lakh in 2015 to 23.69 lakh in 2018 and stood at 21.75 lakh in January-October 2019, recording nearly 21 per cent year-on-year growth from the previous year.

Ease of Doing Business in India:

- Government of India has taken several industry specific reform initiatives since 2014 that have significantly improved the overall business environment. In order to improve ease of doing business, the emphasis has been on simplification and rationalization of the existing rules and introduction of information technology to make governance more efficient and effective. The improvement in the business environment as a result of these reforms is reflected in India’s considerably improved ranking to 63rd position among the 190 countries in the World Bank’s Doing Business 2020 Report. This is a jump of 14 ranks over its previous rank of 77. The ranking is based on 10 indicators which span the life-cycle of a business. India has improved its rank in 7 out of 10 indicators and has moved closer to

- In December 2019, Cabinet approved the Insolvency and Bankruptcy Code (Second Amendment) Bill, 2019. The amendments aim at fast-tracking the insolvency resolution process and to further improve the ease of doing business

ANNEXURE – I to Budget Statement 2020-21

PROPOSED CHANGES IN CUSTOMS DUTY RATES

| AMENDMENTS | ||||||||

| A. | Tariff rate changes for Basic Customs Duty [to be effective from 02.02.2020] * [Clause [] of the Finance Bill, 2020] | Rate of Duty | ||||||

| S. No | Heading, sub- heading tariff item | Commodity | From | To | ||||

| Food processing | ||||||||

| 1. | 0802 32 00 | Walnuts, shelled | 30% | 100% | ||||

| Chemicals | ||||||||

| 2. | 3824 99 00 | Other Chemical products and preparations of the chemical or allied industries, not elsewhere pecified | 10% | 17.5% | ||||

| Footwear | ||||||||

| 3. | 6401, 6402,

6403, 6404, 6405 |

Footwear | 25% | 35% | ||||

| 4. | 6406 | Parts of footwear | 15% | 20% | ||||

| Household Items | ||||||||

| 5. | 6911 10

6911 90 20 6911 90 90 |

Tableware, kitchenware, water filters (of a capacity not exceeding 40 litres) and other household articles, of porcelain or china. | 10% | 20% | ||||

| 6. | 6912 00 10

6912 00 20 6912 00 40 6912 00 90 |

Ceramic table- ware, kitchen-ware, clay articles and other household articles | 10% | 20% | ||||

| 7. | 7013 | Glassware of a kind used for table, kitchen, toilet, office, indoor decoration or similar purposes (other than that of heading 7010 or 7018) | 10% | 20% | ||||

| 8. | 7323 | Table kitchen or other household articles and parts thereof, of iron or steel, iron or steel wool; pot scourers and scouring or polishing pads, gloves and the like, of iron or steel, including pressure cookers pans utensils, misc articles such as iron & steel wool, polishing pads, gloves etc. | 10% | 20% | ||||

| 9. | 7418 10 | Table, kitchen or other household articles and parts thereof, of copper; pot scourers and scouring or polishing pads, gloves and the like, of copper. | 10% | 20% | ||||

| 10. | 7615 10 | Table, kitchen or other household articles and parts thereof, of aluminum; pot scourer and scouring or polishing pads, gloves and the like, of aluminum. | 10% | 20% | ||||

| 11. | 8301 | Padlocks and locks (key, combination or electrically operated) of base metal; clasps and frames with clasps, incorporating locks of base metals; keys for any of the foregoing articles, of base metals (other than lock of a kind used for automobiles.) | 10% | 20% | ||||

| 12. | 9603 | Brooms, brushes, hand operated mechanical floor sweepers, not motorized, mops and feather dusters; prepared knots and tufts for broom or brush making; paint pads and rollers; Squeegees (other than roller squeegees). | 10% | 20% | ||||

| 13. | 9604 00 00 | Hand sieves and hand riddles. | 10% | 20% | ||||

| 14. | 9615 | Combs, hair-slides and the like, hairpins curling pins, curling grips, hair curlers and the like, other than those of heading 8516 and parts thereof. | 10% | 20% | ||||

| 15. | 9617 | Vacuum flasks and other vacuum vessels, complete with cases; parts thereof other than glass inners | 10% | 20% | ||||

