EXECUTIVE SUMMARY

Income Tax

CBDT has come out with the following amendments as below: –

- Launching of New Income Tax Website.

- Compliance check Functionality for ease the usance of section 206AB/CCA.

- Extension of time limits of certain compliances to provide relief to taxpayers.

- Issuance of Cost Inflation Index for FY 2021-22.

GST

CBIC has come out with the following amendments as below: –

- GST notifications issued on June 1st 2021 to provide effect of 43rd GST council meeting

- GST rates reduced on Goods on specific items prescribed in 44th GST council meeting held on June 12th 2021

- Clarification on applicability of Dynamic QR Code

Companies Act 2013/ Other Laws

MCA has come out with the following amendments as below:

- MCA has issued the much-awaited clarification for passing general and special resolutions and convening an EGM in unavoidable circumstances and extended the validity of the existing circulars up to December 31, 2021, in light of the current social distancing norms.

- All companies are free to discuss and approve the matters related to the approval of the annual financial statements; the approval of the Board’s report; the approval of the prospectus; the Audit Committee Meetings for consideration of financial statement including consolidated financial statement if any;

To know in detail please continue reading…

Income Tax |

- CBDT vide Press release dated 5th June 2021 informed for launching of new Income tax website incometax.gov.in on 07th June 2021 with an aim to providing better interface, free ITR preparation utility in some cases, new & functionalities and also for quick refunds etc.

- CBDT vide Notification No. 71/2021 / No. 370142/19/2021-TPL dated 8th June 2021 amend the rule 31A (4) to comply with clauses amended according to 194A, 196D and 194Q. In addition to Appendix II has been changed in form 26Q to give effect to TDS sections.

- CBDT vide Circular F.NO.225/61/2021/ITA-I dated 10th June 2021 has issued parameters for compulsory selection of returns for Complete Scrutiny during Financial Year 2021-22 and conduct of assessment proceedings.

- CBDT vide Press release dated 14th June 2021 has informed that until fixation of bugs/error on new Income Tax website taxpayer can prepare 15CA/CB manually. This notification is applicable till 30th June 2021. A facility will be provided on the new e-filing portal to upload these forms at a later date for the purpose of generation of the Document Identification Number.

- CBDT vide Notification No. 73/2021 / NO. 370142 / 10 / 2021-TPL dated 15th June 2021 has issued Cost inflation index (CII-317) for the financial year 2021-22 and is applicable from AY 2022-23.

- CBDT vide Circular No.11/2021[F.NO. 370133/7/2021-TPL] dated 21th June 2021 has issued circular regarding use of functionality u/s 206AB/CCA. For more details, please click the link: https://knmindia.com/tds-tcs-on-goods-along-with-deduction-collection-at-higher-rates-a-deep-insight/.

- CBDT vide Press release dated 23rd June 2021 has informed about approves agreement between India and Saint Vincent and grenadines for exchange of information and assistance in collection with respect to taxes.

- CBDT vide circular No. 12 of 2021 dated 25th June 2021 has issued clarification that income-tax exemption will be given to the amount received by a taxpayer for medical treatment from employer or from any person for treatment of Covid-19 during FY 2019-20 and subsequent years. It has been decided to provide income-tax exemption to ex-gratia payment received by family members of a person from the employer of such person or from other person on the death of the person on account of Covid-19 during FY 2019-20 and subsequent years. The exemption shall be allowed without any limit for the amount received from the employer and the exemption shall be limited to Rs. 10 lakh in aggregate for the amount received from any other persons.

Further due to covid-19 provide various relaxations through extension of time limits of certain compliances to provide relief to taxpayers as below:

| Particulars | Original Due Date | Due dates extended by previous notifications | New Due Dates (Circular 12/2021) | |||

| Filing of objections to Dispute Resolution Panel (DRP) and Assessing officer u/s 144C of the Act

| 1st June 2021 or thereafter | – | may be filed within the time provided in that section or by 31st August 2021, whichever is later. | |||

| TDS Return -Quarter 4 (FY 2020-21) | 31st May 2021 | 30th June 2021 Vide Circular No. 09/2021