| Household appliances | ||||||||

| 16. | 8414 51 10 | Table Fans | 10% | 20% | ||||

| 17. | 8414 51 20 | Ceiling Fans | 10% | 20% | ||||

| 18. | 8414 51 30 | Pedestal Fans | 10% | 20% | ||||

| 19. | 8414 59 20 | Blowers, Portable | 10% | 20% | ||||

| 20. | 8509 40 10 | Food Grinders | 10% | 20% | ||||

| 21. | 8509 40 90 | Other grinders and Mixer | 10% | 20% | ||||

| 22. | 8509 80 00 | Other Appliances | 10% | 20% | ||||

| 23. | 8510 10 00 | Shavers | 10% | 20% | ||||

| 24. | 8510 20 00 | Hair Clippers | 10% | 20% | ||||

| 25. | 8510 30 00 | Hair-removing appliances | 10% | 20% | ||||

| 26. | 8516 10 00 | Water heaters and immersion heaters | 10% | 20% | ||||

| 27. | 8516 21 00 | Storage heating radiators | 10% | 20% | ||||

| 28. | 8516 29 00 | Other electrical space heating apparatus | 10% | 20% | ||||

| 29. | 8516 31 00 | Hair Dryers | 10% | 20% | ||||

| 30. | 8516 32 00 | Other hair dressing apparatus | 10% | 20% | ||||

| 31. | 8516 33 00 | Hand Drying apparatus | 10% | 20% | ||||

| 32. | 8516 40 00 | Electric smoothing irons | 10% | 20% | ||||

| 33. | 8516 60 00 | Other ovens, cookers, cooking plates, boiling rings, grillers and roasters | 10% | 20% | ||||

| 34. | 8516 71 00 | Coffee and Tea Makers | 10% | 20% | ||||

| 35. | 8516 72 00 | Toasters | 10% | 20% | ||||

| 36. | 8516 79 10 | Electro-thermic fluid heaters | 10% | 20% | ||||

| 37. | 8516 79 20 | Electrical or electronic devices for repelling insects | 10% | 20% | ||||

| 38. | 8516 79 90 | Other electro-thermic appliances used for domestic purposes | 10% | 20% | ||||

| 39. | 8516 80 00 | Electric heating resistors | 10% | 20% | ||||

| Precious Metals | ||||||||

| 40. | 7118 | Coin (of precious metal) | 10% | 12.5% | ||||

| Machinery | ||||||||

| 41. | 8414 51 40 | Railway Carriage fans | 7.5% | 10% | ||||

| 42. | 8414 51 90 | Other fans with a self-contained electric motor not exceeding 125W | 7.5% | 20% | ||||

| 43. | 8414 59 10 | Air Circulator | 7.5% | 10% | ||||

| 44. | 8414 59 30 | Industrial fans blowers and similar blowers | 7.5% | 10% | ||||

| 45. | 8414 59 90 | Other industrial fans | 7.5% | 10% | ||||

| 46. | 8414 30 00,

8414 80 11 |

Compressor of Refrigerator and Air conditioner | 10% | 12.5% | ||||

| 47. | 8419 89 10 | Pressure vessels | 7.5% | 10% | ||||

| 48. | 8418 10 10 | Commercial type combined refrigerator freezers, fitted with separate external doors | 7.5% | 15% | ||||

| 49. | 8418 30 10 | Commercial freezer of chest type, not exceeding 800lt capacity | 7.5% | 15% | ||||

| 50. | 8418 30 90 | Other chest type freezers | 10% | 15% | ||||

| 51. | 8418 40 10 | Electrical freezers of upright type, not exceeding 800 litre capacity | 7.5% | 15% | ||||

| 52. | 8418 40 90 | Other freezers of upright type, not exceeding 800 litre capacity | 7.5% | 15% | ||||

| 53. | 8418 50 00 | Refrigerating or freezing display counters, cabinets, show- cases and the like | 7.5% | 15% | ||||

| 54. | 8418 61 00 | Heat pumps other than ac machines | 7.5% | 15% | ||||

| 55. | 8418 69 10 | Ice making machinery | 7.5% | 15% | ||||

| 56. | 8418 69 20 | Water cooler | 10% | 15% | ||||

| 57. | 8418 69 30 | Vending machine, other than automatic | 10% | 15% | ||||

| 58. | 8418 69 40 | Refrigerating equipment/devices used in leather industry | 7.5% | 15% | ||||

| 59. | 8418 69 50 | Refrigerated farm tanks, industrial ice cream freezer | 7.5% | 15% | ||||

| 60. | 8418 69 90 | Others [like freezers of capacity 800 litres and more etc.] | 7.5% | 15% | ||||

| 61. | 8515 (except

8515 90 00) |

Welding and Plasma cutting machines | 7.5% | 10% | ||||

| Other Electronic goods | ||||||||

| 62. | 8504 40 (except

8504 40 21) |

Static Converters | 15% | 20% | ||||

| 63. | 8504 40 21 | Dip bridge rectifier | 10% | 20% | ||||

| 64. | 8517 70 10 | Populated, loaded or stuffed printed circuit boards | 10% | 20% | ||||

| Automobile and automobile parts | ||||||||

| 65. | 8421 39 20,

8421 39 90 |

Catalytic Convertor | 10% | 15% | ||||

| Furniture Goods | ||||||||

| 66. | 9401 | Seats and parts of seats (other than aircraft seats and their parts) | 20% | 25% | ||||

| 67. | 9403 | Other Furniture and parts | 20% | 25% | ||||

| 68. | 9404 | Mattress supports; Articles of bedding and similar furnishing | 20% | 25% | ||||

| 69. | 9405 | Lamps and lighting fittings including searchlights and spotlights and parts thereof; Illuminated signs, illuminated name plates and the like, having a permanently fixed light source, and parts thereof except solar lantern and solar lamps. | 20% | 25% | ||||

| Toys | ||||||||

| 70. | 9503 | Tricycles, scooters, pedal-cars and similar wheeled-toys; dolls‟ carriages; dolls; other toys; reduced-size (“scale”) models and similar recreational models, working or not; puzzles of all kinds | 20% | 60% | ||||

| Stationary items | ||||||||

| 71. | 8304 00 00 | Filing, cabinets, card-index cabinets, paper-trays, paper rests, pen trays, office-stamp stands and similar office or desk equipment, of base metal, other than office furniture of heading 9403 | 10% | 20% | ||||

| 72. | 8305 | Fittings for loose-leaf binders or files, letter clips, letter corners, paper clips, indexing tags and similar office articles, of base metal; staples in strips (for example, for offices, upholstery, packaging), of base metal | 10% | 20% | ||||

| 73. | 8310 | Sign-plates, name-plates, address-plates and similar plates, numbers, letters and other symbols, of base metal, excluding those of heading 9405 | 10% | 20% | ||||

| Miscellaneous | ||||||||

| 74. | 6702 | Artificial Flowers | 10% | 20% | ||||

| 75. | 7018 10 20 | Glass Beads | 10% | 20% | ||||

| 76. | 8306 | Bells, gongs, statuettes, trophies and like, non-electric of base metal; statuettes and other ornaments of base metal; photograph, picture or similar frames, of base metal; mirrors of base metal. | 10% | 20% | ||||

| B. | New entries added to the First Schedule [to be effective from XX.XX.2020]* [Clause XX of the Finance Bill, 2020] | |||||||

| S. No. | Tariff Item | Description | Tariff Rate | Effective rate | ||||

| 1. | 8414 51 50 | Wall fans | 20% | 20% | ||||

| 2. | 8529 90 30 | Open cell for television set | 15% | 0% | ||||

| 3. | 8541 40 11 | Solar cells not assembled | 20% | 0% | ||||

| 4. | 8541 40 12 | Solar cells assembled in modules or made up in panels | 20% | 0% | ||||

OTHER PROPOSALS INVOLVING CHANGES IN BASIC CUSTOMS DUTY RATES IN RESPECTIVE NOTIFICATIONS

| S. No | Heading, sub- heading tariff item | Commodity | From | To | |||||||

| Animals | |||||||||||

| 1. | 0101 21 00 | Pure-bred breeding horses | 30% | Nil | |||||||

| Fuels, Chemicals and Plastics | |||||||||||