| 15th July 2021 | |||

| Issuance of TDS Certificate -Form 16

| 15th June 2021 | 15th July 2021 Vide Circular No. 09/2021 | 31st July 2021 | |||

| Statement of Income paid or credited by Investment fund to its unit holder in Form 64D for the previous year 2020-21 | 15th June 2021 | 30th June 2021 Vide Circular No. 09/2021

| 15th July 2021 | |||

| Statement of Income paid or credited by Investment fund to its unit holder in Form 64C for the previous year 2020-21 | 30th June 2021 | 15th July 2021 Vide Circular No. 09/2021

| 31st July 2021 | |||

| Application u/s 10(23C), 12AB, 35(1)(ii)/(iia)/(iii) and 80G of the act in Form 10A/ 10AB for registration /intimation approval/ provisional approval of trust/ institutions/ Research associations etc | 30th June 2021 | – | 31st August 2021

| |||

| Furnishing of Equalisation levy Statement in Form No. 1 for FY 2020-21 | 30th June 2021 | – | 31st July 2021 | |||

| Quarterly statement in Form No. 15CC to be furnished by authorized dealer in respect of remittances made for the quarter ending on June 2021 | 15th July 2021 | – | 31st July 2021 | |||

| Annual Statement u/s 9A (5) of the act by eligible investment fund in Form No. 3CEK for the financial year 2020-21 | 29th June 2021 | –

| 31st July 2021 | |||

| Uploading of declarations in Form No. 15G/ 15H received from recipients during the quarter ending June 2021 | 15th July 2021 | – | 31st August 2021 | |||

| Exercising of option u/s 245M(1) of the act in Form No. 34BB | 27th June 2021 | – | 31st July 2021 | |||

| Making Investments or completing construction/ purchase for claiming deduction from capital gains.

(The extension has been given in those cases where the due date falls between 01-04-2021 to 29- 09-2021). | – | – | 30th September, 2021 | |||

|

|

- CBDT vide Notification No. 74/2021/ F. No. 370142/35/2020-TPL dated 25th June 2021 & 75/2021/ No.IT(A)/01/2020-TPL Dated 25th June,2021 has decided to extend the various dates as below:

| Particulars | Original Due Date | Due dates extended by previous notifications | New Due Dates | |||

| Passing of order for assessment or reassessment by AO u/s 153/ 153B · Cases where on account of various extension notifications, the due date is getting expired on 31-03-2021 · Cases where due date is getting expired on 31-03-2021 without giving effect of any extension notification. | 31st March 2021 | 30th June 2021

30th September 2021 | 30th September 2021

30th September 2021 | |||

| Imposition of penalty for Chapter XXI of the Income-tax Act (The extension has been given in those cases where the due date falls between specified period) | – | 30th June 2021 (due date falls between 20-03-2020 to 29-06- 2021) | 30th September 2021 (due date falls between 20-03-2020 to 29-09- 2021) | |||

| Linking of Aadhaar number and PAN u/s 139AA | 31st March 2021 | 30th June 2021 | 30th September 2021

| |||

| Sending intimation of processing of Equalisation Levy u/s 168 (The extension has been given in those cases where the due date falls between 20-03-2020 to 31- 03-2021) | – | 30th June 2021 | 30th September 2021

| |||

| Payment under VSVS | 30th June 2021 NN 39/2021 (extended from 30th April 2021) | 31st August 2021 |

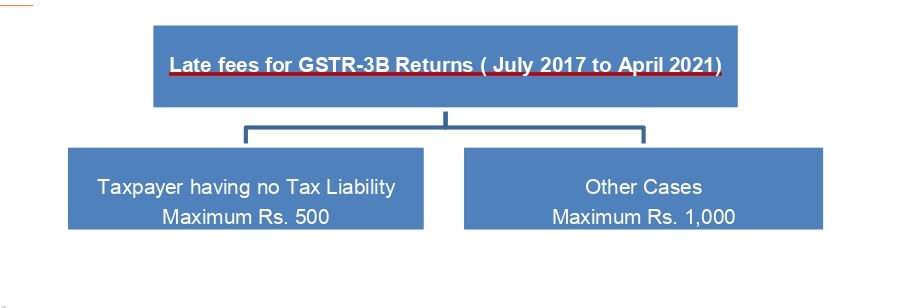

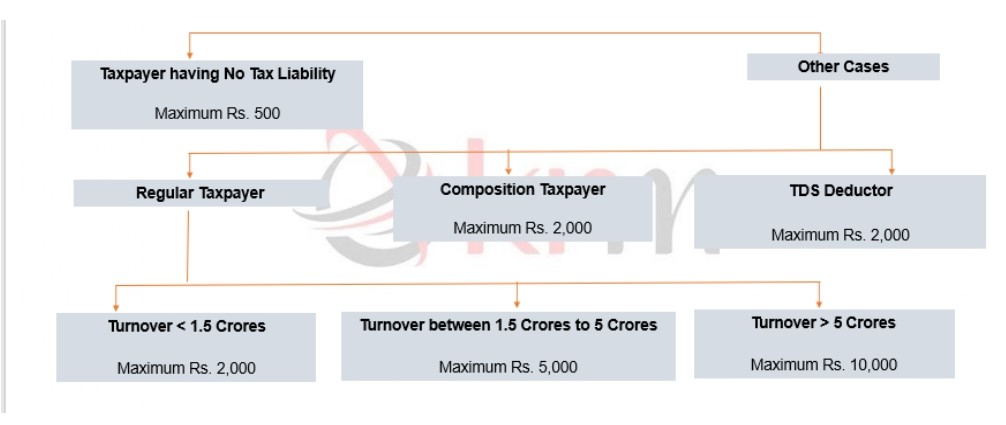

| Goods & Services Tax (GST) |

For GST notifications dated 01st June 2021 for Relaxations and effect to GST council notifications please refer the below link (https://knmindia.com/relaxations-by-gst-council/)

- The GST council in its 44th meeting held on 12th June, 2021 recommended reduction in GST rates on goods on specific items being used in COVID -19 relief and management. (Link /https://knmindia.com/relaxations-by-gst-council/)

- CBDT vide Circular No. 156/12/2021 – GST dated 21st June 2021 issue various clarifications in respect of applicability of Dynamic Quick Response (QR) Code on B2C invoices and compliance of notification 14/2020- Central Tax dated 21st March, 2020 as below:

- Dynamic QR Code is to be provided on an invoice issued to an Unique Identity Number holder.

- Bank account and IFSC details need not to be provided separately in the Dynamic QR Code along with UPI ID.

- where the payment is collected by some person other than the supplier (E-Commerce Operator or any other person authorized by the supplier on his/ her behalf) then in such cases UPI ID of such person who is authorized to collect the payment on behalf of the supplier, may be provided.

- Wherever an invoice is issued to a recipient located outside India, for supply of services where place of supply is in India and the payment is received by the supplier in foreign currency, through RBI approved mediums, then such invoice may be issued without having a Dynamic QR Code.

- In some instances, it may not possible for the supplier to provide details of invoice number in the dynamic QR code displayed to the customer on payment counter where payment received before generation of invoice then cross reference of such payment received along with unique order ID/ sales reference number to be provided on the invoice.

- When the part-payment for any supply has already been received from the customer/ recipient, in form of either advance or adjustment through voucher/ discount coupon etc. then the dynamic QR code may provide only the remaining amount payable by the customer/ recipient against “invoice value”. However, the total invoice value should be mentioned on invoice showing advance adjustment.

- CBIC vide Notification no. 34/2021- customs dated 29th June 2021 seeks to reduce the basic custom duty on Crude Palm Oil [1511 10] and Palm Oil other than Crude Palm Oil [1511 90] till 30th September 2021.

- CBIC vide Notification no. 33/2021- customs dated 14th June 2021 Seeks to rescind notification No. 30/2021-Customs, dated 01.05.2021 relating to reduce IGST on Oxygen Concentrators when imported for personal use.

- CBIC vide Notification no. 32/2021 – (Customs ADD ) dated 03rd June 2021 Seeks to further amend notification No. 23/2016-Customs (ADD) dated 6th June, 2016 extend the levy of Anti-Dumping duty on Polytetrafluoroethylene originating in or exported from Russia, up to and inclusive of 31st October, 2021.

- CBIC vide Notification no. 33/2021 – (Customs ADD ) dated 03rd June 2021 Seeks to further amend notification No. 6/2016-Customs (ADD) dated 8th March, 2016 to extend the levy of Anti-Dumping duty on Phenol originating in or exported from European Union and Singapore, up to and inclusive of 31st October, 2021.

| Companies Act, 2013 |

The MCA has earlier issued General Circular no 14/2020 (first circular) and 17/2020 (second circular) dated 13th April 2020 for providing relaxations and clarifying various difficulties in following the first circular. The circular details guidelines for conducting an EGM for companies that need to provide e-voting facility or have opted for e-voting as per section 108 of the Companies Act, 2013, every listed company and company not having less than 1000 shareholders must mandatorily provide e-voting facility and for companies that do not need to provide e-voting facilities. All other requirement and conditions provided in the said circulars shall remain unchanged.

- MCA has notified the Companies (Accounting Standards) Rules, 2021 which shall come into force on the date of their publication in the Official Gazette i.e 23-06-2021.

Through these Rules, MCA has notified the Accounting Standards for small and medium companies that revise the turnover and borrowing limits as well as help in making disclosure requirements less onerous. The definition of Small and Medium-Sized Companies (SMCs) under the standards has been revised and accordingly turnover limit has been increased from Rs 50 crore to not exceeding Rs 250 crore and with enhanced borrowing limits. This is in addition to the requirements that such entities should be unlisted companies, which are not banks, financial institutions, or insurance companies. The Accounting Standards 1 to 5, 7, and 9 to 29 as recommended by the Institute of Chartered Accountants of India shall be applicable on SMC and shall come into effect in respect of accounting periods commencing on or after 01-04-2021. Every company, other than companies on which Indian Accounting Standards as notified under Companies (Indian Accounting Standards) Rules, 2015 are applicable, and its auditor(s) shall comply with the Accounting Standards at the time of preparation of Financial Statements. Further, an existing Company which has subsequently become SMC can only claim the benefits of SMC under these Rules after two years.

Which shall come into force on the date of their publication in the Official Gazette i.e. 18-06-2021. The MCA has notified the much-awaited amendment and eased the requirement for aspiring as well as serving independent directors on the board of companies to get their names included in an official database of eligible professionals. As per a rule change notified by the ministry on Friday, in spite of any delay, a professional could get her name empaneled in the official database of independent directors maintained by the Indian Institute of Corporate Affairs (IICA) by paying ₹1,000/-. This is expected to give relief to those who have missed their deadline. Aspiring independent directors were expected to get their names included in the database before they took up the assignment while serving ones had time till last October as per an earlier instruction.

Which shall come into force on the date of their publication in the Official Gazette i.e. 18-06-2021. To enable users of financial statements to understand the effect of interest rate benchmark reform on an entity‘s financial instruments and risk management strategy, an entity shall disclose information about the nature and extent of risks to which the entity is exposed arising from financial instruments subject to interest rate benchmark reform, and how the entity manages these risks; and the entity‘s progress in completing the transition to alternative benchmark rates, and how the entity is managing the transition. Among others, there are changes in the basis for determining the contractual cash flows as a result of interest rate benchmark reform. The disclosures will enable users of financial statements to understand the effect of these changes, including an entity’s progress in completing the transition to alternative benchmark rates. Further, the amendments to Ind ASs are in terms of insertion of certain paragraphs, substituting definition of certain terms used in the standard along with aligning the bare text of Standards with Conceptual Framework of Financial reporting under IndAS.

The MCA has notified the Companies (Meetings of Board and its Powers) Amendment Rules, 2021

Which shall come into force on the date of their publication in the Official Gazette i.e 15-06-2021. Through this Amendment, Rule 4 related to the matters not to be dealt with in a meeting through video conferencing or other audiovisual means has been omitted. Accordingly, now all companies are free to discuss and approve the matters related to the approval of the annual financial statements; the approval of the Board’s report; the approval of the prospectus; the Audit Committee Meetings for 2[consideration of financial statement including consolidated financial statement if any; and the approval of the matter relating to amalgamation, merger, demerger, acquisition, and takeover, in any meeting held through video conferencing or other audio visual means. Earlier, MCA has provided relaxation in this regard up to 30th June 2021.

Other Laws

SEBI

- The Securities and Exchange Board of India has amended the SEBI (Alternative Investment Funds) Regulations, 2012(“AIF Regulations”), which were notified on May 05, 2021.

The Amendment, 2021 notified on June 25, 2021 provides a framework for AIFs to invest simultaneously in units of other AIFs and directly in securities of investee companies. In terms of Regulation 15(1) (c) and (d) of the AIF Regulations, AIFs may invest in an Investee Company up to a specified limit, directly or through investment in the units of other AIFs. In terms of Regulation 20(1), the key management personnel of the AIF and the Manager shall abide by the Code of Conduct as specified in the Fourth Schedule of the AIF Regulations. In terms of provision to Regulation 20(8) of AIF Regulations, there is a requirement to furnish a waiver to AIF in respect of compliance with the said Regulation. The consent of the investors of the AIF or scheme may not be required for change in ex-officio external members (who represent the sponsor, sponsor group, manager group or investors, in their official capacity), in the investment committee set up by the Manager.

The relaxation will be available to all such employees who died on or after April 1, 2020. The Share Based Employee Benefit (SBEB) Regulation provides that there will be a minimum vesting period of one year in case of employee stock options and Stock Appreciation Rights (SAR). In the event of death of an employee, all the options, SAR or any other benefit granted to him or her under a scheme till such date will vest in the legal heirs or nominees of the deceased employee. SEBI has now decided the provisions under the SBEB Regulations relating to minimum vesting period of one year shall not apply in case of death (for any reason) of an employee and in all such instances, all the options, SAR, or any other benefit granted to such an employee will vest with his/her legal heir or nominee on the date of death of the employee.

It has now been decided to include the listed debt securities of equity listed companies under the purview of the said System Driven Disclosures for the entities. The Depositories and Stock Exchanges shall make necessary arrangements such that the disclosures pertaining to listed Debt Securities along with equity shares and equity derivative instruments are disseminated on the websites of respective stock exchanges with effect from July 01, 2021.

RBI

RBI with an intent to infuse greater transparency and uniformity in practice has notified a Guidelines on the Distribution of Dividends by NBFCs.

These guidelines shall be applicable on all NBFC’s and shall be effective for the declaration of dividend from the profits of the financial year ending March 31, 2022, and onwards. All NBFCs eligible to declare dividend may pay a dividend, subject to the Dividend Payout Ratio is the ratio between the amount of the dividend payable in a year and the net profit as per the audited financial statements for the financial year for which the dividend is proposed. The proposed dividend shall include both dividend on equity shares and compulsorily convertible preference shares eligible for inclusion in Tier 1 Capital. Further, in case the net profit for the relevant period includes any exceptional and/or extraordinary profits/ income or the financial statements are qualified (including ’emphasis of matter’) by the statutory auditor that indicates an overstatement of net profit, the same shall be reduced from net profits while determining the Dividend Payout Ratio. It has also made clear that the Reserve Bank shall not entertain any request for ad-hoc dispensation on the declaration of dividend.

IBBI

For appointment as, IRP in a CIRP under section 16(4), liquidator in a liquidation process under section 34(6), RP in an individual insolvency resolution process under section 97(4) or 98(3), and bankruptcy trustee (BT) under section 125(4), 146(3) or 147(3) of the Insolvency and Bankruptcy Code, 2016. This list shall be in effect during the period between July 1, 2021 – December 31, 2021. The Board has prepared a common Panel of IPs for appointment as IRP, Liquidator, RP and BT and shall share the same with the Adjudicating Authority (‘AA’) (NCLT and DRT) in accordance with these Guidelines. The Panel will have validity of six months and a new Panel will replace the earlier Panel every six months. For example, the first Panel under these Guidelines will be valid for appointments during July – December 2021, and the next Panel will be valid for appointments during January – June 2022, and so on. The NCLT may pick up any name from the Panel for appointment of IRP, Liquidator, RP or BT, for a CIRP, Liquidation Process, Insolvency Resolution or Bankruptcy Process relating to a corporate debtors and personal guarantors to corporate debtors, as the case may be.

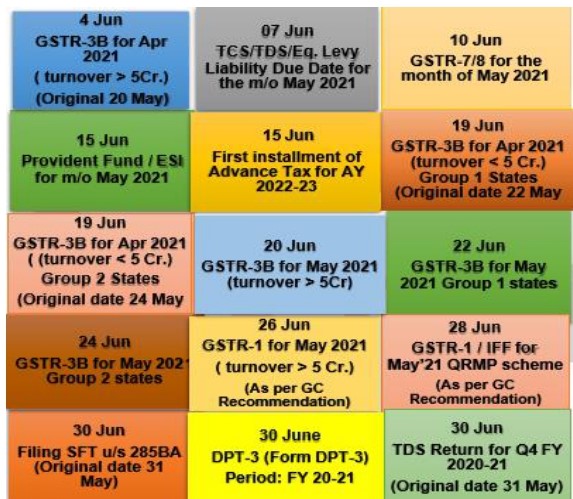

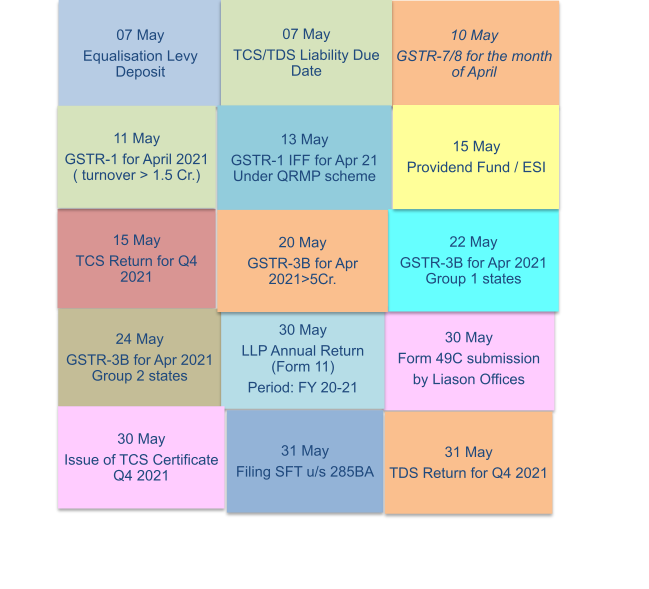

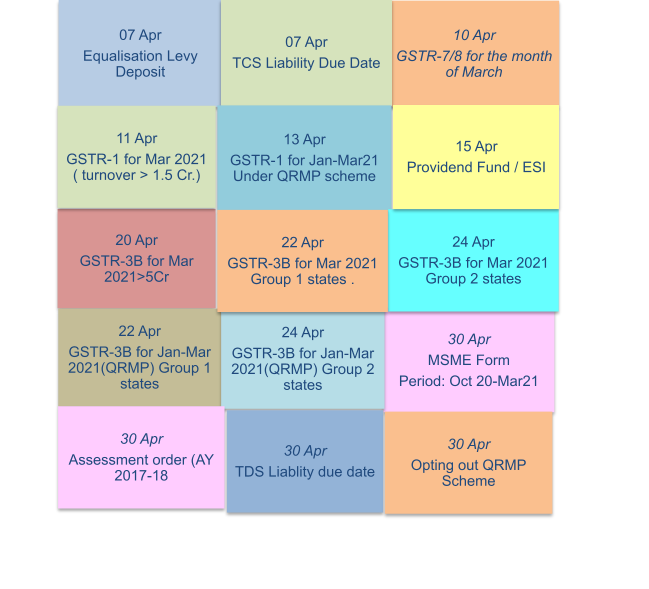

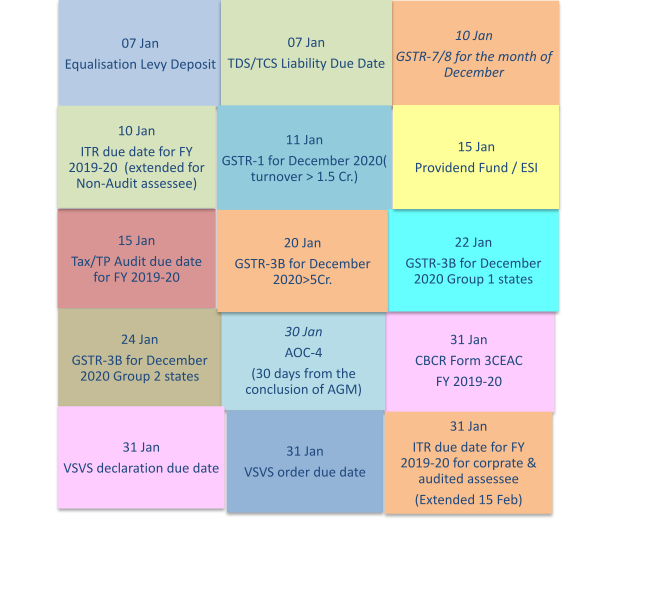

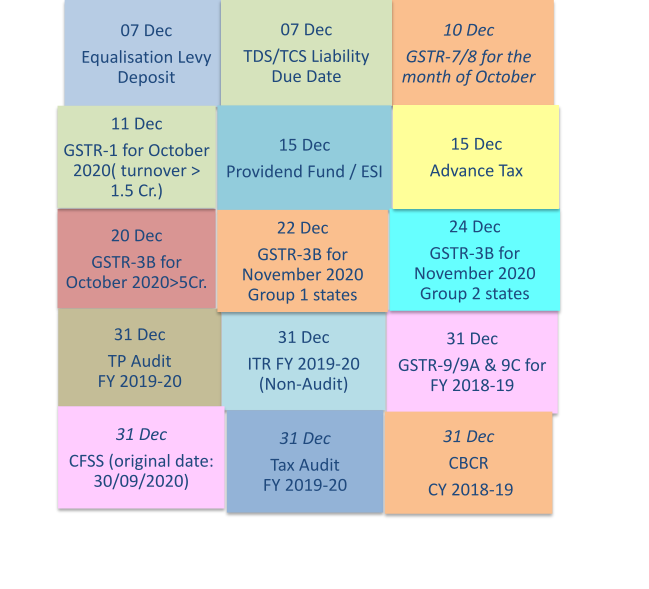

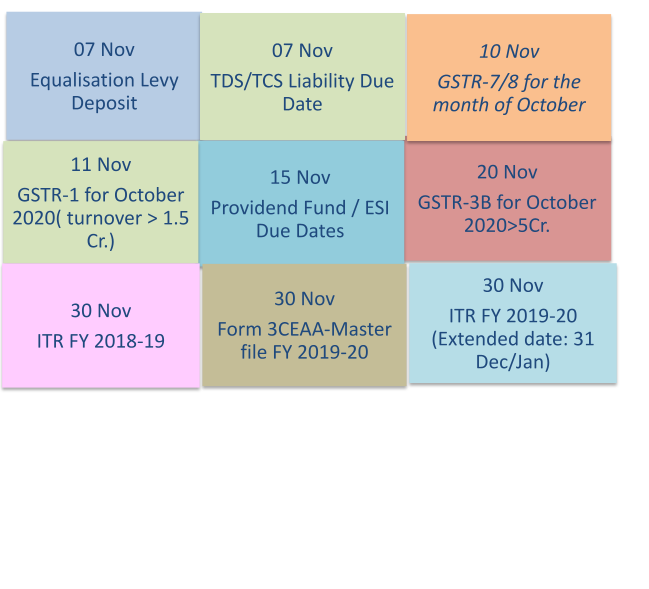

View Monthly Compliance Calendar

KNM India can assist you with a range of complete financial services that range from Corporate advisory to Transaction advisory, Pre-incorporation to Post-incorporation, Insolvency and bankruptcy code to Secretarial services, Assurance to Internal audit services, along with Market entry strategy to Foreign company registration in India. To discuss about any of these please book your slot, or call us on +91-99105-04170 – or email us at services@knmindia.com to get a quick response.

Disclaimer: Information in this note is intended to provide only a general update of the subjects covered. It is not intended to be a substitute for detailed research or the exercise of professional judgment. KNM accepts no responsibility for loss arising from any action taken or not taken by anyone using this publication. Updates are for the period 26.05.2021 till 25.06.2021.